Russia Production Shock Is Fading For Crude Oil Bulls

By Grant Smith, Bloomberg Markets Live reporter and analyst

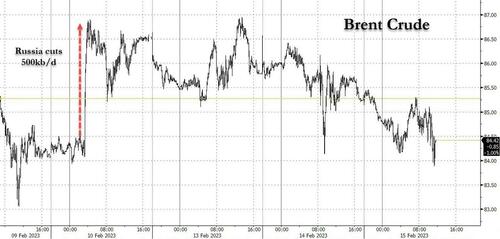

President Vladimir Putin captured the oil world’s attention with last week’s announcement of production cuts, but for crude bulls the impact of a Russian disruption is wearing off.

Brent futures have already surrendered the gains from Friday’s pledge by the Kremlin that it would follow through on repeated threats to retaliate against Western sanctions, promising a production cut of 500,000 barrels a day in March. The international benchmark slipped below $85 a barrel as traders turn their attention to swelling stockpiles and a strengthening dollar.

An even more stark illustration of the fading shock came on Wednesday with the monthly report from the International Energy Agency in Paris.

A year ago, in the immediate aftermath of the Ukraine invasion, the IEA predicted that Russian output would collapse by a quarter within a month as buyers recoiled from Moscow in condemnation. Instead, Russian crude output has largely held steady around the 10 million-barrel mark as it diverts cargoes from Europe to more amenable customers in Asia. Even the onset of EU sanctions on its crude in December, and refined products this month, has done little to change the overall picture.

The IEA has repeatedly deferred its projections of a Russian supply plunge and in its latest report goes one step further, downgrading the loss expected this quarter from 1.6 million barrels a day to 1 million a day — a volume more easily managed by a market that currently appears to be in surplus.

Oil bulls betting on a rally may now be looking away from supply, and toward demand, as the catalyst for any major price boost.

https://ift.tt/Zuv0t1X

from ZeroHedge News https://ift.tt/Zuv0t1X

via IFTTT

0 comments

Post a Comment