Stocks & Crypto Soar Despite Hawkish Fed Expectations Accelerating

The last few weeks have seen US macro data scream 'no landing' with hotter-than-expected payrolls, hotter-than-expected CPI, and now hotter-than-expected retail sales (along with rebounds in Empire Fed and NAHB sentiment). And that has all happened as The Fed has jawboned the Terminal Rate up to cycle highs at 5.25% - a massive breakdown in any monetary policy transmission mechanism...

Source: Bloomberg

And not only is the terminal rate surging but expectations for subsequent rate-cuts (Fed Pivot) have collapsed too. From hopes of over 50bps of cuts in H2 2023 at the start of February, the market is now pricing in less than 10bps of cuts...

Source: Bloomberg

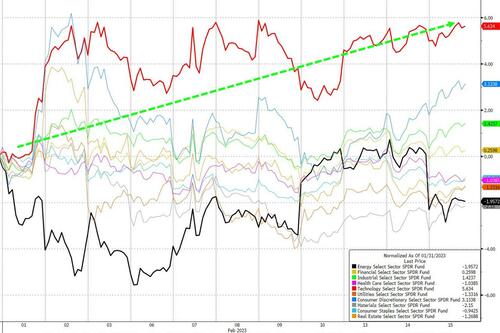

Today saw stocks meltup this afternoon, extending gains from yesterday. Since the CPI print, Nasdaq is outperforming (along with Small Caps) while The Dow lags and the S&P is breaking even...

Another day, another 0DTE rampage we are sure as the market is stuck in a war between bulls eying a “no landing” and bears warning over “higher for longer” rates, that’s emboldening the use of 0DTE options to make quick profits. Over the past month, nearly one of two every options traded on the S&P 500 was 0DTE, according to Nomura’s cross-asset strategist Charlie McElligott.

Today saw 19 of the 20 most active options traded in the S&P 500 names were 0DTE...

Yesterday's short squeeze accelerated today, with "most shorted" stock basket up almost 7% from yesterday's lows. That lifted the basket up to last Wednesday's close - before Thursday's crash...

Source: Bloomberg

Who could have seen that shit coming!?

moment of truth: how much put dry powder is left from last week - do we have enough for a 2nd delta squeeze https://t.co/0Oir0gPSWS

— zerohedge (@zerohedge) February 15, 2023

In fact, Goldman's Prime Desk noted today that hedge funds started to re-risk and net bought US Tech stocks for 11 straight days, led by long buys in the past week...

Treasury yields were higher across the curve today with the long-end underperforming this time (heavy corporate calendar). On the week, however, the belly 95Y) is the laggard (+12bps vs +2bps for 30Y)...

Source: Bloomberg

The dollar extended its gains off yesterday's lows, running stops at last week's highs...

Source: Bloomberg

Also, Bitcoin soared today, apparently ignoring Charlie Munger, trading back up to $24,000..

Source: Bloomberg

Ethereum also spiked, trading back above $1650

Source: Bloomberg

Oil prices ended the day lower but well off their lows after diving on reports of a big Crude inventory build...

Gold tumbled during the Asia session overnight and could not find a bid during the day...

...which is oddly strong given the USD strength...

Source: Bloomberg

Finally, we note that the surge in yields should be putting some pressure on the equity market valuation multiple...

Source: Bloomberg

But for now, stocks don't care... by passing all the steps from here - higher rates sooner >> recession sooner >> crash sooner >> emergency rate-cuts sooner?

https://ift.tt/KLFtqud

from ZeroHedge News https://ift.tt/KLFtqud

via IFTTT

0 comments

Post a Comment