'Bad News' Is No Longer 'Good News' As Jacked-Up Jobs Data & Jamie Dimon Jolt Markets

Banks, big-tech, and the buck tumbled today as gold, crypto, and bonds all surged higher after a weak manufacturing orders print was followed up by some ugly labor market indications from the JOLTS data.

In the "old days", this 'bad news' would have been 'good news' for stocks as the 'QE brrrrr' trade algos kicked in... but it seems the "r" word is a bigger problem for the marginal-buyer, and couple that with another inflationary impulse from oil and stagflation just got another check in the box.

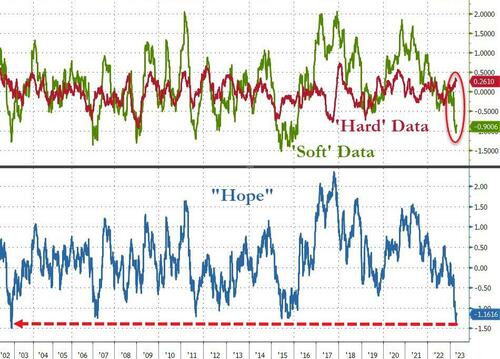

Hope - the spread between 'soft' and 'hard' macro data - has collapsed to its lowest since 2002...

Source: Bloomberg

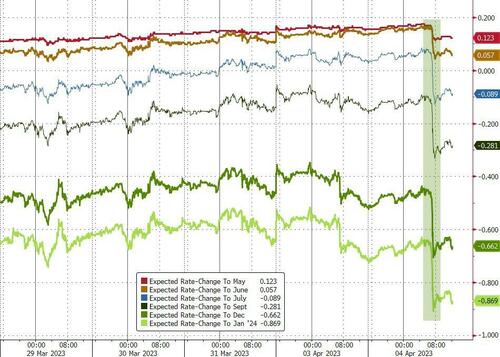

The STIRs markets did react how one would imagine, with a dramatic dovish flush...

Source: Bloomberg

With the entire short-end (Fed expectations) curve adjusting 15-20bps more dovish with a 25bps May hike now less likely than a coin-toss, and a 26% chance of rate-cut in June...

Source: Bloomberg

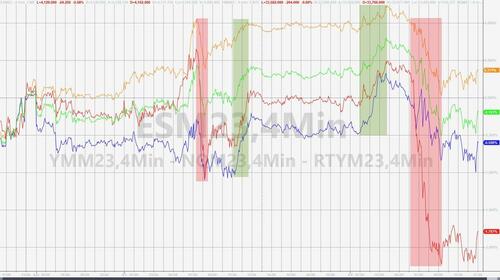

But stocks did not like it, as all but The Dow have erased all of yesterday's gains...

Notably, early in the day, 0DTE traders faded the S&P's losses, but once the index hit 4100, they covered those long delta flows pushing the market to its lows. The rest of the day saw the market track up and down with 0DTE flows...

'Most Shorted' stocks were slammed again at the open but could not make it back like yesterday...

Source: Bloomberg

This was all hampered further by Jamie Dimon's warning that "the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come."

As if small banks didn't suffer enough before today with JPM sucking out their deposits, Jamie Dimon decided to land another crushing blow warning that the regional banks crisis (affecting non-JPM banks of course) will linger for years, sending the KRE sliding.

— zerohedge (@zerohedge) April 4, 2023

Well played

Regional banks tumbled back near the post-SVB lows...

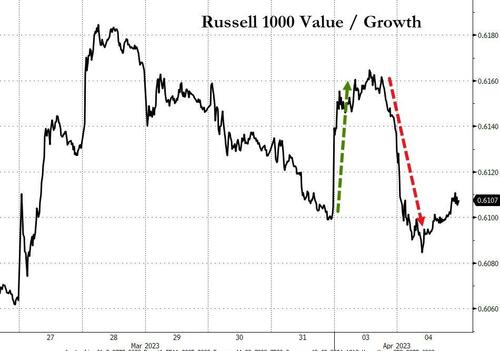

All of yesterday's value-stock rotation was erased today...

Source: Bloomberg

Treasury yields tumbled today on the data with the short-end dramatically outperforming...

Source: Bloomberg

With 2Y Yields back below 4.00%...

Source: Bloomberg

And the re-steepening of the yield curve...

Source: Bloomberg

The dollar dived on the 'dovish' news to two-month lows...

Source: Bloomberg

Crypto rallied on the day with Ethereum outperforming, testing up towards $1900, the highest since Aug 2022...

Source: Bloomberg

Gold soared with Futs above $2040 and spot above $2020. Gold has only closed above today's close on 5 days in history..

Oil prices ended the day flat, with WTI holding above $80...

And finally, with oil prices rising, NatGas (on an oil barrel equivalent basis) is at its 'cheapest' to WTI since 2013...

Source: Bloomberg

And if you're wondering where oil goes next?

Source: Bloomberg

...chop for a few months before lifting off (and surprising an 'easy' Fed with resurgent inflation).

https://ift.tt/5wk4y9E

from ZeroHedge News https://ift.tt/5wk4y9E

via IFTTT

0 comments

Post a Comment