Banks & Big-Tech Breakdown On Bad Data, Fed Flip-Flop Sparks Dovish Dive In Rates

Well that all escalated quickly.

As Goldman's John Flood noted: "First time in a long time that I can recall bad economic data actually being bad for stocks."

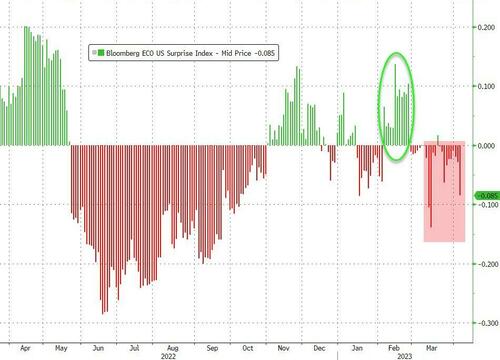

Just a month ago, the world and his pet rabbit was crowing about soft-landings and strong labor markets (ignoring the constant reminders that the labor market is the 'last to go')... and now US macro data is serially surprising to the downside (with ISM Services and ADP today)...

Source: Bloomberg

And sure enough, the labor market (after today's ADP disappointment and yesterday's JOLTS print), is tumbling back to reality...

Source: Bloomberg

Additionally, The Fed's hawks are quickly turning dovish - Fed's Mester clearly got the tap on the shoulder overnight...

-

Yesterday - MESTER: FED WILL NEED TO GET RATES UP 'A LITTLE BIT MORE', SEES FED-FUNDS RATE ABOVE 5%, HOLDING FOR SOME TIME

-

Today - MESTER: TOO SOON TO SAY WHETHER FED WILL RAISE RATES IN MAY, HOPING WE DON'T TIGHTEN UNTIL SOMETHING BREAKS

And the market is not waiting for the rest of The Fed to come along for the ride.

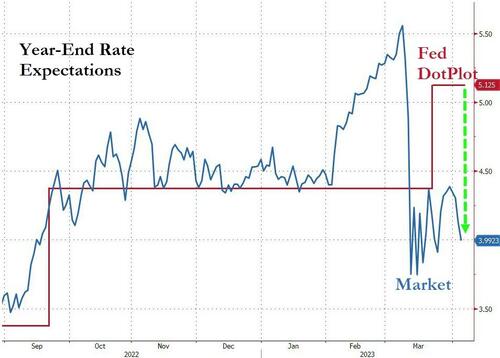

As Nomura's Charlie McElligott noted, the market is betting very aggressively on lower rates by year end as year-end SOFR Skews are soaring (higher price, lower yield)...

Source: Bloomberg

The market is now pricing a terminal rate of around 4.90% in May (40% odds of 25bps hike and done), followed by 4 rate-cuts (back down to 4.00% by year-end)...

Source: Bloomberg

Year-end Fed rate expectations are now back below 4.00% - that is over 112bps below The Fed's DotPlot...

Source: Bloomberg

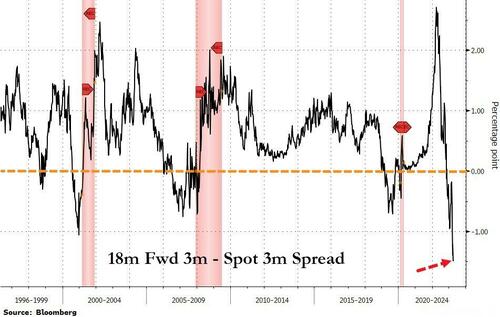

Finally, before we leave short-term interest-rate land, Powell's favorite market-based recession signal (the 18m fwd 3m spread to spot 3m yields) hit a new record low today (inverted by 165bps!)...

Source: Bloomberg

Recession called!

The Dow managed to hold on to gains today (thanks to MRK, JNJ, and UNH - so very defensive) while Small Caps (finance-heavy) and Nasdaq (mega-cap tech) both suffered together with the S&P back below 4,100...

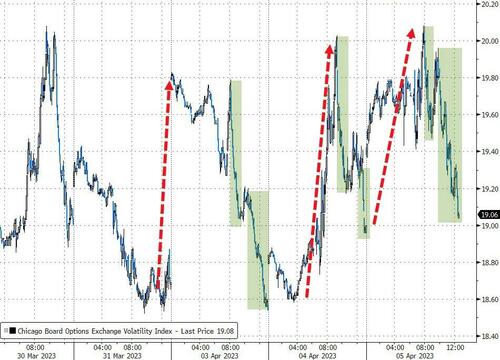

0DTE traders were active today but just tracked the market, no lead or fade. However, while VIX ended the day modestly higher (from yesterday's puke into the close), it was sold down from above 20 intraday...

Source: Bloomberg

Cyclicals have notably lagged since the start of Q2...

Source: Bloomberg

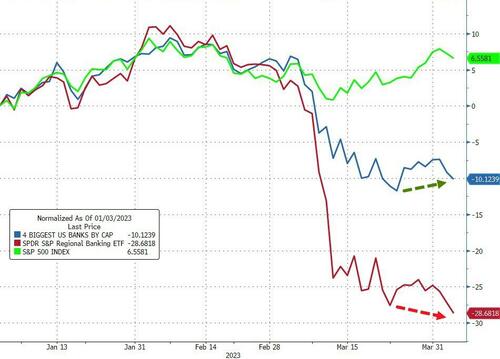

Regional Bank stocks tumbled further today, making new post-SVB collapse lows, with the big banks sliding too (but above post-SVB lows)...

Source: Bloomberg

All eyes were on Western Alliance Bancorp which released data but failed to show its deposits (which spooked a few). Under pressure, around 1300ET, they released the data showing a small drop from $53.6bn at Dec 31 to $47.6bn at Mar 31st (an 11% decline).

Bonds were aggressively bid once again with the whole curve down around 3-4bps (even though the short-end of the curve was whippy today)...

Source: Bloomberg

The 2Y Yield fell to as low as 3.64% today before bouncing back toward 3.80%...

Source: Bloomberg

The 10Y Yield tumbled to its lowest close since Sept 2022...

Source: Bloomberg

Interestingly, amid all the dovish adjustments, the dollar reversed yesterday's losses today, but remains lower on the week...

Source: Bloomberg

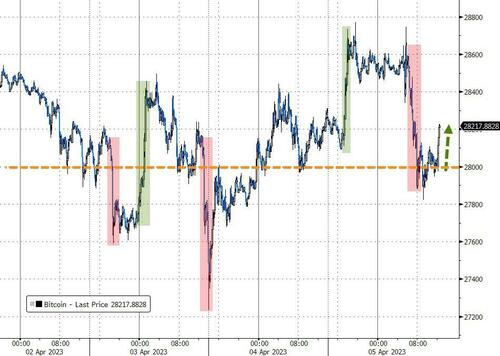

Crypto was choppy as liquidity remains very spartan. Bitcoin rallied up to $28,800 before diving to $27,800 and then bouncing back above $28,000 to end basically unchanged...

Source: Bloomberg

Oil prices were marginally lower today (despite the major draws) with WTI chopping around between $80 and $81 (holding all the post-OPEC+ gains...

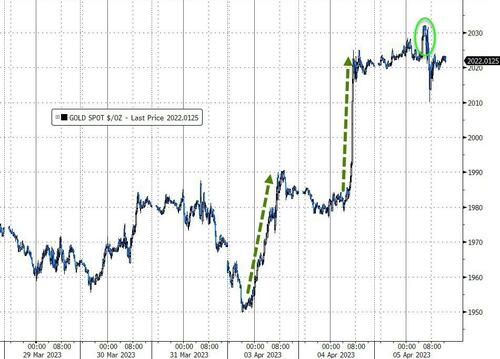

Spot Gold topped $2030 today

Finally, we started this market wrap on data and we'll end of deposits, as Goldman's Chris Hussey noted earlier, after pushing 'pause' on the March banking crisis, regional banks are creeping back into focus this week with some banks losing another 5%-10% of their market cap amidst renewed scrutiny of deposit flows and just what the combination of higher funding costs and tighter lending standards may mean for profitability.

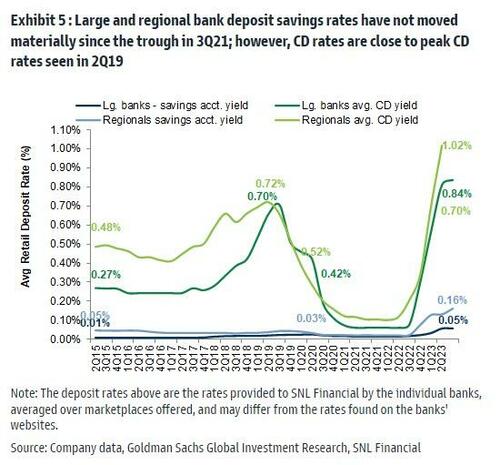

Today, it was WAL that spooked markets (and showed an 1% drop in its deposits in Q1), but Goldman expects deposit inflows into large banks, as both consumers and corporate treasurers have shifted deposits out of smaller banks and into large cap banks, money funds, and directly into UST. Large and regional bank deposit savings rates have not moved materially since the trough in 3Q21; however, CD rates are close to peak CD rates seen in 2Q19...

Clearly, any efforts at increasing deposit betas could create a moderate headwind for bank profitability, lending, and consequently GDP growth... and implicitly pressure the equity prices of the regional banks who would be hardest hit by the margin pressure.

Put another way, this banking crisis is far from over.

https://ift.tt/kLugpjK

from ZeroHedge News https://ift.tt/kLugpjK

via IFTTT

0 comments

Post a Comment