Fed Balance Sheet Shrank By Most In 34 Months But Bank Bailout Facility Usage Rises

After last week saw The Fed's balance sheet shrink very modestly back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to 'improve' or re-worsened amid regional bank shares sliding to new post-SVB lows.

This week's $49.1 billion inflow means more than $350 billion flowed into money funds in the last four weeks, according to the Investment Company Institute. That pushed assets to a record $5.25 trillion, topping the $4.8 trillion pandemic peak and is tracking (suggesting that US commercial bank deposits continued to fall)...

Source: Bloomberg

Fresh deposit data (from the H.8) was scheduled for tomorrow (and according to the site, it was supposed to drop at 1615ET today - but this is govt work after all), but the small silver lining is that the pace of inflows dropped marginally, suggesting the pace of deposit outflows mnay have slowed marginally also...

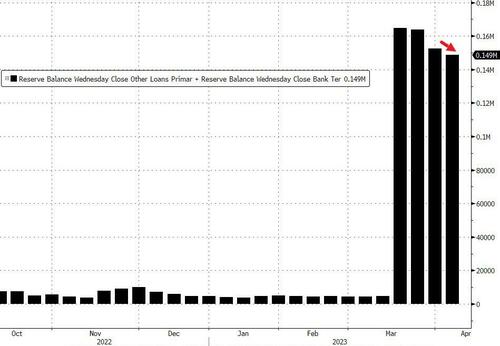

The most anticipated financial update of the week - the infamous H.4.1. showed the world's most important balance sheet shrank again last week, by $73.558 billion. That is the biggest weekly decline in The Fed's balance sheet since July 2020...

Source: Bloomberg

Most of The Fed's balance sheet decline was driven by QT with a total drop in TSY and MBS holdings of $49BN to $.7.877TN

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $153 billion to $149 billion (still massively higher than the $4.5 billion pre-SVB)...

Source: Bloomberg

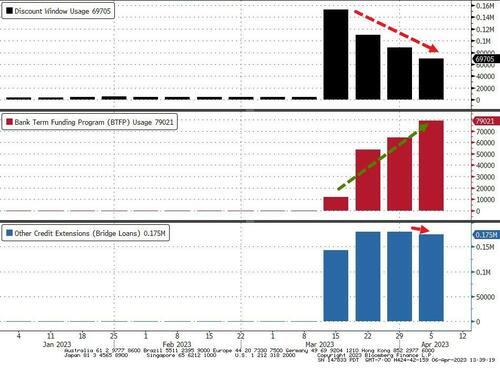

...but the composition shifted, as usage of the Discount Window dropped by $19 billion to $69.7 billion (upper pane below) which however was offset in part by a $15 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $79 billion (middle pane) from $53.7BN last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank - fell very modestly from $180.1BN to $175BN (lower pane)...

Source: Bloomberg

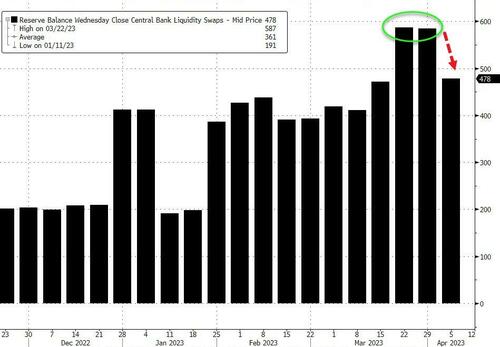

The Fed's USD liquidity swaps shrank to $478 million, down from $585 million in the past week...

Source: Bloomberg

Foreign liquidity swaps fell, along with foreign RRP facility usage but we note that custody holdings of Treasuries at The Fed bounced...

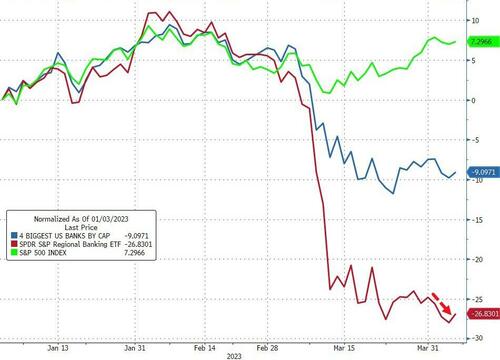

Finally, bear in mind what we detailed earlier, that according to Barclays, a second, slower-burning but even more powerful, bank run wave has now begun as "price sensitive" depositors are no longer dormant, but are not actively looking for the best place to park their money.

Barclays' in-house repo guru Joseph Abate warned that money fund balances could grow by $1trn by the end of this cycle... which would utterly destroy small banks.

Which is also why contrary to the narrative that the banking crisis is now over, because the S&P is back above pre-SVB levels, banks continue to plumb lows.

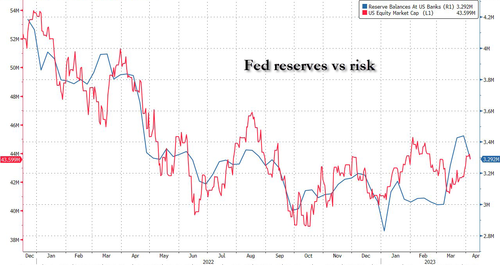

Additionally, the sharp u-turn in reserves...

...stocks may be capped here.

https://ift.tt/IhEUicu

from ZeroHedge News https://ift.tt/IhEUicu

via IFTTT

0 comments

Post a Comment