Why OPEC's "Best Offense Is Defense", And The Biggest Surprise About The Output Cut Announcement

With markets still abuzz over Sunday's OPEC+ decision to cut oil output by over 1.6 million bpd, which was strategic (the political implications of Saudi Arabia bitchslapping the Biden admin just days after it effectively joined the China-Russia-India axes are unmissable even by inbred Deep State types) as well as tactical (i.e., brutalize the oil shorts, a task made easier since energy is now the second most shorted sector after banks, while CTAs are max bearish and will be forced to cover and chase oil higher from here), below we excerpt from two different perspectives on the OPEC decision, the first one from TS Lombard (it is their view that the output cut "this will deter short sellers and help oil prices settle higher – much like what December’s surprise BoJ tweak to Yield Curve Control did for the yen" but in the long run "sticky oil prices are more likely to weigh on growth than arrest the broad disinflation process already under way"), as well as a second one from JPMorgan's chief commodity strategist Natasha Kaneva who lays out what she thinks is the "most surprising part of the announcement."

So without further ado, here is the first take courtesy of TS Lombard's Konstantinos Venetis who explains why OPEC's best offense is defense.

Oil prices have jumped following the decision by a Saudi-led group of OPEC members to cut output by around one million bpd starting next month. This will add to the two million bpd reduction agreed by OPEC+ back in October, taking the total to around 3% of global supply.

The cartel is trying to put a floor under crude prices against the backdrop of rising inventories and downside risks to demand as a US recession looms. This move is also meant to send a message to speculators: the bearish skew in futures positioning had become particularly pronounced recently, which goes some way to explaining today’s strong knee-jerk price response. There is also a political angle to the timing of this announcement, coming shortly after US officials effectively ruled out new crude purchases to replenish the Strategic Petroleum Reserve in 2023, underscoring the souring of US-Saudi relations.

Near term, this will deter short sellers and help oil prices settle higher – much like what December’s surprise BoJ tweak to Yield Curve Control did for the yen. In our experience, however, as a rule the recipe for sustainable oil market turnarounds is positive demand surprises, not pre-emptive supply reductions. Just like the production cuts announced in autumn 2022, this essentially amounts to a defensive move in the hope that the world economy skirts a severe economic downturn in 2023.

Given our expectations for a US recession and limited global spillovers from China’s reopening, our sense is that at this juncture sticky oil prices are more likely to weigh on growth than arrest the broad disinflation process already under way. For bonds, this means that spikes in yields on the back of renewed inflation concerns are likely to be short-lived. For equities, firmer oil prices will (if anything) weigh on already falling earnings expectations.

For commodities overall, the glass still looks half empty: we continue to expect rangebound trading in 2023 Q2, albeit with metals’ outperformance over energy starting to erode as the Brent-to-copper ratio mean-reverts higher.

And here is an excerpt from JPM's Natasha Kaneva laying out what is "the most surprising part of the announcement":

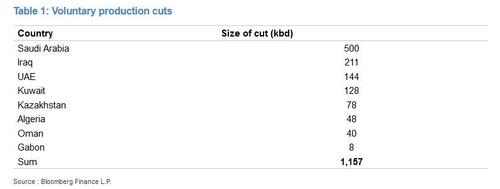

A day before the OPEC+’s advisory (no policy-making) Joint Ministerial Monitoring Committee was set to meet on April 3, Saudi Arabia and other members of the OPEC+ alliance announced a 1.1 mbd oil production cut. Saudi Arabia pledged a “voluntary” 500 kbd supply reduction, in coordination with Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman (Table 1). The cuts will begin in May and last until the end of 2023. Fellow member Russia said the 500 kbd production cut it was implementing from March to June would extend until the end of 2023. Similar to OPEC’s 2 mbd cut last October, we view the current reduction in supply as a preemptive measure, assuring that surpluses that started accumulating in the global oil market since mid-2022 don’t extend into the second half of 2023 as the global economy slows following almost 400 bps of cumulative hikes since 2022.

The most surprising part of the announcement is that it was not made sooner. Since last November our global oil supply-demand balance suggested a strong policy action was needed to keep global oil surpluses in check. For example, the first iteration of the supply-demand balances behind our oil view for 2023 last November resulted in an average 1Q23 Brent price of $78/bbl (WTI at $72/bbl). We believed that the low price level would trigger two policy responses.

- First, the US administration would step into the market to purchase 60 million barrels of oil to partially replenish SPR inventories.

- Second, we believed that to keep the market balanced in 2023, OPEC+ alliance would need to cut its October quota by another 0.8 - 1.0 mbd, effectively slashing production by 0.4 mbd. We estimated that absent policy shift, Brent oil price would be confined to the $70-80/bbl near-term band, with a risk of significantly lower prices were the recent events in the US financial markets to cascade through the regional banking sector.

The combined impact of Sunday's announcement is ~100 kbd (on annualized basis) less crude flowing into the market than we previously expected. Consequently, we leave our long-standing price forecast unchanged. We missed our 1Q23 price forecast by $3/bbl but still see Brent oil prices averaging $89 in 2Q23, rising to $94 in 4Q23 and exiting the year at $96.

- Cuts are taking place two months later than our initial assumption.The timing of the policy response is paramount, and we previously assumed both the US administration and OPEC would act in the first quarter. Acting later diminishes the impact on overall balances and hence it takes longer for the price impact to take hold.

- With the Biden administration publicly ruling out new crude purchases any time soon, OPEC+ alliance needs to do the heavy lifting to balance the market. On annualized basis, our initial assumption of 164 kbd of SPR purchases this year now stands at zero.

- OPEC’s 1.1 mbd cut to production quotas translates to about 0. 8 mbd decline in real production, by our estimates, assuming OPEC+ sticks with current reference levels for the cuts (see our balances in the back of the note). Annualized, this equates to about 533 kbd of supply reduction, which compares to the 333 kbd cut embedded into our price forecast from last November.

- Russia cuts are real but from a higher base than original guidance, offset by longer duration. Russia is moving ahead with its announced 500 kbd cut but from a much elevated crude output level of 10.2 mbd in February (combined Russian crude and condensate production in February was 11 mbd). This means Russia is now aiming to produce 9.7 mbd in March through December, a much shallower reduction in output than Russia previously indicated, but largely in line with our assumption of 9.6 mbd average. If realized, Russia will overcompensate by extending the cuts by six months from the original June end-date through December. The impact on our balance is about 70 kbd less production from Russia this year, annualized.

More in the full reports from JPM and TS Lombard available to pro subs.

https://ift.tt/Qt0icLN

from ZeroHedge News https://ift.tt/Qt0icLN

via IFTTT

0 comments

Post a Comment