Another Day, Another Short-Squeeze For Stocks; Yield Curve Yells 'Recession'

It's like deja vu all over again...

For the second day in a row, US macro data disappointed notably (Housing data today was not good at all). That is the biggest 2-day decline the index since Jan 2022...

Source: Bloomberg

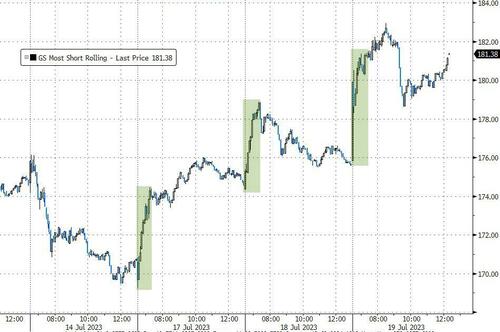

And for the third day in a row, none of that mattered as the algos squeezed the shorts hard at the cash open...

Source: Bloomberg

Nasdaq underperformed on the day (for a change) and ended in the red, with The Dow, S&P , and Small Caps all making modest gains...

Banks were excitedly bid once again...

Source: Bloomberg

For a few brief excitable moments, AAPL (and the AI stocks) all spiked after BBG headlines about AAPL developing a LLM, but that faded as reality was just a copycat and nothing new...

NVDA got excited for an even briefer moment and then faded into the red...

VIX continues to hover with a 13 handle (but VVIX signals some expectation of trouble ahead)...

Source: Bloomberg

The S&P 500 is at its highest since April 2022... but the credit market ain't buying it...

Source: Bloomberg

Yields were lower across the curve today with the long-end outperforming. On the week, the 2Y yield is unch while 30Y is down around 9bps...

Source: Bloomberg

The yield curve (2s10s) flattened once again (back near its most-inverted of the cycle)...

Source: Bloomberg

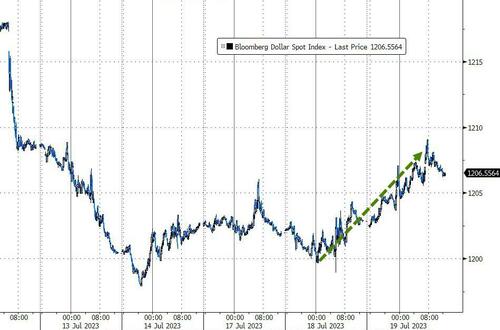

The dollar was stronger today, back to 5 day highs...

Source: Bloomberg

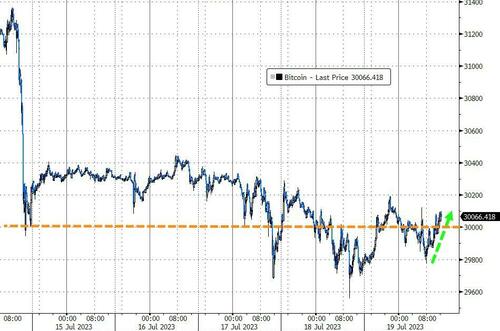

Bitcoin bounced modestly on the day, back above the $30,000 level...

Source: Bloomberg

Gold chopped around on the day but ended unch...

Oil prices ended lower on the day, with WTI testing back down to $75 after DOE reported sizable inventory draws (don't ask us!!)...

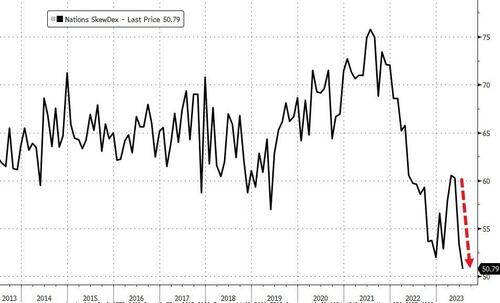

Finally, we note that there is none, nada, zip interesting in hedging downside here. In fact, the S&P 500 skew is at a record low...

Source: Bloomberg

What could possibly go wrong?

https://ift.tt/ZfuE8VO

from ZeroHedge News https://ift.tt/ZfuE8VO

via IFTTT

0 comments

Post a Comment