Asahi Gold Vault 30 Miles Outside Manhattan Added To COMEX Approved Vault List

Submitted by Ronan Manly, BullionStar.us

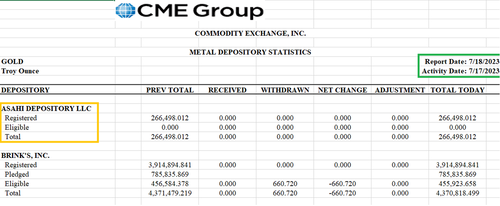

Those who keep an eye on the well-known COMEX daily gold and silver inventory reports, (officially titled CME’s “Warehouse and Depository Stocks”) will by now have noticed that a new depository / vault called “ASAHI DEPOSITORY LLC” has recently made an appearance on the reports, specifically since May of this year.

COMEX inventory reports are always of keen interest in the precious metals space because they show, at least in theory, how much physical gold and silver in held within a group of ‘approved’ depositories / vaults in and around New York City to backstop or meet delivery obligations connected to the trading of gold futures and silver futures contracts on the Commodity Exchange (COMEX).

Note that in addition to gold and silver, ‘Asahi Depository’ is also now an approved CME depository for storing platinum and palladium metals connected to the trading of CME platinum futures and palladium futures contracts on the NYMEX (New York Mercantile Exchange).

Given that a new depository / precious metals vault joining the list of COMEX/NYMEX approved vaulters is quite a rare occurrence, it’s worth examining Asahi Depository and its approval by the CME Group (owner of COMEX and NYMEX), as well as looking at where the Asahi Depository vault is located in the US.

COMEX SILVER VAULT TOTALS RISE OVER 2.2 MILLION OUNCES

- Registered rose almost 1.2M oz. as the newly added Asahi Depository begins adding silver for the first time.

- Open Interest is now equal to 254% of all vaulted silver and 2,252% of Registered silver. pic.twitter.com/JZgU1oPyY9— Michael #silversqueeze (@mikesay98) May 18, 2023

As per the CME website, we find that Asahi Depository made an application to CME to become an approved depository for precious metals storage all the way back on March 15, 2022:

“Application for Gold, Silver, Platinum and Palladium Regularity

Notice is hereby given that Asahi Depository LLC. has applied to become an Approved Depository for gold, gold (enhanced delivery), silver, platinum, and palladium at the following location:

Asahi Depository LLC Location Blauvelt, NY”

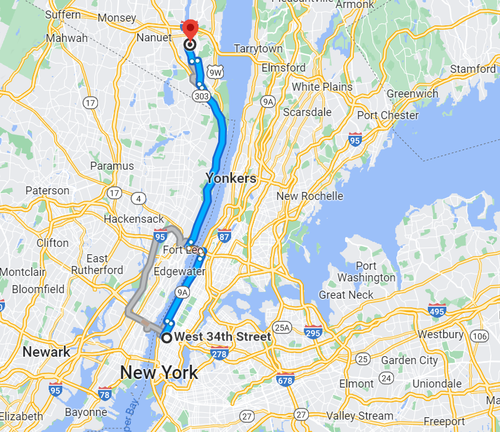

Blauvelt is a municipality in Rockland County, New York, in the town of Orangetown, 30 miles from midtown Manhattan, and about 40 minutes drive from midtown via the NY-9A North/Henry Hudson Pkwy and then Palisades Interstate Pkwy North taking the Orangeburg exit.

Following the application to CME in March 2022, NYMEX and COMEX then approved the Asahi Depository application on May 01, 2023:

“Regularity Approval for Gold, Silver, Platinum, and Palladium

New York Mercantile Exchange, Inc. (“NYMEX”) and Commodity Exchange, Inc. (“COMEX”) (collectively, the “Exchanges”) has approved the application of Asahi Depository LLC. to become an Approved Depository for gold, silver, platinum, and palladium at their facility in Blauvelt, NY.

This approval is effective immediately.”

While this might seem like a long delay between applying for approval (March 2022) and securing approval (May 2023), the delay - as you’ll see below - was probably due to the fact that the Asahi storage facility in Blauvelt, New York, was not fully up and running until early Q2 2023.

Asahi Refining

So who or what is Asahi Depository LLC?

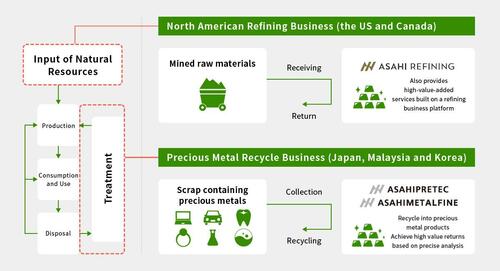

Asahi Depository LLC is a subsidiary of Asahi Refining, which itself is a wholly owned subsidiary of Japan’s Asahi Holdings, Inc. So technically speaking, a Japanese owned depository has now entered the COMEX precious metals storage market.

For those who thought that Asahi is a Japanese beer, you’re not wrong. But … it’s not the same Asahi, and not even the same holding company. Japan’s famous Asahi beer is manufactured by similarly named Asahi Group Holdings. Asahi Depository is part of Asahi Holdings.

Coincidentally, Asahi Holdings, Inc very recently rebranded as ‘ARE Holdings’, actually on July 01, 2023, so any confusion over Asahi Group Holdings vs Asahi Holdings will from now on be purely historical.

Asahi Refining itself came into existence in March 2015 when Asahi Holdings Inc completed the acquisition of the Johnson Matthey Gold & Silver refining businesses in North America, following Johnson Matthey’s decision in 2014 to divest of its nearly 200 year old precious metals refining business.

The Asahi acquisition included Johnson Matthey’s US precious metals refinery located in Salt Lake City, Utah, and the Johnson Matthey precious metals refinery located in Brampton, Ontario, Canada.

As per the Asahi Refining press release about the acquisition on March 06, 2015:

“Asahi Holdings is a Tokyo, Japan based precious metals recycling company (collection, recovery, refinement) founded in 1952. “

“Asahi Holdings is proud to announce on March 5, 2015 that it has finalized the acquisition of the former Johnson Matthey Gold & Silver refining businesses.”

“The Salt Lake City, USA and Brampton, Canada refineries will collectively operate as “Asahi Refining.”

The Johnson Matthey Salt Lake City refinery is now known as the ‘Asahi Refining USA, Inc’ while the Johnson Matthey Brampton, Ontario refinery is now known as ‘Asahi Refining Canada Limited’.

Japanese gold refiner Asahi wins auction for the assets of bankrupt Republic Metals Corp (RMC) of Miami, with a bid of $25.5 million, after Asahi outbid the Swiss Valcambi refinery on Thursday - Reuters https://t.co/0MPkBLMGQx

— BullionStar (@BullionStar) February 1, 2019

Both refiners are on the London Bullion Market Association (LBMA) Good Delivery Lists for both gold and silver. Asahi Refining Canada is a full member of the London Bullion Market Association (LBMA). Asahi Refining also operates a precious metals mint located in Miami, Florida and fabricates a range of gold and silver cast bars and minted bars as well as silver rounds.

Further details about the precious metals recycling business of Asahi Holdings (collection, recovery, refinement) can be read here.

Asahi Depository

Let’s look at Asahi Depository LLC. The company Asahi Depository LLC was registered on December 17, 2021 New York State Department of State (NYSDOS).

Looking at the Asahi Refining website, a press release published on June 02, 2023 refers to “Asahi Refining’s expansion into vaulting and storage services” where it “looks to establish itself as a leader in the precious metals storage industry”. This expansion is being done via Asahi Depository LLC.

Specifically:

“Asahi Depository LLC (ADL) is proud to announce its approval by the CME Group (CME) as a storage facility for Gold, Silver, Platinum, and Palladium.

This is a significant achievement as the approval, which is dually applicable for both the Commodities Exchange (COMEX) and the New York Mercantile Exchange (NYMEX), ensures that ADL meets strict standards for security, transparency, and accuracy in the storage and handling of precious metals.”

As regards the location of the vaulting facility, the press release goes on to say that:

“Located in Blauvelt, NY, ADL is located within 30 miles of the CME in New York. ADL’s near proximity to the New York metropolitan area provides easy access to a range of financial institutions, and other industry professionals.

Likewise, the location, just outside of Manhattan, offers a distinct advantage of accessibility without the hassle of navigating the city’s logistical challenges.”

PDF version of press release here.

875 Western Highway - Hudson Crossing

Its very easy, using publicly available information on the web, to pinpoint exactly where this Asahi Depository vault is located. A quick Google search of “Asahi Depository” and “Blauvelt” reveals that the Asahi Depository is located at 875 Western Hwy, Blauvelt, NY 10913.

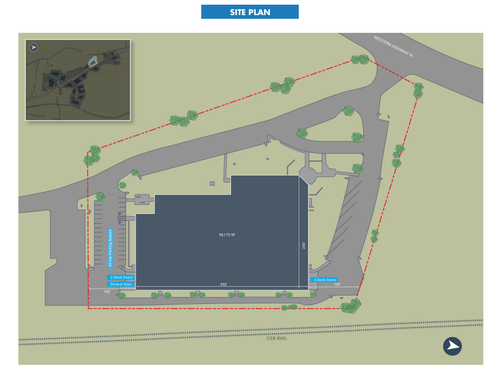

The location 875 Western Highway is in the Hudson Crossing industrial park. The building is Building 11, and is 98,172 sq feet in area with a ceiling height of 23 feet.

Asahi Depository LLC bought its building in Hudson Crossing in February 2022 from Partners Group & Onyx Equities LLC for US$ 24.565 million. The building is described as “100% leased, wet sprinklers, 6 docks, 1 drive-in door, CSX rail line spots”. See Lee & Associates Q1 2022 Industrial market snapshot here.

You can also see plans of the building on the Hudson Crossing website, where it also says that the building, built in 1981, also has a 18,839 square foot mezzanine floor, and 40’ x 40’ column spacing. The site plan is also here on the CBRE website.

Also in February 2022, Asahi then entered into a set of lease agreements with the County of Rockland Industrial Development Agency (IDA) so as to obtain tax relief, in which Asahi leased the property to IDA, and IDA leased it back to Asahi, and IDA promised to grant Asahi an exemption from sales tax up to US$ 711,000 for qualified expenditures up to US$ 8.5 million.

On the Orangetown Tax Map, the Asahi Depository property (located at 875 Western Highway, Blauvelt, New York) is identified as Section 65.13, Block 1, Lot 2; in the LO zoning district.

After buying the building in February 2022, Asahi also submitted some planning requests to the town of Orangetown on June 3, 2022 for modifications to the property:

“Applicant is proposing to utilize the existing building for a NY based corporate office and for the storage of gold and silver”.

“Applicant is proposing a new 8’-0” high fence which requires a 5’-4” setback from the property along the side yards and rear yard.”

A more detailed letter on June 23, 2022 from Asahi’s architect to the Zoning Board of Appeals expanded on this request:

“The building at 875 Western Highway, Blauvelt, NY was purchased by the Owner Asahi Depository LLC to be used as an office & storage facility where rare metals will be stored on site. The need for heightened security on the site is crucial for the operation of the facility. A new 8.0’ high fence is thus proposed along the side and rear yards of the property to ensure the controlled access into the facility.”

Asahi also requested expansion of loading docks and expansion of turning radius area for armored delivery trucks.

This request was heard by the zoning board on September 07, 2022 and the minutes of the hearing can be seen here, which include such facts as that Asahi’s armored delivery trucks are 75 feet long, that Asahi Depository wanted 4 loading docks (2 of which will be in use all the time), that they have trucks coming from Utah and Canada twice a week that are loading and unloading metal bars that are stored in the Blauvelt facility.

Here the references to Utah and Canada refer to Asahi’s Salt Lake City refinery in Utah and Asahi’s Brampton, Ontario refinery in Canada.

Asahi Depository has also recently been hiring staff for the Asahi Depository in Blauvelt, for example “full-time Security Guard positions available at our new facility in Blauvelt”, and also "full-time Material Handler positions available at our new facility in Blauvelt, New York", and also a “a full-time Inventory & Logistics Administrator position available at our new facility in Blauvelt”.

Conclusion

You can see from these timelines that Asahi bought the Hudson Crossing warehouse property in February 2022, then applied for COMEX / NYMEX approval in March 2022, but then also needed to wait to receive local planning approvals and tax relief, and then presumably made security and other modifications to the property, and then CME granted the application for COMEX/NYMEX vault approval by May 2023.

According to the COMEX inventory reports, as of July 20, 2023, the Asahi Depository in Blauvelt is storing 266,498 troy ounces of gold (8.29 tonnes) and 1,880,973 troy ounces of silver (58.5 tonnes), all of which is in the 'registered category' meaning that all of this metal has COMEX warrants attached.

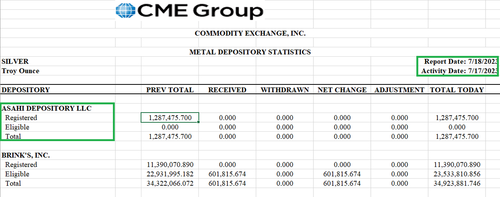

Interestingly, on July 18, a deposit of 593,497 troy ozs of silver (18.46 tonnes) was added to Asahi's 'registered' silver category, which boosted the previous total of 1,287,476 ozs (40 tones) to 58.5 tonnes.

COMEX SILVER VAULT TOTALS RISE 1.14M OUNCES

— Michael 🏳️🌈 #silversqueeze (@mikesay98) July 19, 2023

- Registered rises 593K oz., courtesy of a deposit (not a transfer from Eligible) into the new-ish Asahi depository.

- Open Interest is now equal to 264% of all vaulted silver and 2,076% of Registered silver. pic.twitter.com/JKulQqIgb8

The CME inventory reports show that the Asahi Depository has no gold or silver in the 'eligible' category. Apart rom the 18.46 tonnes inflow of silver, the quantities of gold and silver in the Asahi vault look static and don't seem to be changing regularly at this point in time. But presumably that will change as the Asahi Despository at Hudson Crossing gets more business.

CME warehouse inventory reports for platinum and palladium also show that the Asahi Depository, although listed on the reports, is holding no platinum or palladium in either the 'registered' or eligible categories.

While most of the COMEX approved vaults are in New York City, not all of them are. This is because the CME (COMEX) Rulebook allows approved vaults to be within 150 miles og New York City.

As per CME Rulebook - Chapter 7, 703 (11):

” The depository for gold deliverable against the Gold futures (GC) contract must qualify and be designated a weighmaster and must be located within a 150-mile radius of the City of New York”

For appoved gold depositories, the vaults of JP Morgan, HSBC, MTB, Loomis, Brinks and Malca-Amit are in New York City. But the vaults of Delaware Depository and IDS Delaware, are, as the names suggest, in Delaware. Now you can add Asahi to that list.

For appoved silver depositories, the COMEX list is identical to gold, except that the CNT Depository in Bridgewater, Massachusetts is also an approved depository for silver. While Bridgewater is about 220 miles from midtown Manhattan, the 150 mile rule does not apply to silver.

This article was originally published on the BullionStar.us website under the same title "Asahi vault 30 miles outside NYC added to COMEX approved vault list"

https://ift.tt/Qw812dL

from ZeroHedge News https://ift.tt/Qw812dL

via IFTTT

0 comments

Post a Comment