Large Bank Loan Volumes Continue To Shrink Despite Soaring Deposit Inflows

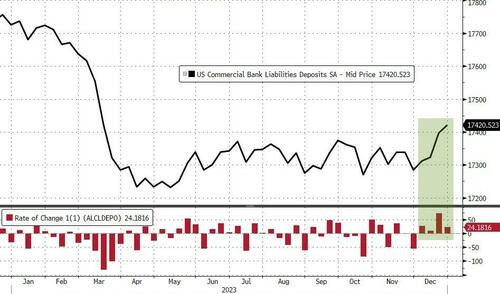

After losing more than a trillion dollars in deposits in 2023 - and seeing usage of The Fed's emergency funding facility soar to a record high yesterday - total bank deposits rose by $24.2BN in the week-ending 12/27/23 (on a seasonally-adjusted basis) - that is the 4th straight week of deposit inflows...

Source: Bloomberg

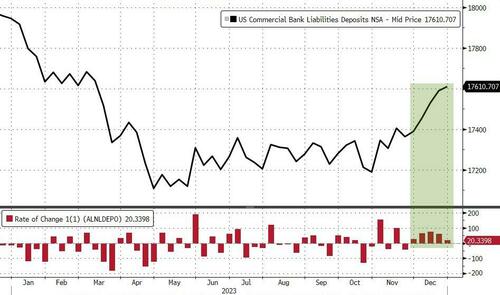

On a non-seasonally-adjusted basis, deposits rose almost in line, up $20.3BN (the fifth week of inflows in a row)...

Source: Bloomberg

Interestingly the sizable deposit inflows are occurring alongside sizable money-market fund inflows...

Source: Bloomberg

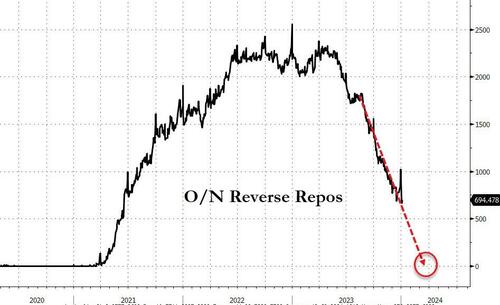

...now we know where all that reverse repo liquidation cash is going...

Source: Bloomberg

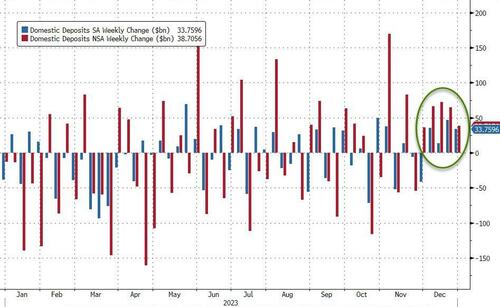

Excluding foreign bank flows, the picture is even rosier with domestic bank deposit inflows of $33.8BN (SA) and $38.7BN (NSA) - the 5th week in a row of NSA inflows...

Source: Bloomberg

While it may surprise some, on an NSA basis, domestic bank deposits are now back above pre-SVB levels...

Source: Bloomberg

Large banks saw $24BN inflows last week and Small Banks $9.4BN (on an SA basis) and for the 5th week in a row both large and small banks saw NSA inflows (+$30BN and +$8.7BN respectively)...

Source: Bloomberg

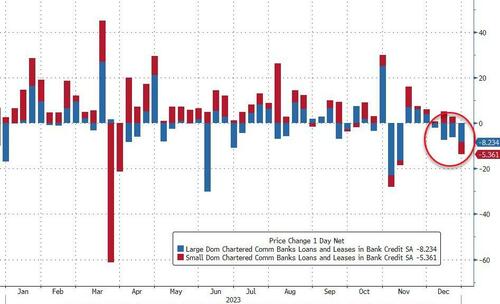

On the other side of the ledger, loan volumes continued to shrink (despite the deposit growth). Large bank loan volumes fell $8.2BN (the 4th week of falling loan volumes in a row)...

Source: Bloomberg

Which leave us continuing to highlight the fact that there is potential trouble brewing still as the key warning sign continues to flash red (Small Banks' reserve constraint - blue line), supported above the critical level by The Fed's emergency funds (for now)...

Source: Bloomberg

As the red line shows, without The Fed's help, the crisis is back (and large bank cash needs a home - green line - like picking up a small bank from the FDIC).

All of which keep us wondering, are we setting up for another banking crisis in March as:

1) BTFP runs out...

It was only a 12 month temporary program, and it is going to be hard for The Fed to keep it alive:

Dear @federalreserve now that everyone knows about your BTFP arb where you literally give free money to banks, you will of course be closing the loophole and ending the facility https://t.co/W3Q5X6AWuI

— zerohedge (@zerohedge) December 22, 2023

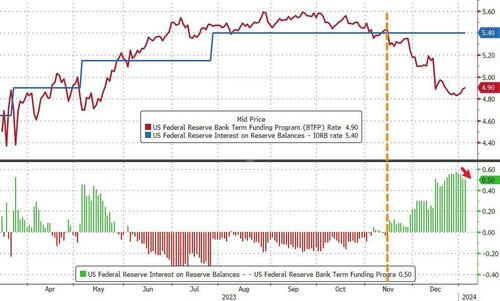

The BTFP-Fed Arb continues to offer 'free-money' (and usage of the BTFP has risen by $32BN since the arb existed), but the spread has narrowed a smidge from a peak near 60bps to 50bps today...

Source: Bloomberg

Which will make it hard for The Fed to defend leaving the facility open after March when its "temporary" nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

2) RRP drains to zero...

...at which point reserves get yanked which means huge deposits flight.

Source: Bloomberg

Is this the real reason why The Fed 'pivoted'? It knows what's coming?

https://ift.tt/39o6Itn

from ZeroHedge News https://ift.tt/39o6Itn

via IFTTT

0 comments

Post a Comment