Yields JOLTed Higher, Stocks Lower Ahead Of Fed/Treasury

Higher-than-expected job openings from the JOLTS survey lifted bond yields (optimistically) today but the real story was in the quits - which dropped to pre-pandemic levels (suggesting "workers' willingness of ability to leave jobs" is considerably lower (i.e. labor market not strong). You can decide which is more 'real'.

Home price appreciation slowed, according to Case-Shiller; but consumer confidence ripped with 'current conditions' hitting the highest since pre-COVID-lockdowns.

The short-end underperformed with notable bear flattening in the curve. The long-end actually rallied on the day (30Y -4bps)...

Source: Bloomberg

In the meantime, 'soft' survey data continues to trend lower as 'hard' economic data is reignited...

Source: Bloomberg

... by the massive loosening of financial conditions...

Source: Bloomberg

But most notably, this is where the week gets really exciting with tonight's GOOG/MSFT earnings, tomorrow's Treasury AQR details, then FOCM and so on.

The Dow managed gains on the day with the S&P 500 unchanged while Nasdaq and Small Caps in the red...

Source: Bloomberg

...as MAG7 stocks faded (on AAPL shipment anxiety), erasing all of yesterday's gains...

Source: Bloomberg

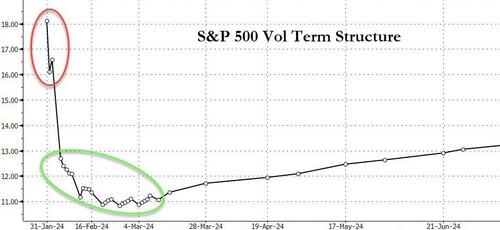

The vol market is pricing some 'uncertainty' in the next few days then a return to the usual...

Source: Bloomberg

Yesterday's manic meltup squeeze was erased in 'most shorted' stocks after it tagged last week's high stops...

Source: Bloomberg

Bitcoin extended yesterday's gains, holding around $43,500, but Ethereum surged back above $2350...

Source: Bloomberg

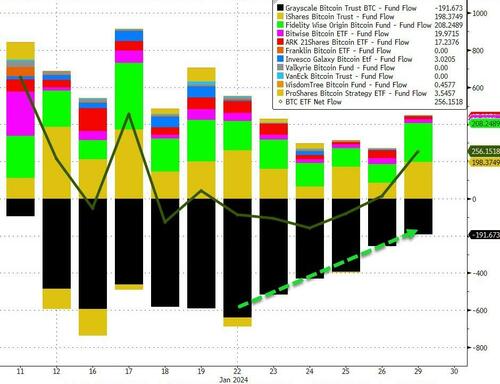

...after the smallest GBTC outflow since 'day one' of the ETFs (and highest net inflow in two weeks)...

Source: Bloomberg

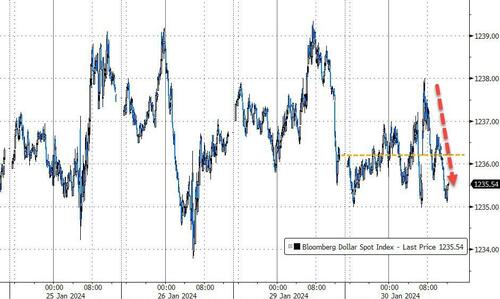

The dollar ended marginally lower on the day but was mostly directionless...

Source: Bloomberg

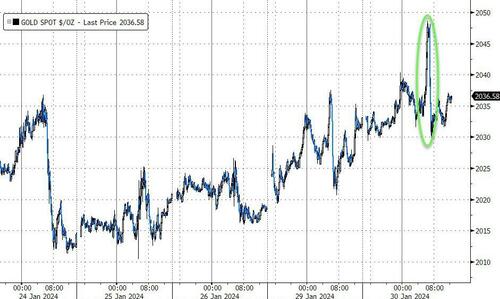

Gold (spot) surged up towards $2050 as the cash equity market opened this morning, only to fall back down to a modest gain after JOLTS...

Source: Bloomberg

Oil prices ended higher with WTI bouncing off $76.00 up to $78...

Source: Bloomberg

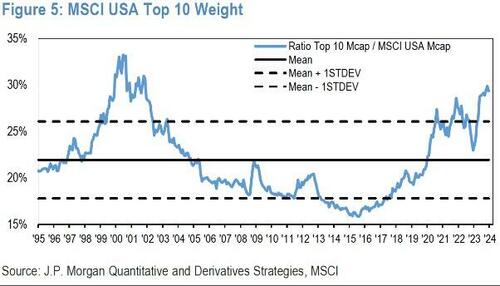

Finally, it's the same this time...

Source: Bloomberg

https://ift.tt/i6v0F5J

from ZeroHedge News https://ift.tt/i6v0F5J

via IFTTT

0 comments

Post a Comment