Credit Card Debt Jumps To New All-Time High, As Card Rates Rise To New Record

Just when you thought US consumers had finally learning their lesson, and had stopped buying stuff they can't afford with money they don't have... we got the latest consumer credit data which collapsed that particular thesis in a millisecond.

After last month we saw an unprecedented halt to growth in both revolving credit (i.e., credit card) growth - which rose by just $1 billion - as well as non-revolving (i.e., auto and student loans) which practially flatlined growing by just $0.5 billion - in January things were seemingly back to normal, as total consumer credit surged by $19.5BN, compared to the $0.9BN downward revised December print (from $1.561BN originally), driven by a powerful rebound in both credit card and auto loans.

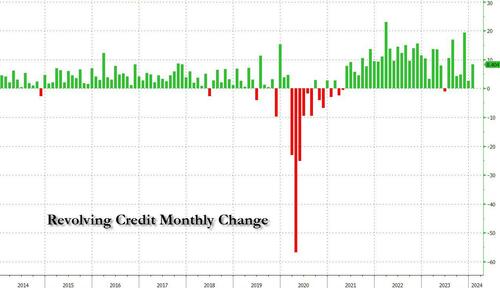

Starting at the top, revolving credit in January rose by $8.4 billion from an upward revised $2.6 billion...

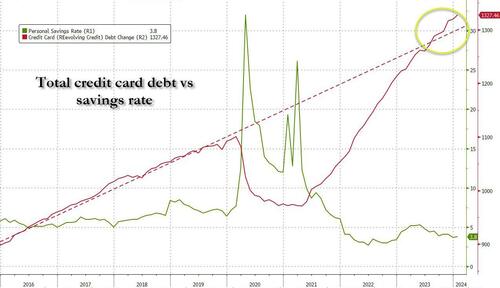

... pushing total revolving credit to a record $1.327 trillion, which as shown in the chart below means that the trendline from the pre-covid era has now been surpassed, while the savings rate is at an all time low.

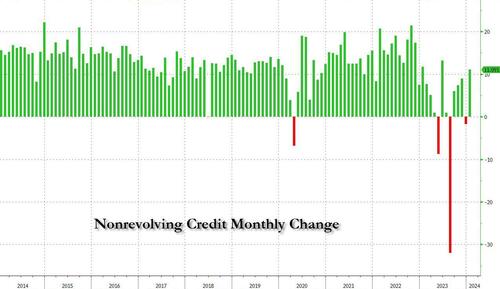

Meanwhile, on the non-revolving credit side, "number also go up", rising by $11 billion to a record high $3.712 trillion after unexpectedly declining by $1.7 billion in December.

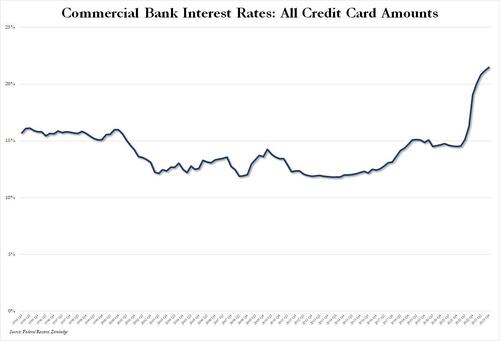

The latest acceleration in credit card debt comes as a surprise for several reasons, not least of all that according to the Fed, the average rate across all commercial banks on all credit card amounts just hit a new record high of 21.47% despite the drop in rates observed in late 2023, which is a vivid reminder that while banks are happy to hike credit card rates, they rarely if ever cut them.

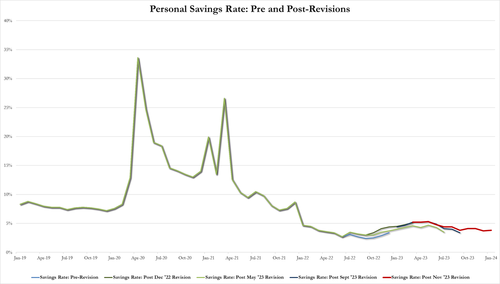

Yet with consumers ever more strapped for actual cash and equity, as the personal savings rate in the US has collapsed from over 5% to 3.8% - the lowest since 2022 - in just a few months...

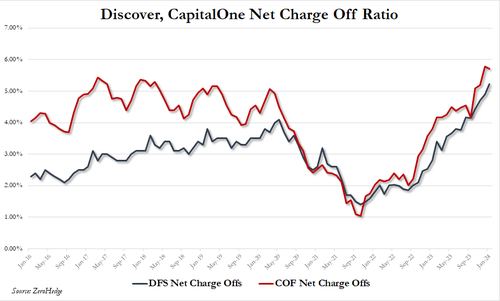

... there is only so much more credit card maxing out that can take place before reality finally sets in, although with an election on the horizon - one which ensures that any credit-card fueled spending must be encouraged - don't be surprised if the White House instructs banks to just ignore soaring delinquency and charge-off rates...

... as discussed in more detail earlier in "These Are The 5 Charts The FDIC Does Not Want You Paying Attention To", only for the hammer to fall on the first day of Trump's new presidency.

https://ift.tt/VFMN1bu

from ZeroHedge News https://ift.tt/VFMN1bu

via IFTTT

0 comments

Post a Comment