Goldman Explains Why A Trump Victory Will Pop The AI/Tech Bubble

With the November elections less than five months ago, the market has been amazingly complacent and oblivious about the potential shock that, frankly, either presidency would unleash. But that's about to change.

As Goldman trader John Flood warns in a weekend note, the results of the upcoming US presidential election could have a substantial impact on the USD and the relative performance of domestic-facing vs. internationally-exposed firms. The first presidential debate is scheduled for this Thursday, June 27th.

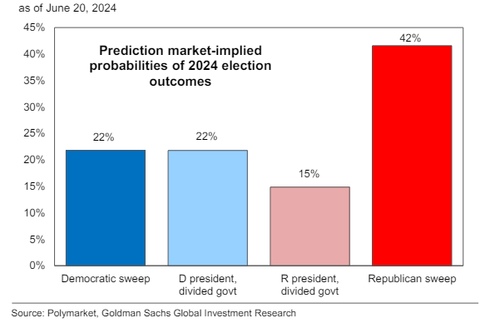

Meanwhile, online prediction markets imply slightly higher odds of a Trump presidency than a Biden presidency, with the probability of a Republication sweep (42%) almost twice the odds of a Democratic sweep (22%)...

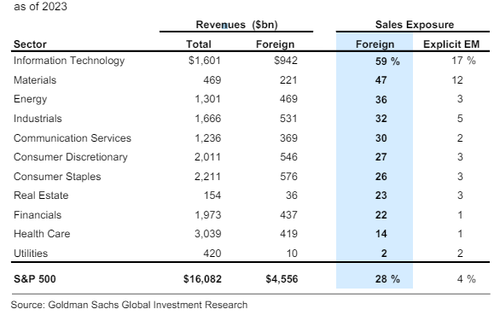

And as attention finally starts to turn to the outcome of the elections, Goldman economists expect the dollar to strengthen under a Republican White House victory regardless of whether there is a sweep or divided government. That's because as discussed earlier, Trump has floated several potential tariff policies, including a 10% across-the-board tariff on imports along with a 60% tariff on imports from China, all of which would spark a sharp increase in inflation. And, as Goldman notes, "tariff increases appear likely in the event of a Trump victory and would likely strengthen the USD." The bank goes on to caution that tariffs would create a headwind to the performance of stocks with high international revenue exposure due to the risk of retaliatory tariffs as well as heightened geopolitical tensions. It may come as a shock to some that the all too bubbly Tech has the highest international sales exposures with a whopping 59% of total revenues (and 17% is purely EM), while the far less bubbly Cyclicals are in second place.

In addition to companies with elevated international revenues, companies that are dependent on international suppliers would also face headwinds from tariffs. Goldman screened S&P 1500 goods companies into groups of stocks with the largest exposure to suppliers from the US, suppliers outside the US, and suppliers in Greater China specifically. Once again, the median Tech Hardware stock has the greatest exposure to suppliers from Greater China while the median Broadline Retail stock has the greatest exposure to domestic suppliers.

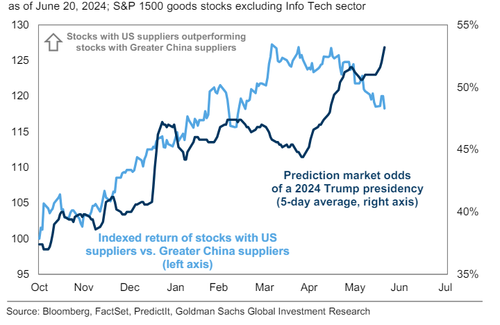

Goldman shows that an equal-weighted portfolio of stocks most exposed to suppliers from Greater China (excluding Tech) has lagged a similarly-constructed portfolio of stocks most exposed to suppliers from the U.S. by 18% since last fall. The relative performance of these two groups has generally moved with prediction market odds of a Trump presidency...

Of course, if one also adds tech names to this portfolio of stocks exposed to China suppliers, one gets an exponential meltup... which is why anyone looking for the pin that pops the mega tech/AI bubble, look no further than Trump's victory on November 5.

More in the full Goldman note available in the usual place to professional subs.

https://ift.tt/VfRx5yw

from ZeroHedge News https://ift.tt/VfRx5yw

via IFTTT

0 comments

Post a Comment