'Magnificent 7' Stocks Fade As NVDA Becomes World's Largest Company... Ever

In an attempt to not bury the lead, NVDA continued its irrepressible charge higher (up $375 BN in the last week, up $1.44 TN in the last two months, and up $2.2 TN YTD)...

Source: Bloomberg

... topping MSFT and AAPL as the world's largest market cap company... ever...

Source: Bloomberg

Did America's capital markets just become a 'Magnificent One' market as the rest of the MAG7 faded today...

Source: Bloomberg

Earlier in the day, weak retail sales but strong industrial production offered a mixed background for today's trading and stocks trod water for most of the early going (apart from Small Caps) as bond yields tumbled.

Also a mixed bag of FedSpeak today (with Goolsbee the standout dove as always against the other realists)

-

*FED'S MUSALEM: COULD TAKE 'QUARTERS' TO SEE DATA TO SUPPORT CUT

-

*FED'S MUSALEM: WOULD SUPPORT HIKE IF INF. PROGRESS STALLS, REVERSES

-

*FED'S LOGAN: I'M STILL WORRIED ABOUT UPSIDE RISKS TO INFLATION

-

*FED'S KUGLER: RETAIL SALES INDICATE ECONOMIC ACTIVITY MAY BE COOLING

-

*FED'S GOOLSBEE SAYS MAY CPI NUMBERS WERE 'EXCELLENT'

The CBO estimated a much bigger deficit than expected which briefly spooked stocks but as always any dip was bought.

But, of note, Nasdaq was the day's laggard and Small Caps led the day (but all with very modest changes)...

Small Caps swings did not appear to come from any squeezes as 'most shorted' was very quiet again...

Source: Bloomberg

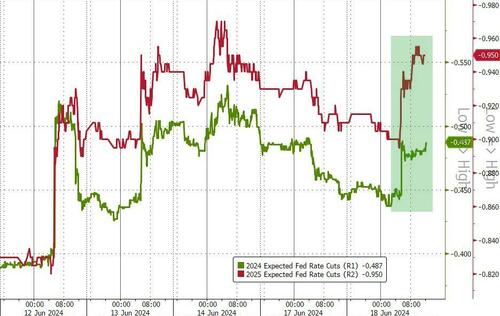

Rate-cut expectations (dovishly) rose today...

Source: Bloomberg

And combined with weak retail sales data and a super strong 20Y auction, Treasury yields tumbled, erasing all of yesterday's yield rises...

Source: Bloomberg

The dollar dipped lower today...

Source: Bloomberg

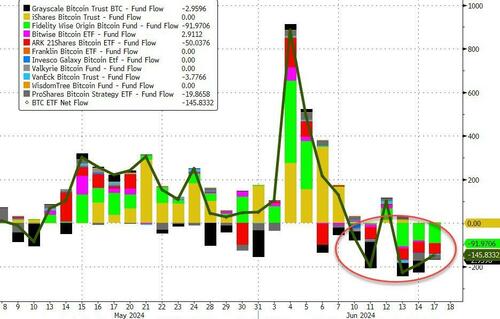

Bitcoin ETFs have seen 5 net outflows in the last six days...

Source: Bloomberg

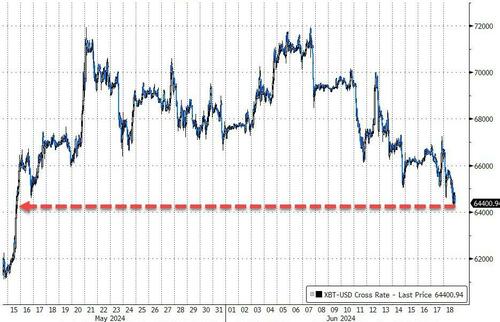

...spot bitcoin breaking down towards $64,000...

Source: Bloomberg

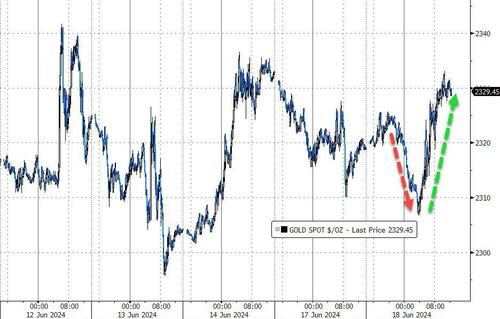

Gold managed modest gains as the dollar dipped today...

Source: Bloomberg

Oil extended its gains, with WTI testing up towards $82 near 7 week highs...

Source: Bloomberg

Finally, remember the dotcom bubble... and CSCO's dominance... well you ain't seen nothing...

Source: Bloomberg

...meh, it's probably different this time, right!

https://ift.tt/2JseaKd

from ZeroHedge News https://ift.tt/2JseaKd

via IFTTT

0 comments

Post a Comment