China's Bond Market Faces Turmoil Amid Maturity Deluge

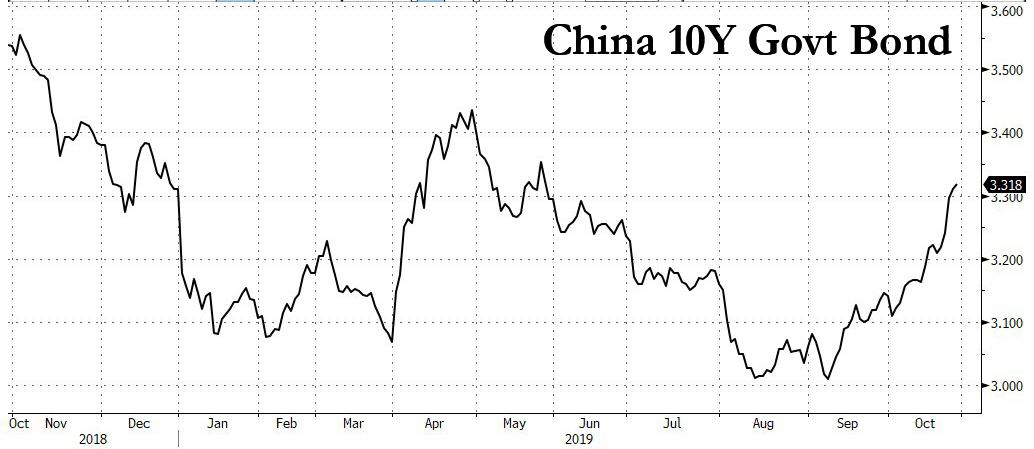

While the US bond market has had its share of harrowing slumps and vomit-inducing short squeezes in the past year as consensus shifted from one of "the neutral rate is far away" to "here comes NIRP", China's bonds have been a bastion of stability, trading in a tight range between 3% and 3.50% for the past year.

That may be about to change.

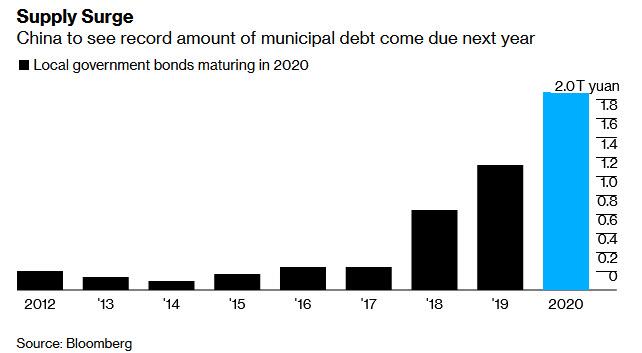

The reason: a wall of bond maturities is about to flood across China’s sovereign-bond market, which in the past three months has already been reeling from a global sell-off and rising inflation.

According to Bloomberg, more than 2 trillion yuan ($283 billion) of local-government notes will mature in 2020, a record and 58% more than this year’s level. This means fresh debt to refinance upcoming maturities will start hitting the market soon, with a the southern province of Guangdong expected to sell notes as early as November.

This is happening as China's 10-year yield rose 3 basis points to 3.31%. the highest since late May, while the cost on 12-month interest rate swaps jumped 5 basis points to 2.92%. The yield on China Development Bank’s 3-year bonds due January 2022 rose 10 basis points to 3.25%.

Despite trading in a narrow range, China’s government bonds have been sliding for nearly two months, starting around the time a "growth shock" hit US rates and sparked the infamous quantastrophe, with the 10-year yield hitting the highest since May as selling momentum accelerated. Naturally, a flood of new supply will only exacerbate the weakness, especially as real, inflation-adjusted yields are barely above zero, a rarity for emerging markets.

“The large amount of supply that will be rolled over will weigh on China’s sovereign bonds,” Ken Cheung, chief Asia FX strategist at Mizuho Bank, told Bloomberg. The risk only grows when one considers the recent surge in food inflation as a result of "pig Ebola", coupled with lower expectations of central bank stimulus.

To avoid a panic issuance scramble, Deputy Finance Minister Xu Hongcai said in September that China will grant part of a special bonds quota in advance to ensure that the funds raised can be used early in the year, Bloomberg reported, noting that so-called "special bonds have mostly been used for infrastructure spending, and the national limit could be raised from 2.15 trillion yuan."

Earlier, in June, the State Council expanded the sectors that funds raised via the special bonds can be put toward. For 2020, they will include transport, energy, agriculture and forestry, vocational education and medical care. Overall fixed-asset investment has slowed this year amid pressure from the U.S. trade war.

Of course, there is only so much selling that the PBOC can take before it has to intervene, which is why so many China watchers have been stumped by the central bank's lack of willingness to intervene so far.

Beijing’s decision to avoid conducting aggressive stimulus measures - even as China's growth engine sputters, and the economy grows at the slowest pace since the early 1990s - has spooked bond investors. The central bank has held off from adding liquidity this week, instead allowing large short-term cash injections to mature. That’s effectively drained 500 billion yuan from the financial system. Meanwhile, China's credit impulse which previously pulled the entire world out of a recessionary ditch, has barely pushed off the cycle lows.

Some analysts said the central bank could instead use a targeted tool to inject one-year cash, which it refrained from doing Wednesday. That said, there is also a limit how aggressive the PBOC can get: soaring consumer prices, fueled by the surging cost of pork, are seen capping how much liquidity Beijing can provide without further stoking inflation.

Which means that very soon, the PBOC will be forced to choose: risk runaway bond yields, tumbling risk prices and an even faster slowdown in the economy, or stimulate the economy, and watch as the yuan tumbles as inflation surges even more. The only question is whether this terminal dilemma will come before or after the US is faced with a roughly similar choice.

https://ift.tt/2MZiXmf

from ZeroHedge News https://ift.tt/2MZiXmf

via IFTTT

0 comments

Post a Comment