Stocks Paralyzed Ahead Of Key GDP Print, Fed's "Hawkish Cut"

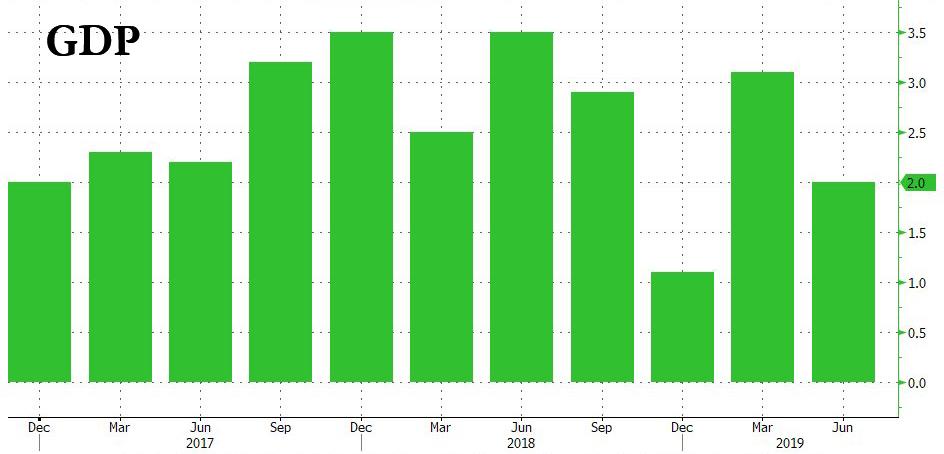

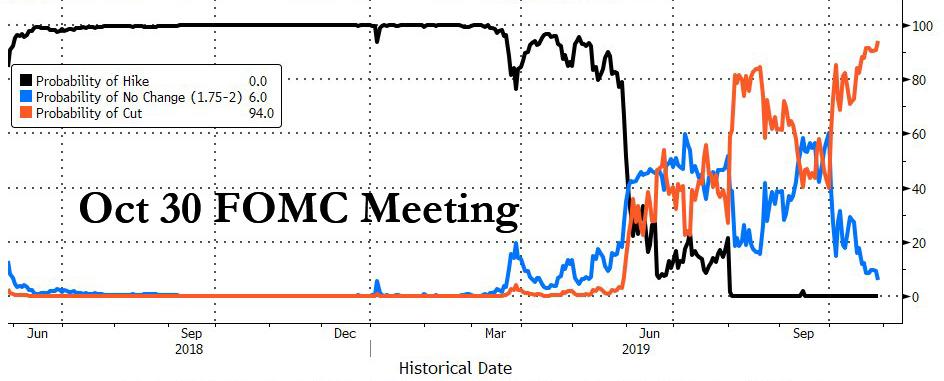

US equity futures and European bourses are unchanged as traders hunker down ahead of two key events: today's Q3 GDP print, which at 1.6% expected, would be the second lowest print of the Trump presidency, but far more important will be today's "hawkish cut" by the Fed, which the market prices in with 94% certainty, but the question is what happens after this 3rd consecutive "insurance" cut, and will the Fed admit the US is headed for a recession with more rate cuts this year of ahead of the 2020 presidential elections.

Global shares slipped off 21-month highs on Wednesday as the fully-priced in prospect of a rate cut was offset by reports a Sino-U.S. trade deal may not take place in November, but a possible $50 billion merger between Fiat-Chrysler and PSA capped European losses. US equity futures struggled for traction after the S&P 500 slipped from a record on Tuesday.

With stocks hitting an all time high just before lunch on Tuesday, broader sentiment was undermined after Reuters quoted a U.S. official as saying an interim trade agreement between Washington and Beijing might not be completed in time for signing next month. That weighed on trade-sensitive tech and commodity shares in Europe, and MSCI’s world equity index edged down after five successive sessions in the black.

Europe's Stoxx 600 Index was unchanged, rebounding from an earlier drop, as banks weighed on the gauge, with Deutsche Bank tumbling more than 6% after reporting a loss for the second consecutive quarter, while Banco Santander SA also pulled down Spain’s benchmark index after earnings. The Stoxx 600 Bank Index was testing its 200-day moving average as earnings from Deutsche Bank and Credit Suisse weighed down the sector. The gauge is down 1.4% on Wednesday, flirting with the key support level, with Deutsche Bank down 5.6% and Credit Suisse falling 2.4%. Santander was also down 5.2% as the stock goes ex-dividend and earnings also lack investor excitement. The SX7P index was just able to trade back above the long term average in October for the first time since May.

European stocks were supported, however, by the auto index which rose 0.7% after news that PSA Group and Fiat Chrysler Automobiles NV were in talks for a merger that would create one of the world’s biggest companies. Fiat Chrysler and French PSA shares jumped 7-8% each. CMC Markets chief market strategist Michael Hewson, said the deal news had not sharply lifted shares because regulatory hurdles remain, not least the French government’s stake in PSA. "We’ve seen a lot of companies exploring M&A and I struggle to understand why this deal in particular is any more probable than the one with Renault," he said, said referring to Fiat’s failed attempt to acquire another French carmaker. M&A aside, Germany’s Volkswagen provided a reminder of slowing global demand, and cut its 2019 sales outlook. Its shares slipped 0.7%.

Earlier in the session, Asian stocks retreated, snapping a four-day rising streak, as investors digested a raft of quarterly earnings while awaiting the Federal Reserve’s rate decision. Markets in the region were mixed, with Australia leading declines and India advancing. Material and technology were among the weakest sectors. The Topix added 0.2%, supported by Shiseido, Fujitsu and Shimano. Sales at Japanese retailers jumped in the month before October’s sales tax hike. The Shanghai Composite Index closed 0.5% lower, with China Merchants Bank and Kweichow Moutai among the biggest drags. China is facing a wall of maturing debt with a record amount of local-government notes due in 2020. India’s Sensex climbed 0.5%, heading for its highest close in almost five months, amid optimism that companies have weathered the worst of an economic downturn. A report that the government is considering scrapping a dividend tax also buoyed sentiment.

It's been another very busy day for earnings, where highlights were as follows, from Bloomberg:

- Total SA’s third-quarter profit beat analyst estimates and cash flow held firm.

- Airbus SE cut its full-year delivery target and said cash flow will be lower than expected.

- Deutsche Bank AG saw earnings from trading debt securities and currencies drop 13%, compared with gains at all big Wall Street peers. Revenue from its remaining businesses fell 4%.

- Credit Suisse Group AG posted better-than-expected top line growth and profit.

- Standard Chartered Plc generated 19% more revenue in Europe and the Americas in the third quarter.

- Volkswagen AG lowered its outlook for vehicle deliveries this year on a faster-than-expected decline in auto markets around the world.

- Sony Corp. boosted its profit outlook for the year.

Besides today's poor GDP print, which is expected to shrink from 2.0% to 1.6%, the second lowest since Trump became president...

... caution has also crept in before the U.S. Federal Reserve announcement at 2pm. While rate futures price a 94% probability of a 25 basis-point cut on Wednesday (with some warning that this may not even happen)...

... markets are fixated on what message the central bank will send, and December rate cut expectations have ebbed in recent days. "The Fed could be quite hawkish in terms of ‘this is it’ and send a message markets don’t really want to hear. They are pricing the Fed on a full-blown cutting path and that may not be what the fed wants to convey," Hewson said, noting still-robust U.S. growth and booming stock markets.

“I don’t think we should fear a hawkish cut, but I do think one of the things to keep in mind, relative to the prior cut periods, is the Fed starting from a much lower rate,” Carol Schleif, deputy chief investment officer at Abbot Downing Investment Advisors, told Bloomberg TV. “There is a lot less room for the Fed to continue to cut.”

The best recap of what to expect today, however, comes from Curvature's Scott Skyrm, who said that "Given the Fed is in easing mode and dumping liquidity into the market, it is unlikely they will NOT ease tomorrow. With over $200 billion in RP operations and $60 billion a month of QE Lite, it would throw the markets in turmoil if the Fed did not ease."

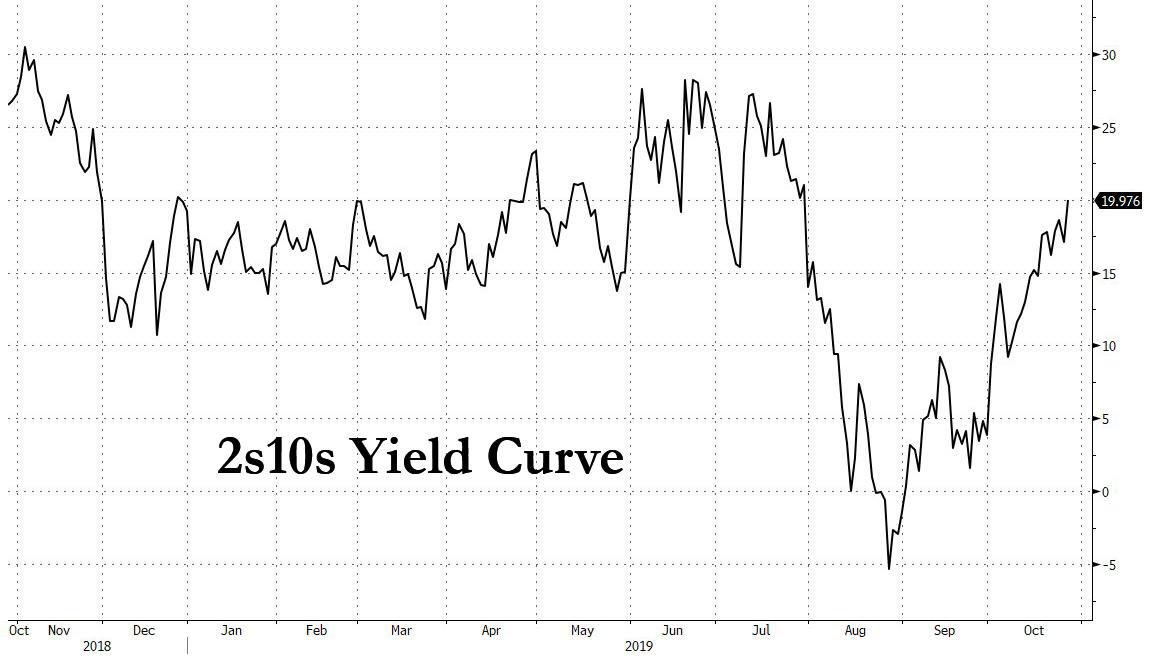

As investors abandoned their safe-haven bets in recent weeks and piled into equities since U.S. President Donald Trump outlined what he called the first phase of a trade deal with China, world stocks have risen almost 3% higher this month while expectations of more U.S. rate cuts after this month have faded, lifting U.S. Treasury yields to six-week highs while German yields are set for their biggest monthly rise since Jan 2018. 2Y TSY bond yields are around 1.65%, rising off two-year lows of 1.368% in early-October while 10-year yields stood at 1.833%, up 20 bps this month, in the process sharply steepening in the 2s10s yield curve.

But the rally has stalled amid the uncertain outlook for trade, economic growth and company profits while optimism over Britain averting a no-deal exit from the European Union has been replaced by trepidation over the calling of a snap election. If no party wins conclusively the future of Brexit will be up in the air again, with options including Britain leaving the EU without agreement with Brussels, or another referendum being held that could scupper the divorce. Those developments pulled sterling 1.2% lower in the past week against the dollar, however on Wednesday the pound strengthened after U.K. Prime Minister Boris Johnson won backing in Parliament for a Dec. 12 election. The euro was steady after data showed France’s economy grew more than expected in the third quarter, but economic confidence in the broader region extended a slide.

Elsewhere in FX, the dollar was steady against other major currencies before the Fed meeting and an advance reading of third-quarter economic growth which could shed light on the rate outlook. Against the yen, the greenback was little moved at 108.86 yen just off a three-month high.

"If the market is going to price in the end of the current rate-cut cycle, the dollar/yen could climb above 110 yen,” said Tohru Sasaki, head of Japan markets research at JPMorgan Chase Bank. “On the other hand, if the market is going to price in two more cuts after this month’s expected cut, the pair could fall to mid-107 yen level."

US House overwhelmingly voted in favour of resolution recognizing Armenian genocide in 1915 which is seen as a rebuke of Turkey and it also voted in favour of legislation seeking to impose sanctions on Turkey for its offensive in Syria. Turkey’s Foreign Ministry later responded that it strongly condemns the adoption of a draft bill that envisages sanctions against Turkey and stated the US administration should take steps to prevent further deterioration of relations

Elsewhere, the lira slipped after the U.S. House voted to sanction Turkey over its military operation in Syria.

Crude prices were rangebound, in uneventful trade as the market awaits coming risk events in form of this evening’s FOMC meeting and EIA Inventory data. The latter is likely to settle some confusion surrounding last night’s API release; initial reports suggested a slightly higher than expected build of 590k bbls, later other sources suggested a draw of 1.7mln bbls and the major newswires were quiet on the subject.

Looking at the day ahead, the obvious focus for markets are the Fed meeting this evening and the Q3 GDP data print prior to that in the US. The other data includes the October ADP employment change reading in the US – which will be important to watch ahead of payrolls on Friday - Q3 GDP in France, October CPI and unemployment data in Germany, October confidence indicators for the Euro Area. Elsewhere, we’ve also got the BoC decision today while the ECB’s Lautenschlaeger is due to speak. If that wasn’t enough it’s also a packed day for corporate earnings with the likes of Apple, Facebook, Total, Credit Suisse, GlaxoSmithKline, Airbus, VW, GE and Bayer reporting.

Market Snapshot

- S&P 500 futures little changed at 3,033.75

- STOXX Europe 600 down 0.05% to 398.17

- MXAP down 0.1% to 162.35

- MXAPJ down 0.2% to 520.51

- Nikkei down 0.6% to 22,843.12

- Topix up 0.2% to 1,665.90

- Hang Seng Index down 0.4% to 26,667.71

- Shanghai Composite down 0.5% to 2,939.32

- Sensex up 0.6% to 40,071.82

- Australia S&P/ASX 200 down 0.8% to 6,689.48

- Kospi down 0.6% to 2,080.27

- German 10Y yield rose 0.2 bps to -0.349%

- Euro up 0.05% to $1.1118

- Italian 10Y yield fell 1.7 bps to 0.645%

- Spanish 10Y yield unchanged at 0.289%

- Brent futures up 0.2% to $61.68/bbl

- Gold spot up 0.2% to $1,490.27

- U.S. Dollar Index little changed at 97.65

Top Overnight News

- Boris Johnson has succeeded, finally, in getting Parliament to give him the general election that he wants. The polls have him far ahead but his move is still a risky one -- polling errors, Brexit and the U.K. voting system pose threats

- Boris Johnson’s Brexit deal would leave the economy 3.5% smaller every year and policy makers at the Bank of England should start thinking about an interest-rate cut, according to the National Institute of Economic and Social Research

- Australia’s core inflation remained sluggish in the third quarter as the economy absorbed much of the currency’s depreciation, highlighting policy makers’ challenge in reigniting prices

- Sales at Japanese retailers jumped in the month before October’s sales tax hike, indicating that rush demand was on a similar scale to 2014 when the economy contracted sharply after a boom-and-bust in consumption triggered by a similar tax increase

- House Democrats will put Intelligence Committee Chairman Adam Schiff in the lead of the next phase of its impeachment inquiry of President Donald Trump as the investigation moves into public hearings under the terms of a resolution released Tuesday

- Chief Executive Officer Christian Sewing’s sweeping revamp of Deutsche Bank AG failed to arrest a slump in revenue, including in one of its areas of traditional strength: fixed income trading

- Citigroup Inc. plans to cut the number of foreign-exchange platforms it supports by two thirds, the Financial Times reported, citing people with knowledge of the matter

- France’s economy grew more than expected in the third quarter, a sign it’s avoiding some of the global manufacturing malaise that’s probably pushed Germany into a recession

Asian equity markets traded negative after the cautious tone rolled over from Wall St, with global sentiment dampened by mixed US-China trade rhetoric and tentativeness ahead of the FOMC. ASX 200 (-0.8%) was dragged by early underperformance in consumer staples amid losses in Woolworths despite reporting stronger revenue figures, while Nikkei 225 (-0.6%) mirrored a lacklustre currency but with declines cushioned by firm Retail Sales data which printed its highest growth since 2014 due to front-loading of purchases before the sales tax hike. Hang Seng (-0.4%) and Shanghai Comp. (-0.5%) conformed to the downbeat tone following an additional CNY 200bln liquidity drain and after a US official triggered doubts on whether the US-China phase 1 deal would be ready in time for the Chile APEC meeting. Finally, 10yr JGBs were higher with prices supported by the risk averse tone and with the BoJ present in the long-end of the market, although upside was limited as the central bank kick-started its 2-day policy meeting.

Top Asian News

- Worst Isn’t Over for Chinese Bonds as Supply Surge Looms

- Soho China Said to Consider $8 Billion China Office Tower Sales

- Same China Stock Costing 216% More Shows Mainland Love for IPOs

- JPMorgan, StanChart Among Banks Selected for Egypt’s Bond Sale

European equities are largely driven by earnings/M&A related action this morning [Eurostoxx -0.2%] following on from a cautious APAC session which was largely weighed on by dampened US/Sino trade sentiment. Major bourses are mixed with outperformance in France’s CAC40 (+0.2%) outperforming on the back of earnings form L’Oreal (+6.8%) which topped expectations despite fears over a China slowdown and unrest in Hong Kong hitting demand. Thus, the consumer staples sector outperforms. On the flip side, Spain’s IBEX (-1.2%) underperforms largely on the back of Santander (-5.9%) post-earnings with NII deteriorating from the prior quarter, hence the financial sector is hit. In terms of European M&A, the French index is propped up by Peugeot (+6.0%) after the company and Italy’s Fiat Chrysler (+9.2%) commenced merger talks for a combined entity worth around USD 50bln, although sources noted that there is no guarantee that the two will reach a deal. Other earnings related large-cap movers include Standard Chartered (+2.5%), Bayer (+1.9%), Airbus (+1.7%), Volkswagen (+1.4%), and Credit Suisse (-2.5%). Finally, Pirelli (-6.4%) share slumped to the foot of the Stoxx 600 after dismal earnings and a downward revision to its EBIT guidance.

Top European News

- Total Profit Beats Estimates as It Boosts Output, Cuts Costs

- Resilient French Growth Offers Hope to Struggling Euro Area

- Janus Henderson Investors Pull Cash For Eighth Straight Quarter

- Berlin Hardliners Suspect Merkel Soft on Huawei to Please China

In FX, the dollar modestly softer but off intraday lows of 97.585 with the broad Dollar and Index biding its time ahead of the advanced US GDP, ADP and more importantly the FOMC’s latest monetary policy decision (at 1800GMT due to the UK clock change) with markets pricing in almost a 100% chance of a 25bps cut to 1.50-1.75% (full preview available on the Research Suite of the RANsquawk website). Chair Powell is largely expected to keep the statement relatively unchanged from the prior meeting and focus will be on whether the Committee signals that it is now on pause, or whether the door to further cuts remains open.

- GBP, EUR - Sterling and the Single currency remain little changed on the day thus far and above 1.1100 and 1.2850 respectively against the Greenback. Cable retested yesterday’s high at 1.2905 as focus steers away from Brexit headlines and onto UK election developments after UK lawmakers approved the election bill by 438 vs. 20 for an election on December 12th, with the last Parliamentary sitting on November 5th before dissolution. Meanwhile, EUR/USD has pulled back from intraday highs after testing its 100 DMA at around 1.1125 with the Single Currency little swayed by modest CPI cooling in German States, as expected looking at the forecasts for the national reading as a proxy. Ahead, incoming ECB President Lagarde is set to speak at 1800GMT alongside the Fed rate decision, with the latter likely to take centre stage.

- AUD, NZD, CAD, JPY - All modestly firmer on the back of an overall softer USD, although the Aussie is underpinned by in-line CPI readings overnight which, coupled with RBA Governor Lowe’s reiterations yesterday, backs the case for the Central Bank to stand pat on its Cash Rate at next week’s meeting. AUD/USD rebounded from its 100 DMA at 0.6850 whilst upside in its Kiwi counterpart is somewhat capped as the AUD/NZD cross reclaimed 1.08+ status post-Aussie CPI. Elsewhere, the Loonie treads water around 1.3075 ahead of the BoC’s monetary policy decision today at 1400GMT (full preview available on the Research Suite of the RANsquawk website) with rates expected to be maintained and the Bank to remain upbeat given the incoming data; Governor Poloz and Deputy Governor Wilkins will partake in the post-meeting presser at 1515GMT. It’s worth keeping in mind that around USD 850mln of USD/CAD options will expire at strikes 1.3100-10. Finally, the JPY remained within a tight intraday band (108.80-90), again with eyes on risk events and Dollar action with the pair eyeing a 2.1bln in options expiring at the psychological 109.00 ahead of its 200 DMA 109.05.

In commodities, crude prices were rangebound, in uneventful trade as the market awaits coming risk events in form of this evening’s FOMC meeting and EIA Inventory data. The latter is likely to settle some confusion surrounding last night’s API release; initial reports suggested a slightly higher than expected build of 590k bbls, later other sources suggested a draw of 1.7mln bbls and the major newswires were quiet on the subject. For now, WTI Dec’ 19 futures are bound by USD 55.15/bbl – USD 55.60/bbl parameters, whilst Brent is rangebound between USD 60.95/bbl – USD 61.35/bbl. In terms of metals; Gold is nudging slightly higher but, for now, has been unable to recoup much of the losses made this week, as trade remains tentative ahead of the Fed. Copper is a touch lower, but holds on to decent gains made in recent weeks. “Recent price strength in the metal has primarily been driven by disruptions and concerns over supply from Chile, coupled with a pullback in the US dollar index” notes ING, but they caveat that “underlying concerns over demand with the poorer macro backdrop is still the key theme for the market, despite this short-term noise”.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -11.9%

- 8:15am: ADP Employment Change, est. 110,000, prior 135,000

- 8:30am: GDP Annualized QoQ, est. 1.6%, prior 2.0%

- 8:30am: Personal Consumption, est. 2.6%, prior 4.6%

- 8:30am: GDP Price Index, est. 1.9%, prior 2.4%

- 8:30am: Core PCE QoQ, est. 2.2%, prior 1.9%

- 2pm: FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

I’ve just entered week 5 of having varying iterations and degrees of a cold/runny nose/sore throat/man-flu. As soon as think I’m going to shake off one part of this another wave takes over. Its an irritant more than anything else. Clearly most of the cause is having three young kids who seem to have had a runny nose constantly since birth. I’m beginning to wonder which will leave first - my cold or the U.K. from the EU. The latter has a better chance of resolving itself one way or another after last night though as MPs finally agreed to a December 12th election. Expect lots of Xmas election gags to ensue in the weeks ahead. More on that later but today starts a busy end to the week with the FOMC and US Q3 GDP to look forward to followed by the global PMIs/ISMs (mostly Friday) and US payrolls also on Friday.

As for the Fed, a 25bp cut is all but priced in but the bigger focal point for markets is what message the Fed wants to send. Our economists highlighted in their preview note that with incoming data since the September FOMC meeting generally underperforming expectations, revisions to the statement language about recent developments should skew in a slightly dovish direction. In terms of forward guidance, the statement should retain the Committee's commitment to "act as appropriate to sustain the expansion". Ultimately the team believe that it is too early for the FOMC to communicate the end of the cutting cycle given where risks lie, the recent data and the leading indicators signaling a further slowdown ahead.

One point they do make though is that the Chair could implicitly raise the bar for further cuts as they await the outcome of a few event risks related to trade policy and take time to assess incoming data. In effect, the threshold for cutting could change from not seeing an improvement in the data – which is how we interpreted the guidance from the past several meetings – to needing to see some further deterioration. This could be communicated by emphasising the magnitude of easing to date and the long lags in monetary policy or by providing a more positive assessment of the distribution of risks around the outlook, among other possibilities. We’ll get the decision at 6pm GMT followed shortly by Powell’s press conference shortly after.

We should add that the FOMC will get one final important data release prior to the meeting with a first look at Q3 GDP at 12.30pm GMT. The consensus is for growth to slow to 1.6% annualised while our economists forecast 1.5%. Remember that this compares to 2.0% growth in Q2. Our economists make the point that the Fed’s median 2019 growth estimate in the September Summary of Economic Projections (SEP) increased a tenth to 2.2%, which implied back half growth of roughly 1.9% annualised. The details of the Q3 GDP report may therefore prompt Fed officials to begin marking down their forecasts ahead of the next SEP release at the December meeting. At a minimum, the Q3 output data should serve as a benchmark for gauging the data going into the December meeting.

Going into today’s meeting the Fed probably didn’t take much from the October consumer confidence data that was released yesterday. The headline reading nudged down from 126.3 to 125.9 however that was in the context of the consensus being pegged for 128.0. The good news was that the present situations component rose from 170.6 to 172.3 but on the flip side the expectations component slipped from 96.8 to 94.9 and the lowest since January.

Ultimately, the S&P 500 slipped -0.08% from its record high while the DOW (-0.07%) was down a similar amount. Unlike Monday, it was the NASDAQ (-0.59%) which struggled as the FANG names broadly fell (-1.57%) as earnings from Alphabet (-2.12%) underwhelmed. On the counter, earnings in the healthcare sector helped following better than expected results from Merck and Pfizer (up +3.53% and +2.49% respectively). Meanwhile, comments from Mnuchin about looser bank liquidity rules saw the S&P 500 banks index climb +0.27% and extend a run that has seen it climb 13 times in the last 15 sessions. Back-and-forth trade headlines caused risk to seesaw throughout the session, as initial reports from the SCMP suggested that Presidents Trump and Xi will sign a deal at a meeting in Chile next month. A US official then contradicted the Chinese reporting, saying that it is still possible that a deal will not be ready by the Chile summit, before a separate White House official reversed course again, saying that the plan is still to sign a deal in Chile.

Elsewhere, there wasn’t much going on in bond markets with 10y Treasury yields down a very modest -0.5bps. Europe did rally a bit more with 10y Bund yields back down -1.9bps. While we’re on the subject, the new ECB Asset Purchase Programme officially kicks off today. We’ve copied in Michal Jezek’s CSPP preview note here again for those who may have missed it.

Jumping to Asia this morning and a quick refresh of our screens shows that most markets are heading lower with the Nikkei (-0.54%), Hang Seng (-0.29%), Shanghai Comp (-0.44%) and Kospi (-0.67%) all down. Elsewhere, futures on the S&P 500 are -0.09% while yields on 10y USTs are down -1bps. WTI oil prices are trading -0.51% this morning as the American Petroleum Institute showed that inventories at Cushing, Oklahoma, America’s largest crude storage hub, rose by 1.22 million barrels last week. This overshadowed earlier reports suggesting that Saudi Arabia is ready to make deeper cuts in oil output than it agreed with other global producers. OPEC+ are due to meet in December to discuss whether steeper cuts to oil supply will be needed to prop up prices amid a surplus and signs of weaker demand. As for overnight data releases, Japan’s September retail sales came in at +7.1% mom (vs. +3.5% mom expected) while previous month’s was revised down to +4.6% mom from +4.8% mom. The overall gain was driven by a surge in purchases of large household appliances and cars ahead of the country’s planned sales tax hike this month and the rush of demand was on a similar scale to that seen in 2014 (per Bloomberg) when the economy contracted sharply after a boom-and-bust in consumption triggered by a similar tax increase. In terms of overnight earnings, Standard Chartered bank reported adjusted pretax profit for the third quarter at $1.24bn thereby beating the average analyst estimate of $1.06bn.

Overnight, the US House passed a bill threatening to sanction Turkey over its military operation in northern Syria. The bill which proposes to sanction Turkish leaders, Halkbank and other financial institutions, and restrict the military’s access to financing and arms passed 403-16, a veto-proof majority. Meanwhile, Fahrettin Altun, an Erdogan spokesman, said in a series of tweets that the bill “threatening sanctions against Turkey is in direct contradiction to the spirit of a strategic alliance,” and, “These brazen efforts to damage our relationship will have long lasting detrimental consequences on many areas of existing bilateral cooperation.” Turkish lira is down -0.41% this morning.

In other news, the US along with its allies criticised China’s treatment of its ethnic Uighurs community, at the UNGA’s human rights committee, calling on the Chinese government to allow the Office of the United Nations High Commissioner for Human Rights and UN Special Procedures “immediate unfettered, meaningful access,” to the Xinjiang province where the US criticises China’s efforts to “restrict cultural and religious practices, mass surveillance disproportionately targeting ethnic Uighurs, and other human rights violations and abuses”. China's UN Envoy retaliated by saying that the US criticism of China's policy in Xinjiang is not 'helpful for having a good solution to the issue of trade talks' and the Chinese side also pushed back against the criticism at the UN by submitting a joint statement signed by 54 countries commending “China’s remarkable achievements in the field of human rights.”

Meanwhile, closer to home a general election is now set for December 12th in the U.K. after MPs finally voted for one by a margin of 438-20. The opposition parties had pushed for the vote to be held on December 9, but in the end Prime Minister Johnson has got the date he wanted. Other amendments to lower the voting age and to allow EU nationals to vote were barred from being considered by the deputy Speaker. Johnson also met with 10 of the 21 recently-expelled members of the Conservative party and re-admitted them into the fold, as he and the opposition both transition into campaign mode.

DB’s Oliver Harvey noted in his report yesterday that the decision of the government not to press on with ratification of its Brexit deal and instead seek a general election is less favourable than an election taking place after ratification. He has slightly increased his tail risk scenario of a minority Conservative administration needing Brexit Party seats to form a government. In this outcome a no-deal Brexit becomes a possibility. Although the Conservative Party have been consistently around 10% ahead in recent polls (like YouGov and Survation) most commentators think this is potentially one of the most unpredictable elections in living memory. Sterling traded flat yesterday as investors will now wait to see who strikes the first blows hen campaigning starts.

Finally, the rest of the data yesterday before we delve into the day ahead. This included a slightly bigger than expected drop in the August S&P CoreLogic house price index of -0.16% mom (vs. -0.10% expected) - confirming the declining trend in the index of late – and a better than expected September pending home sales print (+1.5% mom vs. +0.9% expected). In the UK net consumer credit in September was slightly lower than expected at £0.8bn (vs. £0.9bn expected) while mortgage approvals beat (65.9k vs. 65.0k expected).

Looking at the day ahead, the obvious focus for markets are the Fed meeting this evening and the Q3 GDP data print prior to that in the US. The other data includes the October ADP employment change reading in the US – which will be important to watch ahead of payrolls on Friday - Q3 GDP in France, October CPI and unemployment data in Germany, October confidence indicators for the Euro Area. Elsewhere, we’ve also got the BoC decision today while the ECB’s Lautenschlaeger is due to speak. If that wasn’t enough it’s also a packed day for corporate earnings with the likes of Apple, Facebook, Total, Credit Suisse, GlaxoSmithKline, Airbus, VW, GE and Bayer reporting.

https://ift.tt/2qP9d5h

from ZeroHedge News https://ift.tt/2qP9d5h

via IFTTT

0 comments

Post a Comment