Hong Kong Crashed Into First Recession Since 2009

The first domino in the next global economic crisis has fallen this morning, when Hong Kong crashed into a technical recession, the first time since the 2008/09 financial crisis. Hong Kong's economy plunged 3.2% in 3Q19, government data showed on Thursday, exceeding economists' lowest estimates and confirming a technical recession has begun.

Earlier this week, we reported that Hong Kong Financial Secretary Paul Chan warned after more than half a year of violent anti-government demonstrations, the end of October will likely mark the start of a recession.

"After seeing negative growth in the second quarter, the situation continued in the third quarter, meaning our economy has entered technical recession," Chan wrote in a blog post.

"It seems it will be extremely difficult for us to reach full-year economic growth of 0 to 1%. I would not rule out the possibility that the full-year economic growth will be negative."

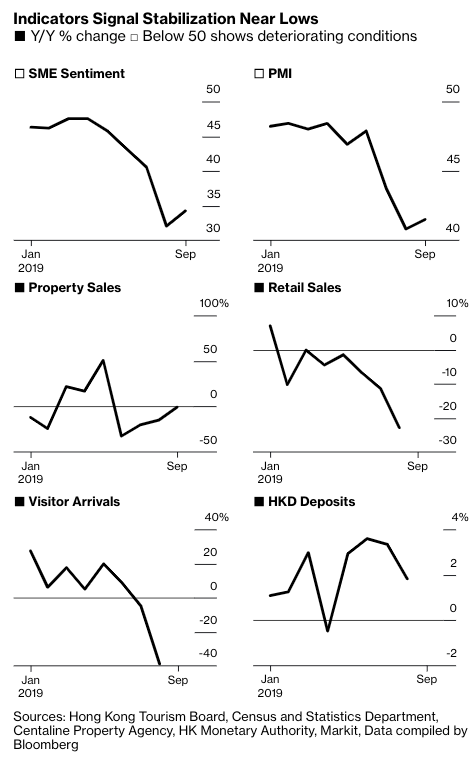

With two consecutive quarters of negative growth and no end to the protests in sight, Bloomberg has noted in a series of graphs that a full-year economic contraction is likely for 2020.

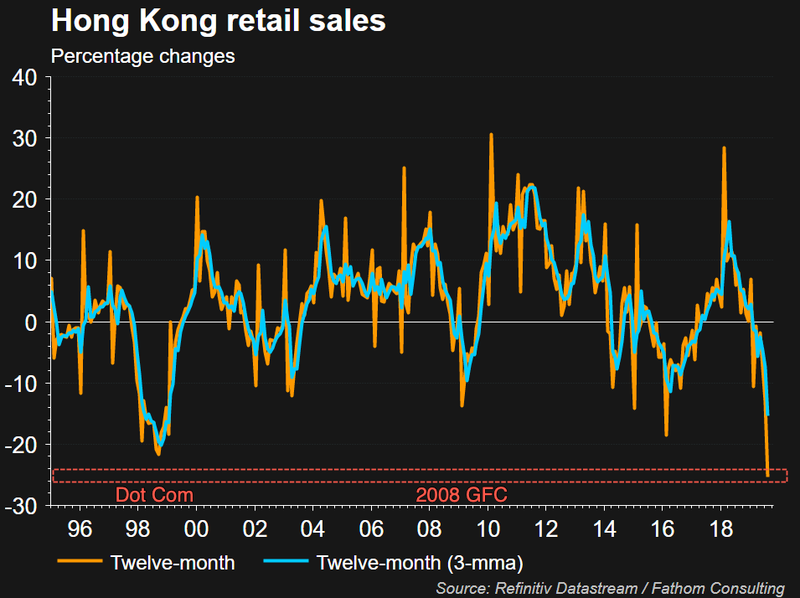

Raymond Yeung, the chief Greater China economist with Australia & New Zealand Banking Group Ltd., told Bloomberg that social chaos in the city is driving the economy into the ground. Protesters have frequently shut down popular shopping districts, something that we outlined several weeks ago, warning that the retail industry in Hong Kong is on the brink of collapse.

Yeung warned: "It's obviously comparable to the global financial crisis. We have a very similar situation that we don't know when it's going to end."

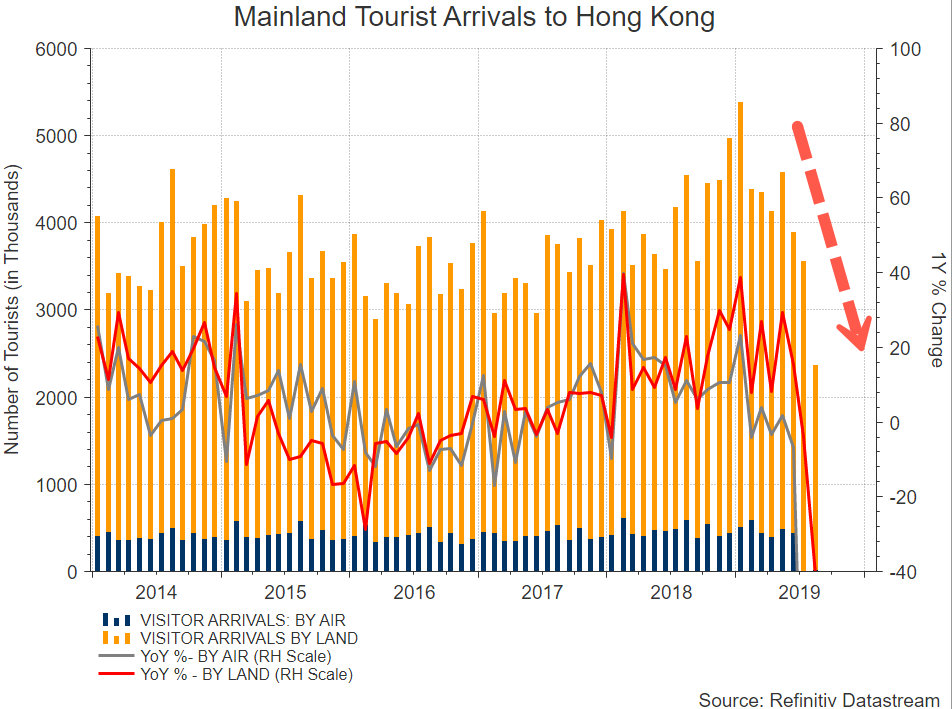

Meanwhile, tourism has plunged 37% Y/Y in 3Q19, and the trend for 4Q19 is likely not to improve. The number of tourists for the first two weeks of October was down 50% on a Y/Y basis. Rooms at the most high-end hotels, like Marco Polo Hongkong in Tsim Sha Tsui, are going for $72 per night, a 75% discount versus last year.

Anyone who wants to travel to Hong Kong this month, departing from New York City airports, can easily get roundtrip plane tickets for 50% off because air travel to Hong Kong remains depressed.

Local businesses are cutting back on their workforce as approximately 77% of all hotel workers have just been asked to go on leave without pay. Iris Pang, an economist at ING, told the Financial Times that Hong Kong's economy would be in a full-blown recession in 2020.

The Hong Kong government has rolled out countercyclical measures to buffer the economy and avoid a flat out depression. Some of these measures include tax cuts and increases to social security, along with housing perks for first-time homebuyers. But with an economic crisis expected to deepen, the government has held back on fully deploying its tools -- would likely wait for a trough in the economy before large stimulative measures are seen.

Pang, on the other hand, said, "interest rates don't matter for this economy anymore. When there's violence in the streets, people don't want to go out shopping or go out for dinner."

In a series of charts below, the great collapse of Hong Kong can be visualized:

Mainland Chinese tourists to Hong Kong volumes are plunging.

In a 12-month and 3-month change, Hong Kong retail sales have absolutely collapsed over the last half-year.

Hong Kong is the first domino to fall. More emerging growth countries will slip into technical recession as a global financial crisis could arrive as soon as 2020.

https://ift.tt/36lNd2f

from ZeroHedge News https://ift.tt/36lNd2f

via IFTTT

0 comments

Post a Comment