"A Once In A Decade Divergence" Warns This Global Macro Fund

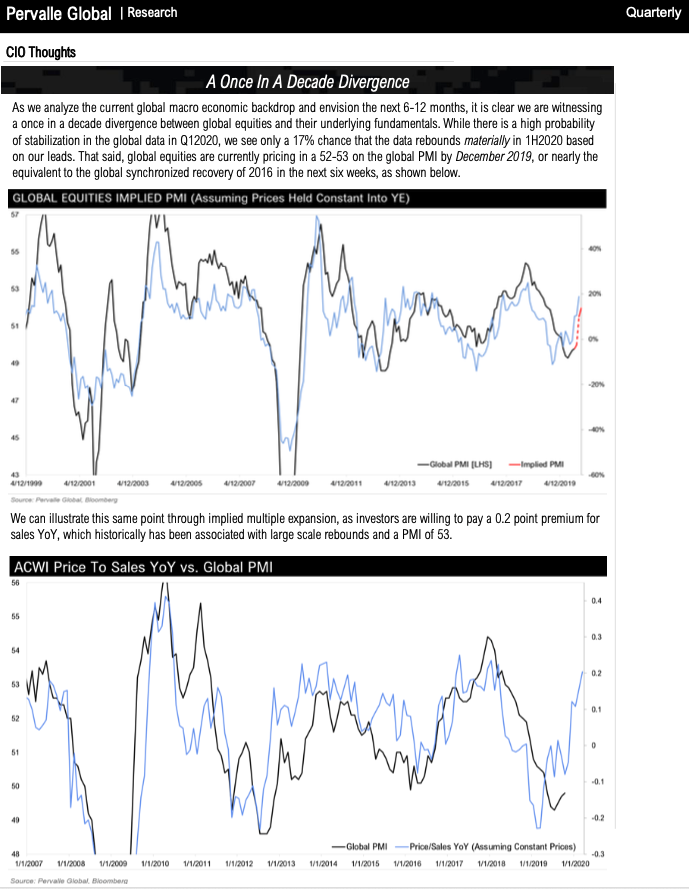

A research note titled "A Once In A Decade Divergence" from Pervalle Global, an NYC global macro fund, is warning that a 2016 global growth cycle rebound that global equities have already priced in might not materialize in early 2020.

The note says the Global economy could stabilize in 1Q20, but a massive rebound is unlikely because of the lackluster of global credit growth. As a result of this mispricing, global stocks could be headed for a repricing event over the next six months.

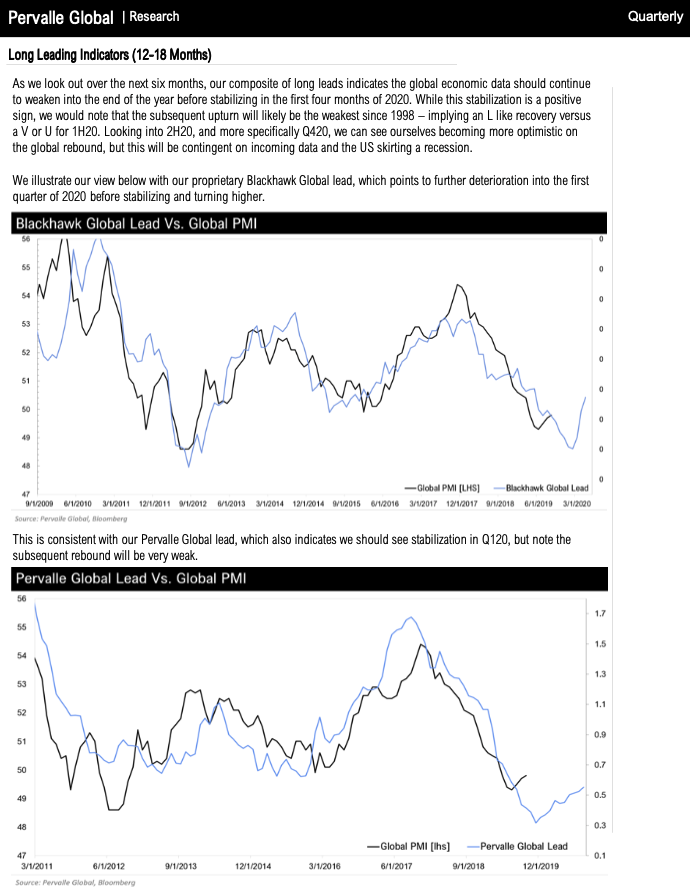

"As we look out over the next six months, we see material risk for global equities as market participants come to the realization that economic growth will not rebound in a similar fashion to the 2016 global growth cycle. However, given our current visibility, we do see stabilization in the global economic data in Q12020, but the rebound following this stabilization will likely be the weakest since 1998 – implying an L like recovery versus a V or U.

This is largely a function of global credit growth, which has only risen 0.84% from its lows versus the historical cyclical upturn threshold minimum of 2.70%. While we see stabilization globally, our US leads point to further deterioration in consumption and employment through 1H20, which complicates the potential global bottom. Nevertheless, global equities are currently pricing in a 2016 like rebound in global growth, which will likely need to be priced out before we become more constructive on international equities and weak dollar plays," Teddy Vallee, CIO of Pervalle Global, wrote.

Here are several highlights from the report:

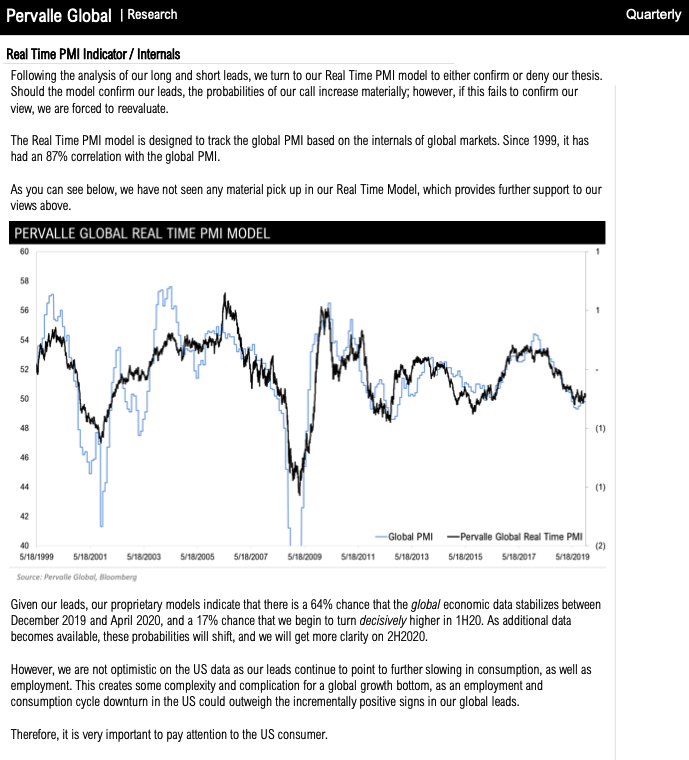

- Long Leading Indicators (P. 2-4): We see additional downside pressure in the global economic data into the end of the year, with the US continuing its downward trajectory through 1H20 due to further deterioration in consumption and employment. We see a 64% chance that the global data stabilizes between December 2019 and April 2020, but only a 17% chance that we witness a material pick up in 1H20.

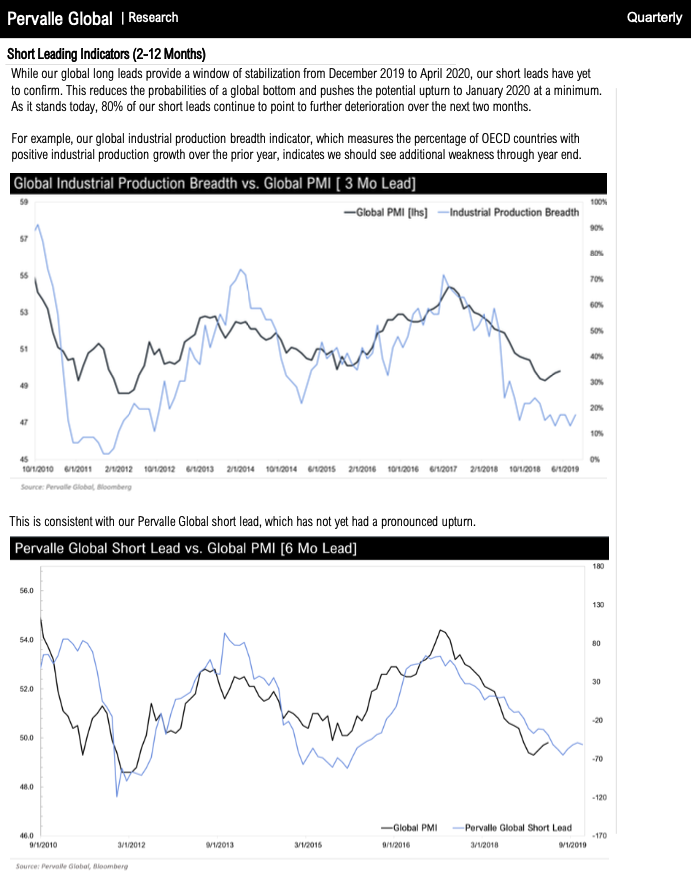

- Short Leading Indicators (P. 5-7): With 80% of our short leads not confirming an economic bottom, we can not assign a meaningful probability to a global cyclical upturn in the next 2-3 months.

- Market Internals / Real-Time PMI (P. 8-9): Our Real-Time PMI indicator has yet to signal a bottom in the global PMI, further pressuring the probabilities of a global upturn.

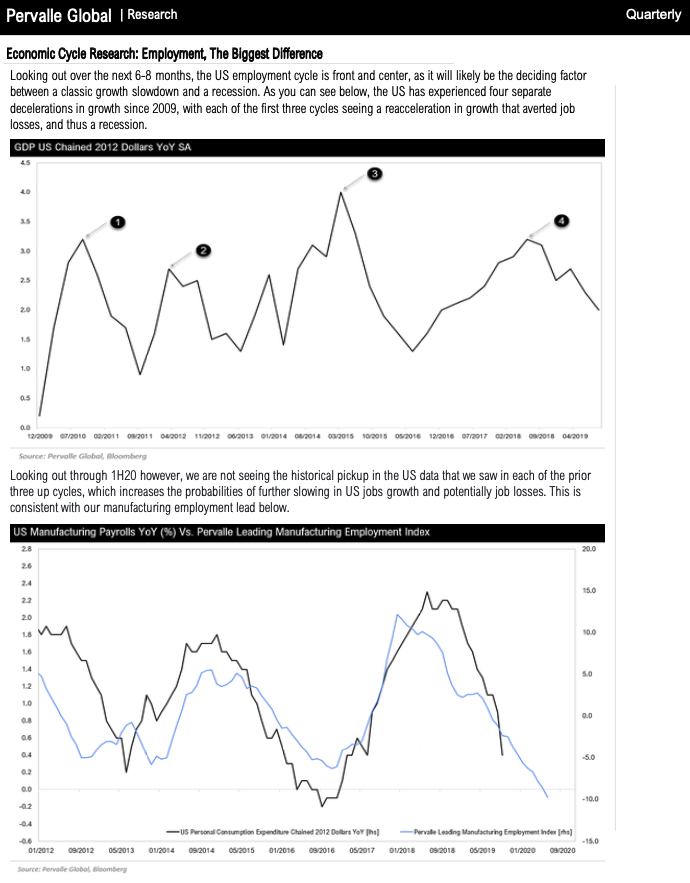

- Economic Cycle Research (P. 10-14) : With the US economy in the midst of its fourth deceleration in growth since 2009, the employment cycle is front in center, as it will likely be the deciding factor between the fourth soft landing and a technical recession.

- CIO Thoughts (P. 15-39): Analyzing the current macroeconomic backdrop and envisioning the next 6-12 months, it is clear we are witnessing a once in a decade divergence between global equities and their underlying fundamentals. This divergence is primarily a result of the Federal Reserve’s pivot, the decline in global interest rates, and China’s tariff demand-pull forwards. That said, over the ensuing months, we expect this gap to close, which could result in a quick repricing given that we are currently in the worst liquidity environment since 2009.

And finally, Pervalle's "Once In A Decade Divergence" could be onto something... We've also outlined a similar divergence of equities pricing in a recovery that might just be fantasy.

https://ift.tt/2QVl6BA

from ZeroHedge News https://ift.tt/2QVl6BA

via IFTTT

0 comments

Post a Comment