Futures Fly On Trade Optimism Amid Barrage Of Megamergers

After some jittery days last week, when it seemed that optimism for a Phase 1 "deal" was cracking, all concerns were set aside over the weekend as investors cheered China’s decision to issue guidelines and raise penalties for intellectual property theft, a move many said boosted the chances of a trade deal between the world’s largest economies while ignoring an offsetting Reuters report that a "Phase 2" of the deal may not happen any time soon if ever. A subsequent tweet by the Global Times said that China and the U.S. are “very close” to reaching a phase one trade deal, citing unidentified experts close to the Chinese government, while the positive sentiment was boosted by a barrage of mega-mergers including:

- Schwab confirming it is buying TD Ameritrade for $26 billion

- LVMH buying Tiffany for $16.6 billion

- Novartis buying Medicines Co for $9.7 billion

As a result, global equities were a sea of green, with the MSCI All-Country World Index up 0.2% by midday in London while treasuries and the yen both declined:

"China being prepared to look at intellectual property is obviously the catalyst for a nice move higher, or a return to the highs earlier this month," said Michael Hewson, chief markets analyst at CMC Markets in London.

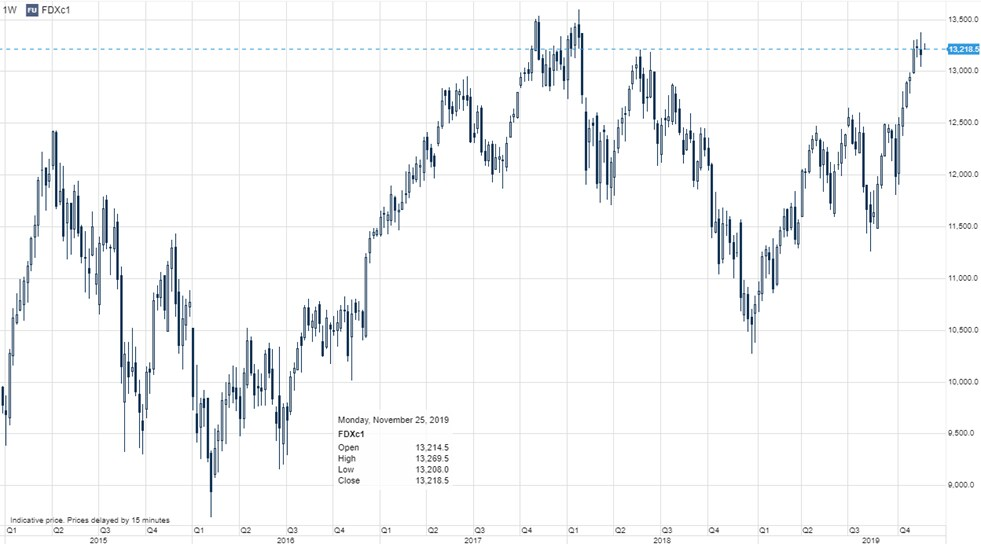

Contracts across US equity futures all pointed to a solid start with the S&P set to open just shy of an all time high...

... despite a sharp drop by Uber Technologies which was in the spotlight following a failed bid to get a new license to operate in London.

European shares rose for the second straight session following reports that Washington and Beijing were nearing a trade agreement. The Stoxx 600 index was up 0.7% at 1200 GMT, led by trade-sensitive mining firms although all 19 industry sectors of the Stoxx 600 in the green following from a broad-based rally in Asia, after China said it will raise penalties on violations of intellectual property rights. Euro Stoxx 50 +0.5%, FTSE 100 outperforms, +0.7%. Gains in Europe being led by basic resources, travel & leisure and household & personal sectors. Despite negative earnings growth and weak economic fundamentals in Europe, DAX futures are approaching all-time highs and today’s IFO survey (Nov) showed improvement as expected lifting sentiment. As Saxo Bank notes, STOXX 600 valuation could soon be a stopping point for the momentum rally as the index trades 20.2x on P/E compared to 20.7x for S&P 500 with the latter index clearly showing better numbers and powered by technology monopolies. However, on 12-month forward basis European equities are still trading on a P/E discount but that’s only because consensus EPS growth over the next 12 months is 34% which would require an impressive rebound in Asia growth.

Earlier in the session, Asian stocks rose for a second day with MSCI’s index of Asia-Pacific shares ex Japan bouncing 0.7%, led by material producers, as investors assessed Hong Kong’s record election turnout and China’s pledge to step up protection of intellectual property rights. Most markets in the region were up, with Hong Kong leading gains and Indonesia retreating. Japan’s Topix closed 0.7% higher, with electronic firms and chemical producers among the biggest boosts. The Shanghai Composite Index gained 0.7%, snapping a three-day losing streak, as large financial firms and energy producers offered strong support. Hong Kong’s Hang Seng Index climbed 1.5% after pro-democracy candidates swept the board in district council elections. India’s Sensex advanced, heading for a record close, amid hopes for more government stimulus to counter the slowest pace of growth in six years.

In separate news, China was planning a record sale of sovereign bonds in dollars, with a potential $6 billion offering, Bloomberg reported.

The irony is that as long as the deal keeps getting pushed back, stocks will just keep rising as optimism just grows and grows, even if the status quo is ultimately one that pushes the global economy into a recession. And yet even though the same dynamic has been obvious since the summer of 2018, analysts keep repeating that there is no more upside from trade rumors, when one look at the S&P shows they are clearly wrong:

"A ‘phase one’ deal is now priced into markets; there isn’t much upside that will come from that unless they announce something like a complete rollback of the tariffs imposed, (but) that doesn’t really seem likely,” said Simona Gambarini, markets economist at Capital Economics.

"The markets are pretty much priced for a deal to go ahead, and that may be the case, but we may see that pushed out to 2020," said Saxo market strategist Eleanor Creagh. "The key sticking point is really going to be the rolling back of tariffs."

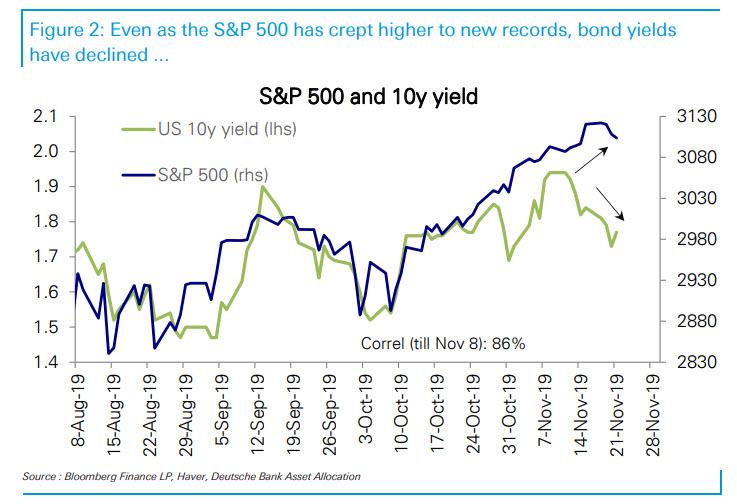

While US stocks are headed for a third month of gains, there have been several notable divergences between the S&P and virtually every other asset class as we showed over the weekend as doubts about the rally remain and bonds and other haven investments seem well-supported. While the S&P 500 Index rose on Friday after President Donald Trump said he was “very close” to a trade pact, the yield on 10-year U.S. notes has steadied around 1.78%, down from the three-month intraday high of 1.97% touched in early November.

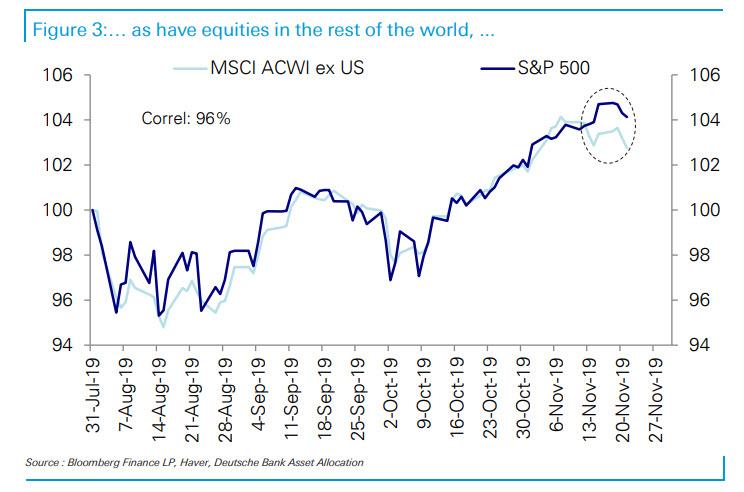

The divergence is not just between bonds and stocks, but between US and international stocks.

In fx, the dollar was steady against its major peers and was near a 10-day high against the euro hit after its rally on Friday when U.S. manufacturing surveys beat forecasts, just as European Union numbers disappointed. Rising Germany business morale in November did not help the euro, which traded 0.1% lower at $1.1014. Munich-based Ifo’s business climate index rose to 95.0 in November from 94.7 in October. The November reading was in line with a Reuters consensus forecast. The yen fell against most major peers as haven bids waned and overall risk appetite got a boost after China sought to bridge a gap in U.S. trade talks by taking a stricter line on intellectual property rights. The pound led G-10 currency gains as latest pre-election opinion polls showed the ruling Conservative Party maintaining its lead. Sweden’s krona touched an almost four-month high on the improved global sentiment and expectations of a Riksbank rate hike next month.

In rates, bond markets were not moving much, with UST yields steady to 1bp higher across 2-yr through 10-yr tenors, same with German bonds. The Treasury 2s10s curve was flat at just above 14 bps, a sharp drop in recent weeks and sparking concerns of another economic slowdown. ECB President Christine Lagarde on Friday called on euro zone governments to strengthen domestic demand.

Federal Reserve Chair Jerome Powell speaks later on Monday and is expected to underline the steady outlook for rates given the better economic figures.

In geopolitics, North Korea leader Kim visited a military site and urged the army to be prepared for regular mobilization, while it was also reported that they will increase war-like drills. Elsewhere, Turkey was reportedly testing the S-400's radar system, which sent the turkish lira sharply lower on the day.

In commodities, West Texas-grade oil futures drifted, after ending Friday barely changed on the week. Bitcoin fell as much as 11% and headed for its ninth weekday session of declines, the longest losing streak in a year. Gold was down $4 to $1,457.10/ounce.

Agilent, HP Enterprise and Palo Alto Networks are reporting earnings.

Top Overnight News from Bloomberg

- Boris Johnson unveiled a safety-first program of policies for a “sensible” Conservative government as he aimed to consolidate his lead in opinion polls ahead of the Dec. 12 U.K. general election.

- China is planning a record sale of sovereign bonds in dollars, with a potential $6 billion offering, according to people familiar with the discussions. The Ministry of Finance is considering tenors of three years, five years, 10 years and 20 years, according to the people, who asked not to be named as the talks aren’t public.

- Hong Kong residents handed an overwhelming victory to pro-democracy candidates in a vote for local district councils on Sunday. Pro-democracy candidates won 86% seats of the 444 seats counted as of 9 a.m., official results showed, with eight seats still up for grabs. In the last election in 2015, they had won about a quarter of all seats.

- Oil was steady near a two-month high as optimism over progress toward a limited U.S.-China trade deal was balanced with investor fatigue due to the long-running negotiations.

- Former New York Mayor Michael Bloomberg’s late entry into the presidential race highlights the deep philosophical divide animating the Democratic contest – putting his experience, his reputation and his fortune behind the argument that a pragmatic centrist pledging competent government is what’s needed to take down an unconventional president

- The International Monetary Fund cut its 2019 economic growth forecast for Japan for a third time this year amid heightened risks from the global slowdown and called on the government not to tighten its spending stance for now

- U.S. companies have sold 12.9 billion pounds ($16.6 billion) of sterling bonds this year, the biggest full-year tally since 2007. Warren Buffett’s Berkshire Hathaway Inc., Citigroup Inc. and Verizon Communications Inc. are among borrowers to issue pound debt, partly due to U.K. bond buyers seeking overseas investments to help offset domestic Brexit risks

- The Swiss National Bank has additional room to cut its already negative interest rate, the central bank’s Chief Economist Carlos Lenz told Swiss Sunday newspaper NZZ am Sonntag in an interview

- Bets that the U.S. currency will strengthen against its major counterparts slipped last week to the lowest level since the start of July, according to CFTC data

Market Snapshot

- S&P 500 futures up 0.2% to 3,119.00

- STOXX Europe 600 up 0.7% to 406.85

- MXAP up 0.6% to 164.82

- MXAPJ up 0.7% to 526.66

- Nikkei up 0.8% to 23,292.81

- Topix up 0.7% to 1,702.96

- Hang Seng Index up 1.5% to 26,993.04

- Shanghai Composite up 0.7% to 2,906.17

- Sensex up 1.2% to 40,852.17

- Australia S&P/ASX 200 up 0.3% to 6,731.41

- Kospi up 1% to 2,123.50

- German 10Y yield rose 0.4 bps to -0.355%

- Euro down 0.07% to $1.1013

- Italian 10Y yield rose 0.4 bps to 0.836%

- Spanish 10Y yield fell 0.8 bps to 0.402%

- Brent futures up 0.1% to $63.47/bbl

- Gold spot down 0.2% to $1,458.37

- U.S. Dollar Index little changed 98.29

Asian equity markets began the week on a positive note with sentiment underpinned by encouraging reports from the Greater China region in which Beijing released fresh guidelines to increase penalties on IP theft and after protesters eased tensions in Hong Kong for elections where pro-Democracy candidates achieved a landslide victory. ASX 200 (+0.3%) was led higher by the trade sensitive sectors such as tech and materials although financials lagged amid continued losses in Westpac due to the AUSTRAC breaches which prompted its Chairman Maxsted to put CEO Hartzer on notice that he could be fired if the scandal continues to destabilise the reputation of the bank, while Nikkei 225 (+0.8%) was underpinned by a weaker currency and with commodity-related sectors front running the advances. Hang Seng (+1.5%) and Shanghai Comp. (+0.7%) conformed to the optimism after China’s steps to increase penalties on IP theft, which despite being vague in its promise, is still seen as an effort to appease the US side. In addition, Hong Kong was buoyed following the District Council elections where protests quietened to avert the risk of a cancellation and in which the pan-democratic camp won more than six-fold the number of seats than the pro-Beijing establishment, although gains in the mainland were to a lesser extent following a substantial CNY 180bln net liquidity drain by the PBoC. Finally, 10yr JGBs were relatively uneventful as focus centred on riskier assets, but with mild gains seen amid the BoJ’s presence in the market for JPY 890bln of JGBs with varying maturities.

Top Asian News

- Alibaba Climbs in Gray Market Before Hong Kong IPO Debut

- Dubai Islamic Bank Board Agrees to Buy Noor Bank Via Share Swap

Major European bourses (Euro Stoxx 50 +0.4%) are modestly firmer in quiet Monday morning trade (but off highs), as the region continues to benefit from weekend tailwinds in the form of further promises from the Chinese on IP and an easing of tensions in Hong Kong to allow for elections. Sectors are all in the green, with Consumer Discretionary (+1.2%) and Materials (+0.8%) in the lead, with the former boosted by outperformance in LVMH (+2.0%) after the luxury goods maker agreed to purchase Tiffany & Co. (+6.0% pre-market) for USD 135/shr, or USD 16.3bln. Further consolidation within the industry has prompted other luxury names, including Christian Dior (+2.0%), Richemont (+1.8%) and Kering (+0.9%) to move higher in sympathy. Elsewhere in M&A, Novartis (+0.4%) has agreed to acquire The Medicines Co. for a transaction value of USD 9.7bln on a fully diluted basis that includes outstanding stock options and convertible debt. Moreover, BHP (+1.1%) caught a bid amid price action within the base-metal complex, whilst reports stated that the Co. reportedly intends to increase its stake in SolGold further to 14.7% from 11%. In other notable stock specific news; IAG (+0.9%) are higher after British Airways agreed to a pilot pay deal to stop strike action with pilot union Balpa. Petrofac (-1.7%) is lower on the news that it had been identified as the energy Co. accused of having fake account for the purpose of disguising bribe payment to foreign government officials. Finally, of note for Just Eat (+0.2%); US competitor Uber (-5.6% pre-market) was not granted an operating license from London’s public transport regulator TfL.

Top European News

- Johnson Unveils ‘Sensible’ Manifesto to Keep Tories in Power

- German Business Expectations Gain, But Fall Short of Forecasts

- Sweden’s SVT to Broadcast New Money Laundering Report on Nov. 27

In FX, the USD and Index kick-start a new week relatively directionless amid consolidation from Friday’s advances. The Dollar succumbed to slight pressure in APAC/early EU hours from trade developments over the weekend after vague reports that China will tighten laws around IP theft, which is seen as a step to appease the US amid stumbling blocks in Phase 1 talks. DXY remains above the 98.00 mark and around recent highs (98.30) and having sound support at its 50 DMA at 98.22. Meanwhile, the CNH feel some reprieve amid the China steps coupled with a firmer-than-forecast PBoC fixing. USD/CNH hovers around 7.0300 having gapped lower at the open last night, currency nearer to the bottom of the 7.0280-0420 daily band.

- GBP, EUR - Sterling stands as the marked outperformer thus far and stages similar gains to last Monday as some weekend polls show a steady uptrend in the Conservative’s lead over the Labour party. Furthermore, analysis on YouGov data could be adding further fuel to the bullish fire as it projects the market-friendly Tory party with a parliamentary majority of 48. Cable has reclaimed 1.2850+ status having currently clocked in a range of 1.2842-85 as it eclipses its 21 DMA at 1.2878. Meanwhile, the Single Currency remains relatively uneventful and little swayed by the German Ifo Survey which printed a modest improvement in the three metrics but was caveated by cautious comments from the institute, who noted that it is too early to speak of a German economic turnaround. EUR/USD stay afloat just above 1.1000 with touted support around 1.0990-94 should the round figure be breached with ECB’s Mersch and Lane the EZ highlights post-Ifo, although some calendars also highlight hawk Holzmann on the docket.

- AUD, NZD, JPY - All moving according with risk, albeit antipodeans have drifted off highs (amid a firming Buck) following an upbeat APAC performance due their China exposure and in light of the aforementioned China IP announcement, seemingly a concession in trade talks with the US. Further, Hong Kong saw a more peaceful weekend as local elections went underway – which concluded with a landslide win for the pro-democratic candidates and hopes of calm in the region in the aftermath. AUD/USD trades flat intraday having tested 0.6800 to the upside overnight (with AUD 800mln in options expiring between strikes 0.6780-90), although pressure on the Aussie could also stem from the AUD/NZD cross which backed off after failing to breach 1.06 to the upside. The cross also keeps the Kiwi buoyed and still above 0.6400 vs. the USD, having traded within a 20-pip range thus far. Elsewhere, USD/JPY hovers near session highs after printing a high of 108.90 in early trade after surpassing its 21 DMA at 108.76 with added upside in the pair as the Dollar gains traction.

- EM - The Lira experiences renewed pressure amid reports that Turkey is testing the radars on the Russian made S-400 missile systems, thus potentially prompting backlash from US lawmakers who have threatened CAATSA sanctions should the system be activated. The news of the tests largely overshadows reports of Turkey ceasing military operations in Northern Syria as per its agreement with Russia. USD/TRY topped its 100 and 21 DMAs (5.7100 and 5.7317 respectively) ahead of potential resistance at its 50 DMA (5.7500) with eyes now on any action from US Congress.

In commodities, crude markets are in consolidation, with WTI and Brent front months contracts rangebound just below the USD 58.00/bbl and USD 63.80/bbl levels respectively, as the complex largely fails to garner any impetus from the more favourable macro backdrop. Crude specific news flow has been on the light side; there have been some scheduling updates – JMMC and OPEC meetings will reportedly both take place on the 5th of December, with OPEC+ meeting a day later. In terms of the metals; more favourable risk appetite has seen copper advance; the red metal managed to eke out two-week highs and trades just above its 21 DMA at USD 2.6567/lb. Meanwhile, lack of demand for havens sees gold under pressure; the precious metal is now rangebound around the USD 1458/oz level. Finally, Dalian iron ore futures climbed over 3.0% with upside attributed to trade optimism amid the latest headlines.

Goldman Sachs sees 2019 WTI prices at USD 56.90/bbl and 2020 at USD 55.50/bbl, while it sees 2020 non-OPEC supply to increase 2.1mln bpd and demand growth of 1.2mln bpd. Goldman Sachs said its 2020 top trade recommendation is long oil-heavy enhanced S&P GSCI Index and that it sees oil returns of 10% next year despite maintaining USD 60/bbl oil forecast, while it affirmed its bullish gold target of USD 1600/oz. (Newswires)

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. -0.2, prior -0.4

- 10:30am: Dallas Fed Manf. Activity, est. -3.8, prior -5.1

- 7pm: Powell Speaks in Rhode Island After Visiting Hartford, Conn.

DB's Jim Reid concludes the overnight wrap

Hope you had a good weekend. The biggest shock to me was that I saw that it was 28 years ago yesterday that Freddie Mercury died. I couldn’t believe it was that long ago but then I remembered an amusing story that reminded me it was. Queen guitarist Brian May went to my school and sent his son there too. He was 4-5 years younger and whenever we walked passed him in the corridor we would invariably think ourselves very funny to sing Bohemian Rhapsody quietly. Anyway at parents evening the week after Freddie Mercury sadly died our very old, traditional, and perhaps out of touch with popular culture history teacher, met Brian May and was overheard to say “I’m really sorry to hear about Freddie Starr”. He had no idea who Freddie Mercury was and confused him with a comedian of the time. This story spread round the school in a “Flash” which rather boosted the street cred of the history teacher.

Anyway, “show must go on” and today is exactly one month until Christmas. It will be quite a truncated week due to the Thanksgiving holiday on Thursday that usually extends into a soporific Friday for markets. Expect your email box to be full of Black Friday offers you simply can’t refuse over the next few days.

The holiday shortened week still see some interesting US data with consumer confidence (tomorrow), preliminary Q3 real GDP, October durable goods orders, October personal income/spending, the November Chicago PMI and the Fed’s Beige Book (Wednesday). Ahead of the December FOMC blackout period at the end of the week, Fed Chair Powell speaks this evening in Rhode Island and centrist Governor Brainard speaks tomorrow in New York to discuss the Fed's policy framework review.

Powell’s recent Congressional testimonies didn’t reveal anything new so it’s unlikely we’ll learn much from Powell tonight but we’ll tune in nonetheless. Our economists think there is a chance that tomorrow Brainard discusses more about possible future yield curve control as an addition to the Fed’s policy toolkit. This is something she is known to have support for

For consumer confidence tomorrow, the reading has fallen for the last 3 consecutive months, but the consensus is looking for a slight uptick to 126.8 in November. For Wednesday our economists don’t expect any material revisions to the second print on Q3 real GDP (+1.9% preliminary vs. 1.9% advance), but the October durable goods data will provide an initial read on current-quarter capex spending if we can adjust for any impact from the GM strikes. A bounce back from these strikes should help the November Chicago PMI rebound (47 expected vs 43.2 last month) but there could be an additional boost from the recent stabilisation and slight bounce in the global manufacturing data over the last couple of months. See our economists recent piece (" Global growth: Green shoots or false dawn? " ) for more on this.

How far this small recovery in manufacturing goes may rest on the “phase one” trade deal so all eyes on new information on that topic this week. Over the weekend China has issued new guidelines saying that it will raise penalties on violations of intellectual property rights in an attempt to address one of the sticking points in trade talks with the US. On Friday President Trump had said in an interview with Fox News that “This can’t be like an even deal, because we’re starting off on the floor and you’re already at the ceiling. So we have to have a much better deal,” before adding, we are “very close” to a trade pact.

Asian Markets are trading higher this morning with the Nikkei (+0.64%), Hang Seng (+1.61%), Shanghai Comp (+0.33%), and Kospi (+0.98%) all up on the China IP story. Futures on the S&P 500 are up +0.23%. As we go to print, the Chinese daily The Global Times has reported that the US and China are “very close” to a Phase 1 deal citing experts close to the Chinese government.

Meanwhile, on Sunday, Hong Kong held local district elections where the results indicated a big victory to pro-democracy candidates as they are indicated to win 86% seats of the 444 seats counted as of 9 am local time (per official results), with eight seats still up for grabs. In the last election in 2015, they had won about a quarter of all seats. So a remarkable jump. Also, the voter turnout was at a record high of 71%, roughly double the number in the previous election. Hong Kong’s Chief Executive Carrie Lam said of the results that “The government respects the results of this election,” while adding, “I am aware there’s lots of analysis about the results among the community, which said the results are a reflection of the public’s dissatisfaction towards the current situation and deep-seated problems in society. The government will listen to the public’s feedback with humility and reflect on it.” Elsewhere, Colombian President Ivan Duque said on Saturday that the country will keep joint military-police troops on the streets to maintain calm after the organised nationwide protests degenerated into looting in some areas. Columbia becomes another country after Chile in LatAm to face elevated political risks.

In other news, We also heard from the ECB Chief Economist Philip lane on Saturday where he said that the ECB policies are “in good shape” for the baseline scenario but further rate cuts can’t be ruled out. Mr. Lane added that “If it is necessary to put the rate lower, we will be prepared to do so,” and that, “of course, everyone agrees at some level the negative rate will not be helpful. But our assessment is we are not at that level now.” On inflation, he said “we do not find it acceptable to have inflation around 1.6%. So 1.6% is not close to 2%. That is important.” Elsewhere, the Swiss National Bank’s Chief Economist Carlos Lenz said on Sunday that the central bank has additional room to cut its already negative interest rate.

In terms of the weekend polls in the U.K. election the Conservative Party consolidated their lead and edged it higher with an average lead of around 13 percentage points. The Tories ranged from 41-47% support with the Labour Party at 28-32%. Many thought at the start of this campaign that this was one of the most unpredictable elections in history. However for me it was always pretty simple. There are three main established political parties in the U.K. and the electorate is split close to 50:50 on Brexit. As only one is committed to Brexit they were always going to have a numerical advantage. In a constituency/Parliamentary system the less than 1 year old Brexit Party was always very unlikely to get much traction. I suspect the only way the Conservatives won’t win a sizeable majority is if Labour and The LibDems (and/or their voters) form a remain alliance and do it very quickly. If there is a surprise in this campaign it’s that the LibDems hard line remain/cancel Brexit stance has not resonated more with voters. Yesterday the Tories unveiled their manifesto which seemed to be biased towards not making any mistakes rather than offering an exciting new agenda. In 2017, the Labour Party started to climb after the Tories released their manifesto with many blaming an ambitious plan to pay for elderly care which got labeled the “dementia tax”. So all eyes on whether this relatively risk-free manifesto works for them from a safety first point of view.

Back to this week and Europe’s main releases are back ended. Friday sees the Euro Area CPI estimate alongside unemployment. Thursday sees the release of the European Commission’s confidence indicators for November, which as usual will be keenly watched for signs of whether the economy shows some signs of stabilisation. Last month, the economic sentiment indicator fell yet again to 100.8, its lowest level since January 2015. The industrial confidence indicator was at its lowest since July 2013, while the services confidence indicator was at its lowest since June 2015. In the advance consumer confidence reading this week, we did see a slight uptick to -7.2 however (vs. -7.6 previously), so it’ll be interesting to see if this is followed through in the rest of the data.

Turning to last week’s market action now where the highlight was the nuanced details to Friday’s PMIs. In Europe, the manufacturing sector rebounded more strongly than anticipated (46.6 from 45.9 for the euro area), though the services sector lagged (51.5 from 52.2). The trend was especially pronounced in Germany, where the manufacturing PMI rose to 43.8 from 42.1. The data indicated that the divergence between industrial and consumer sectors is narrowing, though from both directions. The PMIs in the US were more uniformly positive, with manufacturing PMI rising +0.9pts to 52.2 and the services reading up +1.0pt 51.6. On net, the results were positive for risk sentiment, with major equity indexes paring their losses on the week. The S&P 500 ended -0.32% (+0.23% on Friday), while the STOXX 600 retreated -0.51 (+0.44% Friday) last week.

The trade-sensitive semiconductors index fell -2.99% (flat on Friday) as confidence fell that the US and China will reach a trade deal this year, leaving the spectre of the planned tariff increase alive. Fixed income rallied amid a flight to safety, with 10-year yields on Treasuries and bunds falling -6.2bps and -2.5bps (-0.3bps and -3.4bps Friday) respectively. Despite the widening rate differential, the dollar gained +0.26% (+0.27% Friday), with the euro down -0.26% (-0.33% Friday). Credit widened on the week, with HY cash indices +16bps and +4.5bps wider in the US and Europe (-2bps and +0.2bps Friday).

https://ift.tt/37xjXq5

from ZeroHedge News https://ift.tt/37xjXq5

via IFTTT

0 comments

Post a Comment