"Fundamentally Rigged" - Runaway Algos Spark Chaos, Crackdown In World's Most Important Futures Market

The eurodollar futures market is among the most important for the functioning of global financial markets, providing faux-credit fillers for institutions everywhere as well as critical signaling (whether reflexive or not) on the future path of interest rates (and thus what The Fed is expected to do, or will do).

So, it seems appropriate to worry when that critical credit market is over-run by chaos-producing algos who seem to have moved on from front-running stocks (because it's all buybacks all the time) to the vastly less-liquid (and notably wider tick-spreads) eurodollar market.

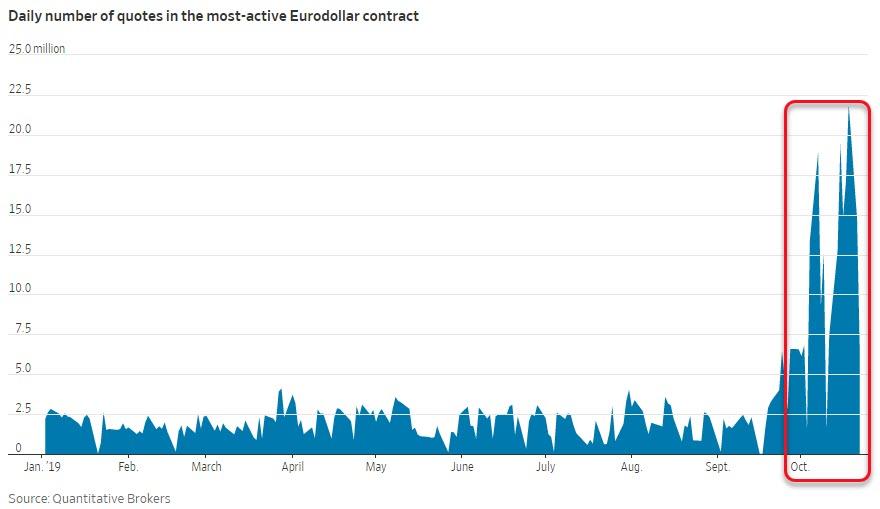

As The Wall Street Journal reports, over the past two months, the volume of data generated by activity in CME’s Eurodollar futures soared 10-fold, according to exchange statistics.

The torrent of data strained trading systems and prompted complaints to the exchange, traders said. Want to get an idea of just how insane that level of data is...

This Oct. 7 video nicely illustrates the CME data-surge issue I wrote about yesterday. UO, Z1 and H1 are Sept '20, Dec '20 and March '21 Eurodollar futures. Quote sizes are spinning around wildly as algos race each other behind the scenes. pic.twitter.com/Kb0q37fhEp

— Alexander Osipovich (@aosipovich) October 30, 2019

The data surge, which hasn’t been previously reported, wasn’t caused by an actual increase in trading. Instead, the Journal notes that it mainly consisted of digital messages that showed changes to quotes to buy or sell Eurodollar futures - i.e. algos spoofing each other.

And in this case, the chaotic explosion in quotes was caused by a standoff between two firms whose algorithms entered a loop, racing each other to be the market’s biggest player, according to Emergent Trading, a small Chicago-based firm that said it was one of the two dueling traders.

Emergent founder Brandon Richardson estimated that his firm and its rival were responsible for 90% of messaging volumes during the surge...

...

After Emergent entered the Eurodollar market, it discovered there was an advantage to quoting prices for more contracts than any other market maker. The benefit: If another trader bought or sold Eurodollar futures, executing against quotes from different market-making firms, the market maker with the biggest quote would get notified 10 millionths to 20 millionths of a second before its next-biggest competitor, Mr. Richardson said.

It subsided Monday after CME took emergency measures to halt it, announcing new penalties for firms that bombard its markets with too many messages:

“We believe this change, which already has had a positive impact, will encourage responsible messaging practices going forward.”

Starting this week, CME will fine traders $10,000 whenever their messaging exceeds a certain threshold and cut off their connections to the exchange after repeat violations.

But, as WSJ notes, Mr. Richardson said the policy benefits large market makers, because they can establish dozens of connections to CME, while a smaller firm such as Emergent might get less than 10.

“It’s fundamentally rigged against a small player,” Mr. Richardson said.

A CME spokesperson, of course, rejected this assertion, but it is nevertheless a worry that as the Fed's liquidity spigot is wide-open every day and uncertainty over the Fed's future path of rates remains high that the most critical market for short-term credit is increasingly exposed to the possibility of flash-crashes (which in this case, thanks to the leverage created, will almost definitely ripple into the rest of the global financial markets).

https://ift.tt/2PFs8Kj

from ZeroHedge News https://ift.tt/2PFs8Kj

via IFTTT

0 comments

Post a Comment