The Federal Reserve Is A Barbarous Relic

Authored by EconomicPrism's MN Gordon, annotated by Acting-Man's Pater Tenebrarum,

The Sky is Falling

“We believe monetary policy is in a good place.”

– Federal Reserve Chairman Jerome Powell, October 30, 2019.

The man from the good place. “As I was going up the stair, I met a man who wasn’t there. He wasn’t there again today, Oh how I wish he’d go away!” [PT]

Ptolemy I Soter, in his history of the wars of Alexander the Great, related an episode from Alexander’s 334 BC compact with the Celts ‘who dwelt by the Ionian Gulf.’ According to Ptolemy’s account, which survives via quote by Arrian of Nicomedia some 450 years later, when Alexander asked the Celtic envoys what they feared most, they answered:

“We fear no man: there is but one thing that we fear, namely, that the sky should fall on us.”

Today, at the risk of being called Chicken Little, we tug on a thread that weaves back to the ancient Celts. Our message is grave: The sky is falling. Though the implications are still unclear.

Various Celts – left: fearsome warriors; middle: fearsome warriors afraid of the sky falling on their heads; right: Cernunnos, fearsome Celtic horned god amid his collection of skulls. [PT]

The sky, for our purposes, is the debt based dollar reserve standard that has been in place for the past 48 years. If you recall, on August 15, 1971, President Nixon “temporarily” suspended convertibility of the dollar into gold. The dollar became wholly the fiat money of the Treasury.

At the G-10 Rome meeting held in late-1971, Treasury Secretary John Connally reduced the new dollar reserve standard to a bite-sized nugget for his European finance minister counterparts, stating:

“The dollar is our currency, but it’s your problem.”

The Nixon-Connally tag team in the White House. [PT]

Predictably, without the restraint of gold, the quantity of debt based money has increased seemingly without limits – and it is everyone’s massive problem. What’s more, over the past 30 years the Federal Reserve has obliged Washington with cheaper and cheaper credit.

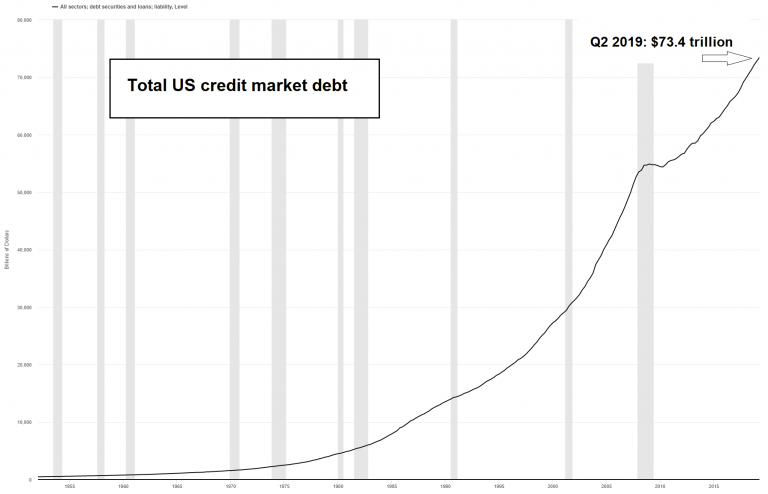

Hence, public, private, and corporate debt levels in the U.S. have multiplied beyond comprehension. Total US debt is now on the order of $74 trillion. The consequences, no doubt, are an economy that is equally distorted and disfigured beyond comprehension.

Behold the debt-berg in all its terrible glory. [PT]

Selective Blind Spots

America is no longer a dynamic, free-market economy. Rather, the economy is stagnant and operates under the central planning authority of Washington and the Fed. The illusion of prosperity is simulated by spending trillions of dollars funded by history’s greatest debt bubble.

Simple arithmetic shows the country is headed for economic catastrophe. Clearly, Social Security and Medicare face long-term financial challenges. Current workers must shoulder a greater and greater burden to pay for the benefits of retired workers.

At the same time, the world that brought the debt based dollar reserve standard into being no longer exists. Yet the dollar reserve standard and the Federal Reserve still remain as legacy institutions.

The divergence between the world as it exists – with its massive trade imbalances, massive debt loads, wealth inequality, and inflated asset prices – and the legacy dollar reserve standard is irreversible. Unless the unstable condition that has developed is allowed to transform naturally, there will be outright collapse.

Rather than adopting policies that allow for economic transformation and minimizing the ultimate disruption of a collapse, today’s planners and policy makers are doing everything they can to hold the failing financial order together. They are deeply invested academically and professionally; their livelihoods depend on it.

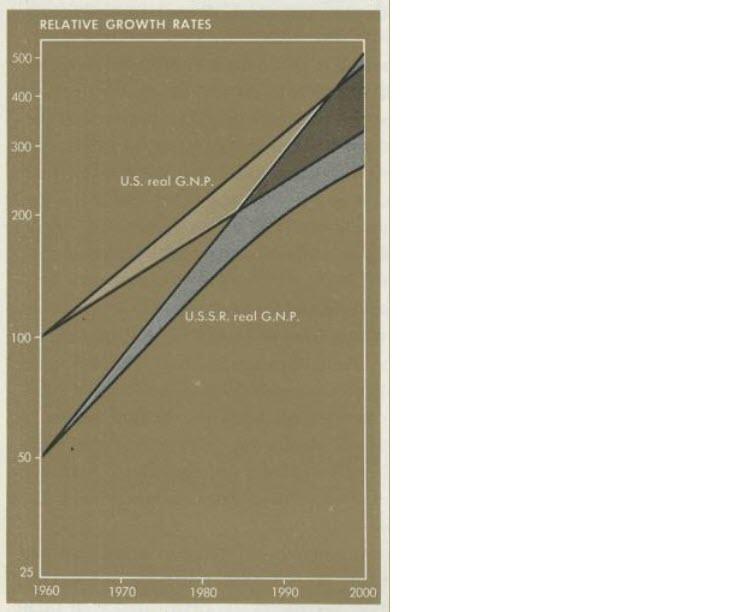

You see, selective blind spots of the best and brightest are normal when the sky is falling. For example, in 1989, just two years before the Soviet Union collapsed, Paul Samuelson – the “Father of Modern Day Economics” – and co-author William Nordhaus, wrote:

“The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.” – Paul Samuelson and William Nordhaus, Economics, 13th ed. [New York: McGraw Hill, 1989], p. 837.

Could Samuelson and Nordhaus possibly have been more clueless?

The bizarre chart illustrating the alleged “growth miracle” of the “superior” Soviet command economy, as seen by Samuelson – published about one and a half years before the Soviet Bloc imploded in what was undoubtedly the biggest bankruptcy in history. [PT]

The Federal Reserve is a Barbarous Relic

On Wednesday, following the October federal open market committee (FOMC) meeting, the Federal Reserve stated that it will cut the federal funds rate 25 basis points to a range of 1.5 to 1.75. No surprise there.

But the real insights were garnered several days earlier. Leading up to the FOMC meeting Fed Chair Jerome Powell received some public encouragement from one of his former cohorts – former President of the Federal Reserve Bank of New York, Bill Dudley. What follows is an excerpt of Dudley’s mental diarrhea, which he released in a Bloomberg Opinion article on Monday:

“People shouldn’t be as worried as they are about the risk of a U.S. recession. That said, it wouldn’t take much to trigger one, which is why the Federal Reserve should take out some insurance by providing added stimulus this week.

“Sometimes, an adverse event and human psychology can reinforce each other in such a way that they bring about a recession. Given how slowly the economy is growing, even a modest shock could do the trick.

“This danger bolsters the argument for the Fed to ease monetary policy at this week’s meeting of the Federal Open Market Committee. Such a preemptive move will reduce the chances that the economy will slow sufficiently to hit stall speed. Even if the insurance turns out to be unnecessary, the potential consequences aren’t bad. It just means that the economy will be stronger and the inflation rate will likely move more quickly back toward the Fed’s 2 percent target.”

Retired former central planner Bill Dudley. These days an armchair planner, and as deluded as ever. [PT]

Dudley, like Samuelson, believes he can aggregate economic data and plot it on a graph; and, then, by fixing the price of credit, he can make the graphs appear more to his liking. He also believes he can preempt a recession by making ‘insurance’ rate cuts to stimulate the economy.

Like Samuelson, Dudley doesn’t have a clue. The Fed cannot preemptively stop a recession. And after the dot com bubble and bust, the housing bubble and bust, the great financial crisis, zero interest rate policy, negative interest rate policy, quantitative easing, operation twist, quantitative tightening, reserve management, and many other failures, the Fed’s standing is clear to everyone but Dudley…

The Federal Reserve is a barbarous relic. The next downturn will be its death knell. Alas, what comes after the Fed will probably be even worse. Populism demands it.

https://ift.tt/2WyTiEb

from ZeroHedge News https://ift.tt/2WyTiEb

via IFTTT

0 comments

Post a Comment