"Dire" European Manufacturing Downturn Deepens In December

The manufacturing downturn across Europe deepened in the last month of 2019 according to the latest survey data released on Thursday.

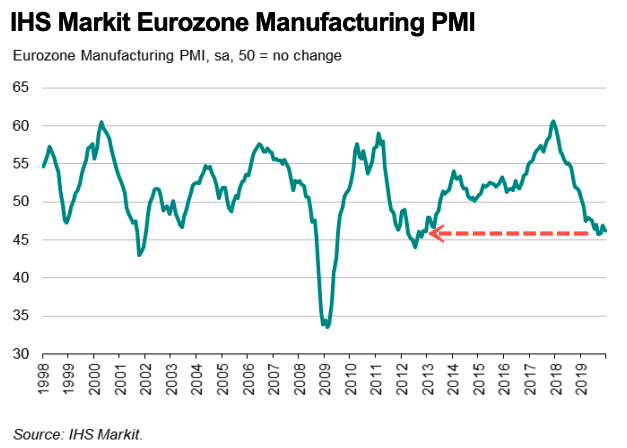

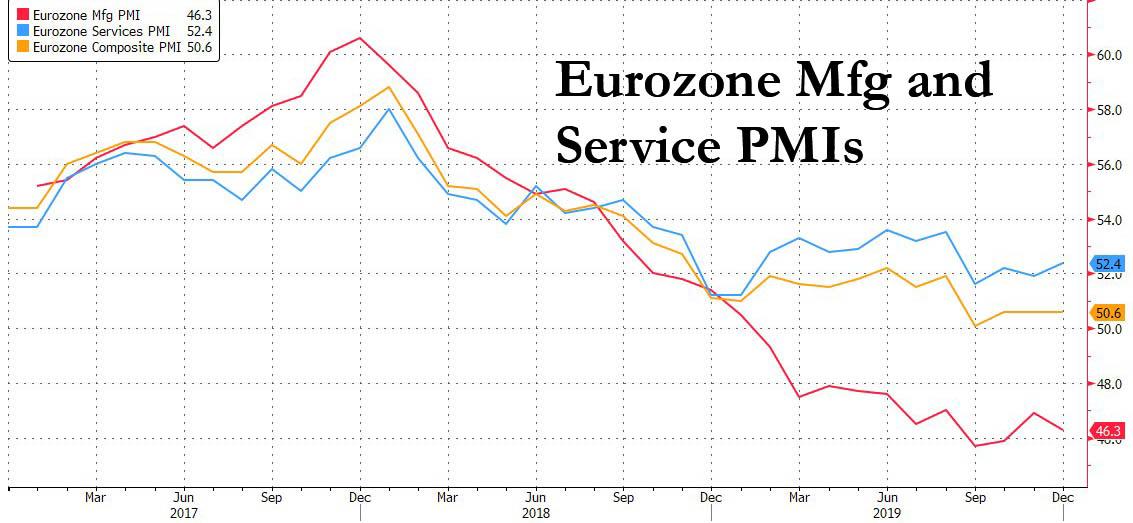

IHS Markit Eurozone Manufacturing PMI lost momentum last month, printing at 46.3, down from 46.9 in November, if modestly above the 45.9 expected. The PMI averaged 46.4 in 4Q, a seven-year low. The slowdown was due to "underperformance" in the investment goods sector. There was marginal growth in consumer goods for the first time since August.

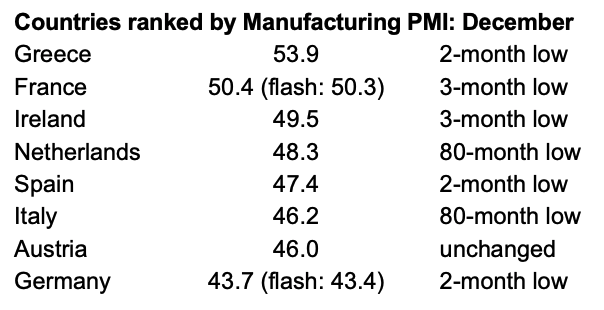

The downturn across Europe was broad-based, with seven of the eight countries polled recording weaker PMI numbers than November.

Germany, the largest manufacturing hub in the region, continued to show the weakest performance, while deceleration in Italy and the Netherlands were the sharpest in six-and-a-half years. Greece and France printed marginal growth over the period.

European production and new orders dropped in December. Output declined for an eleventh consecutive month. Levels of new incoming work also dropped over the month. Of note: the rate of job losses in December was the sharpest recorded by the survey since 2013. The manufacturing recession in the region has transmitted weakness into employment with Germany laying off the most. Greece saw steady employment growth, while France was the only other country that didn't record a contraction during the month.

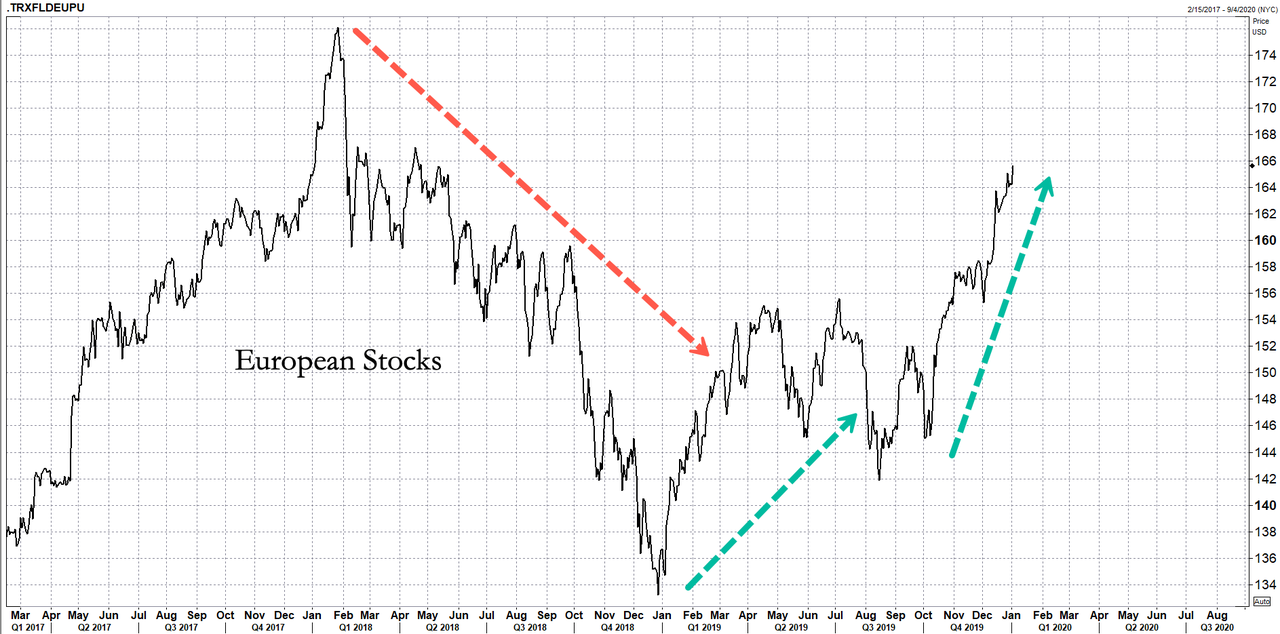

Still, manufacturing confidence jumped from a six-and-a-half-year low in August thanks to central bank easing and "trade optimism" via a possible signing of a phase one trade deal between the US and China. At the same time, European equities soared since bottoming in August, frontrunning a recovery that is expected in 2020, but may very well not come.

Commenting on European Manufacturing PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said that

"Eurozone manufacturers reported a dire end to 2019, with output falling at a rate not exceeded since 2012. The survey is indicative of production falling by 1.5% in the fourth quarter, acting as a severe drag on the wider economy", and confirmation that the manufacturing recession is still in full force.

And while "firms grew somewhat more optimistic about the year ahead, a return to growth remains a long way off given that new order inflows continued to fall at one of the fastest rates seen over the past seven years" Williamson noted. "

"Firms sought to reduce inventory levels and cut headcounts as a result, focusing on slashing capacity and lowering costs. Such cost-cutting was again also evident in further steep falls in demand for machinery, equipment and production-line inputs."

In conclusion, "only households provided any source of improved demand in December, underscoring how the consumer sector has helped keep the economy out of recession in recent months. The ability of the wider economy to avoid sliding into a downturn in the face of such a steep manufacturing contraction remains a key challenge for the eurozone as we head into 2020."

In the end, it will be up to Christine Lagarde to avoid a European recession. Good luck, Europe.

https://ift.tt/2QkIuIp

from ZeroHedge News https://ift.tt/2QkIuIp

via IFTTT

0 comments

Post a Comment