Global Stocks Crash As Coronavirus Pandemic Infects 3,000; China, Yuan Plummet

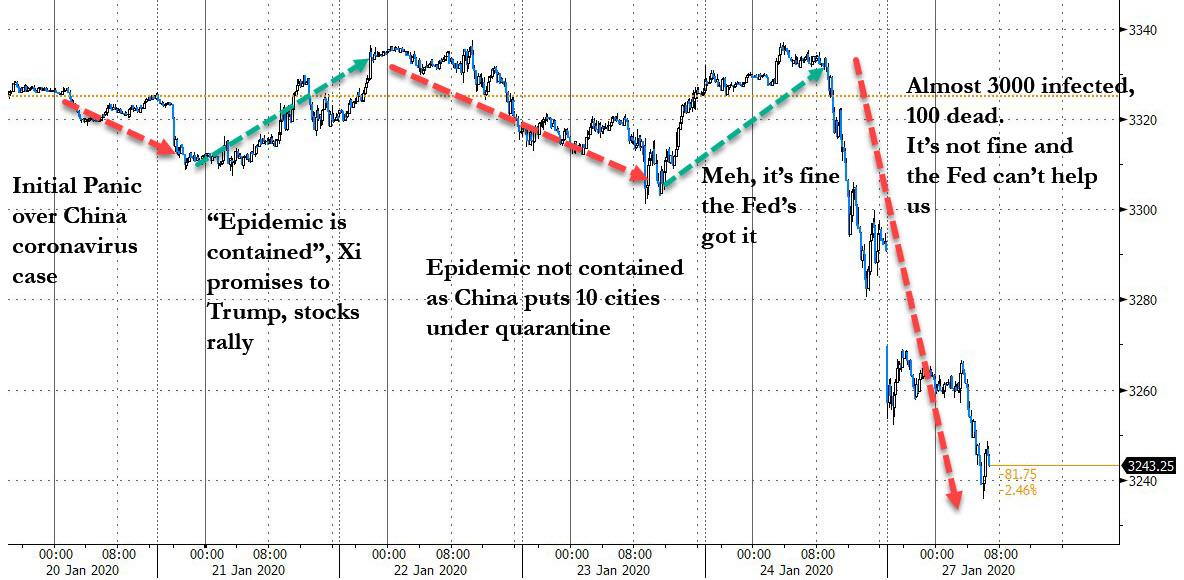

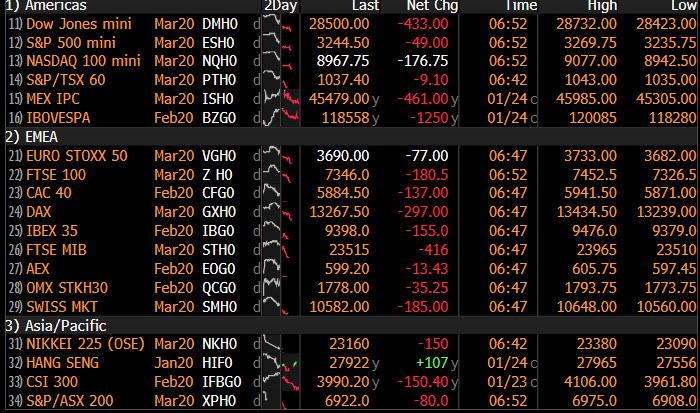

Global markets are a freefalling, sea of red mess, as algos finally realized that last week's optimism that "China's coronavirus epidemic is contained" was actually dead wrong, and the result is Dow down over 400 points and S&P futures plunging below 3,250...

... because with nearly 3,000 people infected around the globe and over 80 dead, one thing is certain: the epidemic is anything but contained.

And so, after denying reality for over a week, global stocks finally tumbled on Monday with S&P futures plunged the most since October 2, as investors grew increasingly anxious about the economic impact of China’s spreading virus outbreak, with demand spiking for safe-haven assets such as the Japanese yen and Treasury notes.

"Any economic shock to China’s colossal industrial and consumption engines will spread rapidly to other countries through the increased trade and financial linkages associated with globalization,” Stephen Innes, chief Asia market strategist at Axitrader, wrote in a note Monday. “I’m starting to think cash is the right place to be for the next few weeks" Innes added making a mockery of Ray Dalio's cash forecast for the second time in three years.

As Saxobank notes, equities are finally beginning to contemplate the possibility that the virus 2019-nCoV in China will have significant economic impact as the lockdown is now affecting 56 million people. China has imposed travel bans, school closings in major cities and is extending the Lunar New Year. The market reaction already started Friday with the US equities declining as more news disseminated, but in today’s session Chinese related markets are hit hard.

“Investors will react quickly to any sign of negativity and this is no exception as China announces that the issue has become an emergency. This could keep oil prices fragile until the coronavirus shows signs of slowing down,” said Mihir Kapadia, chief executive at Sun Global Investments.

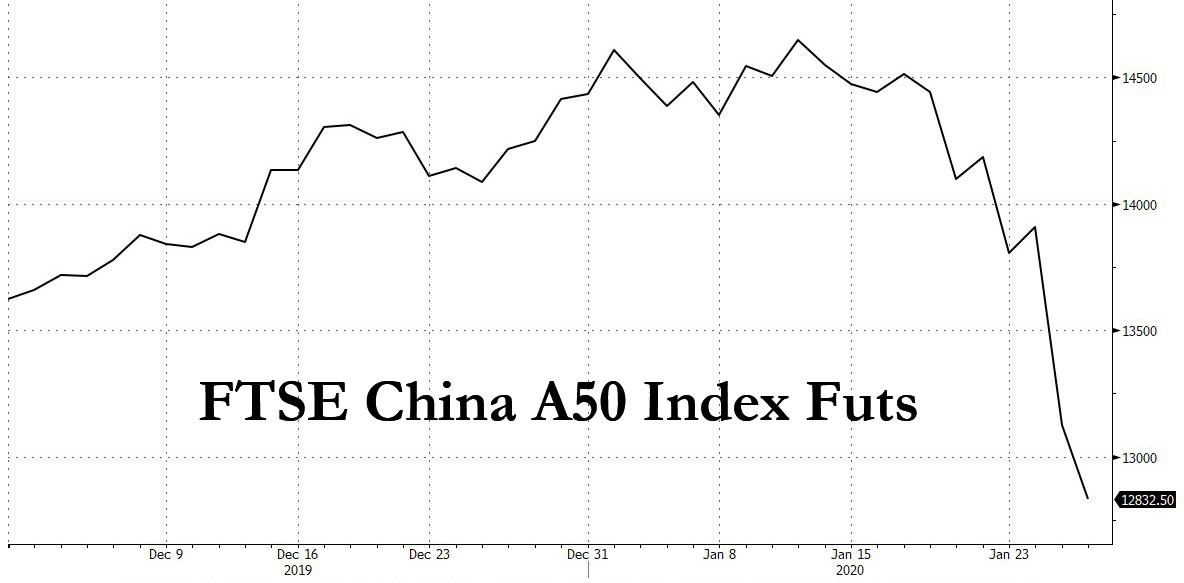

In Asian trading, the MSCI index of Asia-Pacific shares ex-Japan was off 0.4%, although trade in the region has already slowed for the Lunar New Year and other holidays, with financial markets in China, Hong Kong, Taiwan, South Korea, Singapore and Australia closed on Monday. Japan’s Nikkei average slid 2.0%, the biggest one-day fall in five months. Amid the Lunar New Year holiday, many markets in Asia were closed with China expected to be closed until at least Feb 3, however those who wanted to get out of China could do so thanks to the Singapore-tarded China proxy, the FTSE China A50 future, has plunged over 11% since the disease outbreak was reported.

The risk-off sentiment continued in European trading, where volumes and volatility surged, as Europe reacted to Asian equity weakness driven by weekend updates on the coronavirus spread. The Stoxx Europe 600 Index headed for its worst decline since October, with the mining group dropping by 4%. All Euro Stoxx 600 sectors are in the red with miners, travel and tech names posting the heaviest losses; a key measure of risk for the debt of Europe’s most fragile companies jumped to the highest in nearly two months. Adding to Europe's pain, Germany's IFO survey disappointed, confirming that the economic rebound in Germany is not a straight line as we have seen in previous rebounds since 2008. It all adds to uncertainty.

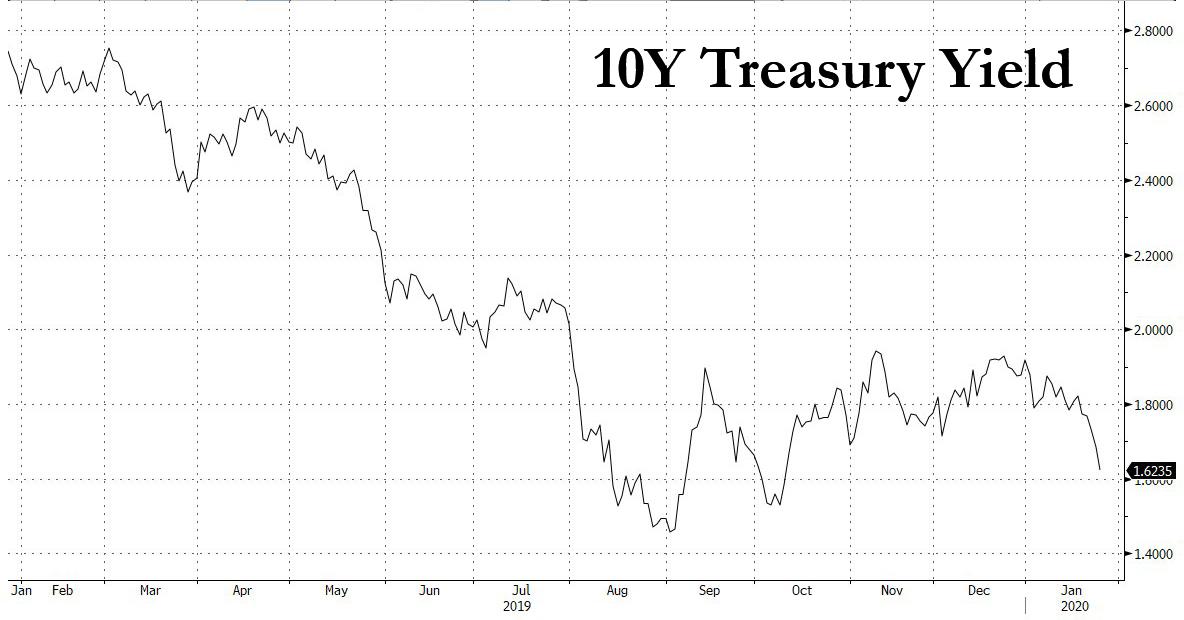

U.S. Treasury prices advanced, pushing down yields further, with the benchmark 10-year notes dropping to a 3-1/2-month trough of 1.627% in early Asian trade.

As yields plunged, so did oil and Brent crude futures fell to three- and five-month lows, respectively, with Brent plunging below $60 for the first time since October.

In Rates, German bonds rallied after closing their opening gap in early London trade with the curve bull flattening, spurred by a large block trade in bobl futures. One-way traffic in Italian bonds, 10y BTP rally ~230 ticks, tightening ~17bps to core after the weekend regional election. Amusingly, in Greece 10-year GGB yields drop to record lows after Friday’s upgrade by Fitch. Treasury curve bull steepens, 10-year yield drops ~6bps, with 2y and 5y supply due later today.

Emerging market equities are down 4.1% and cyclical sectors are leading the declines with especially travel, luxury goods, semiconductors and mining related stocks being hit the hardest.

Adding to risk-off sentiment we observe the VIX Index is close to 18, the highest level since October, which means that the equity market is shifting in a different state with lower expected returns and higher volatility. Remember as we have said many times in the past that the 22 level is the magical level where equity markets downside dynamics become very ugly. So stay alert and pay attention to news out of China and watch the VIX.

In the currency market, the concerns about the virus supported the yen, which strengthened as much as 0.5% to 108.73 yen per dollar, its 2-1/2-week high. The euro last stood at $1.1028 versus the dollar, having fallen to its eight-week low of $1.1019 on Friday. The offshore yuan dropped more than 0.5% to 6.9776 against the dollar, its weakest level since Jan. 6 and its biggest drop since October.

In other commodities, base metals slump, LME Nickel over 2% lower to underperform peers. Spot gold rose as much as 1.0% to $1,585.80 per ounce, the highest level since Jan. 8, as rising concerns over the spread of a virus outbreak in China and its potential economic impact prompted investors to buy the safe-haven metal.

In geopolitical news, Iran nuclear agency deputy chief said they have the capacity to enrich uranium at any percentage if the government decides to. There was an attack on the US embassy in Baghdad, Iraq where 3 rockets hit the embassy which left one individual injured although the injuries were only minor and the person later returned to duty, while the US embassy is said to have informed the Iraqi government that there will be a military response according to Twitter sources.

New home sales are among economic data due. Scheduled earnings include Sprint, Whirlpool

Market Snapshot

- S&P 500 futures down 1.3% to 3,250.25

- MXAP down 0.7% to 170.81

- MXAPJ down 0.5% to 556.16

- Nikkei down 2% to 23,343.51

- Topix down 1.6% to 1,702.57

- Hang Seng Index up 0.2% to 27,949.64

- Shanghai Composite down 2.8% to 2,976.53

- Sensex down 1% to 41,210.97

- Australia S&P/ASX 200 up 0.04% to 7,090.54

- Kospi down 0.9% to 2,246.13

- Brent futures down 3.4% to $58.62/bbl

- Gold spot up 0.8% to $1,583.27

- U.S. dollar Index up 0.06% to 97.91

- STOXX Europe 600 down 1.7% to 416.42

- German 10Y yield fell 2.7 bps to -0.362%

- Euro down 0.07% to $1.1017

- Brent Futures down 3.2% to $58.75/bbl

- Italian 10Y yield fell 2.2 bps to 1.064%

- Spanish 10Y yield fell 5.2 bps to 0.296%

Top Overnight News from Bloomberg

- Traders see nearly 60% chance of a Bank of England cut this week as of Monday. Economists are more cautious, predicting a 6-3 vote to keep rates on hold as the government prepares to negotiate a trade deal with the European Union that will help define the post-Brexit economy

- Japanese Prime Minister Shinzo Abe’s upcoming choice of candidate to join the Bank of Japan board could shed light on the leader’s current thinking on the importance of achieving a stubbornly difficult inflation goal. be’s nomination to replace Yutaka Harada is scheduled to take place Tuesday morning, according to a document seen by Bloomberg

- China’s escalating viral outbreak may end up hitting Japan’s fragile economy harder than the SARS outbreak of 2003, according to economists

- Traders are pricing in a full quarter- point Federal Reserve rate cut this year amid fears of headwinds to global growth from the spread of the coronavirus. Economists for their part see the Fed holding rates steady this year and next, according to a survey by Bloomberg

A broad risk-averse tone resumed across asset classes following on from last Friday’s declines on Wall St. where the S&P 500 posted its worst weekly performance since August amid ongoing coronavirus fears, with the number of confirmed cases stateside now at 5. Furthermore, the latest official update from China stated the number of infected rose to 2744 with the death toll at 80, and China also warned that the coronavirus is getting stronger and the amount of cases could increase. This heavily pressured US equity futures which slipped around 1% in early trade and spurred safe-haven bids for T-notes and gold, while Nikkei 225 (-2.0%) sold off due to the virus outbreak fears, detrimental currency flows and against the backdrop of thinned conditions with nearly all major bourses in the region closed for holiday. India’s NIFTY (-1.0%) was also lower after large-scale protests yesterday regarding the Citizenship Amendment Act, but with losses limited amid corporate earnings including ICICI Bank. Finally, 10yr JGBs were underpinned on safe-haven buying due to the coronavirus jitters which also spurred T-notes to gap higher by about 10 ticks at the re-open, although the upward momentum for JGBs has since petered out amid the lack of BoJ presence in the market and absence of most regional participants.

Top Asia News

- Abe’s Pick to Replace BOJ Board Member Could Come on Tuesday

- Coronavirus Seen Hitting Japan’s Economy Harder Than SARS

- Bidders Must Absorb $3.3 Billion Debt to Buy Air India

European stocks see hefty losses across the board [Eurostoxx 50 -2.2%] following muted but negative APAC session as the region experiences mass holiday closures. For reference, the pan-European Stoxx 600 index sees around 95% of its stocks in negative territory. UK’s FTSE 100 (-2.5%) sees slightly more pronounced downside amid heavy-bleeding from large-cap miners and energy names, in-fitting with price action in the respective complexes - Rio Tino (-4.8%), Antofagasta (-4.3%), Anglo American (-4.5%), Glencore (-4.5%), BP (-2.0%) and Shell (-2.0%). Meanwhile, Italy’s FTSE MIB (-0.7%) fares better in light of the aftermath from the Emilia Romagna regional elections which diminished the chances of an Italian snap election, thus Italian banks cushion losses in the index with tailwinds from favourable BTP price action – Ubi Banca (+0.1%), Banco BPM (+0.1%), Intesa Sanpaolo (-0.1%). Sectors are broadly, but firmly in the red, with Materials (-2.8%) lagging amid the base-metal price action. Defensives meanwhile see losses to a lesser extent than their cyclical peers. Consumer discretionary names also remain a laggard amid the demand implications from the virus outbreak for luxury goods and travel names, such as: Swatch (-3.6%), Richemont (-3.0%), IAG (-6.0%) and easyJet (-5.5%). In terms of individual movers; William Hill (-1.7%) saw losses at the open amid a breakdown in expansion talks with CBS Sports. Bayer (-1.5%) conforms to losses seen in the region despite a pushback from a spokesperson regarding last-week’s sources reports of an imminent settlement to its Roundup weedkiller scandal. On the flip side, positive broker moves see RWE (+0.1%), Uniper (+0.1%) Orsted (+0.1%) and Italgas (+1.4%) in the green.

Top European News

- Populists Humiliated in Italy Vote as Conte Gets a Respite

- Axa Narrows Bids for Eastern Europe Unit to Generali, Austrians

- Slovenian Prime Minister Resigns, Floats Holding Early Elections

- Turkey Starts Probe of ‘Provocative’ Social Media Posts on Quake

In FX, broad losses experienced in the EM-sphere, led by downside in the Yuan as the coronavirus crisis claims more lives and spreads further towards the West (full analysis available on the Newsquawk feed). USD/CNH has gained traction and breached 6.9800 to the upside (vs. 6.9400 low), topping its 200 and 55 DMAs at 6.9817 and 6.9843 respectively – with talks of potential stimulus measures by the Chinese Government to cushion the economic impact of the outbreak. TRY and ZAR feel the Yuan contagion with USD/TRY looking for a test of 5.9500 to the upside whilst USD/ZAR inches closer to 14.6000, but could see mild resistance at 14.5970 (21st Jan high) with reported stops above the round figure and ahead its 200 DMA at 14.6105.

- CAD, NOK, RUB - Energy-related FX succumb to losses seen in the complex as jitters materialise regarding the implications of the virus outbreak on global oil demand. The Rouble remains the most impacted as USD/RUB surpasses 62.50 (vs. 62.24 open) before stopping short of its 200 DMA (62.63). The Loonie meanwhile extends losses vs. the Buck as the pair found support ~1.3150 before taking out its 55 and 100 DMAs (at 1.3158 and 1.3178 respectively) ahead of the psychological 1.3200. Similarly, Norway’s oil-correlated Crown drifted lower since the open – EUR/NOK reclaimed 10.0000 (which also coincides with its 55DMA) to the upside and topped its 100 DMA (10.0183) – with potential resistance touted at 10.0500.

- AUD, NZD - The antipodeans also drift in tandem with the risk aversion and headwinds from detrimental base metal price action amid the aforementioned virus woes. AUD/USD has given up its 0.6800-status as losses exacerbated amid the domino-effect coronavirus would have on the Australian economy via China’s anticipated economic slowdown – with reports noting that Chinese GDP could see a reduction of as much as 1ppt. The pair remains the marked G10 underperformer thus far and eyes 0.6755 (26th Nov low and 76.4% Fibo of the Oct to Dec move) to the downside for a potential support level, and with some AUD 800mln in options seen expiring at strike 0.6765. Meanwhile, its Kiwi counterpart looks to test its 55 DMA to the downside at 0.6550.

- JPY, DXY - Safe haven flows have seen an early bid in the Japanese currency, as USD/JPY gapped below 109.00 at the open vs. Friday’s 109.25 close. Since then, the pair has fluctuated on either side of the round figure having found a base around 108.75, and with technicians eyeing 108.67 (100 DMA) and 108.52 (200 DMA) should the base fail to hold, and with 109.00 seeing circa USD 800mln in options expiries. DXY meanwhile remains flat intraday having notched a current range of 97.800-941 and with little by way of schedule data/speakers to sway the state of play.

- EUR, GBP - Mixed session for the Sterling and Single Currency, but relatively muted action compared to some of its G10 and EM peers. EUR/USD saw some pressure amid a downbeat German Ifo Survey which reaffirmed that the German economy has a subdued start to the year, but somewhat echoed Markit’s assessment that the manufacturing sector is slowly emerging from its downturn. EUR/USD failed to glean much reprieve from the development in Italy after the Centre-Left bloc defeated Salvini’s league in regional elections, thus dimming the chances of a snap election. The pair hovers just above 1.1000, having clocked in a current range of 1.1015-35. Meanwhile, Cable found an overnight base at 1.3050 and took advantage of some weakness seen in the Single Currency. EUR/GBP drifts further below 0.8450 whilst GBP/USD meanders just under 1.3100, having eclipsed the level in recent trade.

In commodities, WTI and Brent front-month futures continue their downward trajectory amid the materialising concerns surrounding the virus outbreak’s impact on global growth, oil demand and overall sentiment. While some desks have drawn comparisons to the SARS virus in 2003, which trimmed 0.15ppts off of global growth, some believe that the comparisons may be slightly unfair, albeit some economists note that Chinese GDP could see a reduction of as much as 1ppt. WTI Mar’20 futures gapped lower at the open before downside exacerbated and prompted the contract to test levels close to USD 52/bbl to the downside, levels last seen in October 2019. Similarly, Brent Mar’20 surrendered the USD 60/bbl handle and currently posts loses around USD 2/bbl; the contract did find some support at USD 58.50/bbl. Elsewhere spot gold is bolstered by the flows in to safe-havens, with prices testing USD 1590/oz to the upside during APAC trade vs. Friday’s ~USD 1570/oz. The overall demand/global growth aspect of the outbreak of the coronavirus has led to sharp losses in base metal prices: copper slumped around 2% at one point and dipped below USD 2.62/lb vs. Friday’s ~USD 2.67/lb close, whilst iron ore futures fell as much as 6% at one point.

US Event Calendar

- 10am: New Home Sales MoM, est. 1.53%, prior 1.3%

- 10am: New Home Sales, est. 730,000, prior 719,000

- 10:30am: Dallas Fed Manf. Activity, est. -1.6, prior -3.2

DB's Jim Reid concludes the overnight wrap

There’s a reasonable amount of drama to anticipate this week. The progress of the coronavirus will be the overwhelming key short term driver (latest below) as more and more concerns rise to the surface. As an aside the week ends with a landmark moment in history as at midnight CET on Friday the U.K. will finally leave the EU 43 months after the vote. Staying with the U.K., a finely balanced BoE meeting the day before might be the highlight elsewhere. The FOMC (Wednesday) will attract the usual interest even if the Fed seemingly have a high bar to act in either direction at the moment. Also watch today’s German IFO with expectations that it will match the strongest level since June. China’s official PMIs (Friday but possibly delayed as the holiday season has now been extended until February 2) could be a very important release for the globe but the reality is that the virus will impact these numbers from next month making trends difficult to decipher. Q4’s GDP numbers from both the US (Thursday) and the Euro Area (Friday), as well as the European flash CPI (Friday) will also garner some interest.

We also have some very high profile earnings this week with four of the five largest US companies reporting (Apple, Microsoft, Amazon, Facebook). On Friday night our US equity strategists reiterated their view of very stretched positioning in the market. They now see it in the 98th percentile of their historical dataset with systematic funds at all time high exposure. They also show that 3-5% pull backs typically happen every 2-3 months and we’ve now been without one for 3.5 months. In another two weeks this will put us in the 90th percentile through history (86th currently). See their report here.

Staying with the US and with great importance to US equity markets, it seems that Bernie Sanders has edged into the lead in the Democratic nomination race over the weekend with a probability of between 35-40% in bookmaker markets. He was 5th in the race and only just above 5% in mid October. Joe Biden probabilities range from c.31-37%. So pretty tight with Sanders climbing rather than Biden falling. This time next week Iowa will vote in the first primary so we’ll soon be giving this race a lot more macro attention. The polls (Emmerson College and YouGov) suggest he’s edged into a very narrow lead there, the same as with New Hampshire that polls 8 days later. A reminder that in our last monthly investor sentiment poll, 90% thought a Sanders Presidency would be negative for US equities. Should more risk premium be priced into markets therefore? Especially with positioning and valuations as stretched as our strategists believe.

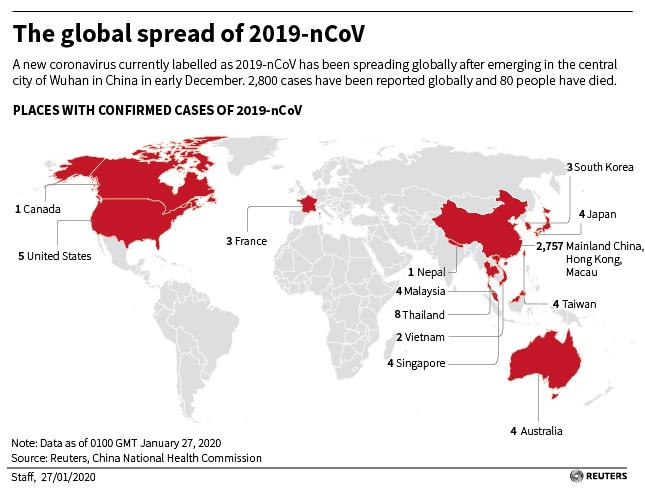

Before we go through the two main central bank events of the week in more detail and review last week in markets we should go straight to Asia and for updates on the coronavirus. The latest is that there are now 80 confirmed deaths (up from 25 on Friday) and 2,774 confirmed cases (up from 835) with around 30,000 people under observation. Meanwhile, France became the first country in Europe to report cases of the virus. As of now, the global tally is 7 in Thailand, 3 in Japan, 3 in South Korea, 3 in the US, 1 in Canada, 2 in Vietnam, 4 in Singapore, 3 in Malaysia, 1 in Nepal, 3 in France, and 4 in Australia along with 8 in Hong Kong, 5 in Macao and 4 in Taiwan. Elsewhere, on Saturday China said that it is imposing a ban on all outgoing overseas group tours from today after banning all domestic group tours on Friday. China has now also banned wildlife trade across the country with the government saying that the shipping and sale of wild animals won’t be allowed, and breeding sites will be quarantined and warned citizens against the consumption of wild animals. Also about 56 million people in China are now under severe transport curbs.

Risk off continues to be the theme in Asian markets this morning as the concerns over the coronavirus continue to rise. Safe heaven assets are up with gold (+0.48%) and the Japanese yen (+0.18%) both higher while yields on 10y USTs are down -4.2bps to 1.643% and crude oil prices are down c. -2.35%. Meanwhile, Asian equity markets are declining with the Nikkei (-1.97%) and India’s Nifty (-0.43%) both down. Markets in Hong Kong, China and South Korea are closed for the NY holiday. As for Fx, the offshore Chinese yuan is down c. -0.50% to 6.9669 while most emerging market currencies are also trading weak. Elsewhere futures on the S&P 500 are down -0.98% while those on the Chinese equity market (SGX FTSE China A50) are down -5.19%.

In other news, the Italian government led by Prime Minister Giuseppe Conte were boosted by a victory in a regional election in Emilia-Romagna with interior ministry figures showing that support for the center-left bloc led by the Democratic Party was at around 50% while the group headed by Salvini’s Lega Party trailed at only 45%. Meanwhile, the support for the M5S dropped to only 5%. The election results should help the performance of BTPs albeit in a risk off environment.

We also got news over the weekend that three rockets hit the US embassy in Iraq's capital Bhagdad on Sunday with Bloomberg reporting that at least one person was wounded in the attack. It is not clear how serious the injuries are or whether the person was an American national or an Iraqi staff member. This indicates that geopolitical risks are likely to linger this year.

Now to the knife-edge BoE decision on Thursday (Mark Carney’s last meeting). This meeting follows a run of fairly weak economic data over the last few weeks but with last week’s strong employment data and better than expected flash PMIs (more later) confusing the picture. Our economists have expected a cut for a good couple of months now but markets are closer to 50:50. Sterling is at $1.3058 in Asia (-0.11%) as we approach the big day. It started the year at $1.3257 so net net the weak data in 2020 has impacted pricing.

As for the FOMC on Wednesday, our US economists write in their preview (link here) that the FOMC should hold rates steady, and that “the current stance is likely to be unchanged barring a “material reassessment to the outlook.” However, they do foresee a 5bp upward technical adjustment to the interest rate on excess reserves (IOER), though they write that “it is a close call given the communication challenges of such a move.” All eyes will be on Chair Powell’s press conference following the meeting for any new information. The full day by day week ahead is at the end.

Earnings seasons ramps up this week, with a number of large companies reporting. Tuesday sees reports from Apple, LVMH, Pfizer and SAP. Then on Wednesday we’ll get an array of companies, including Microsoft, Facebook, Mastercard, AT&T, Novartis, Boeing, McDonald’s, PayPal, General Electric and Banco Santander. On Thursday, releases come from Amazon, Visa, Roche Holding, Verizon, The CocaCola Company, Royal Dutch Shell, Unilever, Amgen and Samsung. Finally on Friday, we’ll hear from Exxon Mobil, Chevron and Caterpillar.

Now for last week where we ended weak as fear grew over the coronavirus. Global equity markets sold off with the S&P 500 coming off record highs to end the week down -1.03% (-0.90% Friday), with its decline on Friday actually its worst daily performance since early October. It was a similar story elsewhere, with the NASDAQ also down -0.79% (-0.93% Friday), and the STOXX 600 down -0.22% (+0.86% Friday before the late US sell-off). Chinese assets in particular suffered last week, though they were closed on Friday for the New Year holiday, with the Shanghai Composite index down -3.22% in its worst week since August, while the CSI 300 was down -3.63% in its worst week since May. Other risk assets also underperformed, with Brent crude down -6.41% (-2.18% Friday) in its worst weekly performance since December 2018 and its 3rd successive weekly decline. So probably not where a lot of investors thought we’d be for oil following the heightened geopolitical tensions that started the year between the US and Iran.

Safe havens were the beneficiaries, with 10yr bund yields falling every day last week, down -12.0bps (-2.7bps Friday), which is actually their biggest weekly decline since May 2018. 10yr Treasury yields were also down -13.8bps (-4.9bps Friday) in their biggest weekly fall since October, down to 1.684%, their lowest level since October. Other safe haven assets outperformed as well, with gold up +0.92% (+0.55% Friday) and the Japanese Yen +0.79% (+0.19% Friday) against the US dollar.

The main data release on Friday came from the PMIs, which were a mixed set of results, though their impact on markets was rather outweighed by the virus. For the Euro Area as a whole, the composite PMI surprised slightly to the downside, remaining at 50.9 against expectations for an increase to 51.2. The French composite PMI fell back this month, down to 51.5 (vs. 52.0 expected) amidst the ongoing strikes in the country, while the German reading surprised to the upside, with the composite PMI up to 51.1 (vs. 50.5 expected), which is the strongest reading since August. Here in the UK, the PMIs also surprised on the upside, with the composite PMI coming in at 52.4 (vs. 50.7 expected), and up from a contractionary 49.3 in December. Following the news, investors dialled back their expectations of a rate cut from the Bank of England this week, which now stand at around a 46% chance, down from 70.5% chance a week ago. For completeness, over in the US the composite PMI rose to a 10-month high of 53.1, in spite of the fact that the manufacturing PMI declined for a second successive month, down to 51.7 (vs. 52.5 expected).

https://ift.tt/3aMlom0

from ZeroHedge News https://ift.tt/3aMlom0

via IFTTT

0 comments

Post a Comment