A Great Debate Emerges On Wall Street: Are Men Or Machines Behind The "Panic Selling"?

Over the past few days, we have carefully tried to put together the pieces of the "liquidation puzzle", to find out i) just who is selling, whether machines or people or some combination of both, and ii) is there more selling to go? Readers can catch up on some of our most recent articles on the topic below:

- Gamma Trapdoor Opens: Markets Brace For "Shock Down" As Dealers Puke

- What's Behind Today's Market Plunge? A Stunned Wall Street Responds

- Morgan Stanley: If We Close Below 3,235, Systematic Selling Will Become "Self-Fulfilling"

- The $60 Billion Puke: Here Comes The Systematic Selling... And Watch The Russell 2000

- CTAs Begin Selling

- Nomura: Investors Are Finally Considering A "Previously Unthinkable Scenario"

And while, as often happens with such opaque market positioning and flow topics, no clear answer has emerged, with contradictory and confusing evidence pointing to the recent sharp drop in dealer gamma, the triggering of CTA deleveraging, the unwind of record net long SPX speculative positions, forced selling by quant/systematic (vol targeting, risk parity) funds as well as liquidations by discretionary hedge funds operated by carbon-based traders.

What has emerged is yet another great Wall Street debate, with some, such as JPMorgan, claiming the selling was mostly systematic (i.e., algos and model quants), while others such as Nomura, confident that the recent bout of selling is largely man-made, i.e., discretionary hedge funds unwinding.

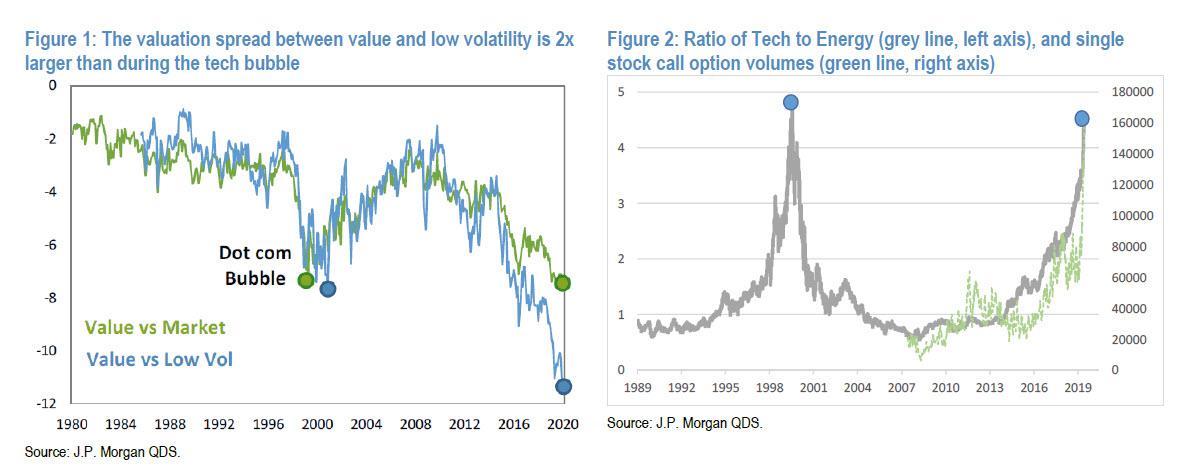

Starting with the former, in his latest note, JPMorgan's head quant, who last week doubled down a trade that turned out to be catastrophic for those who put it on when he first recommended it last summer as a "once in a decade opportunity" (to lose money perhaps) namely buying value stocks over low-vol/growth, and which led to unprecedented losses for anyone who held on to this trade for the past 6 months...

... takes a victory lap and writes that "last Wednesday, we cautioned about high valuation and risk in certain market segments, i.e. factors and sectors. The publication date coincided with all-time highs on the Nasdaq, and over the next 2 trading sessions momentum, growth and tech stocks sold off significantly." What he failed to mention is the absolute murder unleashed across his favorite "value" stocks, where some iconic names such as Exxon have cratered to a 15 year lows, its dividend yield approaching a record 7% (!).

But while the jury is still out on whether this time Kolanovic will be right on the great rotation out of low-vol/momentum/growth into value, the JPM quant focuses squarely on what he believes sparked this week's near record selling. Echoing what we said earlier in the week, the Croat says, "in addition to broad risk-off sentiment from the virus, significant drivers of price action was selling from systematic strategies and option hedgers." Laying out the various classes of investors, Kolanovic identifies:

- Option hedging (gamma) which likely resulted in $40-50Bn of outflows,

- CTAs ~$40-60Bn selling,

- volatility targeting strategies ~$40-60Bn of selling.

At the same time, overall liquidity, or market depth dropped by over 50%, and confirming what has been obvious to everyone, Kolanovic observes that "this total selling of ~$150Bn produced a large market impact."

Additionally, picking up on what we said about the plunge in dealer gamma, Kolanovic said that dealers' gamma turned significantly short, so selling on account of option hedges was ~$15-20Bn on Monday, and ~$25-30Bn on Tuesday.

That said, as has been the case for much of the past 3 years, Kolanovic then quickly shifted to the silver lining, pointing out that gamma hedging works both on the downside and upside, and "should there be a move higher , option hedgers would need to buy a significant amount of equities and could prompt a market squeeze higher." Alternatively, their selling may accelerate even more in the coming days: the truth is nobody knows.

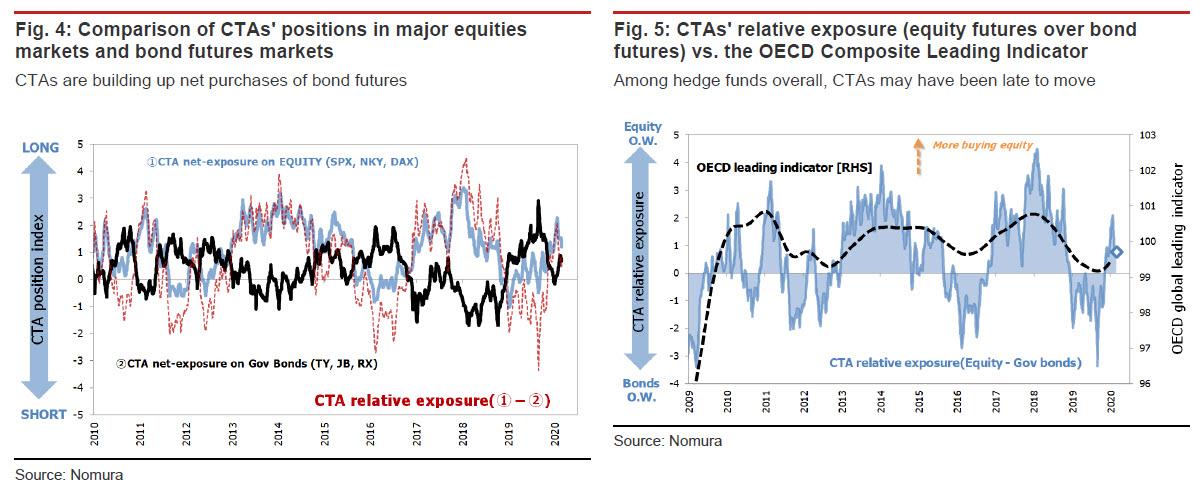

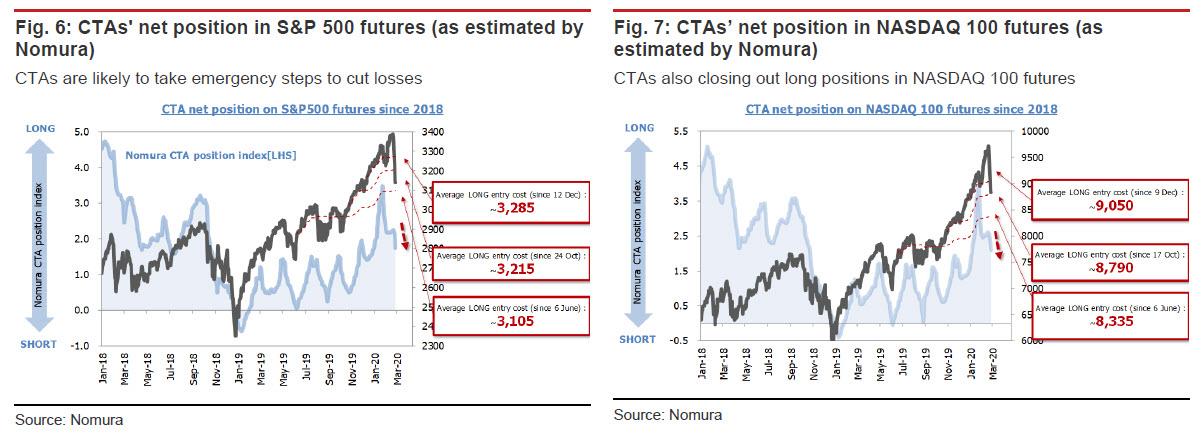

Meanwhile, focusing on another group of investor, the JPM quant says that since CTAs' starting point was high equity exposure, they began selling equities already Monday as SPX breached 20- and 50- day moving averages overnight, and then continued selling on Tuesday as SPX breached the 100-day moving average, something our readers already knew.

Where Kolanovic does provide some unique perspective, is his assertion that "CTA selling is now over, as 200d (~3045), 6M

(2900) and 12M (2800) signals are not likely being breached, in our view." We are not so sure: with ES sliding after hours, the 200DMA is suddenly looking very, very close. And a close below 3,045 means the big trapdoor opens.

But don't tell "bullish cop" Kolanovic, who instead focuses on the hypothetical scenario in which the market moves higher, and claims that this "could prompt CTAs to buy back equity exposure, so we think risk from CTAs is skewed to the upside." Considering that stocks plunged since this note was published just around noon on Wednesday, we think that JPM is wrong, but that too may change eventually.

Next, Kolanovic looks at volatility targeters such as variable annuities, risk parity funds, which he says had relatively high

exposure going into the sell-off (~75th percentile), which he explains by noting that "bond moves had been offsetting equity moves in the first month of the virus epidemic." However, equity moves on Monday and Tuesday were too large to be offset by bond moves, and that prompted significant selling from vol targeters, according to Marko who notes that "Monday alone likely prompted ~$30-40Bn of selling, and Tuesday another ~$20Bn. Volatility targeters will likely continue selling over the next few days, but following this adjustment, their exposure will have dropped to ~35th percentile, so selling pressure should ease thereafter."

That is probably a correct assumption, the only question is where will the S&P be by then...

So where does this leave the oddly schizophrenic Marko Kolanovic who is bullish on the overall market yet believes that low-vol stocks are a bubble?

Well, in his Wednesday note he concludes that "option hedgers and CTAs are now more likely to buy than sell, and volatility targeters are still selling but at a lower pace, so we think a short term bounce-back is getting likely given month-end flows." To underscore his point of an imminent bounce, he claims that over the next 2 days, given the significant underperfomace of equities vs bonds month to date, "there should be buying of stocks and selling of bonds" with JPM estimates indicating the

"rebalancing move could produce upside pressure on equities of 1-2%, which could be enough to prompt additional buying from gamma hedgers and CTAs." Of course, we will check back in 3 days to see if this particular opportunity actually materialized.

And just in case Kolanovic is once again overly bullish as he tends to be, he hedged by saying that the risk to this outcome "is clearly coming from virus developments in Europe and the US; should the news significantly deteriorate, the bounce is not likely to happen." He is absolutely correct on this one, we will add.

What about upside risk? Here Kolanovic leaves it in the hands of China, whose situation he claims is "steadily improving, with a net negative number of cases the last several days (number of recoveries is ~1000-2000 larger than the number of new cases). Because when all else fails, may as well put one's faith in China's grotesquely manipulated numbers. And if China fails, there is always the Fed to bail out each and every chronic permabull, to wit: "upside risk could come from significant stimulative policy measures that could be introduced. "

In sum, Kolanovic - as usual - remains positive on the market, "with a strong preference for cyclicals, value and EM exposure over momentum and low volatility stocks: the virus should go, but stimulative measures will likely stay."

Kolanovic's latest bullish reversal, just as we were commending him last week on once again turning "contrarian" and calling a market bubble a spade, what the JPM quant basically said is that discretionary investors were not part of the violent puke observed over the past three days, which was largely a systematic event.

* * *

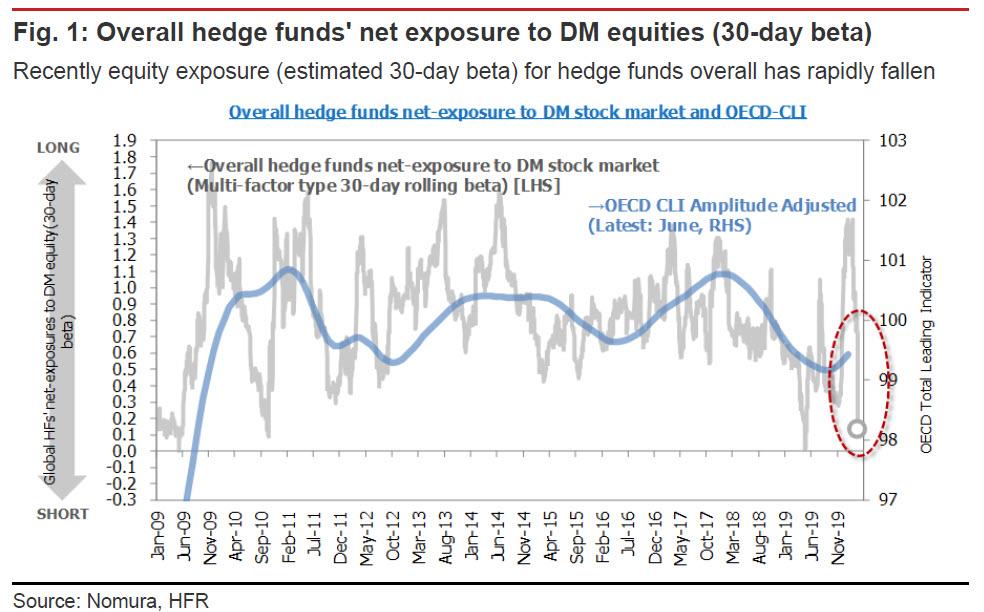

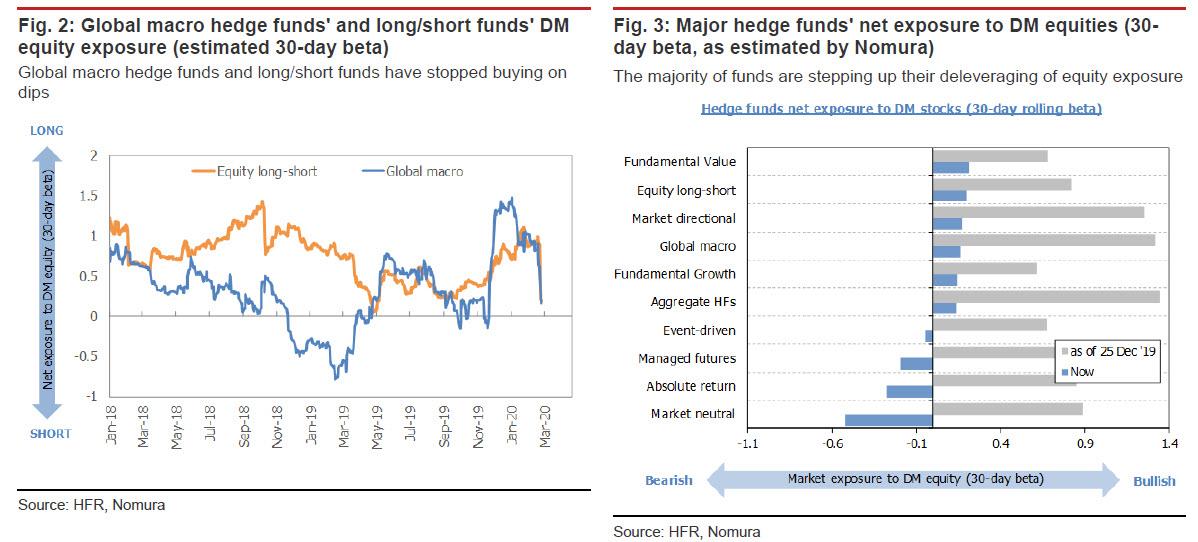

It will hardly come as a surprise that not everyone agrees. In fact, in a note from Nomura's, Masanari Takada, the Japanese quant reaches the opposite conclusion, writing that "equity long/short funds and global macro hedge funds unloading long equity positions, CTAs may have been late to move for the exit."

Contradicting Kolanovic, Takada writes that "it is looking very likely that the main culprits in panic selling of DM equities were fundamentals-focused hedge funds, as we had originally posited. Recently equity exposure for hedge funds overall has plummeted, with the main driver being equity long/short funds and global macro hedge funds unloading long equity positions."

The reason for this is that while discretionary investors had been picturing a V-shaped recovery in the global economy and corporate earnings, when confronted with the surge in COVID-19 infections, "many are now being forced to drastically change their strategies." And while the selling could be an overreaction, the situation is suggestive of global macro hedge funds and long/short funds turning to trades that prepare for a global recession.

Meanwhile, the Nomura quant argues that systematic traders (CTAs and risk-parity funds) are simply chasing the fundamentals-oriented funds and reducing their long positions in equities, and makes the point "that CTAs were late to head for the exit suggests that the latest sell-off was not necessarily driven by systematic trading", contradicting what Kolanovic said.

Be that as it may, with CTAs forced to cut losses, with the SPX sliding below key resistance levels of 3,285 and 3,215 which then forced CTAs to close out some of their holdings, in the end their trades exacerbated the drop in US equities. CTAs are likely to step up sales of equities a further notch if the S&P 500 goes below 3,105.

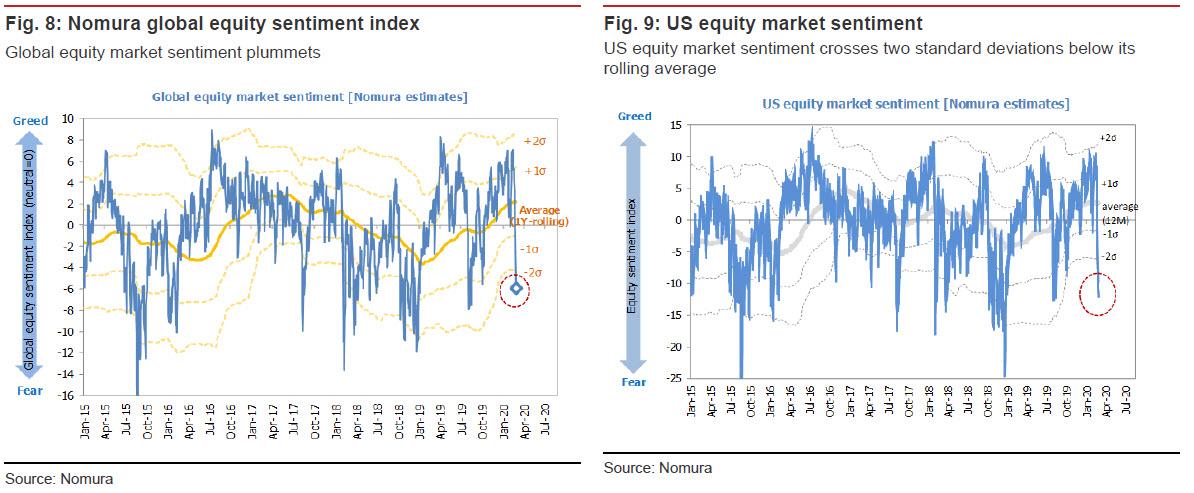

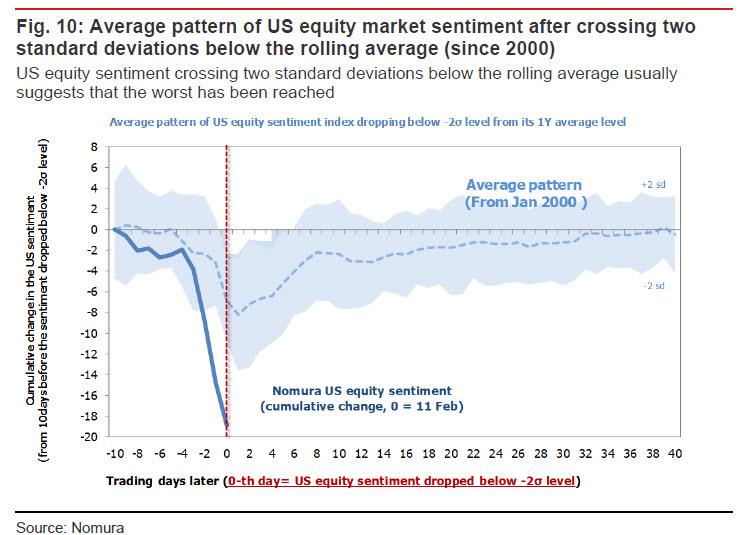

Separately from the "man or machine" debate, Nomura writes that a particularly noteworthy point, one we touched upon earlier this week, is that "global equity sentiment and US equity sentiment have fallen past two standard deviations below their one-year rolling averages for the first time since December 2018. A rapid cooling off in investor confidence looks to have triggered panic selling, including by hedge funds."

That said, this could also be a blessing in disguise because if the view that pessimism about a global economic downturn has gone too far, then Takada - in borrowing a page from Kolanovic's bullish playbook - "sees the possibility that the current situation will in hindsight appear to have been the darkest day." If so, and based on past sentiment patterns, the timing could be approaching over the next one to three months to target a swing back from pessimism in each region and sector. The only question is just how much more will said regions and factor drop first.

In the end, despite Wall Street's trivial ego pursuits of trying to reverse engineer who is behind the selling - an exercise in futility when stocks have plunged almost 10% in less than a week - the question whether the liquidation is "man or machine" is largely irrelevant due to the reflexive nature of the market (where humans sell if machines sell and vice versa), and all that matters is if indeed, it is now too late to stop a global viral pandemic, triggering the "Unthinkable" scenario posited by Rabobank last week, one in which one share of google will have far less intrinsic value than a bag of rice, a gallon of water or a 50-pack of bullets.

https://ift.tt/2HZsTcg

from ZeroHedge News https://ift.tt/2HZsTcg

via IFTTT

0 comments

Post a Comment