Friday's Dip Buying By Hedge Funds Was The Most Extreme In The Past Decade: Why This Is Worrying Morgan Stanley

Amid the broader market carnage which culminated with the fastest 10% S&P correction from an all time high, last week also we observed the biggest one-day point drop in the Dow Jones ever (this in turn was followed by the biggest one-day Dow point surge ever on Monday). But more notably, following several days of freefall, on Friday equity long/short hedge funds finally stepped up, and whether it ends up being the “best trade”, the “worst trade”, or something in between, Morgan Stanley's prime brokerage writes that "the buying of US equities among Equity L/S funds on Friday was the biggest we’ve seen in the past decade." And while Monday's ramp certainly eased some concerns about another year of woeful hedge fund performance, Morgan Stanley cautions that depending on what happens to stocks from here, it "raises the risks that we could see a rotation and alpha drawdown, should these flows look to reverse in the future."

As we first observed two weeks ago, the record high leverage, crowding, and factor risks among the hedge fund community have raised the risk for future violent hedge fund rotations.

And while we have not yet seen these risks realized in the sharp sell-off over the past weeks, the recent behavior and mixed performance among HFs has made Morgan Stanley more concerned that we could be getting closer to a sharp rotation. In particular, three of the things the bank is watching have changed recently and are driving its greater concern:

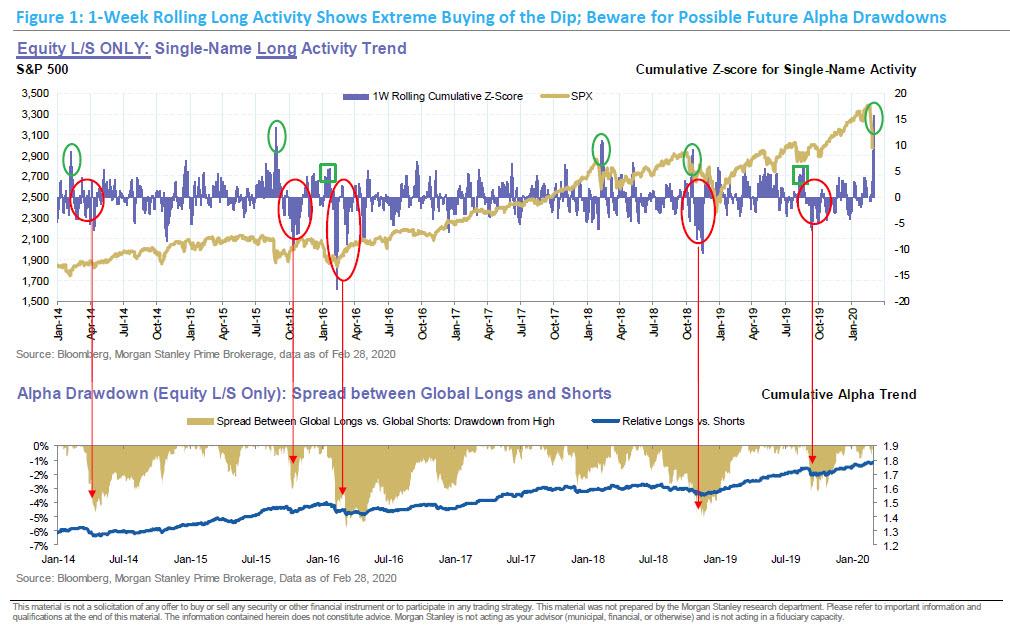

- HFs have been actively adding to gross leverage, particularly by adding longs in the largest amounts of the past decade last Thurs and Fri. This is concerning because in 3 of the 4 similar past episodes since 2014, large long selling has followed afterwards and has coincided with negative HF alpha (see Figure 1 below)

- L/S funds bought large amounts of Momentum last week (and sold Value), once again crushing Marko Kolanovic's argument that a rotation out of momentum/low-vol and into value stocks is imminent.

- Performance (while good relative to the markets) has declined in absolute terms into negative territory and crowded stock performance has been mixed

So was Friday's record dip buying a sign that hedge funds have finally gotten their mojo back and are again able to time market inflection points? According to Morgan Stanley that is hardly the case, and instead last week's flush into risk assets merely underscores the top three rotation risks, which are as follows:

Rotation Risk Consideration #1: Largest Long Buying of Past Decade

Throughout the sharp sell-off last week, HF activity showed almost no signs of active de-grossing. In fact, the opposite was largely the case as L/S funds bought longs throughout last week and Quant funds generally added to both sides of their books to keep their leverage from falling as fast as it would simply due to the falling markets. Put simply, there were no real signs of capitulation among Hedge funds.

While this behavior of buying dips and adding to gross exposure is fairly common during market pullbacks, the magnitude of the long buying among L/S funds spiked to unprecedented levels on Friday. For context, the long buying on Thursday was in line with the prior high from 2010-2019 and Friday’s buying was ~75% higher than that. Similarly, large long buying has often come near short term market troughs, aside from what happened in late 2018 (i.e. HFs generally exhibited good timing from a broad market perspective). Looking at the peak long buying within the green ovals in Figure 1, they peaked on the following dates:

- Feb 6, 2014

- Aug 27, 2015

- Feb 9, 2018

- Oct 17, 2018

However, this behavior raises the rotation risk that Morgan Stanley's Prime Brokerage has been getting more concerned about for a while. Essentially, the concern is that HFs have tended to sell longs afterwards (often as markets rebounded) and this selling coincided with negative alpha from L/S funds.

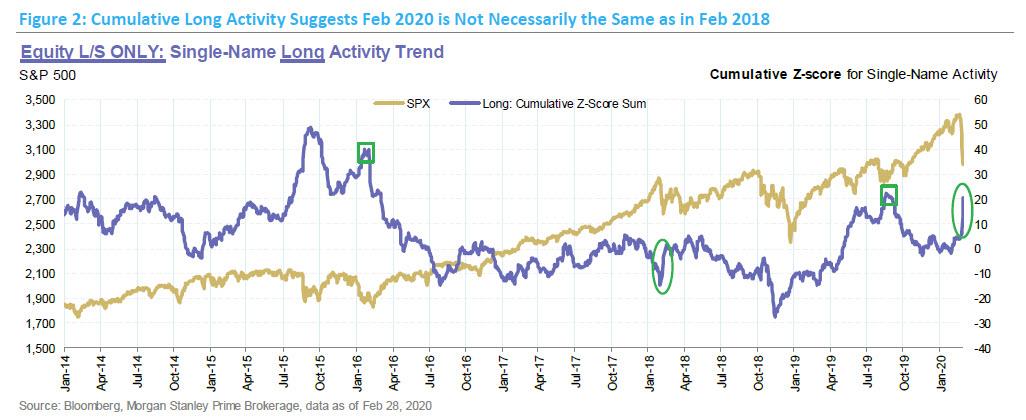

Notably, the one time there wasn’t a subsequent alpha drawdown in the next few months was early 2018. But as one can see from the next chart below, the long buying then was a reversal from long selling into the Jan ’18 peak, rather than an acceleration of long buying as we’ve seen recently. The chart below tracks the trend in the cumulative long activity over time to help show when longs have been built up or reduced. To be clear, HFs were covering shorts aggressively from 4Q17 to early ’18 so nets were going higher, but L/S funds weren’t arguably pressing their longs into the market high.

In addition, this chart shows that, while the long buying in Jan 2016 and Aug 2019 were not quite as extreme over a short period of time (as highlighted in the green rectangles in Figure 1), the long risk had been building for months leading up to the drawdowns in 1Q16 and Sep-Oct 2019.

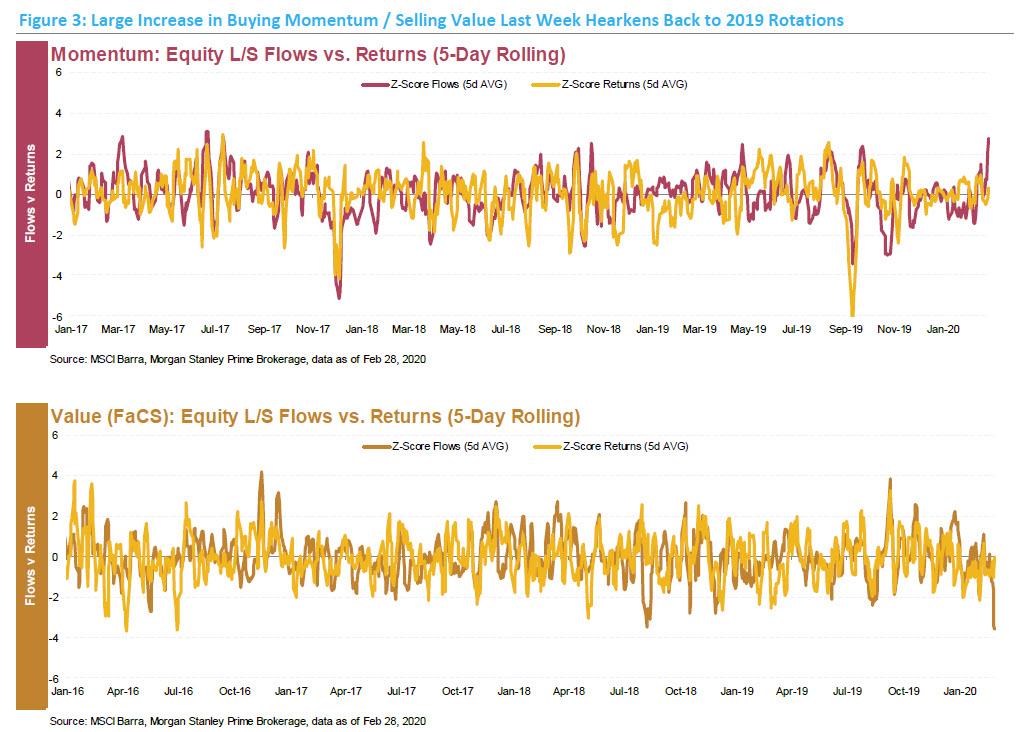

Rotation Risk Consideration #2: Increased Momentum Buying (and Value Selling)

It’s not just that L/S funds were adding risk by buying the dip last week, what’s also notable is what they were buying. From a sector/industry perspective, they were mostly buying areas they’re already quite long: Software, IT Services (payments), Aero & Defense, Semis, Internet Retail, Hotels Restaurants & Leisure, and Entertainment.

From a factor standpoint, this manifested itself in one of the largest weeks of buying of Momentum in many years. It was the largest since last Sep (during the brief rebound after the sharp drawdown) and last Aug. In addition, it was the largest selling of Value in years. From a net exposure standpoint, L/S fund Momentum exposure is around the 50th %-tile since 2010 (and similar to where it stood prior to the selloff last Sep) while Value is around the 10th %-tile since 2010.

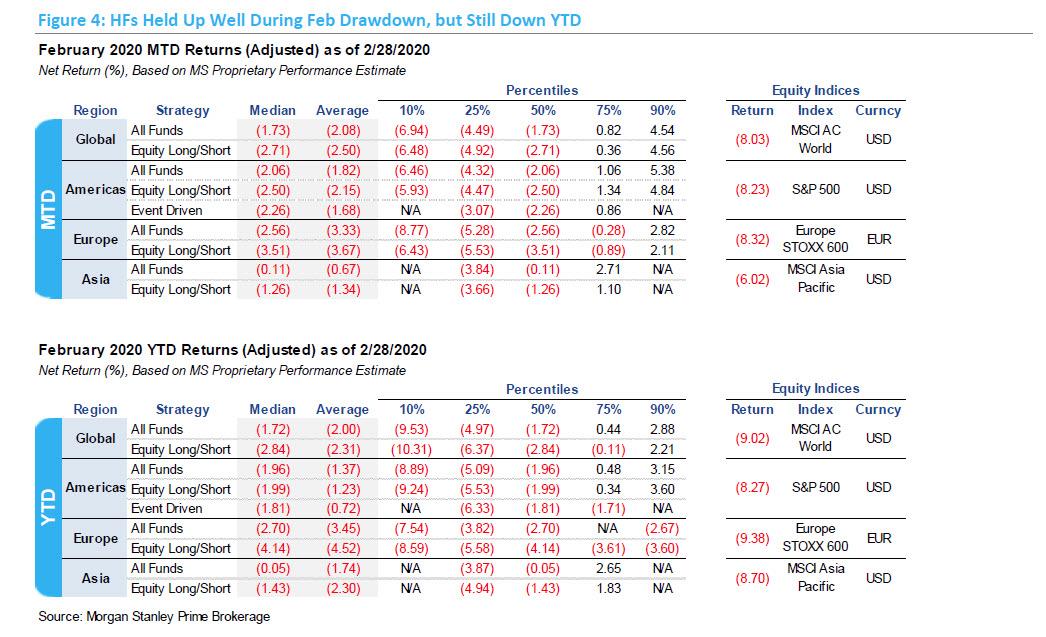

Rotation Risk Consideration #3: Performance Declines

For many HFs that are net long the market, there were few places to hide last week. Thus, it’s not surprising that funds lost about 4-5% gross last week as markets were down about 10%. This shifts returns into negative territory on a YTD basis. Needless to say, dipping into negative territory on a YTD basis early in the year is very different from doing so late in the year and leads to different investing behavior. Thus, being down about 2% hasn’t apparently triggered large de-grossing, especially as equity markets are now down 8-9% on the year.

For those looking for a performance trigger, Morgan Stanley suggests that one reference point might be early 2016. As the S&P sold off 9% from Dec 31 to Jan 20, L/S funds were down about 4-5%. However, the tipping point was that as the S&P rallied towards the end of Jan to be down only 5%, L/S were still down about 3.5-4% (i.e. there was little upside capture on the rebound). When markets started to sell-off again in early Feb and funds went back to being down closer to 5% on the year, they aggressively switched to de-grossing.

So while performance has held up so far, the concern is that a breakdown in returns could cause risk appetite to decline and de-grossing to increase. Two things to note on this front are:

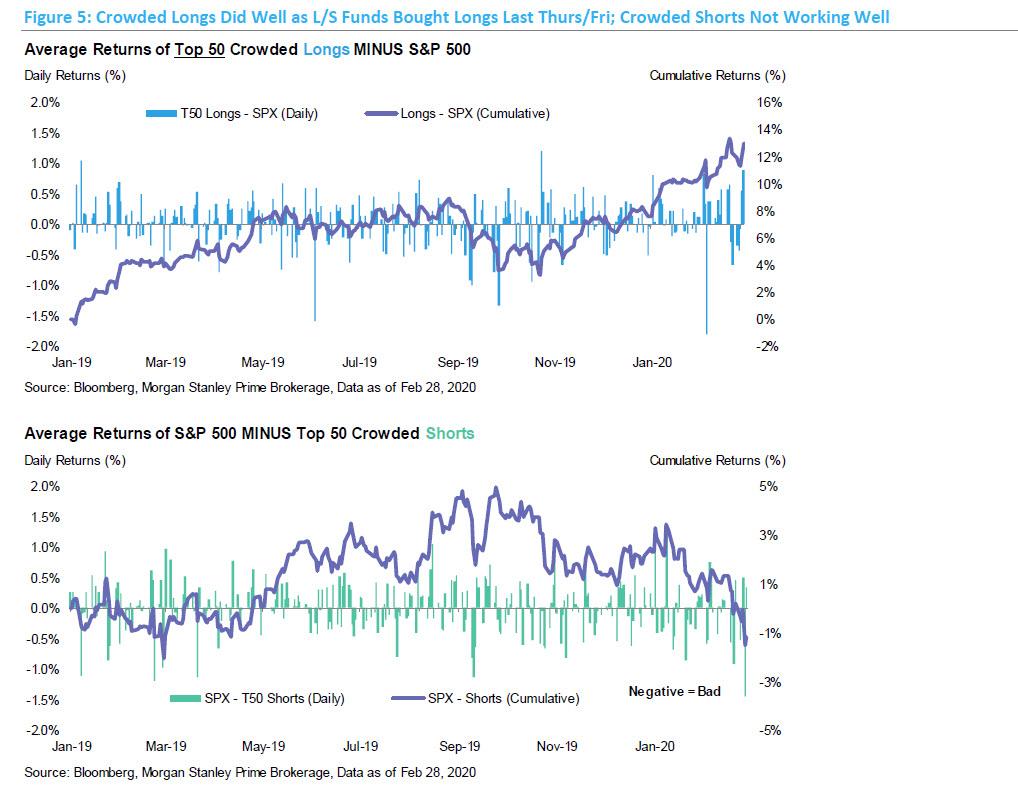

- The crowded longs in the US have held in relatively well lately, but the 2 best days last week were last Thurs & Fri, which coincided with outsized long buying among HFs

- The crowded shorts have not been working well, which may suggest less cushion if the longs start underperforming

In conclusion, Morgan Stanley reminds us that a few weeks ago that the Combined Risk Metric of leverage-crowding-factors was back at highs, BUT that we had not yet seen aggressive HF behavior at that point and the rotations usually came a couple months after the metric hit highs. As such, "with the changes in behavior last week and more time passing, the risks of a rotation appear to be greater now and if capitulation (i.e. de-grossing) does play out among HFs, this would likely be fairly painful."

https://ift.tt/32LIWUE

from ZeroHedge News https://ift.tt/32LIWUE

via IFTTT

0 comments

Post a Comment