Market Mutates Into A Harrowing Rollercoaster As Futures Soar Then Tumble

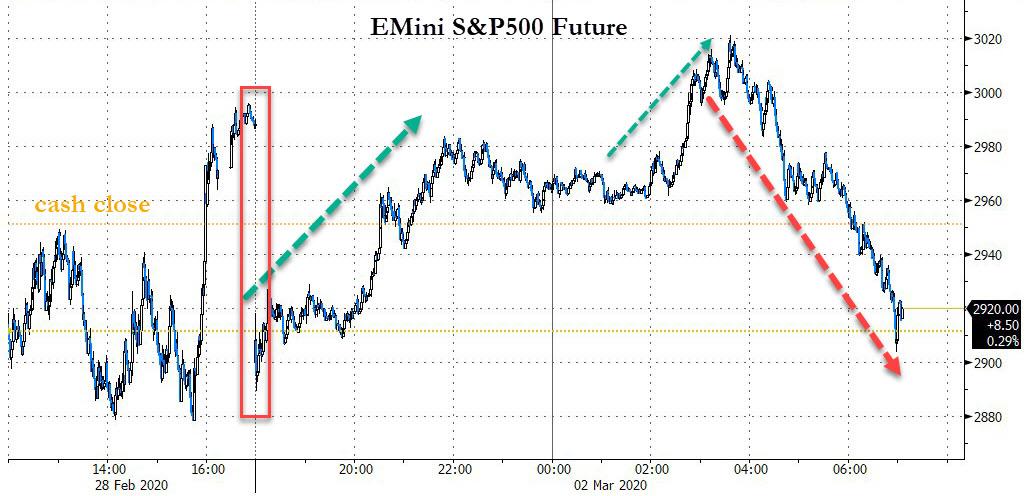

A lot has happened since Friday's cash close, which itself was a furious 600-Dow point squeeze on expectations of a coordinated central bank intervention... that never came.

On Sunday night, US equity futures initially tumbled after Powell failed to satisfy rumors that he would make an emergency rate cut announcement ahead of the 6pm trading open; however, subsequent jawboning attempts by the BOJ and BOE that they are ready to stabilize markets helped futures surge above 3,000.

“The market is coming back because there is perception that there will be a coordinated G7 policy response,” said BlueBay Asset Management’s head of credit strategy David Riley. “We have Fed and ECB meetings coming up in the next couple of weeks. The Fed is the key one and it will be very hard for them to hold off (from rate cuts) if we are in a situation where the economic downsides are becoming more prevalent.”

Alas, it wasn't meant to last because once Europe opened, futures tumbled as much as 100 points in just over under three hours as traders felt compelled to make their case for 2 rate cuts to the Fed's front door.

The failed attempt at a bounce followed a rare statement on Friday from the Federal Reserve that opened the door to a rate cut based on the “evolving risks” posed by the outbreak. Central banks in Japan and the U.K. followed suit with supportive messages. Investors weighed the comments against increasing pessimism from economists on global growth, with fears mounting that the virus will trigger more losses after the S&P 500 Index’s worst week since 2008. World growth will sink to levels not seen in over a decade as the outbreak hammers demand and supply, the OECD warned.

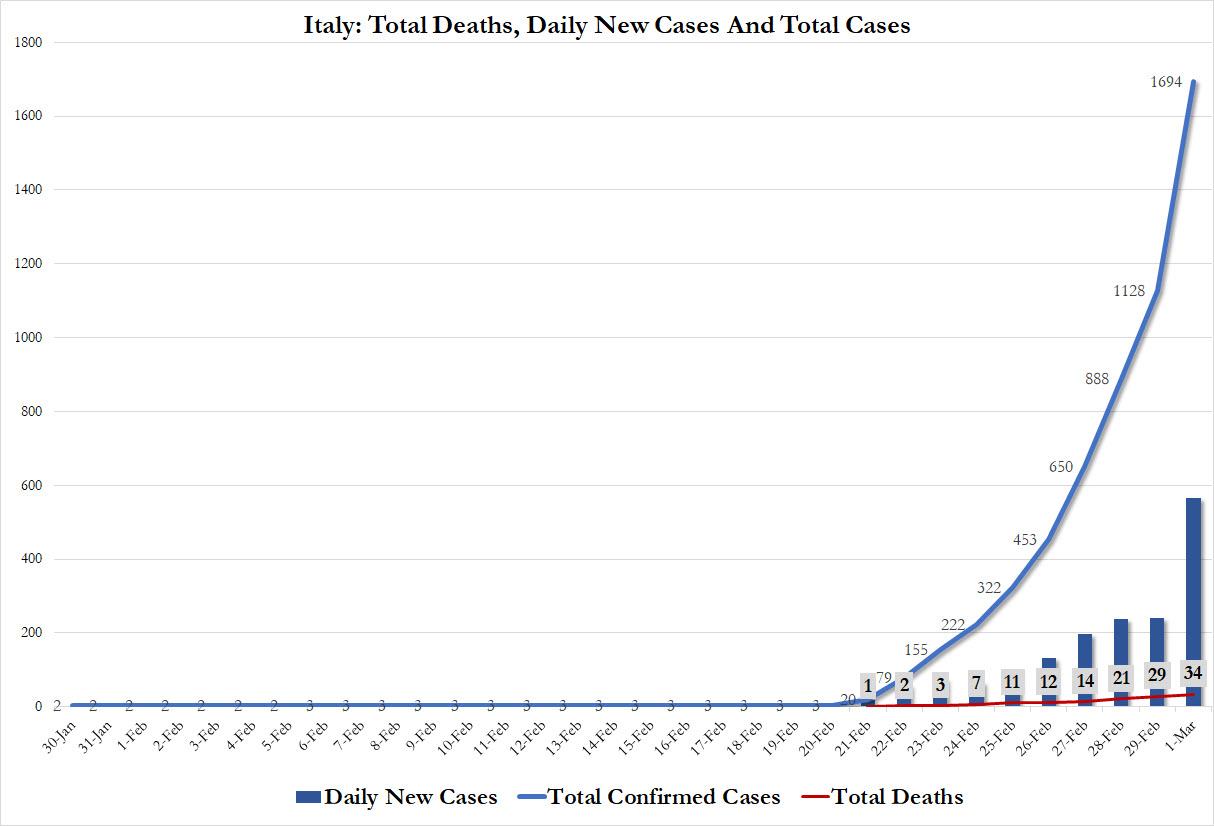

All this is happening as the global death toll from the virus has surpassed 3,000. U.S. cases climbed over the weekend, with the first infections appearing in New York City, Brussels and Berlin, while cases jumped in hot spots of Italy, South Korea and Iran as the US reported a second death and a case count which suggests several community outbreaks. Positive tests in Italy jumped by more than 500 to 1,694 on Sunday with 41 deaths. Lombardy, the region that includes the financial capital of Milan, accounted for almost 1,000 cases.

A weekend data release from China indicated contractionary activity levels - China’s official PMI plunged to a record low 35.7 – Asia trade was set for an ugly open. China’s worse than expected PMI decline will keep pressure on authorities to maintain liquidity and policy rate cuts this month, and more accommodation will be needed, particularly for exporters as the global disruptions from the COVID-19 outbreak escalate and China is now hit with the double-whammy of collapsing export demand from its trading partners.

Back to stocks where after last week’s worst plunge for equities markets since the depths of the 2008 financial crisis, it was always going to be a wild ride. Asia had initially dived again after China reported a record slump in factory activity but the region rallied to finish higher as bond yields sunk and talk of OPEC supply cuts sent oil prices roaring up 3.5%. As a result, Asian stocks halted a seven-day losing streak, led by energy and tech companies, as global central banks advocated policy support to coronavirus-hit economies.

Markets in the Asian region were mixed, with the Shanghai Composite Index and India’s S&P BSE Sensex Index rising, while the Jakarta Composite and Taiwan’s Taiex fell. Trading volume for MSCI Asia Pacific Index members was 20% above the monthly average for this time of the day. Central banks sent the markets some supportive signals when the Bank of Japan said it will provide ample liquidity and ensure stability in the financial market, despite not actually doing anything, while the Federal Reserve said it is ready to reduce interest rates this month. Bank Indonesia cut banks’ reserve ratios and signaled it’s ready to add more measures to defend the nation’s battered currency and bonds. The Topix gained 1%, with CareerIndex and Land rising the most. The Shanghai Composite Index rose 3.1%, with Henan Huanghe Whirlwind and Longjian Road & Bridge posting the biggest advances.

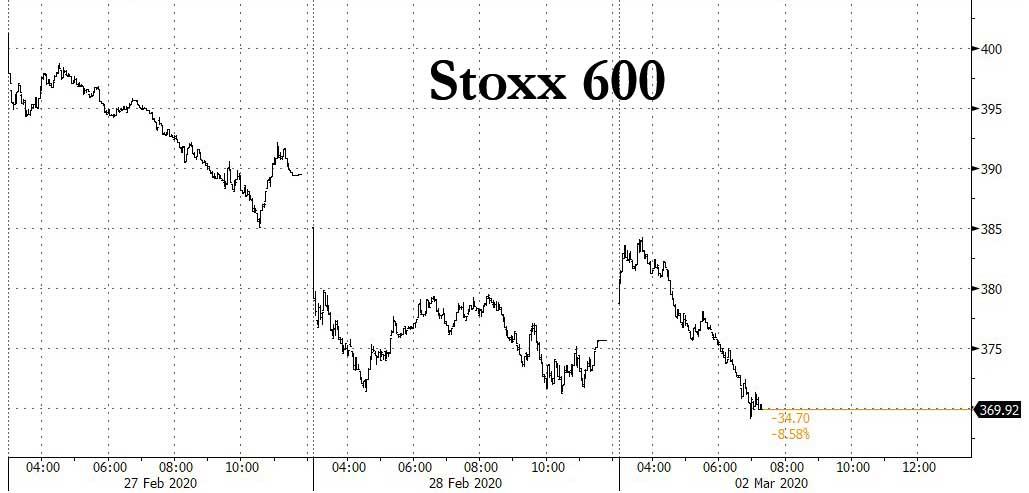

After Asia's torrid surge, Europe then made a blistering start. The Stoxx 600 initially jumped 1.5% putting it on course for its best day in well over a year and Wall Street S&P 500 and Dow futures were pointing to similar gains too. However, the overnight rally in European stocks evaporated with Italian stocks under the most pressure as the epicenter of the region’s virus cases.

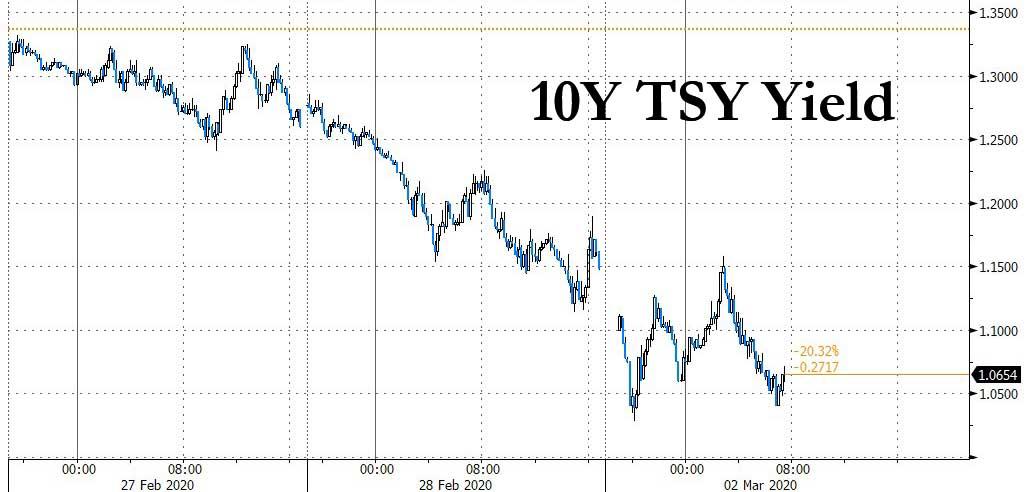

In rates, Treasuries surged, sending the 10-year rate closer to 1%, tumbling as low as 1.0283%.

Yields tumbled by up to 20bp across front-end of the curve, steepening 2s10s by 10.2bp; 10-year yields lower by an additional 10bp vs. Friday’s close around 1.05%. Sentiment soured as even more cases were reported around the world and the OECD cut its forecast for global growth. Most core European bonds gained, tracking Treasuries as they rallied for an eighth day.

Overnight index swaps now price in 50bp of rate cuts by April FOMC meeting, with the latest phase of the rally fueled by potential for a global economic slowdown was sparked by OECD cutting this year’s growth forecast as coronavirus spreads in the U.S. As treasuries continue to lead global flight-to-safety bid, bunds and gilts are relatively cheaper by 5.5bp and 5bp. Treasury 2-year yield dropped to 0.706%, breaching November 2016 low. 3-month dollar Libor -20.9bp at 1.25375%, biggest drop since 2008.

The dollar slipped against the euro and most major currencies on expectations of a Fed rate cut.

Commodity markets were part of Monday’s global rebound. Oil prices bounced $1.5 a barrel on hopes of a deeper cut in output by OPEC after earlier hitting multi-year lows. Brent crude last traded at $51.3 per barrel and WTI at $46.2 per barrel, while industrial metals copper and nickel were 2% and 3% higher respectively and gold jumped 1.4% too after a mild drop last week.

Looking at today's events, expected data include PMIs and construction spending.

Market Snapshot

- S&P 500 futures up 0.4% to 2,962.50

- STOXX Europe 600 up 1.1% to 379.88

- MXAP up 0.9% to 156.95

- MXAPJ up 0.9% to 513.55

- Nikkei up 1% to 21,344.08

- Topix up 1% to 1,525.87

- Hang Seng Index up 0.6% to 26,291.68

- Shanghai Composite up 3.2% to 2,970.93

- Sensex down 0.2% to 38,208.00

- Australia S&P/ASX 200 down 0.8% to 6,391.52

- Kospi up 0.8% to 2,002.51

- Brent futures up 0.3% to $50.68/bbl

- Gold spot up 1.5% to $1,609.16

- U.S. Dollar Index down 0.4% to 97.78

- German 10Y yield fell 2.6 bps to -0.633%

- Euro up 0.5% to $1.1080

- Italian 10Y yield rose 2.6 bps to 0.934%

- Spanish 10Y yield fell 2.6 bps to 0.256%

Top Overnight News

- New York state and California reported new coronavirus cases as Americans grappled with the prospect of a widening epidemic at home. The global death toll from the coronavirus outbreak surged past 3,000 as trading got underway Monday, after a weekend that saw cases in Italy surge 50% and France add 30 new infections

- Bank of Japan Governor Haruhiko Kuroda issued an emergency statement after market jitters over over the economic implications of the coronavirus outbreak forced sharp drops in stocks and a strengthening of the yen

- The Federal Reserve is now prepared to reduce interest rates this month even though it recognizes monetary policy cannot completely shelter a U.S. economy increasingly threatened by the coronavirus. Fed Chairman Jerome Powell opened the door to a rate-cut at the Fed’s March 17-18 meeting by issuing a rare statement Friday pledging to “act as appropriate” to support the economy.

- Pete Buttigieg is ending his presidential campaign, people close to his campaign said Sunday. The decision to drop out just before Super Tuesday, when voters in 14 states to to the polls, is a potential boon for former Vice President Joe Biden, who’s looking for moderate and establishment Democrats to unite behind his campaign in an effort to blunt Sanders’ momentum from the party’s left wing. Michael Bloomberg says Super Tuesday won’t be end

- The U.K. outlined its negotiating objectives for trade talks with the U.S., seeking a deal it hopes will deliver a 3.4 billion-pound ($4.4 billion) boost to the British economy.

- After getting caught up in last week’s punishing virus-driven sell-off that hit everything from equities to commodities, gold rebounded on Monday to refresh its credentials as a haven in troubled times.

- Expectations the OPEC+ alliance will deepen output cuts put a floor under last week’s 16% plunge in oil prices, with futures in New York rallying even as the coronavirus continued to spread rapidly.

Asian bourses and US equity futures began the week volatile with hefty losses seen at the reopen as markets reacted to the abysmal Chinese Manufacturing PMI data over the weekend which slumped to below GFC levels and its weakest on record. This saw US equity futures drop by as much as 3% although later recouped all their losses as markets found reprieve from the declining pace of China’s coronavirus cases and amid widespread anticipation of Central Bank measures including calls for the Fed to deliver a 50bps cut at this month’s meeting. ASX 200 (-0.8%) and Nikkei 225 (+1.0%) were mixed in which Australia suffered from its heavy exposure to China and with financials also weighed by expectations of a rate cut by the RBA tomorrow, while the Japanese benchmark staged a comeback helped by the BoJ which is to ensure liquidity through operations and offered to buy JPY 500bln of JGBs. Hang Seng (+0.6%) and Shanghai Comp. (+3.2%) were also positive despite the alarming Chinese PMI data in which both China’s Official and Caixin Manufacturing PMIs fell to record lows, as sentiment was underpinned by measures including China permitting SMEs to delay debt repayments and with construction stocks surging on anticipation of China rushing into infrastructure projects to offset the fallout to the economy from the outbreak. Finally, 10yr JGBs traded positive but were off their intraday highs as the turnaround in stocks eventually dampened safe-haven appetite, although JGBs still remained afloat after the BoJ declared it will ensure ample liquidity and received JPY 571bln of total bids for the aforementioned JPY 500bln offer.

Top Asian News

- Indonesia Cuts Reserve Ratios After Virus Fears Spark Selloff

- Member of Iran Advisory Body to Supreme Leader Dies From Virus

European stocks have given up their earlier gains [Eurostoxx 50 -1.3%] which initially emanated from Central Bank stimulus hopes given the concoction of dismal PMIs from China coupled with rising worldwide COVID19 cases. The European bellwether rose as much as 2.3% at the open before the optimistic sentiment faded during mid-trade with a lack of any fresh headlines to shadow the ongoing virus narrative. DAX 30 cash and futures briefly reclaimed 12k whilst the FTSE MIB (-3.1%) underperforms the region following another sharp rise in virus cases in the country alongside disappointing manufacturing PMI figures. Sector-wise, dropping yields see financials underperforming whilst defensives remain in firm positive territory amid the turnaround in sentiment. That said, energy and material names continue to benefit from the price action in the respective complexes. In terms of individual movers, Tesco (+2.0%) holds onto a bulk of its gains following a WSJ report that a Thai billionaire has secured USD 10bln in a bid to acquire Co’s Asian assets. SES (-17%) shares slumped to foot of the Stoxx 600 post-earnings despite noting that it sees no meaningful impact from coronavirus. Finally, Nokia (+1.6%) shares opened higher after Lundmark has been appointed as President and CEO of the Co.

Top European News

- U.K. Mortgage Approvals Reach Highest Since Brexit Referendum

- Deutsche Bank’s Controls Put Under Heightened Scrutiny in U.K.

- Euro-Zone Factories Suffer Supply Disruptions From Coronavirus

- Barclays Activist Pressures Board to Remove CEO Staley

In FX, the DXY has retreated even further amidst broad Greenback losses and growing speculation that the Fed will follow/front run other global Central Banks with decisive action to counter the nCoV epidemic. Indeed, expectations were stoked further by unexpected and unscheduled comments from Powell on Friday pledging to use ‘tools’ as required to support the US economy given risks posed by the aforementioned coronavirus outbreak. Rate cut pricing duly ramped up to 50 bp for the upcoming March FOMC and the index has now slipped below the 200 DMA (97.840) to a 97.693 low compared to 98.087 at best with little in the way left in terms of chart support ahead of 97.500.

- AUD/EUR/CAD/CHF/NZD/JPY - Although the RBA is widely tipped to shave its OCR by ¼ point overnight, the Aussie is benefiting from US and NZ underperformance, while gleaning extra traction from relative Yuan strength on the premise that Chinese PMIs were so bad that more stimulus is almost certain to be forthcoming. Indeed, Aud/Usd has rebounded strongly from even deeper sub-0.6500 lows to 0.6550+ at one stage, while Usd/Cnh is back down around 9.9600 and Nzd/Usd is hovering just under 0.6275 as Aud/Nzd pivots 1.0450. Elsewhere, the Loonie has pared losses from circa 1.3445 to around 1.3340 ahead of Canada’s manufacturing PMI, the Franc is eyeing 0.9600, but waning against the Euro ahead of 1.0625 as the single currency forges more pronounced gains across the board, Eur/Usd towards 1.1100 and Eur/Gbp approaching 0.8700. Last, but by no means least the Yen is holding within a wide 107.00-108.57 range after the BoJ’s own considerable efforts to combat the adverse economic impact of COVID-19.

- GBP/NOK/SEK - Sterling is bucking the overall trend, with Cable losing grip of another big figure handle at 1.2800 on the cusp of UK-EU trade talks that are not expected to go smoothly given well documented differences of opinion on key post-Brexit terms and conditions. However, a downgrade to the manufacturing PMI has also dented sentiment, in contrast to Norwegian and Swedish prints that both picked up pace from previous levels. Nevertheless, Eur/Nok and Eur/Sek are trading on a mixed footing circa 10.3800 and 10.5800 respectively.

- EM - In keeping with the divergence noted above, regional currencies are somewhat betwixt and between as euphoria over the prospect of concerted and/or coordinated action to spur global growth fades, while the Lira is still anxiously eyeing events in Syria where Turkish President Erdogan renews calls for Government forces to withdraw or face more military attacks.

In commodities, WTI and Brent font-month futures have rebounded with a vengeance on the first trading session of the week as sentiment was bolstered amid hopes of monetary and fiscal intervention to deal with the fallout of the virus. Furthermore, OPEC will publish its latest output policy decision on March 6th as planned as per sources – with Russia seemingly on board for a unison response following comments from Russian President Putin. That being said, Putin caveated that the current oil prices are acceptable for Russia’s budget, whilst Kremlin stated the meeting with Russian oil companies were not aimed at taking any specific decision. Russia's Energy Minister Novak stated that Russia did not get a proposal from OPEC to jointly cut production by 1mln BPD and are evaluating the earlier JTC proposal of 600k BPD cut. Futures opened lower to the tune of over 2.5% amid dismal Chinese PMI figures coupled by surging nCoV cases, in which WTI found a base at ~USD 44/bbl before recoiling to a high of USD 46.70/bbl, whilst the Brent contract bounces from an intraday low of around USD 49.50/bbl and tested USD 52/bbl to the upside, although the contracts encountered some selling pressure in recent trade but remain in solid positive territory thus far. Ahead of the OPEC confab, ING believes that “anything that falls short of the OPEC+ Joint Technical Committee recommendation of 600Mbbls/d of additional cuts over 2Q20, and extending the current deal through to year-end, will be taken as bearish.” Meanwhile, BofA Global Research lowered their 2020 WTI and Brent price forecasts by USD 8/bbl each to USD 49/bbl and USD 54/bbl respectively. Elsewhere spot gold drifts higher as the original optimism seen around the market-place fades, with the yellow metal back on a 1600/oz handle from an intraday low of ~1575/oz. Elsewhere copper initially spiked higher on further hopes of China stimulus, with prices briefly topping 2.60/lb before waning back below the figure.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 50.8, prior 50.8

- 10am: Construction Spending MoM, est. 0.6%, prior -0.2%

- 10am: ISM Manufacturing, est. 50.5, prior 50.9; New Orders, est. 51.8, prior 52; Prices Paid, est. 50.5, prior 53.3

DB's Jim Reid concludes the overnight wrap

After a stunning rebound in the last 15 minutes of trading in the US session on Friday (up 2.5% in that time to close ‘only’ -0.82%) markets are holding on to these gains in Asia even after a bad weekend for newsflow. Asia risk kicked off slightly weaker but has rallied on hopes of co-ordinated action by global central banks. BoJ Governor Kuroda became the latest to signal potential action. He said overnight that the BOJ “will strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases” and soon after the BoJ offered to buy JPY 500bn ($4.6 bn) of government bonds with repos. The Nikkei (+0.94%), Hang Seng (+0.77%), Shanghai Comp (+2.88%), CSI (+3.06%) and Kospi (+0.87%) are all up alongside most bourses in the region. As for fx the Japanese yen is down -0.25% and the US dollar index is down -0.15% overnight. Elsewhere, futures on the S&P 500 are also up +0.48% while 10yr USTs yields are down -5.8bps to 1.092 this morning. In, commodities brent crude oil prices are up +3.06% while gold is up +1.20%.

As discussed above the rally is in spite of negative news flow on the virus. In the US, New York City, California and the Seattle area all reported new coronavirus cases over the weekend. The US now has 88 cases with 2 deaths. In a sharp uptick of cases over the weekend, South Korea now has 4,212 cases (vs. 2,022 on Friday morning) with 22 deaths. Cases in Italy also more than doubled to 1694 (vs. 655 on Friday) with fatalities at 34. Similarly, Iran now has 978 confirmed cases up from 270 on Friday morning with 54 deaths up from 26 with most media reports suggesting this still understates the number. Elsewhere cases in Europe outside of Italy are starting to multiply.

The big thing for this week though is probably watching for the spread of cases in the US. There was a Bloomberg story on Friday suggesting there hadn’t been any tests for the virus in New York yet. Other anecdotal stories of late also suggest that testing elsewhere in the country is behind other countries. Indeed fewer than 2,000 had been tested in the US as of Thursday. Other large countries with much smaller populations have tested many more. The U.K. had tested 10,000 as of Saturday morning and South Korea are doing this number on a daily basis. So the US numbers could soar over the next couple of weeks as tests are in the process of moving to the jurisdiction of state and local health authorities from a centralised federal level. Bloomberg reported that 75,000 tests will be available in the US this week. There has even been talk of a severe flu season this year in the US, with cases at elevated levels. You can’t rule out the possibility that covid-19 has been spreading around the US for many weeks already now. Markets will likely take fright if these reported cases now soar.

Data is taking a back seat at the moment but one can’t ignore a truly shocking set of official Chinese PMI February numbers on Saturday with the manufacturing number falling from 50 to 35.7 (consensus 45). The non-manufacturing fell to an even more incredible 29.6 from 54.1. Both were their record ever lows and for perspective the lows for both in the GFC was 38.8 and 50.8 respectively. So the latter has never seen a reading below 50 before and now it’s below 30. Can you imagine the shock at being told at the start of the year that there would be a Chinese PMI with a 2-handle in your lifetime let alone 2 months later. Other global PMIs come out today but they’ll be very backward looking so will be of limited value. Markets will fear the Chinese print is the shape of things to come in Europe if we see anything like the kind of containment that China saw.

Some relief has come from China’s Caixin manufacturing PMI which came in better than the official number this morning at 40.3 (vs. 46.0 expected) but still its lowest reading since the series began in 2004. This reading is seen to be more export orientated than the more domestic based official one. Elsewhere South Korea’s PMI, a critical bellwether of global demand, dropped to a four-month low of 48.7 from 49.8 in January and Japan’s PMI declined to 47.8 (vs. 47.6 from the flash reading), the lowest reading since May 2016. Other PMI, in the region also slid to multi year lows.

Another story to watch is the potential migrant crisis in Turkey and hence the EU. The former has effectively now allowed passage through its country of tens of thousands of asylum seekers from Syria and elsewhere. EU leaders are already starting to condemn the action (fearing a populist backlash) and this is a headache they don’t need as they try to tackle the virus spread.

Recapping last week in markets, the S&P 500 fell -11.49% (-0.82% Friday) for the worst week since the GFC with the NASDAQ -10.54% (+0.01% Friday). Late in the trading session on Friday, Fed Chair Powell signalled that rate cuts may be needed if the market’s reaction to the virus tightens financial conditions, and risk markets did look to bounce on that announcement even if it faded out soon after. The huge rally in the last 15 minutes of trading was an hour or so after Powell’s statement and could have been more month-end index rebalancing between debt and equities given the abruptness of the move in the last minutes of the month. Before Powell’s statement our economists changed their Fed forecast and now expect two 25bps cuts. One this month and one next with the risks tilted to there being more needed. See their report here .

Staying on US equities you may remember we highlighted the work of our US equity analysts last month showing positioning in the 97th percentile and valuations not far behind. Well last week the former dropped from 95th to the 12th percentile in a week. So it’s probably fair that stretched positioning contributed to the scale of the sell-off last week. See their latest report here for more.

The STOXX 600 also saw its worst week since 2008, dropping -12.25% (-3.54% Friday) on the week. Asian markets actually declined less but did see large pullbacks late in the week, with the Nikkei down -9.59% (-3.67% Friday), the Kospi down -8.13% (-3.30% Friday), and the CSI 300 down -5.05% (-3.55% Friday). The VIX finished the week at 40.11 (highest since the China deval in August 2015), up from 17.08 a week ago but peaking at 49.48 intra-day Friday. Credit had an equally challenging week with Euro and US HY spreads +91bps (+31.5bps Friday) and +109bps (+28bps Friday) wider. The thing to watch going forward in credit is outflows and trader illiquidity. Companies are in decent shape but the illiquid market won’t be if you see consistent outflows.

With the large risk off move, sovereign debt continued to rally. The 30yr US Treasury yield has never been this low, finishing the week at 1.68%, down -24bps (-8.3bps Friday). 10yr US Treasury yields closed at 1.149% down 32.3bps (-11.2bp Friday) for the week, to also finish at record lows. Fed futures are now pricing in two cuts by the April Fed meeting and more than 1.5 cuts by March, indicating the belief among traders that there may be an emergency cut outside the regularly scheduled meetings. 10 year bund yields traded back to October levels, finishing the week at -0.607%, with yields falling -17.6bps (-6.4bps Friday). Not all haven assets performed well however, with Gold having a particularly bad close to the week, finishing down -3.51% (-3.61% Friday).

Its clear that not much else matters this week apart from the virus but there are other things to keep an eye on. The full day by day week ahead is at the end but we’ll expand on some of the main highlights below.

The main event will be from the Democratic primaries, with Super Tuesday tomorrow seeing primaries taking place across the US with 34% of total delegates being awarded on this single day. We’ll be publishing a primer on the whole primaries and US 2020 election later today so we’ll save our best material for that. Note that Joe Biden scored a substantial victory in South Carolina on Saturday with 48.4% of the vote vs Sanders 19.9%. He was expected to win but the margin was impressive and brings him back momentum into tomorrow. In other news Pete Buttigieg has pulled out of the race which might help the centrists gather some more momentum against Sanders.

In addition there are a number of usually important data releases out, particularly the PMIs (today and Wednesday) and Friday’s US jobs report. However they’ll be backward looking. Post-Brexit negotiations between the UK and the EU on their future relationship will begin, while central banks in Australia and Canada will be deciding on interest rates. There really isn’t much point in previewing much other data this week as it won’t be taken that seriously. You’ll see it all listed in the day by day week ahead below. If you really want to read about last Friday’s economic data we have a couple of paragraphs after this week ahead calendar. I’ll be impressed if anyone cares.

https://ift.tt/2PFmKpT

from ZeroHedge News https://ift.tt/2PFmKpT

via IFTTT

0 comments

Post a Comment