A Look Inside The $52 Trillion Bubble That Has "Hijacked China's Economy" Tyler Durden Sun, 07/26/2020 - 23:08

More than three years ago, we explained why "the fate of the world economy is in the hands of China's housing bubble." As we said at the time, "China has always been a serial bubble inflator courtesy of a closed (capital account) economy, and nearly $30 trillion in bank deposits [$40 trillion as of July 2020] which slosh from one asset class to another, be it the stock market, bitcoin, commodities, farm animals or - most often - housing. "

Why is it so important for China to consistently reflate this bubble? The answer is simple: for China's middle class there is no more important asset than housing: as Deutsche's Zhiewi Zhang wrote in 2017 when discussing the macro and market consequences of the Chinese bubble, it is nothing more (or less) than "a massive wealth effect."

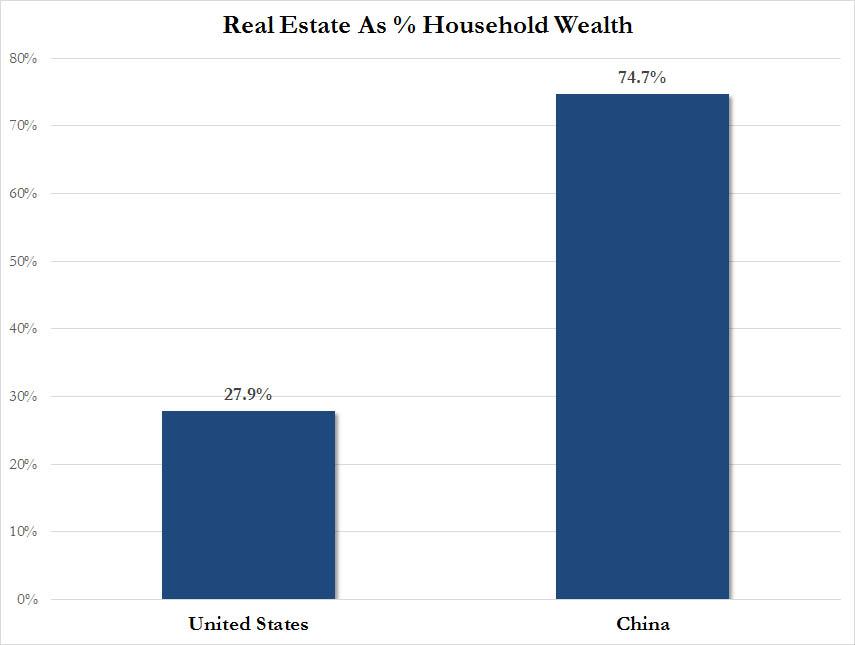

Furthermore, unlike the US, which is hyperfinancialized and the bulk of household net worth is in financial assets (less than 30% is in real estate), in China it is the opposite, and roughly three-quarters of all household worth is in real estate.

And since a global healthy economy starts with a growing, stable and inflating Chinese economy, unless China's housing bubble is growing at a steady, measured pace created a "wealth effect" illusion among several hundred million middle-class Chinese, we concluded three years ago that the global economy is just as reliant on China's housing market as it is on the global - and certainly US - stock market.

Fast forward a little over three years, when China's housing bubble is bigger than ever, and now the WSJ has picked up on what we said three years ago, namely that China's epic housing market is perhaps the world's most defining bubble, and more importantly, not even the covid pandemic did anything to threaten the sanctity of this bubble.

First, some context why China's housing bubble currently eclipses the one in U.S. housing in the 2000s: "At the peak of the U.S. property boom, about $900 billion a year was being invested in residential real estate. In the 12 months ended in June, about $1.4 trillion was invested in Chinese housing. More was invested last month in Chinese real estate than any other month on record."

Some more statistics: "the total value of Chinese homes and developers’ inventory hit $52 trillion in 2019, according to Goldman Sachs, twice the size of the U.S. residential market and outstripping even the entire U.S. bond market." China's housing market is certainly bigger than the US stock market, and at its current growth rate will surpass the total value of all global stocks (which is currently about $85 trillion) in just a few years!

And since just like the US stock market, China's housing bubble is one of those special "assets' that continue to grow with the explicit blessing of the government, Chinese houses are not allowed to suffer even a modest drop in values. Which also means home prices constantly have to keep rising, and they do just that:

In March, 288 apartments in a new Shenzhen property development sold out online in less than eight minutes. A few days later, buyers snapped up more than 400 units in a new housing complex in Suzhou. In Shanghai, apartment resales neared a record high in April, by one estimate. One Saturday last month, nearly 9,000 people each put down a deposit of one million yuan ($141,300) to qualify to buy apartments in a Shenzhen development.

“I barely had time for lunch on weekends in March” when the market started bouncing back, said Zhao Wenhao, a Shanghai-based agent at Lianjia, one of China’s largest real-estate brokerage firms.

To be sure, by now China's middle class must be aware that it is buying into a giant bubble - how has that not put paused some of the relentless euphoria? The answer is simple: Many of Lianjia's clients worry China’s currency will depreciate in the global economic slowdown, he said, driving even more money into housing as a haven. As a result, instead of holding soon to be devalued 1s and 0s in some bank deposit account, the local population is bracing for devaluation by scrambling into real estate, in the process only assuring that the inevitable housing market crash may well come before said devaluation.

But not just yet: and whereas some speculated that the coronavirus crash would send Chinese home prices tumbling, that never happened and instead the market’s coronavirus pause didn’t last long. Urban home prices in China were 4.9% higher in June than in the year-earlier period. Year-to-date investment is up 1.9% in the first half of the year, despite a huge drop in sales in February and cutting earnings guidance by 50% in late February.

The unexpected resilience has been a blessing to local home developers, which plunged in February and March only to stage a dramatic recovery since. China Evergrande, the country’s biggest home builder, even raised its sales target for the year by 23% from its January estimate, after strong sales in March.

That said, the continued growth of China's housing bubble simply means that the day of reckoning has merely been delayed. And while the rapid housing-market recovery is good news on one level for Beijing, the WSJ notes that it is also a reminder of behavior that has long worried the central government, which has tried repeatedly to keep property prices from getting out of control. Chinese President Xi Jinping declared in 2017 that “houses are built to be lived in, not for speculation,” which became the guiding mantra for government housing policy.

Of course, having had virtually no declines since then, Xi's words proved to be just a hollow as Bernanke's CNBC interview in which he "didn't buy the premise" that housing prices can crash. The only difference is that so far China has been able to preserve control over home prices, but its day of reckoning is also coming.

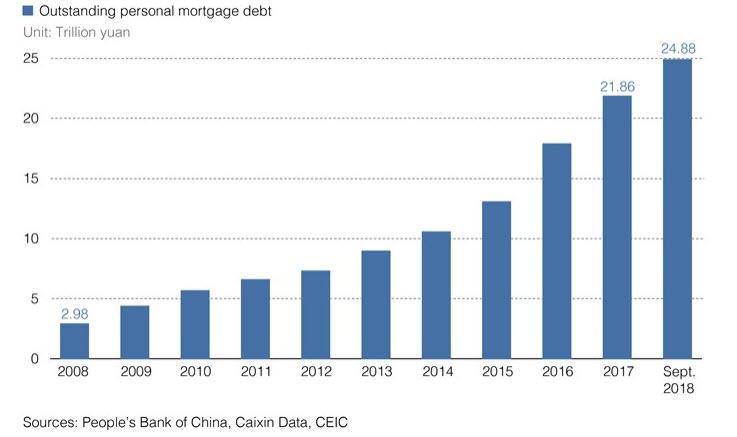

Meanwhile, since Beijing has tipped its hand that it will not temper any housing price speculation, the local population has been happy to chase home price to the upside, and after a decade of rapid home-sales growth, fueled by borrowing, China’s household leverage ratio hit a record high of 57.7% in the first quarter. It was, according to the WSJ, the biggest quarterly jump in the ratio since the first quarter of 2010.

Indeed, as noted above, the WSJ confirms that "the central problem in China is that buyers have figured out the government doesn’t appear to be willing to let the market fall. If home prices did drop significantly, it would wipe out most citizens’ primary source of wealth and potentially trigger unrest", something we have been saying for more than half a decade.

That gives Chinese citizens who have enough money an incentive to keep buying because they believe property in large cities will remain the safest investment in China, regardless of the health of the broader economy.

"Property has hijacked China’s economy, so the government wouldn’t dare to push for a plunge in housing prices, even if that’s the most effective way to deflate the bubble,” said Chen Zhiyu, who works for an American retailer and is looking to purchase a property in Shenzhen. He could as well be talking about the US stock market, which is serving a similar wealth effect function half a world away in the US.

“You gotta follow the money,” said the 37-year-old, adding that he has raised his budget for spending on property since the coronavirus pandemic helped drive up prices. "Whenever governments start printing money, asset prices will go up. In the U.S., you have a bull stock market, but in China, only housing prices will keep surging."

Bingo, and for the reason why to China the housing market is as stocks are to the US, see the top chart above.

Meanwhile as the bubble grows bigger, an ever greater portion of the economy becomes reliant on its continued expansion and viability. Sales activity, for one, is being driven by cash-strapped developers and the local governments that sell them land. And both need to gin up revenue to pay down debts or offset other problems, and are cooking up more incentives to move properties. The bottom line: everyone is targeting higher home prices which in turn drive much of the rest of the economy.

The problem, as China has found out the hard way on so many occasions, is that every bubble eventually bursts, and when it comes time for the housing bubble - which is now arguably even bigger than the US stock bubble, let along the US housing bubble of 2007 which was amateur hour by comparison - no one has any idea how Chinese officials can manage the problem without destabilizing the broader economy. Even if the market stays strong, it creates headaches for policy makers, who have had to hold off on more aggressive economic stimulus this year—which some analysts say is needed—partly because of fears it will inflate housing further.

Meanwhile, the bubble is only getting worse:

Polling conducted by the China Household Finance Survey, based in the Southwestern University of Finance and Economics in Chengdu, suggests the coronavirus pandemic has encouraged the kind of buying Beijing worries about, with demand for property rising among people who already own multiple properties, even as it has dropped among those who don’t yet own any.

That is a telltale sign of speculative investment, according to Gan Li, a professor of economics at Texas A&M University and an expert in Chinese household finance.

"Speculative demand is on the rise because [people] view housing as a safer asset than the stock market or overseas assets,” he said. “They think it’s guaranteed. Because of the pandemic they’re actually consuming less, and saving more. So they’ll actually have more money available to invest. That will create an even larger housing problem."

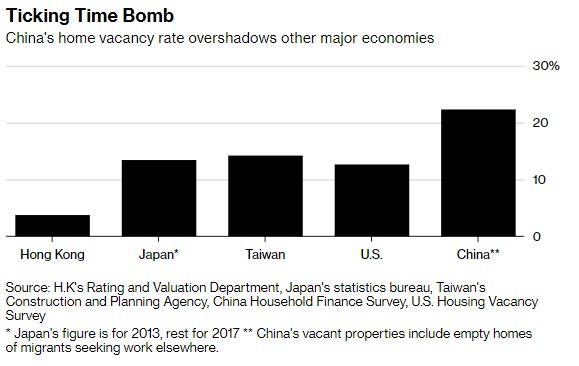

There are other problems too, one is that instead of actually living in them, many Chinese use local apartments as nothing more than an investment asset. Back in late 2018 we observed that for Beijing, a "nightmare scenario" was unfolding as more than 50 million apartments were vacant, about 21% of all homes in urban China.

Since then the number was only increased, and according to the WSJ which cites recent data from China Household Finance Survey, there are now 65 million empty units. Among families who owned two properties, the vacancy rate reached 39.4%, and among those that owned three or more, 48.2% were empty.

The record number in vacant units has meant little upward pressure on rents; in fact, Chinese rental yields are below 2% in major cities like Beijing, Shanghai, Shenzhen and Chengdu, less than can be made buying Chinese government bonds. Even so, Shannon Bi, a 42-year-old English teacher, told the Journal that the pandemic has pushed her to invest in a second home in Shenzhen sooner than she planned, because she worries about inflation. "You have to invest the money somewhere, or it will only depreciate," she said, and she is not wrong.

* * *

What is so worrisome to some economists is the speed at which China’s property boom - just like the US stock market rebound in the past four months - has grown so large, and its tendency to keep climbing even during times of economic stress. As recently as the 1990s, it was illegal under China’s communist system for most people to own homes.

A State Council decision in 1998 abandoned the country’s system of employer-allocated housing, and homeownership took off. By late last year, about 96% of China’s urban households owned at least one home, according to a Chinese central bank survey released in April, far exceeding the 65% homeownership rate in the U.S. Needless to say, mortgage debt in China has absolutely exploded.

In some ways, the boom accomplished Beijing’s goals. It has boosted economic growth and created wealth for millions of middle-class Chinese families (even if it is all dependent on nothing more than money printing and cheap credit, and like every other bubble, it will eventually crash). It also gave local governments, which must turn over a major part of income-tax revenue to the central government, additional revenue from land sales to developers.

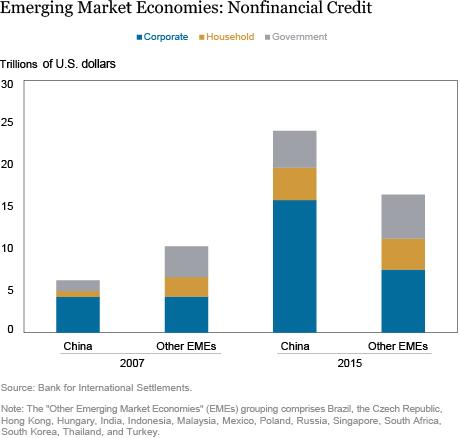

But the boom has taken investment dollars away from other industries competing with real-estate borrowers for bank funding. It also has saddled many families with debt. Globally, China accounted for around 57% of the $11.6 trillion increase in household borrowing over the decade through 2019, according to Bank for International Settlements data, or roughly half of all global debt created since 2005! The U.S. accounted for about 19%.

Home prices in some Chinese cities have reached levels comparable with some of the world’s most expensive urban areas. Average home prices across China reached 9.3 times average income in 2018, according to the Chinese Academy of Social Sciences, compared with 8.4 in San Francisco.

In Tianjin, a city of 15 million southeast of Beijing, apartments in upscale areas sell for around $9,000 a square meter, or about $836 a square foot, according to real-estate services company Savills PLC. That is roughly the price an average buyer would pay in some of the most expensive parts of London, even though disposable incomes are seven times as high in London as in Tianjin.

The bottom line is that, for better or worse, just as Americans have gone all in on stocks, urban Chinese have bet everything on their homes. And picking up on the chart that we first showed years ago, the WSJ notes that the Chinese "now have nearly 78% of their wealth tied up in residential property, versus 35% in the U.S."

And so, to avoid a spectacular bubble burst in Feb and March when the Chinese economy imploded due to covid, bigger developers and local governments rolled out incentives to bring buyers back. Since February, at least 26 of 32 Chinese provinces and regions have unveiled policies to boost their property markets, according to Huatai Securities, including looser down-payment requirements and subsidies for home purchases.

"While local governments are under pressure to prevent further surges in housing prices, what scares them more is a sharp decline,” said Gao Fei, general manager at real-estate firm Centaline Group in Tianjin. They can ill afford to let the market go down. Income from land sales and related taxes on developers accounted for 52.9% of local governments’ revenue in 2019, a record high, according to Shanghai Yiju Real Estate Research Institute.

China Evergrande, whose enormous debt gives it the largest interest bill in the world among listed nonfinancial stocks, offered discounts of 25% in February and 22% in March. Country Garden Holdings, another major developer, offered more than 17,000 new homes across China via social media with discounts of up to 50%.

These worked: of China’s 34 largest developers, 27 reported a year-over-year increase of sales volume in May, according to data from China Real Estate Information Corporation.

One can, of course, say that same thing for the symbiotic relationship between the US government and the stock market. The bottom line is that every regime has its own pet bubble that it will cultivate as a bubble pop could mean a civil uprising, if not revolution as hundreds of millions realize their paper wealth was just that.

Yet the unprecedented push to preserve the bubble at all costs is now ending.

As the WSJ notes, in a sign the central government disapproves of some of the loosening measures, in at least 12 cities, including Jinan and Guangzhou, documents detailing relaxed lending policies were removed from local governments’ official websites within days. One city in Shandong province backed off plans to provide subsidies to home buyers in mid-May, saying some parts of its plan “violate relevant requirements from senior officials.”

More recently, incentives have been trimmed, though not entirely. At one development in Shanghai in mid-May, CK Asset Holdings offered prospective buyers a Huawei phone and vouchers of 20,000 to 40,000 yuan ($2,800 to $5,600) for future apartment-management fees.

In other developments, no discounts were on offer, and would-be buyers had to enter lotteries to access the smaller and cheaper apartments. China Vanke Co. sold apartments in mid-May worth a total of 148 million yuan ($20.8 million) within four hours online in a live-streaming show hosted by an actress. In other developments, no discounts were on offer, and would-be buyers had to enter lotteries to access the smaller and cheaper apartments.

Still, it doesn't look like China actually needs all the incentives: China Vanke sold apartments in mid-May worth a total of 148 million yuan ($20.8 million) within four hours online in a live-streaming show hosted by an actress.

Why? Because just as FOMO is pushing 10-year-old retail investors in the US stock bubble due to FOMO, so in China the fear of losing out is driving more buyers to look now, with home prices in some desirable areas up by at least 10% this year according to Yin Haiping, who runs a property consulting firm in Shenzhen.

Xu Xiaohua, a university lecturer in Tianjin who already owns a property there, just bought another apartment this month in Shenzhen. He paid 6.5 million yuan ($913,050) in cash in early May (they sure pay university lecturers well in China) for the 50-square-meter (538-square-foot) property after checking out about a dozen apartments within a week.

He said he thinks most Chinese will park their wealth in real estate during downturns. “The worse China’s economy turns,” he said, “the higher property prices in places like Shenzhen will climb.”

He is right, of course, as long as there is a greater fool willing to buy the next marginal unit at an even higher price. And in a world where central banks are now openly the buyer of last and first resort, one wonders just how much longer this farce of fake wealth built up on artificially inflated assets - housing in China, stocks in the US - can continue...

https://ift.tt/39x5njO

from ZeroHedge News https://ift.tt/39x5njO

via IFTTT

0 comments

Post a Comment