Apple Bears Come Out Of Woodwork With New Warnings Ahead Of Earnings Tyler Durden Mon, 07/27/2020 - 05:30

Apple is set to report earnings this coming Thursday (July 30), and already, bears are coming out of the woodwork to warn about deteriorating fundamentals.

Wolfe Research analyst Jeff Kvaal wrote in a note Friday (seen by Barrons) that Apple's current valuation was perplexing:

"Few firms shape their industry as has Apple; fewer shape society," Kvaal wrote. "We challenge neither premise. We do, however, ponder the stock's sharp multiple expansion. Possible rationales—a 5G supercycle, mix shift to services, re-rating to a consumer staples multiple—all seem thin."

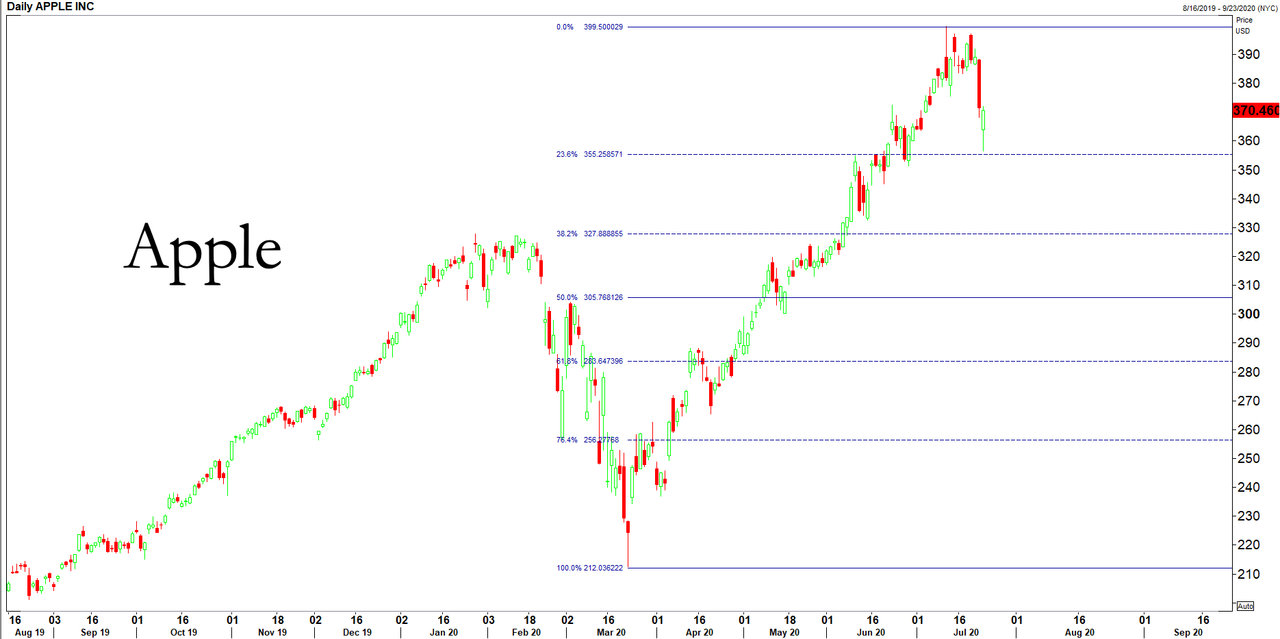

With shares up 75% since the March low, Kvaal warns Apple's fundamentals "can't support the move."

He downplayed the 5G supercycle tailwind, indicating "orders into its supply chain are flat to below last year's iPhone 11 orders."

Adding that, "US operator data from the 4G cycle indicates a lengthening replacement cycle," he wrote. "Phone sales decelerated sharply during the 2008 recession. Neither trend supports a 2020 supercycle. We believe Apple's iPhone 12 orders into its supply chain are flat to below last year's iPhone 11 orders."

Kvaal continues, "Apple's rising services mix, sticky ecosystem, and capital return policy do merit multiple expansion from its five-year average of 14x," but that "the expansion to 26x seems aggressive."

We noted Thursday, Goldman Sachs advised its clients to "avoid the stock," labeled it as "unsustainable."

Also, Wells Fargo analyst Aaron Rakers said estimates for Apple seem too high for the September and December quarters "given the current environment and uncertainties on the velocity of a materializing 5G iPhone upgrade cycle."

On Saturday, china ordered Apple to remove all games on its app platform in the country that don't have approval from the government.

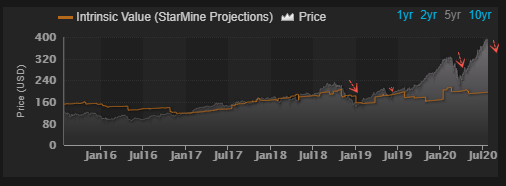

Financial modeling via StarMine shows Apple's intrinsic value is around $195 per share, the stock is currently trading at around $370.

If Apple shares slump next week, Jerome Powell, and the clowns at the Federal Reserve, might have to restart the printing presses, or at least keep buying Apple bonds. Brrr.

https://ift.tt/3f4bAVx

from ZeroHedge News https://ift.tt/3f4bAVx

via IFTTT

0 comments

Post a Comment