Fed Stimulus Has Created The "Cobra Effect" Tyler Durden Sun, 07/26/2020 - 10:30

Authored by Lance Roberts via RealInvestmentAdvice.com,

Stocks Fail To Breakout

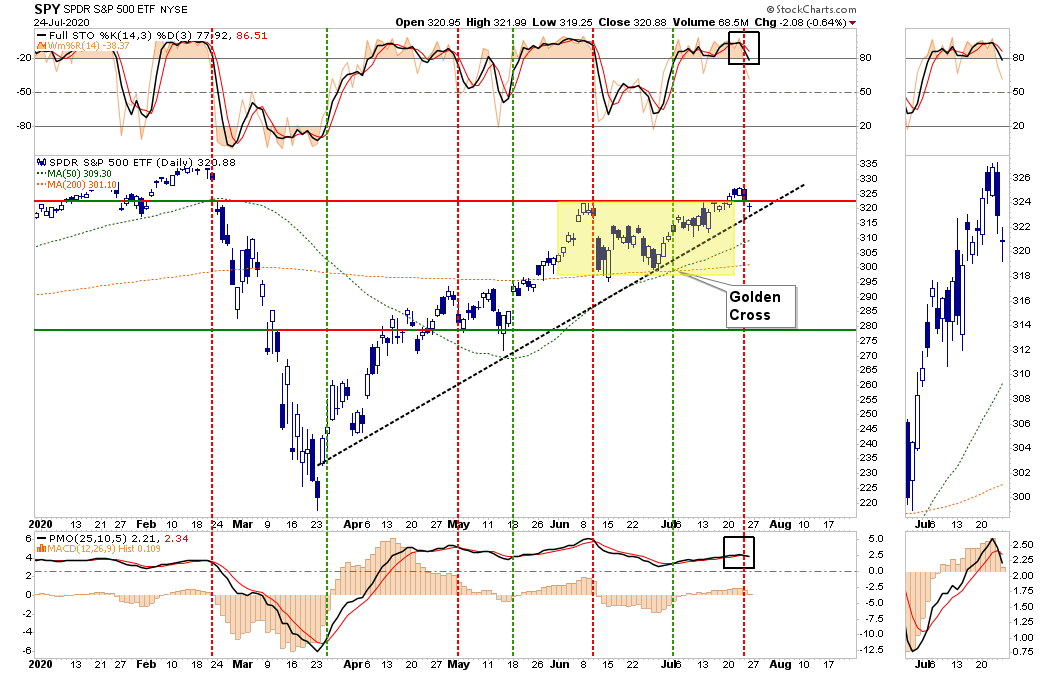

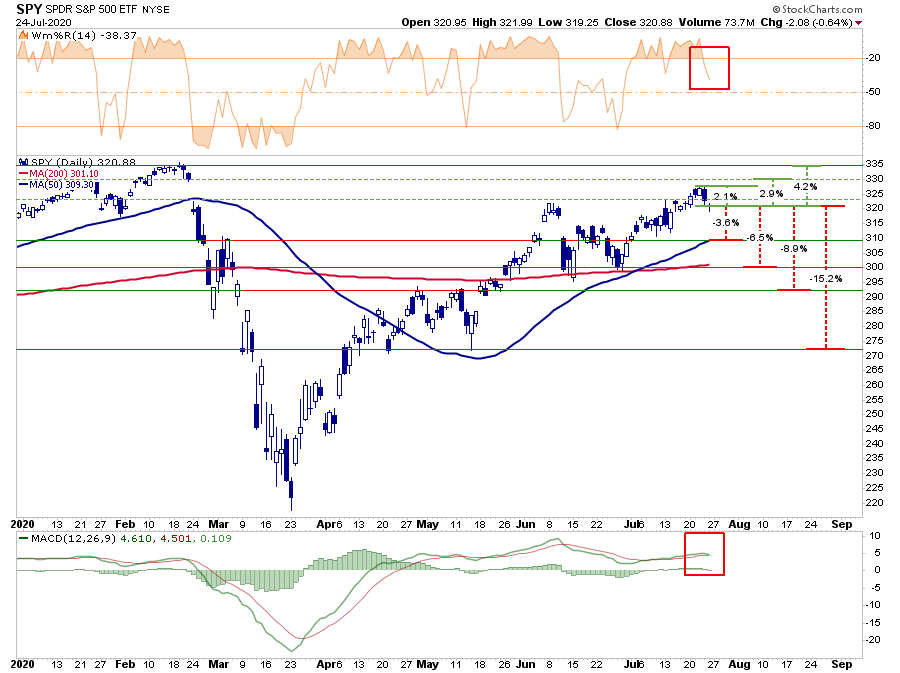

Previously, we discussed how stocks struggled as virus cases rose. Importantly, the market had remained within a consolidation range since the mid-June highs. To wit:

“Furthermore, the S&P 500 continues to remain ‘technically trapped’ between the June highs and the recent consolidation lows. With the market overbought on a short-term basis, the upside has remained limited. However, there is substantial support between the current uptrend line and the 50- and 200-dma’s, limiting downside risk.”

With the late week sell-off, we have updated our risk/reward ranges below. Unfortunately, the market failed to hold its breakout, which keeps it within the defined trading range. The market did hold its rising bullish uptrend support trend line, which keeps the “bullish bias” to the market intact for now.

The “not-so-bullish” aspect is that all four (4) of the primary buy/sell indicators have now tripped into “sell” territory. Such does not mean an imminent crash for the market. It does suggest upside is limited in the near term.

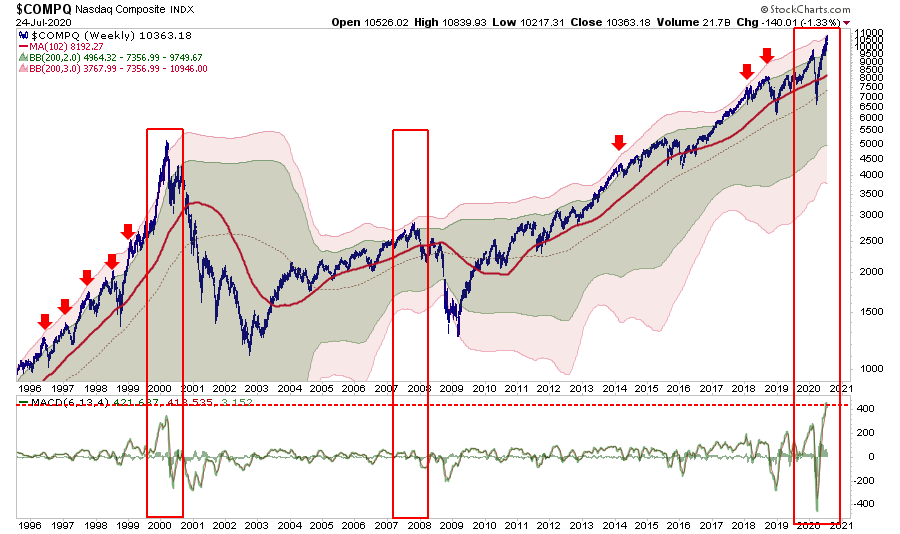

Tech Extremes

Currently, we are focusing our attention on the Nasdaq, which is currently being driven by the 5-largest mega-cap names. As discussed in this week’s #MacroView, the “Tech Bubble” is back in terms of technical deviations from long-term means. As shown below, whenever the Nasdaq trades at 3-standard deviations above its 200-dma, prices always correct.

Most of the time, the corrections come very quickly. However, there are a few occasions where the payback was NOT immediate. Such lured investors into more risk before the reversion eventually came. (Note the extremity of the MACD indicator in the lower panel.)

As we have discussed over the last couple of weeks, July has held to its historical trends of strength. However, with a bulk of the S&P 500 earnings season concluding next week, we suspect the weakening economic data will collide with the more exuberant market sentiment in August and September.

Too Many Stocks Underperforming

In Tuesday’s Technically Speaking post, we laid out 15-charts, which should give any investor a bit of pause. The purpose was to potentially counteract the “confirmation bias” trap that typically befalls investors during more bullish market episodes.

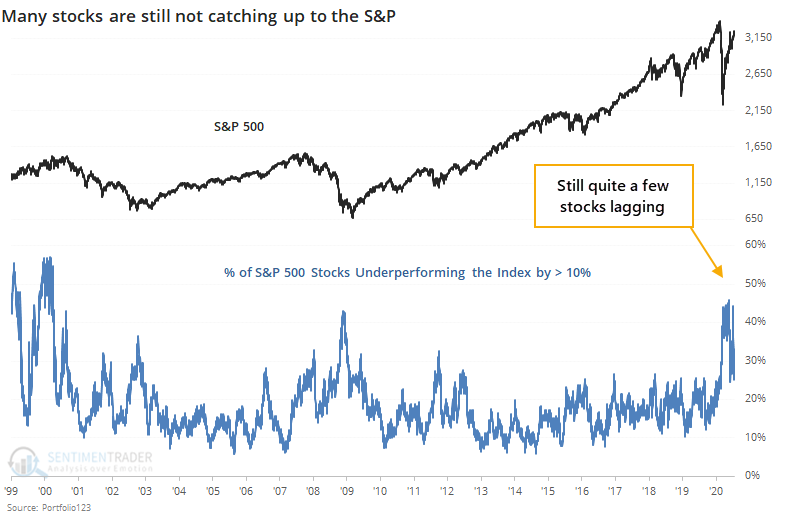

Sentiment Trader added another warning to the list yesterday.

“The percentage of stocks trailing the index by more than 10% has spiked. While we have different data sources and likely a different methodology, we can see that this is the case.”

The chart shows the percentage of stocks within the S&P 500 that are trailing the index’s returns by 10% or more over the past 13 weeks. It’s not unusual to see this figure jump during bear markets, which it did during the pandemic. Still, it is relatively unusual to see so many stocks continue to lag the index by so much when the index has climbed close to its prior highs.

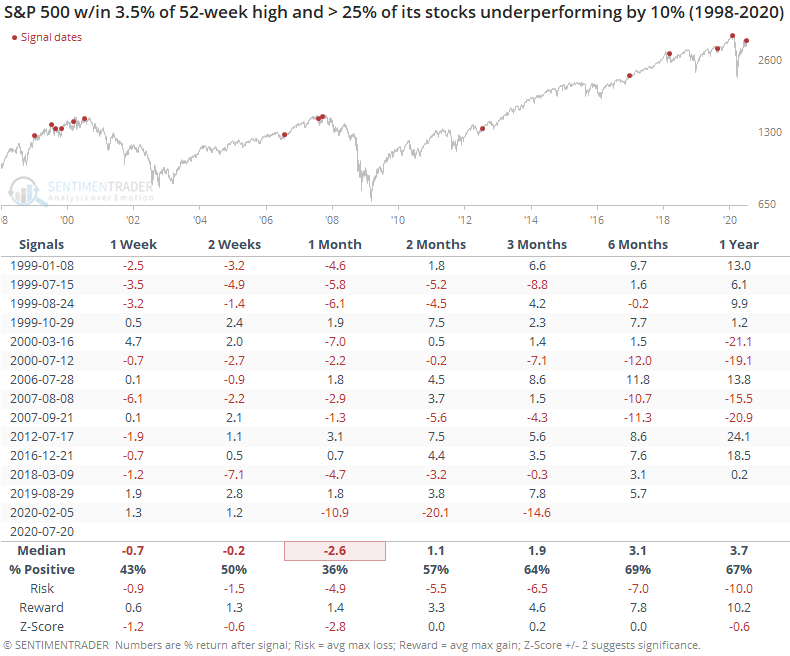

The table below shows every date since 1999 when the S&P was within 3.5% of its 52-week high. And, more than a quarter of its component stocks were trailing the index by double-digits.”

Forward returns over the shorter-term were poor, with a very negative risk/reward skew during the next month. Even up to three months later, the risk/reward was more heavily tilted toward ‘risk.’“

Such further confirms our concerns about a market correction over the next couple of months.

Yes, as noted above, there are instances where this indicator failed to provide a timely signal. However, more often than not, investors were punished for ignoring the warning signs.

Such is why “confirmation bias,” the act of seeking out only information that confirms your current views, is inherently dangerous. Investing is always about weighing possibilities versus probabilities and managing the “risk of failure” over time.

Fed Stimulus Creates The Cobra Effect

Our colleague, Jeffrey Marcus, penned a great piece this week for our RIAPro subscribers (Try Risk-Free for 30-days) discussing how Fed stimulus has created the “Cobra Effect.”

The term relates to an old story from Dehli, India.

“As the story goes, there was once so many cobras in Delhi was a bounty placed on each dead one delivered to the government. At first, it worked. But then, entrepreneurs began breeding cobras to garner more income from the bounties. When the authorities figured out the scam, they canceled the program.

The problem came when the breeders, who had a large inventory of cobras, released them into the wild. With the demand (the bounty) for the snakes removed, the cobra population exploded worse than before.”

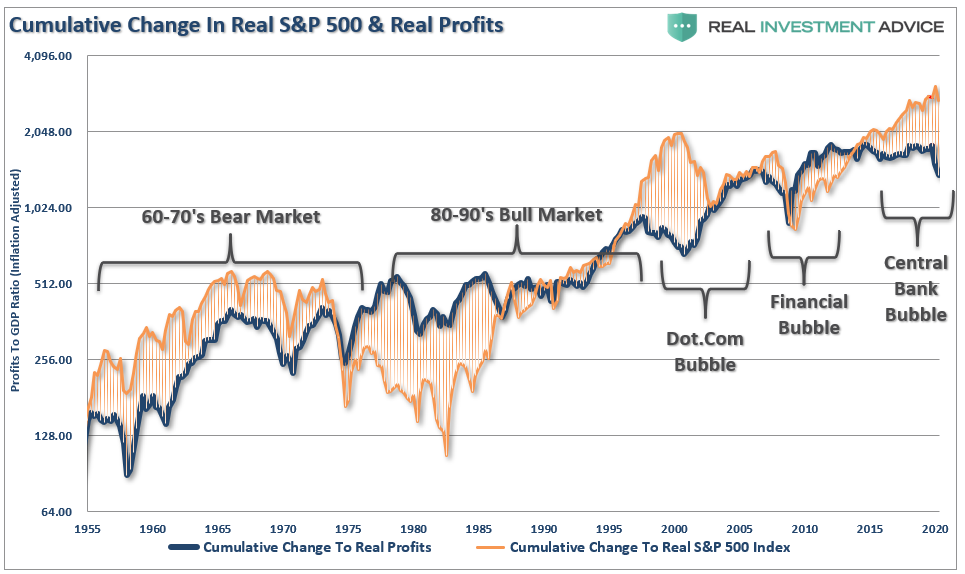

As Jeff goes on to discuss, the actions taken currently though Fed stimulus to sustain the economy, and buoy the stock and bond markets, will eventually cause a bigger problem. The flood of liquidity is hitting a highly illiquid market that has now detached the market from the underlying economy.

In other words, as Jeff concludes, the “cure will be worse than the disease.”

The “consequence” of the Fed’s actions isn’t necessarily a failure in the stock market. Such would only impact a small portion of the population that owns stocks. The real concern is it manifests itself in weaker economic growth, a widening of the “wealth gap,” and an acceleration toward socialism.

Fed Stimulus Drives Psychology

However, the main point Jeff makes is that while the eventual outcome of massive amounts of Fed stimulus will be negative, asset managers will do what they are paid to do. They will continue to invest in ways that reap their clients the best returns.

Such is what creates bubbles, and eventually, the busts. George Soros’ theory on bubbles, explains this idea more clearly.

“Every bubble has two components:

An underlying trend that prevails in reality, and;

A misconception relating to that trend.

When positive feedback develops between the trend and the misconception, a boom-bust process is set into motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced.

Eventually, market expectations become so far removed from reality that people are forced to recognize that a misconception is involved. A twilight period ensues during which doubts grow, and more people lose faith. Still, the prevailing trend is sustained by inertia.

Eventually, a tipping point is reached when the trend is reversed; it then becomes self-reinforcing in the opposite direction.”

The pattern of bubbles is interesting because it changes the argument from a fundamental view to a technical view. Prices reflect the psychology of the market, creating a feedback loop between the markets and fundamentals.

In a world where there is “no fear” of a market correction, a sense of “urgency” to be invested, and a continual drone of “bullish chatter;” the market is poised for an unexpected, unanticipated, and inevitable event.

Such is why we pay attention to the “risk.”

Updating Risk/Reward Ranges

In our last “risk/reward” update we stated:

“After several failed tests of the June highs this week, we derisked our portfolios and added to our hedges. Even with those adjustments, our portfolios continued to perform as the rotation to ‘risk-off’ sectors kept portfolios stable. The reason for the derisking is the negative tilt to the risk/reward ranges currently.”

This week, that negative bias came into effect as the market failed to maintain its attempt to break out of the consolidation range. Importantly, we saw the rotation from “growth” to “value” gain some traction.

-

-3.6% to the 50-dma vs. +2.1% last week’s highs (Negative)

-

-6.5% to the 200-dma support vs. +2.9% to all-time highs. (Negative)

-

-8.9% to the previous consolidation highs vs. +4.2% to all-time highs. (Negative)

-

-15.2% to previous consolidation lows vs. +4.2% to all-time highs. (Negative)

This negative tilt to the market’s risk/reward dynamics keeps our current portfolios hedged more than usual.

The Guidelines

This week’s report’s universal theme is that “risk” has become more elevated as we enter into August and September. Such doesn’t mean markets will “crash.” It does mean there is an increased potential for a correction to occur.

In the #MacroView below, these guidelines are ones I have learned over the last 30 years. These are our guidelines, but maybe you will find some value in them.

-

Investing is not a competition. There are no prizes for winning, but there are severe penalties for losing.

-

Emotions have no place in investing. You are generally better off doing the opposite of what you “feel” you should be doing.

-

The ONLY investments you can “buy and hold” provide an income stream with a return of principal function.

-

Market valuations (except at extremes) are inferior market timing devices.

-

Fundamentals and Economics drive long-term investment decisions – “Greed and Fear” drive short-term trading. Knowing what type of investor you are, determines the basis of your strategy.

-

“Market timing” is impossible– managing exposure to risk is both logical and possible.

-

Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

-

There is no value in daily media commentary– turn off the television and save yourself the mental capital.

-

Investing is no different than gambling– both are “guesses” about future outcomes based on probabilities.

-

No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

As an investor, our job is to view the markets through the lens of statistics and probabilities. If we can control risk, the opportunity to create wealth becomes simpler.

Yes, markets have always recovered their losses, but getting back to even isn’t the same thing as making money.

https://ift.tt/3eVCf6M

from ZeroHedge News https://ift.tt/3eVCf6M

via IFTTT

0 comments

Post a Comment