Massive Short-Squeeze Sends Cryptos Surging: BTC Above $10k, Ether Tops $300 Tyler Durden Sun, 07/26/2020 - 13:10

Aside from the 'safe-haven' status amid the global money-printing fiasco occurring in fiat-land, the major run in the largest cryptocurrencies in recent days appears to have been driven by two technical factors (over-leveraged shorts unwinding and traders taking profit from over-extended altcoins).

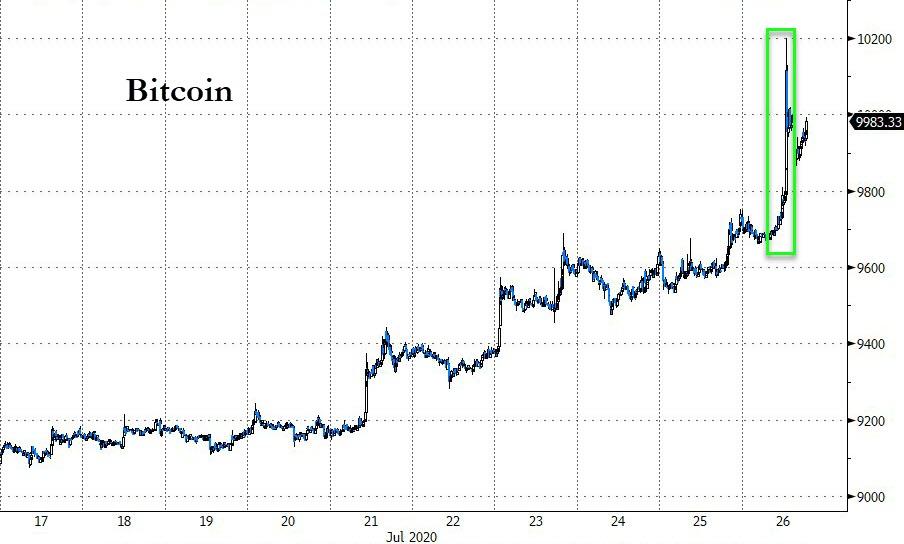

Overnight saw Bitcoin top $10,000...

Source: Bloomberg

As CoinTelegraph reports, when Bitcoin initially broke over $10,000, it triggered over-leveraged short contracts to become liquidated. When BTC reached $10,200, it caused a cascade of liquidations to occur, totaling $74 million.

Bitcoin has seen many phases when more than $50 million worth of short or long contracts gets liquidated. But for this to occur within a span of a few hours is less typical.

The mass liquidations of long contracts at $10,000 also suggest that the $10,000 to $10,200 remains as a heavy resistance area. As soon as BTC hit $10,200, the price dropped below $10,000, marking a short-lived rally.

Will it hold this time?

Source: Bloomberg

As CoinTelegraph goes on to note, as the price of Bitcoin recovered strongly in recent weeks, some industry executives and investors expressed optimism toward BTC and ETH.

“Are you ready?” Grayscale CEO Barry Silbert tweeted when Ether price broke out of the dreaded $280 resistance level on July 25.

Well-known trader Peter Brandt, meanwhile, expects the price of Bitcoin to hit a new record high and eventually make its way to $50,000. He said:

“That is actually where my head is. Massive symmetrical triangle in $BTC points to ATHs, then $50k.”

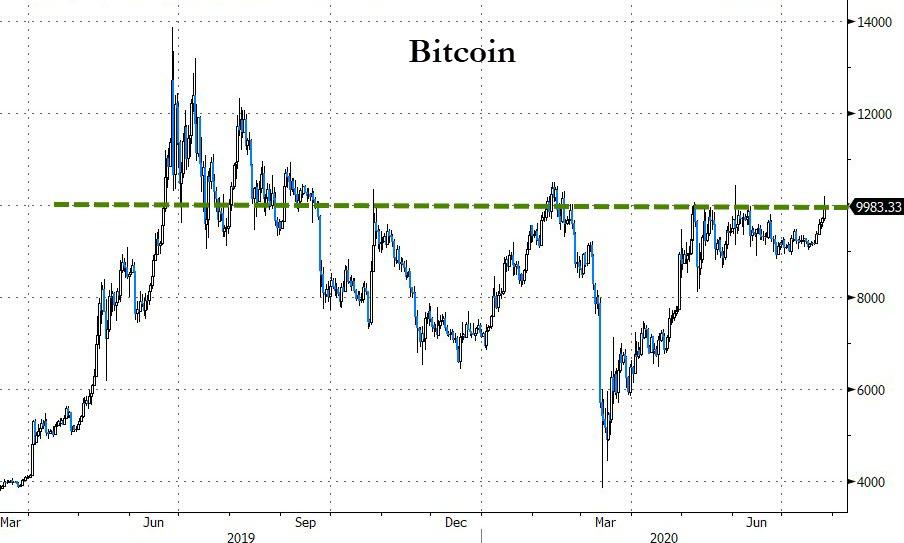

But some variables could affect the short-term price trend of BTC price. First, the funding rate of Bitcoin is projected to be over 0.04% on BitMEX. That is nearly four times higher than the average funding rate of 0.01%. It signifies that the majority of the market is taking long positions.

Second, $10,000 has acted as a key psychological level for Bitcoin since October 2019. If BTC rejects at $10,200, it would still be lower than the previous peak in February 2020 at $10,473.

Although it would be far-fetched to call it a lower high formation, it might show that BTC price has not cleanly broken out of the multi-month range.

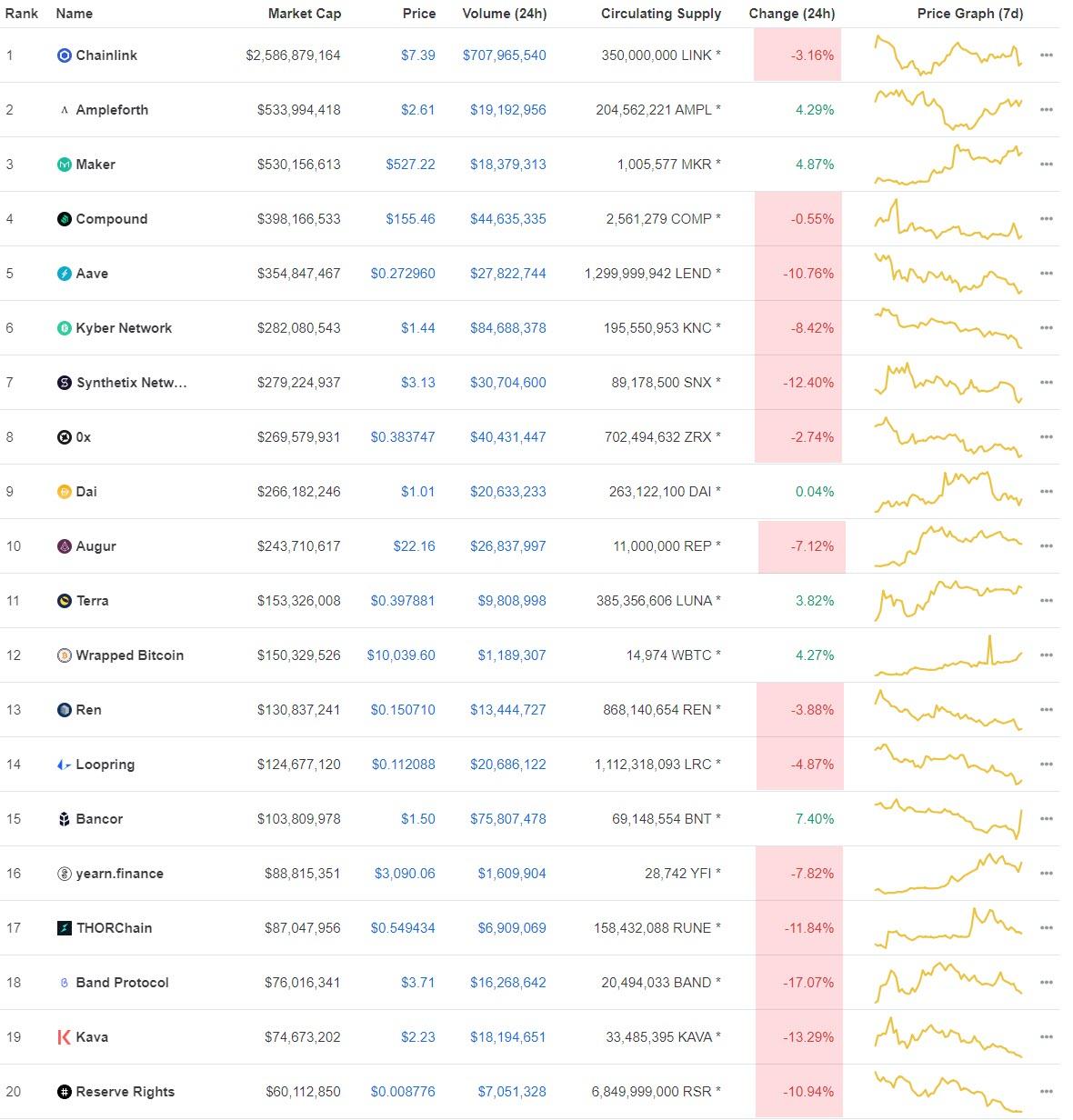

Additionally, as the big 'core' cryptos have exploded higher in recent days, the previously popular DeFi Tokens have taken a significant hit...

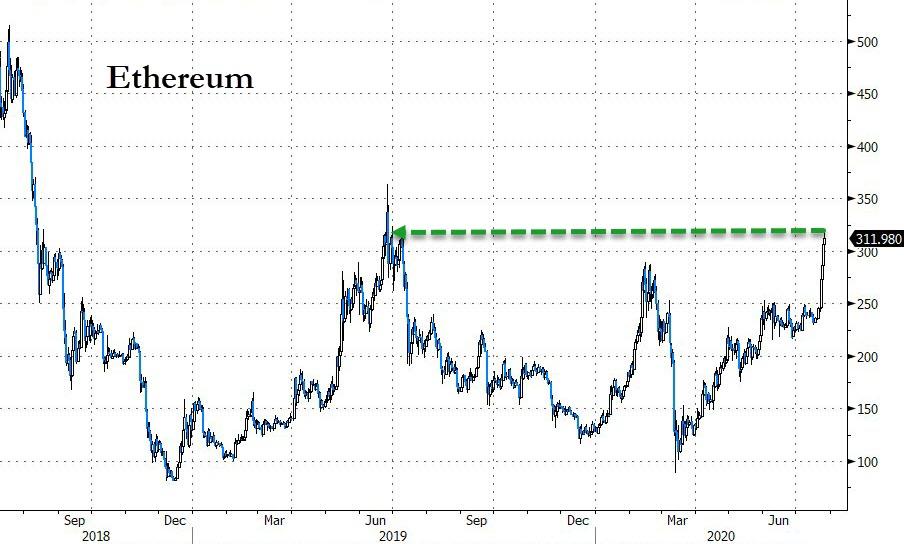

And that cash has seemingly rotated into Ethereum, driving the cryptocurrency to its highest in over a year...

Source: Bloomberg

Having topped $300, investors are looking for the $350 spike highs from June of last year...

Source: Bloomberg

And investors are looking for more as optimism over Ethereum 2.0 and the rise in options and spot demand accelerate.

As CoinTelegraph details, especially since the beginning of the second quarter of 2020, the Ethereum market has seen high options and spot demand. Previous rallies have been led by the futures market. The funding rate of Ether during the February 2020 peak was hovering at 0.2% on BitMEX. That means long holders had to incentivize short holders with substantial fees due to market imbalance.

During the recent rally, the funding rate of Ether futures contracts stayed relatively low. Despite a 30% increase in the past five days, the funding rate of ETH on BitMEX is well below 0.2%. It is likely due to the spot and options market playing a big role in ETH’s ongoing rally.

On July 24, the Deribit team said it had reached a record high for ETH options volume and open interest. Deribit accounts for 93% of the Ether options market in terms of open interest, tweeting: “We have a new record high for ETH Options volume and open interest! With a peak 24hr volume of $49 million, the Deribit ETH options OI sits at $241 million (and currently 93% of the global Ethereum market share)!”

Santiment researchers also noted ETH does have room for additional growth, relative to the performance of leading altcoins. Cryptocurrencies like Chainlink’s LINK have hit new highs in July, significantly outperforming top crypto assets. Possibly due to the lack of involvement of the futures market in the Ether rally, some analysts see a room for a bigger rally for ETH. Santiment stated on Twitter:

“The top 100 market cap #blockchains in the past 30 days show that $ETH still has a long way to go to catch most other #altcoins. This is a positive sign for current #Ethereum holders, currently +16.3% in the last 30d vs. an avg. top 100 return of +32.7%.”

In the longer-term, Ethereum 2.0 could act as a newfound catalyst, especially as ETH approaches Q4 2020. Earlier this week, Ethereum developers, led by fork coordinator Afri Schoedon, said that the official testnet launch of Ethereum 2.0 would begin on August 4.

The first phase of Ethereum 2.0 is called the beacon chain. For it to be activated or launched, developers need to develop testnets to mimic the conditions of the beacon chain. Stable and long-term testnets are necessary to ensure a seamless launch of Ethereum 2.0, Schoedon wrote on GitHub. The Medalla testnet is expected to be the final testnet before the mainnet launch, as Schoedon said:

“Before such a mainnet can be launched, we need testnets that mimic mainnet conditions as good as possible. This requires us to have stable, long-term, and persistent testnets up and running that are supported by not only one client but multiple clients, ideally, all clients.”

Positive progress on Ethereum 2.0, specifically on the Medalla testnet, could further boost the sentiment around Ether in the coming months. A confluence of rapidly-growing DeFi market and growing demand on the spot and options market, combined with Ethereum 2.0 hype, appear to be fueling a strong ETH rally.

Despite all these recent gains, it seems it is still not going to save John McAfee from having to eat his own dick.

https://ift.tt/2CFvEAp

from ZeroHedge News https://ift.tt/2CFvEAp

via IFTTT

0 comments

Post a Comment