Retirement Confidence Declined Despite A Surging Market Tyler Durden Mon, 07/27/2020 - 08:49

Authored by Lance Roberts via RealInvestmentAdvice.com,

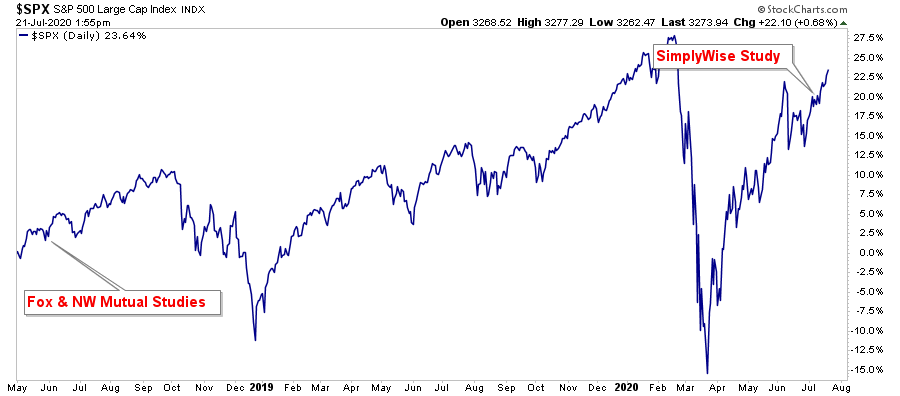

Despite the surging stock market from the March lows, trillions in liquidity support from the Fed, retirement confidence declined.

I have written on this subject previously regarding a 2018 Fox Business study. That study showed more Americans doubted they would be able to save enough for retirement than those confident of reaching their goals.

-

37% are NOT confident they can save enough to retire

-

32% ARE confident they can save enough.

-

48%, however, don’t think their retirement savings will reach $1 million.

Another study in 2018 from Northwestern Mutual showed equally depressing statistics.

“Americans feel under-prepared for the financial realities of retirement, according to new data from Northwestern Mutual. Nearly eight in 10 (78%) Americans are “extremely” or “somewhat” concerned about affording a comfortable retirement. At the same time, two-thirds believe there is some likelihood of outliving retirement savings.”

Again, that was 2018.

Two years later, and with the market 22.5% higher, have things improved?

The Index

According to a recent update of the SimplyWise Retirement Confidence Index, the answer is “no.”

“With the unemployment rate remaining above 10%, the rise in {virus] cases and updated policies threaten to make the coronavirus-related layoffs and furloughs permanent.

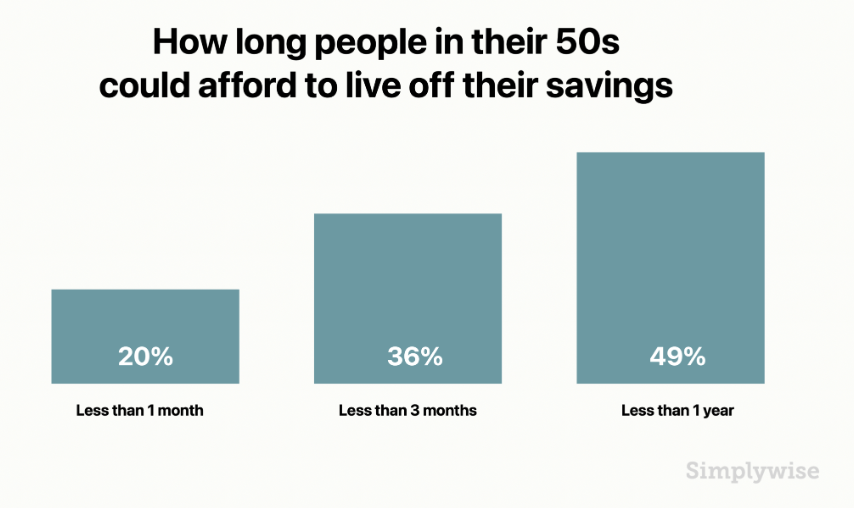

In a country where most people live paycheck to paycheck, this could be devastating. Most Americans lack the savings to last them for even three months. Of course, that savings gap is all the more dramatic when it comes to saving for retirement. And with the havoc the pandemic has wrought, that savings gap seems likely to worsen.”

According to the July 2020 SimplyWise Retirement Confidence Index, 62% of Americans are more concerned about retirement today than how they were feeling about it a year ago. Such is up from 56% in our May 2020 Index. The survey also found that 70% of people in their 50s—who are nearest to retirement—are more concerned about retirement today.

The Findings

Here are the key findings of the report:

-

62% of Americans more concerned about retirement today compared to a year ago. (This is up from 56% in the May 2020 Index.)

-

Half of Americans believe they will outlive their retirement savings.

-

1 in 5 could not last more than 2-weeks off their savings.

-

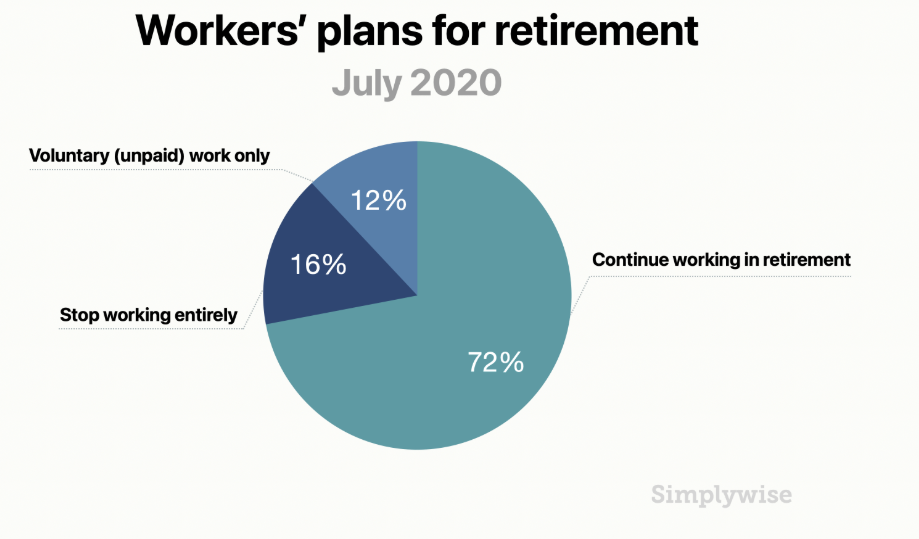

72% now plan to work in retirement. (Up from 67% in May.)

-

Only 58% of those in the workforce are making what they were making before COVID-19. (67% for White Americans, 50% for Hispanic Americans, 45% for Black Americans.)

-

One-in-five Americans in their 60’s have lost their jobs or were furloughed due to COVID-19.

-

24% are now planning to tap their 401(k), including 41% of those laid off due to COVID-19.

-

63% of Black Americans could not come up with $500 cash today (without selling something or taking out a loan)—compared to 35% of White Americans.

-

48% of Black Americans and 43% of Hispanic Americans could survive less than a month on savings (versus 33% of White Americans).

-

Half of Americans say another stimulus check is very important to their finances.

-

72% (83% of Democrats vs. 60% of Republicans) believe a recession will continue into the next year.

A “COVID” Infection

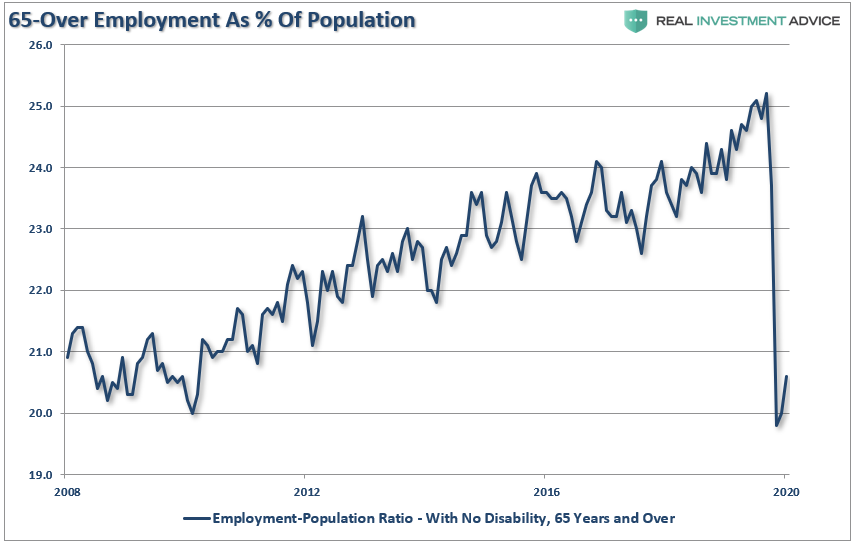

As noted, the disruption caused by the “economic shutdown” has permanently impaired the retirement plan of many. Those over the age of 65 and still working, have been steadily increasing over the years due to better health and longevity, the need for medical insurance, and underfunded retirement accounts. However, post-COVID, many have been displaced, as shown by the sharp drop in the employment-to-population of that demographic.

Such is even more problematic for 72% of those surveyed who are planning on working into retirement.

Importantly, this “age-group” are some of the highest income earners. Those job losses put a damper on hopes for a recovery in consumption. While 49% of those surveyed could only live off savings for one-year, the burden on pension and welfare funds will increase markedly.

Roadblocks To Saving

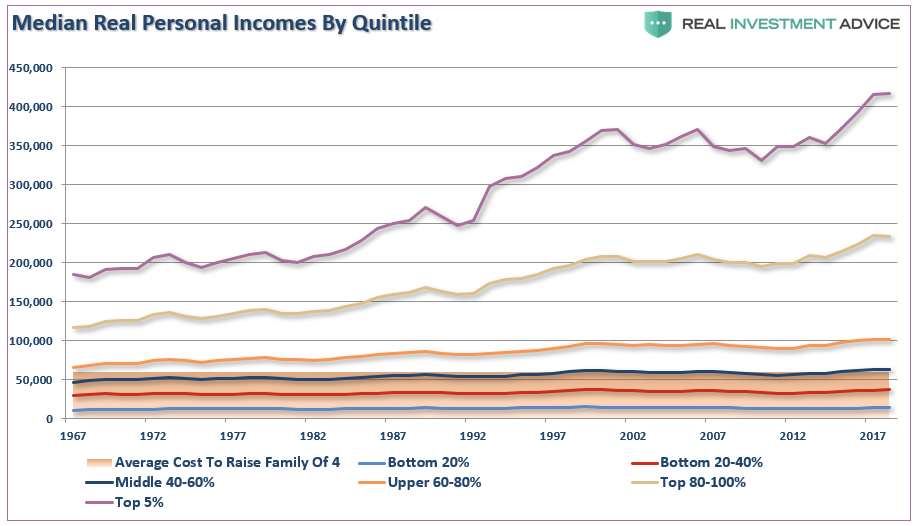

These are pretty depressing statistics when you think about it. However, for the bottom-80% of income earners whose income growth has been stagnant over the last two decades, the roadblocks to saving money shouldn’t be surprising.

In a survey from Kiplinger and Personal Capital, Americans said the biggest roadblocks to saving for retirement were:

-

The high cost of health insurance. “From 1999 to 2017, the cost of family health insurance coverage has more than doubled the amount of take-home pay it consumes.”

-

Disappointing investment performance. “Just under 30% of all respondents (29.4%) said that disappointing investment performance had stopped them from saving as much as they would have liked to for retirement.”

-

The amount of consumer debt they carried. “21.3% of Americans said that debt, not including student loans, kept them from saving for retirement combined with the increased costs of living.”

Filling The Gap

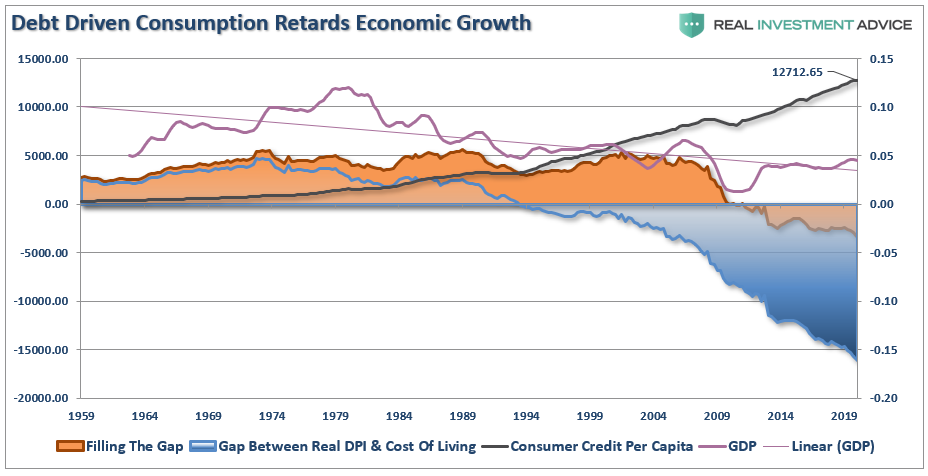

I showed the following chart recently, which illustrates the gap between income, savings, and the cost of living.

“The continued increases in debt, which was used to fill the gap between income and the cost of living, contributed to the retardation of economic growth.”

It’s hard to reduce debt when it is required just to “make ends meet.”

Pension Crisis Looms Large

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. Many of them are public-sector employees. In a 2015 study of public-sector organizations, nearly 50% of the responding organizations stated they could lose 20% or more of their employees to retirement within the next five years.

Local governments are particularly vulnerable: a full 37% of local-government employees are at least 50-years of age in 2015.

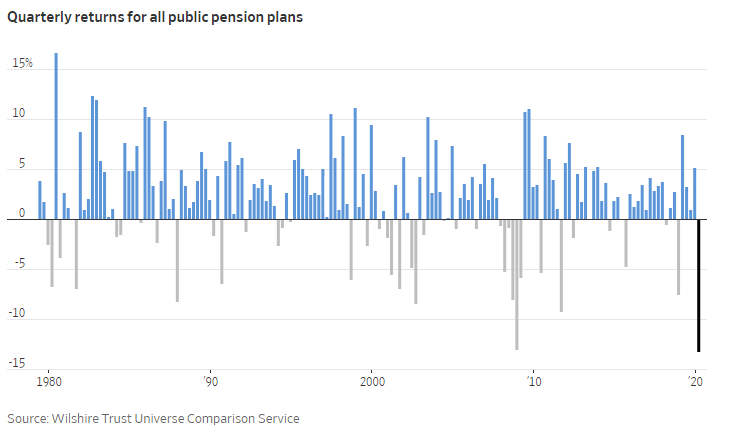

That was 5-years and one-economic shutdown ago. Today, the roughly $6-trillion under-funding of pensions has now come home to roost. As noted previously:

“Moody’s investor’s service estimated that state and local pension funds had lost $1 trillion in the market sell-off that began in February 2020. The exact damage is hard to determine, though, because pension funds do not issue quarterly reports.

At the end of the year, we will find out the true extent of the damage. However, this is not, and has not been, a real plan to fix the underfunded problem. ‘Hope’ for higher rates of sustained returns continues to be the only palatable option. However, targeted returns have continuously fallen short of the projected goals.”

Can’t Catch Up

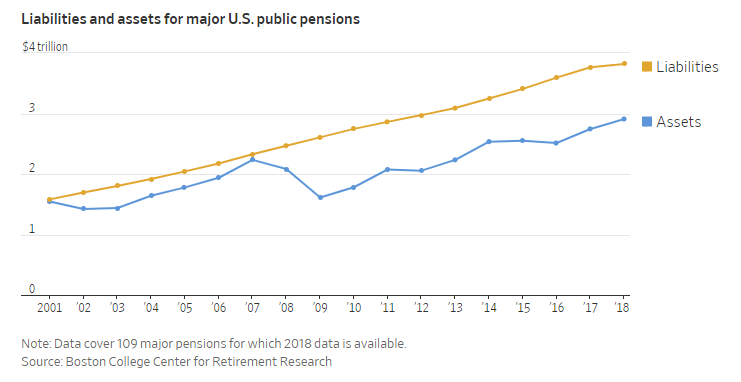

The amount owed to retirees is accelerating faster than assets on hand to pay those future obligations. Liabilities of major U.S. public pensions are up 64% since 2007, while assets are up 30%, according to the most recent data from Boston College’s Center for Retirement Research.

If the numbers above are right, pension funds must set aside the unfunded obligations of approximately $5-$6 trillion today. Without doing so, the principal and interest won’t cover the program’s shortfall between tax revenues and payouts over the next 75 years.

With boomers forced to retire sooner than planned due to the economic shutdown, the window of opportunity to fix pensions has closed.

“Demography, however, is destiny for entitlements, so arithmetic will do the meddling.” – George Will

Social Welfare Strains

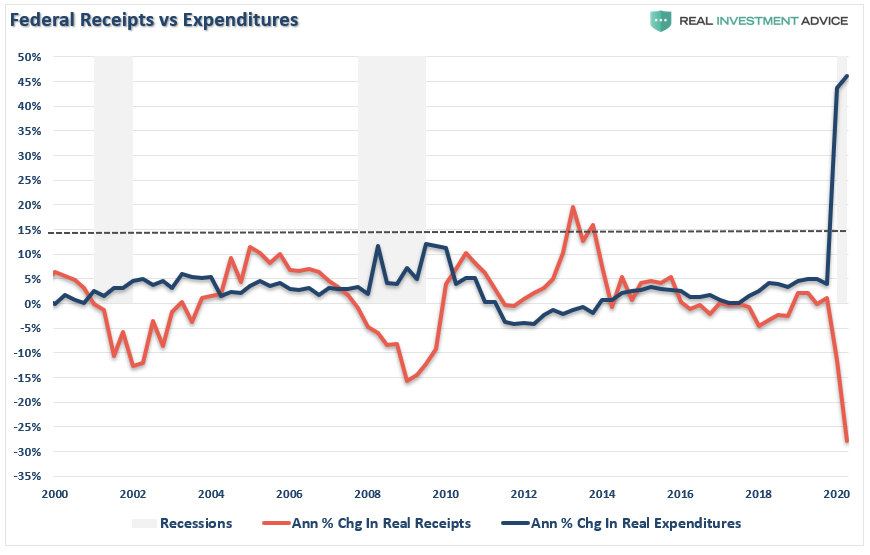

It isn’t just “public pensions” that are in trouble. The collapse in economic growth has resulted in a collapse in Federal Tax revenue needed to pay for the massive social welfare schemes in the U.S.

It now requires in excess of 100% of tax receipts just to meet the mandatory spending of social welfare and interest on the debt. In other words, we are now going into debt more just to provide social assistance.

How bad is it?

Social Security will be insolvent and unable to pay the full value of promised benefits by 2035. Social Security’s costs will exceed its income by 2020, according to a new report published Monday by the program’s trustees.

At the end of 2018, Social Security was providing income to about 67 million Americans. About 47 million of them were over age 65, and the majority of the rest were disabled. If nothing changes, the Social Security Trust Fund will be fully depleted by 2035. If such occurs, the program would impose across-the-board cuts of 20 percent to all beneficiaries.”

Getting Worse

That report, dire in its warning already, was issued before the “Pandemic” and “economic shutdown.”

Meanwhile, demographics are blowing up the basic premise of how Social Security is funded. There were 2.8 workers for every Social Security recipient in 2017. That’s down from 3.3 in 2007, and that’s way down from the 5.1 workers per beneficiary that existed in 1960.

Furthermore, the two programs function mostly as a giant conveyor belt to transfer wealth from the young and relatively poor to the old and relatively rich. Such allows the average person (who now lives to be 78) more than a decade of taxpayer-funded retirement.

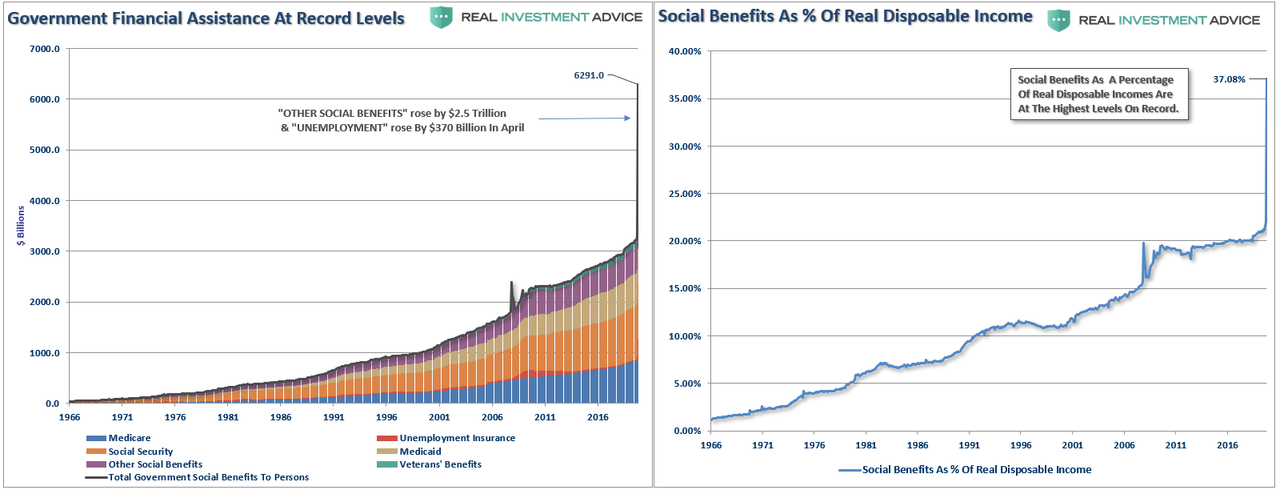

Welfare now makes up the highest percentage of disposable personal incomes in history despite record low unemployment, rising wage growth, and the longest economic expansion in U.S. history.

During the “Great Depression,” the economically devastated masses would form “breadlines.” Today, those “breadlines” form at the mailbox. Today, without government largesse, many individuals would be living on the street. The chart above shows all the government “welfare” programs and current levels to date. The black line represents the sum of the underlying sub-components. Since the onset of the “pandemic,” unemployment insurance and “other benefits” have surged by $3 trillion along with continued rises in all other benefits, like social security, Medicaid, and Veterans’ benefits.

Importantly, for the average person, these social benefits are critical to their survival. Government assistance now makes up ~38% of real disposable personal incomes. With more than 1/3rd of incomes dependent on Federal assistance, it should not be surprising the economy continues to struggle. Recycled tax dollars used for consumptive purposes, has virtually no impact on increasing economic activity.

Bull Markets Aren’t The Answer

While the Fed keeps inflating stock markets, the “trickle-down” effect has yet to occur. Even as noted in the SimplyWise survey, “disappointing investment returns” have stunted retirees saving plans.

However, after 4-decades of transferring wealth from the middle-class to the rich, it is the top-10% of income earners, who own 88% of the stock market, such isn’t surprising. For the rest, two major bear markets, lack of wage growth, and surging costs of living have eroded any ability to build savings for retirement. Such is why most retirees will depend on social welfare for 50%, or more, of their retirement income.

“At the age of 63, ‘baby boomers’ are staring retirement in the face. Yet, because of the devastation of two major bear markets, they are no closer to their retirement goals than they were 13-years earlier.” – RIA

Despite a massive surge in the markets from the “Pandemic” lows, trillions in market support from the Fed, and household support from the Government, “retirement confidence” continues to erode.

The mirage of consumer wealth has not been a function of a broad-based increase in Americans’ net worth. Instead, it has been a division in the country between the Top 20% who have the wealth and the Bottom 80% dependent on increasing debt levels to sustain their current standard of living.

With the vast amount of individuals already vastly under-saved and dependent on social welfare, the current economic devastation will reveal the full extent of the “retirement crisis.”

Of course, this is also why the calls for more socialistic policies continue to rise.

https://ift.tt/2BxQzEM

from ZeroHedge News https://ift.tt/2BxQzEM

via IFTTT

0 comments

Post a Comment