"This Might Be The Craziest Thing I've Seen In My Stock Market Career" Tyler Durden Thu, 07/02/2020 - 06:00

This morning we have the somewhat unprecedented situation where both the monthly non-farm payrolls data and weekly jobless claims data coincide.

Even more 'unprecedented' is the fact that the two measures of the labor market are expected to diverge dramatically with a 1.35 million increase in new jobless claimants occurring at the same time as the BLS is expected to report an increase of 3.058 million jobs in the US economy.

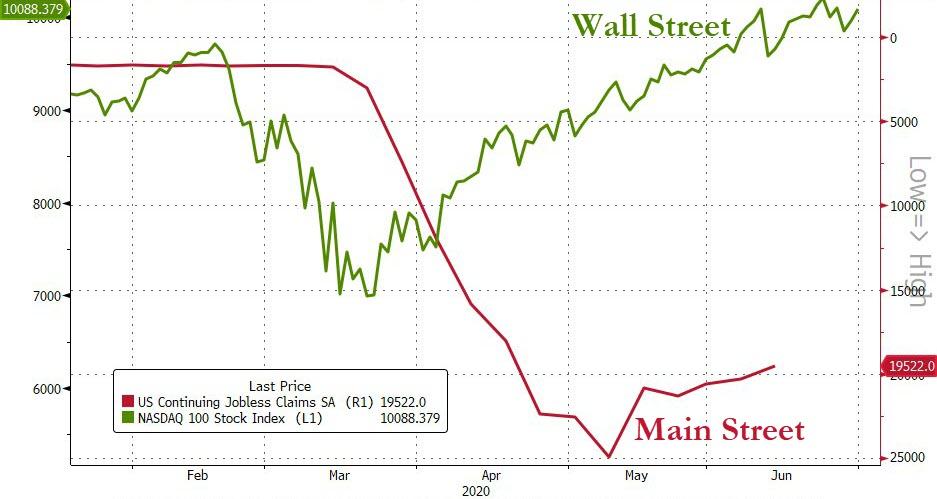

Of course, this all sits against the backdrop of an unprecedented surge in the stock market as the economy remains mired deep in collapse...

As Jesse Felder points out rather shockingly, echoing the thoughts of most rational Americans: "this might be the craziest thing I've seen in my stock market career"

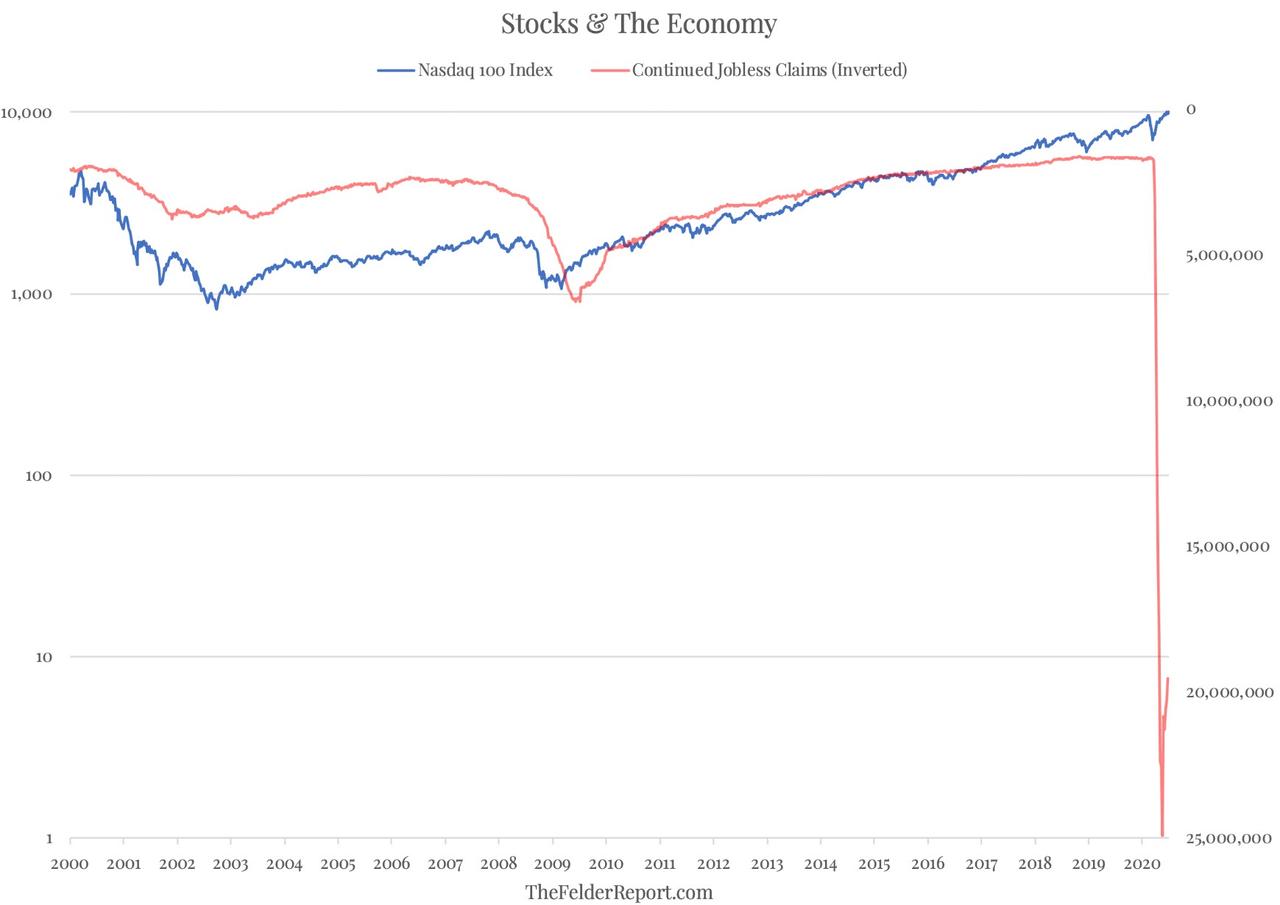

As I write this, the Nasdaq 100 Index is up 30% over the past year while continued jobless claims have soared to record highs as the result of a pandemic.

It’s like nothing I’ve ever seen (or anyone else has ever seen, for that matter).

Typically, when recession hits and unemployment rises dramatically it’s not good for the stock market as both revenues and earnings take a hit. In the past, the trends in continued jobless claims and stocks had a negative correlation, meaning that when the former rose the latter fell. Over the past few months, however, we have seen both rise strongly in tandem.

And there may be no better representation of the massive gulf between the stock market and the economy right now.

"Crazy" indeed!

https://ift.tt/31C5tEH

from ZeroHedge News https://ift.tt/31C5tEH

via IFTTT

0 comments

Post a Comment