Three Reasons Why Morgan Stanley Thinks The Recovery Is Still On Track Tyler Durden Sun, 07/26/2020 - 20:00

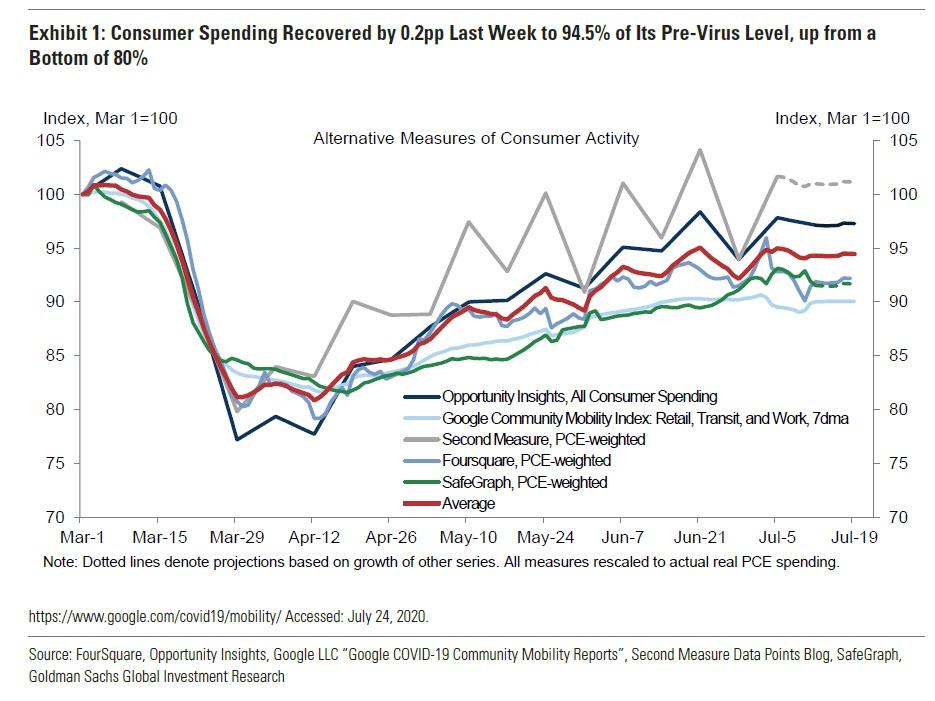

One day after Goldman poured cold water on the V- or any other shaped recovery narrative, when its high-frequency, real-time indicators showed that the pace of the recovery was slowing across various consumption metrics...

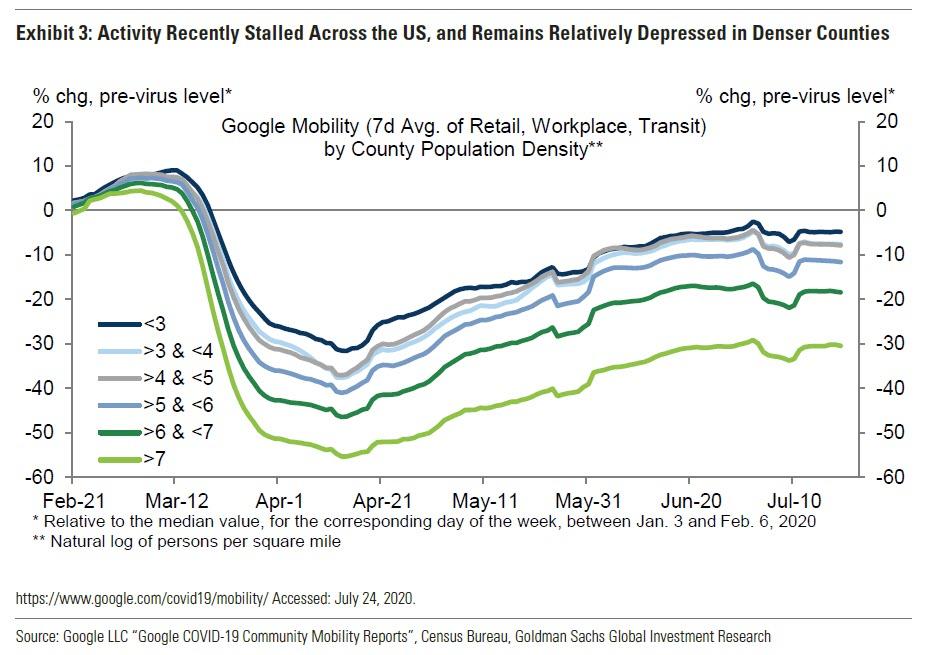

... but more notably, observed a clear contraction within the US job market and warning that "the labor market recovery is stalling due to the worsening virus situation" as "workplace activity measures have declined in the states hit hardest with virus spread and moved sideways in others since late June"...

... on Sunday, Morgan Stanley, which in the past 4 months has emerged as the biggest cheerleader of the economy (perhaps because it feels the need to justify its bullish market take by being optimistic on the broader economy as if the two are still somehow connected), felt its was its duty to launch another full-throttled defense of the economy - something it has been doing virtually every week - and in the bank's Sunday Start note, Morgan Stanley chief economist Chetan Ahya gives "three reasons why the recovery is still on track", and lists the following:

- Unlike in March, there has been a change in calculus between the virus and economy, and policy-makers (at least those who are no part of the #resistance) are now balancing the social and economic costs brought about by lockdown measures versus the adverse implications for public health.

- The outlook for vaccines/treatments for COVID looks promising (although there is a risk that elevated levels of COVID-19 cases could coincide with the traditional flu season (which typically leads to hospitalizations beginning to rise from around mid-November onwards and peaking in January), meaning that there will be a greater strain on hospital capacity during that time period.

- Policy support remains unprecedented. As a refresher, the G4 central banks are expanding their balance sheets by 28% of GDP by end-2021 and the G4 and China economies are extending fiscal support of 17% of GDP in 2020. The Fed’s balance sheet will rise to 30% of GDP by end-2021 and the fiscal deficit in the US will rise to 24.6% of GDP in 2020, on our forecasts.

And just in case the bulls are starting to get cold feet, below are the details from the rest of Morgan Stanley's traditionally upbeat take on the US economy and global markets.

Three Reasons Why the Recovery Is Still on Track, by Chetan Ahya, chief economist and global head of economics at MOrgan Stanley.

Every new economic cycle begins with considerable uncertainty. Concerns about whether we have seen the worst effects of the shock and whether there will be aftershocks or lingering effects tend to be the key causes of uncertainty during the initial recovery. This time is no different.

But we have steadfastly held on to our forecast that the global economy will regain its pre-COVID-19 levels of output by 4Q20 (and DMs by 4Q21). Our views on the global macro outlook are underpinned by three factors – (1) the evolving COVID-19 situation, (2) the race for effective treatments and vaccines, and (3) the extent of the policy support. As we review each of them in turn, we hope to shed some light on why we think the global recovery is still on the right track.

#1: The equation between the virus and the economy is changing

The virus is still spreading in the US and LatAm, while new clusters of infections have emerged in Asia and Europe. For the latter group, policy-makers have been able to manage these new clusters with selective lockdowns, and aggregates for economic activity have not been affected.

This risk of a renewed aggressive lockdown is the most acute in the US. But the equation between the virus and the economy is now changing – with policy-makers now balancing the social and economic costs brought about by lockdown measures versus the adverse implications for public health.

Moreover, the link between new case counts, hospitalizations, and fatalities is also very different today versus the situation in March/April. Today’s cases include more of the milder or asymptomatic variant, a reflection of ramped-up testing capacity as compared to the earlier days of the outbreak where testing capacity constraints meant that only symptomatic cases were being tested. The median age of new cases is also lower, and the medical community is better prepared to deal with COVID-19 patients. Net new hospitalizations have now eased from the recent peak, easing concerns that policy-makers would have to take up strict lockdown measures.

#2: The outlook for vaccines/treatments for COVID-19 is promising

We have been concerned about a renewed wave of infections in the autumn ever since the beginning of the outbreak (we built this into our base case with a forecast that the pace of growth will slow, but not re-enter into sequential decline, around the turn of the year). The issue is that elevated levels of COVID-19 cases could coincide with the traditional flu season (which typically leads to hospitalizations beginning to rise from around mid-November onwards and peaking in January), meaning that there will be a greater strain on hospital capacity during that time period.

However, we are also watching the potential mitigating factors. The additional precautions such as widespread wearing of masks may help to temper the spread of COVID-19 and the traditional flu season. There is also emerging evidence that the current flu season in the Southern Hemisphere is more subdued as compared to previous seasons.

Moreover, treatment options are available today, with the prospect of more to come. In addition to remdesivir, our US biotechnology analysts have highlighted that there are over 20 antibodies in development, and they believe that Regeneron and Eli Lilly are likely to be first to market. They also view antibody treatments as having a high probability of success and expect details of the clinical trials to be released later this summer.

A number of potential vaccine candidates are also entering into phase III trials. Our US biotechnology analysts expect all three companies (Moderna, Pfizer and AstraZeneca) to have a reasonable probability of success in delivering positive phase III results, with potential details released in the September-November timeframe. Manufacturing of these vaccines is already under way and each of these companies are positioned to provide 100M+ doses of vaccines by year-end. This combination of treatments and vaccines will give us another layer of defense against COVID-19.

#3: Don’t forget about the significant support from policy stimulus

Policy support is crucial during the initial stages and, this time around, the scale of stimulus has been unprecedented. As a refresher, the G4 central banks are expanding their balance sheets by 28% of GDP by end-2021 and the G4 and China economies are extending fiscal support of 17% of GDP in 2020. The Fed’s balance sheet will rise to 30% of GDP by end-2021 and the fiscal deficit in the US will rise to 24.6% of GDP in 2020, on our forecasts.

The fact that this is an exogenous shock (i.e., nobody was at fault for causing the recession) has meant that policy-makers have acted quickly. Just this week, we received a welcome upside surprise with the earlier than expected approval of the European recovery fund. In the US, negotiations are ongoing over CARES II and we expect an additional US$1 trillion fiscal package, with the risks skewed towards a bigger package of over US$1.5 trillion (which will take the deficit over 27% of GDP – a post-1943 high). Moreover, considering the outsized impact that the recession has had on lower-income households, central banks and policy-makers have committed to make the recovery as robust as possible, which in turn means that the overall monetary and fiscal policy stance will remain accommodative for some time.

In sum, our big-picture view is that the global economy will continue to make up lost ground, attaining pre-COVID-19 output levels by 4Q20 (DMs by 4Q21). In fact, the recent run of upside surprises in the data in the US and China makes us believe that this might even pan out a bit faster than we originally envisaged. As these economies have already made up a lot of lost ground, they will naturally see a moderate pace of improvement from here and we would also expect to see some month-to-month gyrations in the data. The baton of growth leadership will be passed on to Europe next as it begins to experience catch-up rates of growth.

https://ift.tt/2EgdiGo

from ZeroHedge News https://ift.tt/2EgdiGo

via IFTTT

0 comments

Post a Comment