Inflation Never Mattered Much For Crypto... Until About A Year Ago

Inflation never mattered much for crypto... until about a year ago.

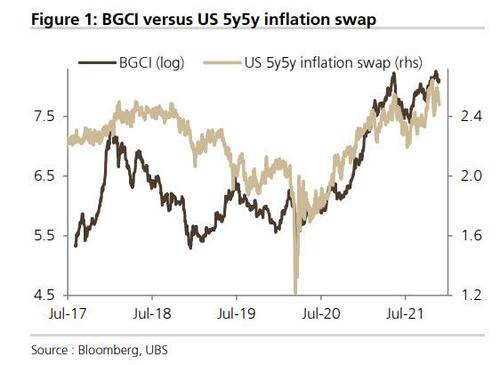

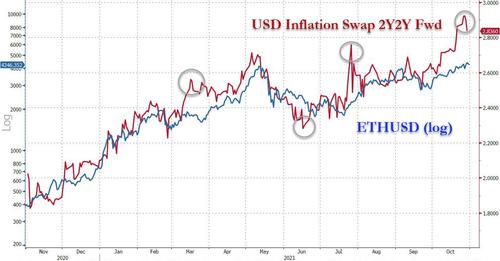

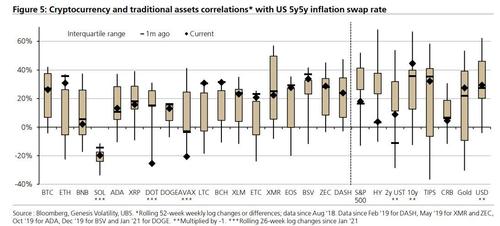

As UBS notes in its latest Crypto Keys note last week, forward-looking measures of US consumer prices today rank among the most prominent correlations for digital assets...

.... something we first pointed out a month ago.

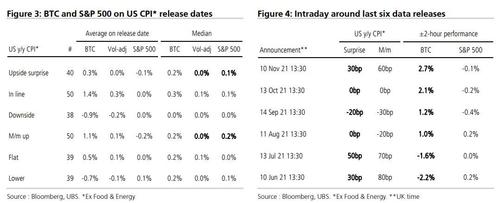

Sensitivity to actual data prints is also mounting accordingly...

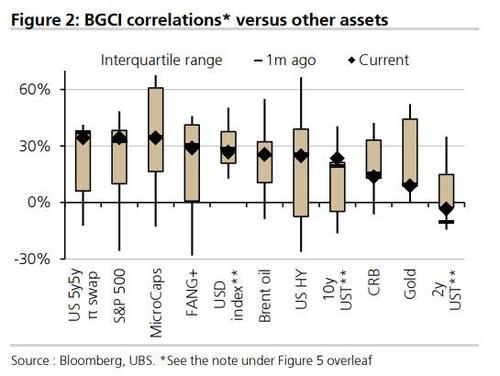

... and as UBS notes, BTC, ETH and a range of more established tokens screen statistically on par with traditional instruments that are considered classic inflation winners or losers.

Co-movement is weaker for newer coins like BNB as well as ADA, SOL, DOT and AVAX, which have strongly outperformed in 2021, along with meme plays like DOGE. But to UBS that seems encouraging rather than surprising when idiosyncratic factors have clearly been driving their price action.

But while inflation clearly has be driving the top cryptocurrencies in the past year, the risk now according to UBS is that more powerful drivers will emerge to dislodge the status quo. Potential candidates could be things like stablecoin regulation, tighter exchange and account registration requirements reducing activity in CeFi and DeFi, and new restrictions on bank participation, all of which could be near-term negatives affecting market liquidity and activity but longer-term positives paving the way for institutional participation. While such things may sound crypto-specific, they mirror conditions that govern how conventional inflation hedging instruments behave.

https://ift.tt/3rhulhL

from ZeroHedge News https://ift.tt/3rhulhL

via IFTTT

0 comments

Post a Comment