Will The Omicron Virus Turn Out To Actually Be Bullish For Stocks

Earlier today, we laid out one trader's view - that of Mizuho's multi-asset strategist Peter Chatwell - why despite the incremental mitigating information gathered over the weekend which clearly eased Friday's liquidation panic and today the Nasdaq wiped out all of its losses, the Omicron variant is decidedly bearish for stocks, and why "a re-test of 4600 appears much more likely here than a rally back to 4700."

His argument, in a nutshell, was that even though Omicron may appear "extremely mild" - so far - it is based on Chatwell's argument that the South African doctor who discovered the strain, Dr. Angelique Coetzee, treated patients who were mainly 40 or younger, and thus "we cannot conclude that the mild symptoms will translate to older populations." Meanwhile, "it looks like Omicron may be more transmissible and vaccine evasive than Delta, meaning it it likely to infect more vulnerable people." This, to Chatwell, means that it has the ability to evade existing immune response may be more important than its expected lower severity of symptoms. As such "governments are likely to remain cautious, biased towards greater social restrictions and partial lockdowns."

Needless to say, this entire bearish argument is based on the forced assumption that even though Omicron is "very mild" for patients below 40 - which incidentally is a trend widely observed in virology where incremental mutations leads to more transmissable but less potent variants - it will somehow prove to be far more dangerous to patients 40 and older.

Perhaps, but one can just as easily argue the opposite which is precisely what we did yesterday morning when we said that since Omicron appears to be a far less stable strain than Delta or previous variants due to its numerous, 30+ spike-protein mutations, "one could make the point that while Omicron could soon become the dominant strain due to its higher R-nought (or pace of transmission), that could be a blessing in disguise as it pushes out the much more dangerous (and more stable) delta strain."

None other than Pershing Square's Bill Ackman apparently read this take because a few hours later, he tweeted what we said, namely that "while it is too early to have definitive data, early reported data suggest that the Omicron virus causes ‘mild to moderate’ symptoms (less severity) and is more transmissible. If this turns out to be true, this is bullish not bearish for markets.”

A thought. While it is too early to have definitive data, early reported data suggest that the Omicron virus causes ‘mild to moderate’ symptoms (less severity) and is more transmissible. If this turns out to be true, this is bullish not bearish for markets.

— Bill Ackman (@BillAckman) November 29, 2021

It's not just us and Bill Ackman that have a decidedly contrarian take on the potential impact of Omicron on risk assets: Deutsche Bank's chief credit strategist Jim Reid was also bullish.

As he wrote in his Daily Reid note overnight, Omicron "could still prove less deadly (as virus variants over time mostly are) but if it is more contagious that could offset this and it could still cause similar healthcare issues, especially if vaccines are less protective."

On the other hand, Reid said, "the South African doctor who first alerted authorities to the unusual symptoms that have now been found to have been caused by Omicron, was on numerous media platforms over the weekend suggesting that the patients she has seen with it were exhausted but generally had mild symptoms. However she also said her patients were from a healthy cohort so we can’t relax too much on this. However as South African cases rise we will get a lot of clues from hospitalization data even if only 6% of the country is over 65s."

Putting these together, Reid says that his "personal view is that we’ll get a lot of information quite quickly around how bad this variant is. The reports over the weekend that numerous cases of Omicron have already been discovered around the world, suggests it’s probably more widespread than people think already. So we will likely soon learn whether these patients present with more severe illness and we’ll also learn of their vaccination status before any official study is out. The only caveat would be that until elderly patients have been exposed in enough scale we won’t be able to rule out the more negative scenarios."

As for why he remains optimistic, he says that "it's dangerous to be positive on covid at the moment but you only have to look at the UK for signs that boosters are doing a great job. Cases in the elderly population continue to collapse as the roll out progresses well and overall deaths have dropped nearly 20% over the last week to 121 (7-day average) - a tenth of where they were at the peak even though cases have recently been 80-90% of their peak levels. If Europe are just lagging the UK on boosters rather than anything more structural, most countries should be able to control the current wave all things being equal."

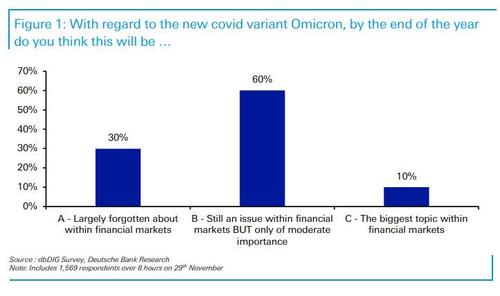

It appears markets now agree with this benign view: in a subsequent report, Reid published the results of a flash poll he conducted earlier this morning, which found that market participants are not expecting Omicron to be a significant event with only 10% thinking it will be the biggest topic in financial markets at year-end (C). The vast majority - or 60% - thought it would still be an issue but only of moderate importance (B), with 30% thinking it will be largely forgotten about (A).

There are two ways to read this data: on one hand it shows that markets are not set up for bad news on this front. So, negative Omicron news is likely to be bad for markets without huge additional stimulus. On the other hand, perhaps just this time Wall Street consensus is due to finally be right...

https://ift.tt/3DcimVi

from ZeroHedge News https://ift.tt/3DcimVi

via IFTTT

0 comments

Post a Comment