A Puzzled Wall Street Reacts To Powell, And The Market's Furious Melt Up

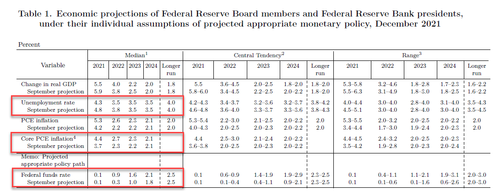

Heading into today's FOMC, consensus was clear: anything more than 2 rates hikes in 2022, a year-end core PCE above 2.5%, and an upward shift in the 2024 dot (from 1.75%) would be viewed as clearly hawkish and would spark concern in the markets that the Fed is tightening too fast.

And yet, despite the Fed clearly hawkish pivot which among other things, also saw the retirement of the word "transitory", stocks initially sank only to soar, before closing at session highs, just above 4,700 and not too far from all time highs.

Time having second thoughts pic.twitter.com/suRlUpSzJC

— ForexLive (@ForexLive) December 15, 2021

Of course, for those who have seen enough Fed days in their time, nothing that happened today was unexpected, because with sentiment heading into the 2pm announcement at rock bottom, there was only one that the market could respond: up.

Everyone expecting stocks to tumble after the FOMC. You know what that means

— zerohedge (@zerohedge) December 15, 2021

And more to the point, while the market reaction was clearly downbeat after the hawkish statement, it was Powell's dovish press conference that was the real trigger...

... just as we expected it would be.

The usual good cop/bad cop combo - hawkish statement, means now Powell will be dovish during the presser

— zerohedge (@zerohedge) December 15, 2021

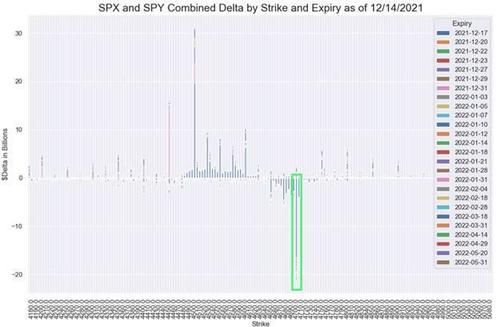

There are of course other explanations: one is that having hedged aggressively into the FOMC, with bearish sentiment soaring, the only possible trade was to unwind hedges, triggering a massive gamma squeeze higher, just as Nomura's Charlie McElligott predicted earlier today.

And speaking of overhedging, we reminds readers that according to McElligott, heading into Wednesday the 10-day average of the Cboe put-call ratio hovered near the highest level in 13 months as total equities put volume over the past 50 days climbed to an all-time high! No wonder that with this positioning, the market was ripe for a bounce should a “hawkish surprise” scenario be avoided (spoiler alert: it was avoided).

“It seemed like there was some hedging demand into the event, perhaps relief that the event has happened, regardless of outcome,” said Danny Kirsch, head of options at Cornerstone Macro LLC. “The event is gone, sell your hedge and move on.”

Yet others, those who goalseek narratives for a living, such as former NY Fed BIll Dudley, saw a hidden message in Powell's remarks:

“What I took away from the press conference was Powell is pretty upbeat about the economy,” Dudley said on Bloomberg TV.

What Dudley did not say is how it is possible that the Fed sees stronger GDP, a higher inflation and lower unemployment when predicting 3 hikes today, compared to September when every economic parameter was weaker yet when the Fed forecast just one rate hike. Does the Fed even know what "tightening" means? (If not, it very soon will...)

Dudley aside, what started as a rally driven by positioning quickly drew in momentum chasers and other buyers, many of whom were either short or were easing their bullish bets in the past month as the omicron variant emerged and Powell signaled a change in heart on price gains. As we reported last week, according to Goldman Prime, hedge funds slashed equity exposure at the fastest pace since April 2020 as their concentrated bets in speculative software firms came under fire with the specter of higher rates putting pressure on richly valued stocks. And, as Bloomberg notes, there are signs that such skepticism has been walked back. A basket of expensive software shares jumped 2.8% Wednesday while an exchange-traded fund tracking hedge-fund favorites added 1.5%.

“The markets were sufficiently de-risked and positioned for a hawkish statement,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group. “The markets have rallied a bit here because we saw investors gross down into the event, and now that the event/overhang is over we are beginning to see a little bit of market strength after the event.”

But while in retrospect, trading the Fed today was especially easy if one ignores all fundamental and analytical insight and just focuses on positioning, flows and historical precedent, many financial professionals were confused as their kneejerk commentary following the Fed revealed. Below we present some of the more notable hot takes from around Wall Street.

Mohamed A. El-Erian, Advisor to Allianz:

"A notable shift in #Fed policy that’s slightly more hawkish than consensus expectations (though somewhat less than what I think is needed). The doubling of the taper comes with an increase in the #inflation forecast and more aggressive signaling of rate hikes. Press conference key"

Sam Stovall, chief investment strategist at CFRA Research:

“The assumption is that this outcome was largely built into equity expectations. Because the FOMC was not more hawkish, equities are breathing a sigh of relief and reversing course -- at least for now.”

Brian Coulton, chief economist at Fitch Ratings:

“This is a major pivot from the Fed, prompted by clearer evidence that inflation is broadening. ... Most significantly, inflation is described as having already exceeded 2 per cent ‘for some time’, so it looks like the Fed feels enough progress has now been made in compensating for earlier shortfalls in inflation.”

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance:

“Although the stock market moved higher during the press-conference, the sectors leading the market higher (e.g. Utilities and Healthcare) are both very defensive sectors and indicate some concern about the future path of the economy.”

Matt Maley of Miller Tabak & Co. says this about the positive market reaction:

“It seems like people are playing ‘buy the news,’ but when the Fed gets more hawkish at a time when the stock market is as expensive as it is today, investors are playing with fire. I’d also say that some investors are taking the comment that the Fed can adjust policy further if it is warranted as saying they can become more dovish if the economy slows too quickly.”

Chris Harvey, head of equity strategy at Wells Fargo:

“We believe the initial positive equity market reaction is due to investors gaining confidence in the Fed’s willingness and ability to fight inflation. As a result they are decreasing the odds of stagflation and policy error.”

Bill Northey, U.S. Bank Wealth Management:

“It’s not uncommon following a monetary policy announcement to have some volatility. In fact, the initial direction following the announcement oftentimes is not the direction that we conclude the day with. "

Sylvia Jablonski, chief investment officer at Defiance ETFs:

“It gives me more confidence to buy on these dips off of 52 week highs. We shouldn’t forget that the economy is actually expanding, and less stimulus is needed. None of this is bad news for the market.”

Cheryl Smith, economist and portfolio manager at Trillium Asset Management

“There is still a significant difference between the unemployment rates for White and Black Americans at all levels of education and age. Further, participation rates are still well below the pre-pandemic level.”

Ian Shepherdson, chief economist at Pantheon Macroeconomics:

“The upshot of these new forecasts is that the Fed has moved into line with market thinking. The key question now is the timing of the first hike. If it weren’t for Omicron, we’d expect it in March, but experience elsewhere signals that the U.S. is about to see a massive, unprecedented surge in Covid cases, with unknowable -- but likely temporary -- consequences for the economy. We think this will delay the first hike until May, with the next moves in September and December.”

Here’s Bankrate.com chief financial analyst Greg McBride:

“The Fed retired the word ‘transitory’ from their statement and gave strong indications that they’re poised to hike interest rates once they deem the labor market to be at full employment. Definitely a more hawkish tone, and the most we have seen in some time -- similar to inflation.”

Jan Hatzius, chief economist at Goldman Sachs

"The FOMC revised the statement to acknowledge that inflation has “exceeded 2% for some time” and removed language in the previous statement that said that “with inflation having run persistently below” 2%, it would aim to achieve inflation “moderately above 2 percent for some time” and expected to maintain an accommodative stance until that goal is achieved."

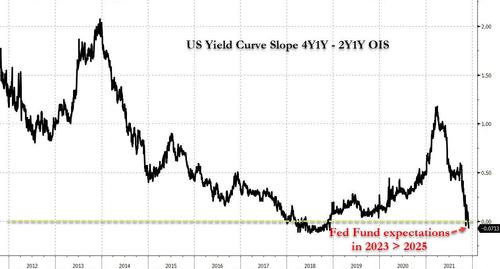

At the end of the day, the simplest explanation is probably the right one, and it is the one we showed two weeks ago, namely that the forward yield curve has already inverted (rates in 2025 are seen as lower than 2023)...

... suggesting that the market is delighted by the Fed's aggressive tightening plans because they will crash and burn and force Powell to end tightening in the near future and then immediately start the next easing cycle. In other words, the Fed's tightening cycle is over before it has even begun, and yes that means the time to frontrun the next mega bubble has arrived.

https://ift.tt/3ISPfu5

from ZeroHedge News https://ift.tt/3ISPfu5

via IFTTT

0 comments

Post a Comment