Beijing Signals Growth-Pain Threshold Is Reached

By Ye Xie, Bloomberg Markets Live commentator and analyst

Three things we learned last week:

1. Beijing’s focus has shifted to propping up the economy. The statement from the annual Central Economic Work Conference, where leaders set the economic strategy for the next year, signaled Friday that it’s a priority now to put a floor under the economy. It mentioned the words “stability” or “stabilize” 25 times, compared with 13 last year. Policy makers pledged to push forward infrastructure investments and cut fees and taxes. While it kept the mantra that housing is not for speculation, the authorities said they support reasonable demand for homes.

The statement left out last year’s phrase that Beijing will keep the leverage ratio steady. The omission got some economists’ attention because it may suggest more monetary policy easing. But China Bull Research cautioned not to read too much into it because the CEWC didn’t mention the leverage ratio in 2019 either.

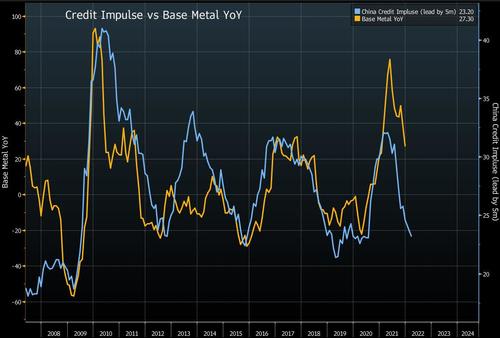

So now what? Credit growth seems to have bottomed, but how far it can run up again is unknown as the broad control of the housing market remains intact. Investors are nonetheless encouraged that the macro policy mix is becoming more market friendly. Foreign investors added a record 49 billion yuan ($7.7 billion) via the northbound stock connect last week, while iron ore has gained about 30% since the low in mid-November.

The next window to read the policy tea leaves comes on Wednesday when MLF loans mature. After the recent RRR cut, there’s speculation that the PBOC may lower the MLF rate, when the loans are rolled. It will come on the same day the Fed announces its policy decision. It sets up a potential show of the policy divergence between the Fed and PBOC (as first discussed here last week in "China Shifts To An Easing Mode While "Ex-China" Is On A Tightening Path").

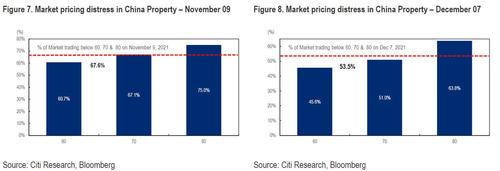

2. Evergrande’s landmark default didn’t cause turmoil. Fitch labeled Evergrande and Kaisa Group as defaulters last week. But the tone of the junk bond market has improved after various policy tweaks.While default by the weakest credits are still likely, the BBB-/BB space is oversold, according to Citigroup’s credit strategists including Eric Ollom. They recommend buying a basket of junk bonds, including Country Garden, Shimao, Sino-Ocean and Sunac China.

3. PBOC is drawing a line in the sand on the yuan. The central bank Thursday raised the foreign-exchange reserve, effectively draining the dollar supply to alleviate the appreciation pressure on the yuan. On Friday, the central bank set the fixing far weaker than analysts expected. While the one-two punch weakened the yuan a bit, the currency is not far away from the strongest since 2018. Monday’s fixing will be closely watched. There’s a risk that the counter-cyclical factor (CCF) will be re-introduced to add a weakening bias to the official fixing price.

https://ift.tt/3GA1sSv

from ZeroHedge News https://ift.tt/3GA1sSv

via IFTTT

0 comments

Post a Comment