BoJ Panics, Unleashes Short-Term Liquidity For First Time Since 2006 Amid Repo Spike

A sudden panicky surge in Japanese repo rates prompted The Bank of Japan to unleash a rarely-used tool in an attempt to tamp down any liquidity crisis before it accelerates.

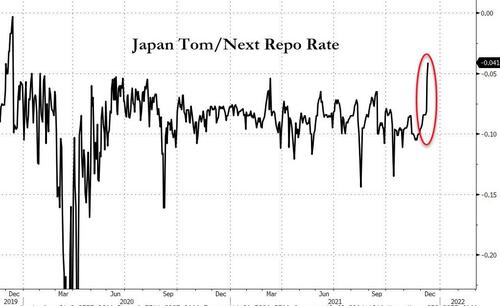

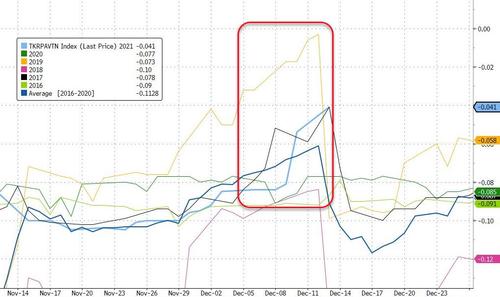

Tom/Next repo rates (the one-day repo rate for transactions starting next business day), surged early in the day to their highest in 2 years...

Though this is not all that unusual - given the year-end timing - it is notable in terms of the sudden velocity of the move...

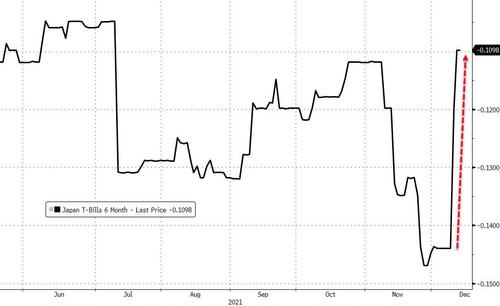

Specifically, BoJ offered to buy 2 trillion yen ($17.6 billion) of government bonds under repurchase agreements (which will be sold back to the market on Tuesday). Despite drawing 1 trillion yen of offers to sell at the BoJ's capped rate, the repo rate still climbed as did the Japanese T-Bill yield

As Bloomberg reports, this is the first time since 2006 that the authorities have conducted a repo operation to buy bonds that started on the same day as the announcement.

“The BOJ probably conducted the operation in response to funding demand as repo rates surged,” said Kenji Sato, a manager in Tokyo at Central Tanshi Co., a money-market dealer.

“The BOJ reasserted its stance of not tolerating a rise in short-term interest rates above zero.”

The surge in repo rates was probably driven by dealers who needed to fund their purchases of T-bills, said Naomi Muguruma, a senior market economist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo. Overseas investors, who are the major buyers of the securities, may be cutting back on trading levels before the Christmas holidays, reducing liquidity in the T-bill market, she said.

Some have also suggested that ahead of this week's much-anticipated Fed meeting, liquidity is in great demand, as evidenced by the resurgence of borrowing at The Fed's repo window (80 counterparties took $1.60 trillion down)...

While no immediate panic is warranted, it is worth keeping a close eye on these arcane markets, especially as a number of 'bubble' markets are imploding as The Fed tapers.

https://ift.tt/3GG3RLr

from ZeroHedge News https://ift.tt/3GG3RLr

via IFTTT

0 comments

Post a Comment