Erdogan Fires Turkey's Finance Minister, Replaces Him With Rate Cut-Friendly Puppet

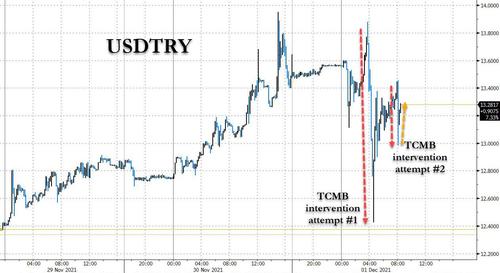

In retrospect, it should have been obvious that something big is coming out of Turkey today when overnight the central bank intervened in the FX market (both spot and futures) for the first time since 2014 to halt the ongoing rout in the Turkish lira.

Well, that something was revealed just around midnight Turkish time, when President Recep Tayyip Erdogan announced he was firing Turkey’s finance minister, Lutfi Elvan, who vacates his post after a little more than 12 months in office and will be replaced with Nureddin Nebati, according to a decree published in the Official Gazette. Incidentally back in 2018 when the Turkish Lira collapse first started in earnest, Erdogan appointed his son-in-law Berat Albayrak as finmin - the clearest sign at the time that Turkey's economy was set for a spectacular collapse.

And so, having already fired virtually every central banker in the past 3 years just to appoint hand-picked puppets, Erdogan has now moved to other branches of the banana republic.

The termination exposes growing rifts in Erdogan's administration over a string of aggressive interest-rate cuts that have undermined the currency.

While not much is known about the country's new finance minister, who until today was deputy finance minister, last week Nebati has was quoted by the local press as saying that the country is determined to continue with its policy of interest rate cuts.

The article in DuvaR, said that the Deputy Finance Minister Nureddin Nebati said in a series of tweets late on Nov. 25 that Turkey is determined to continue a policy of interest rate cuts, and "manipulative attacks" on the lira, which has plunged to all-time lows this week, will not leave any lasting damage

"Since 2013, every time we attempted to implement our low interest rate policy, we were met with strong opposition. This time, we are determined to carry this out", he wrote.

"The manipulative attacks waged on the Turkish Lira over our low interest rate policy will not seriously damage our economy," he said. "Though there were turbulences in the real sector with the last exchange rate attack, our economy maintains all of its strength," he added.

8) 2013’ten beri düşük faiz politikamızı her uygulamaya yeltendiğimizde güçlü bir itirazla karşılaştık. Bu sefer bunu uygulamada kararlıyız.

— Dr.Nureddin NEBATİ🇹🇷 (@NureddinNebati) November 25, 2021

Prophetically, the article also quoted the lead of the Opposition İYİ (Good) Party Meral Akşener who has said that Nebati's messages "signaled that Treasury Minister Lütfi Elvan might be ousted soon and that "Mr. Nebati is our new minister candidate."

In retrospect, he was right.

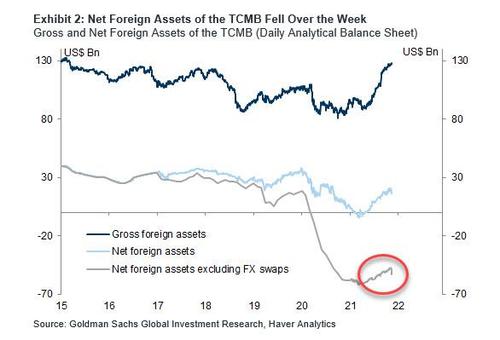

And now, the question becomes just how active will the Turkish central bank be in the FX market as it seeks to halt any further selling of the lira, and how long before one or more significant FX players team up and drain the central bank of all of its - already negative on a net basis - reserves...

... before the central bank capitulates, sending the lira into a hyperinflationary collapse.

https://ift.tt/3DdvCJ9

from ZeroHedge News https://ift.tt/3DdvCJ9

via IFTTT

0 comments

Post a Comment