Goldman: Are We Starting To See What The "New Normal" Looks Like?

By Goldman strategist Chris Hussey

New Normal?

US stocks traded sharply lower Friday, and on pace for another decline this week, as investors reacted to a new virus variant, strong business sentiment surveys, and Friday's decidedly mixed labor report -- and contemplated how to position into a now-volatile year-end.

...is this what it looks like?

As we leg further into the last month of 2021 and the post-pandemic era, this week may be raising the question: are we starting to see what the 'new normal' looks like?

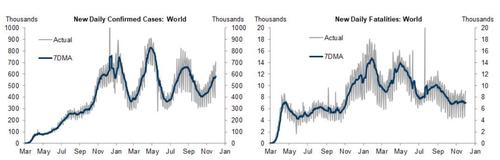

It's not unreasonable to look at the Omicron variant as an anomaly that 'surprises' markets and represents a left tail risk. But after enduring the original COVID-19 outbreak followed by waves from the Beta and Delta variants, investors may be determining that COVID waves are becoming a regular thing -- seasonal like the flu the perhaps.

For now, we don't yet know how much of an impact the Omicron virus will have, but what we might be learning is that the virus is still having an impact, even if that impact is not as great as it first was back in early 2020.

And beyond the virus, this week may also have delivered a clearer view of what else may become 'normal' in the post-pandemic era: from inflation, to labor, shopping, sentiment and volatility. A few things to consider:

- high inflation. Leading into this week, our economists revised our forecast for Fed Fund rate hikes to 3 in 2022, from 2, as inflation is remaining remarkably sticky. Fed Chair Powell's testimony before Congress earlier this week only reinforced our view that the FOMC is concerned about high inflation. And high commodity prices are unlikely to provide a relief valve for inflation pressures as Jeff Currie discusses in the latest Commodity Watch. We now see a 28%+ total return for commodities over the next 12 months.

- tight labor. Friday's payrolls report revealed that fewer non-farm payroll jobs were added in November (210k vs 546k a month earlier) but also that fewer people are unemployed than expected (the unemployment rate fell to 4.2%). So while its tempting to look at the 210k new job adds as a disappointing indicator of US growth, the 4.2% unemployment rate may tell us more about the economy -- everyone who wants a job, has one. Also interesting in Friday's report, despite the ultra-low unemployment rate, wage growth moderated to +0.3% mom from +0.4% a month ago. But will wage pressures continue to ease in a world where so few are looking for a job but 'Help Wanted' signs seem to appear on every store you walk by? One other note on payrolls: from December 2011 through February 2020 (8 years+ of pre-pandemic data), monthly non-farm payroll additions averaged 200k (meet the new payrolls, the same as the old payrolls).

- Black Friday now takes place on Black Monday. The post-Thanksgiving holiday shopping stats have been somewhat uninspiring, another reason, perhaps, to doubt the growth pace of the US economy. But Eric Sheridan and Kate McShane point out that people are still shopping, they just are starting their holiday shopping a lot earlier than they used to. Perhaps people are starting to shop on October 19th rather than November 29th. And our weekly retailer activity tracker continues to show strong shopping activity throughout November.

- Business sentiment is very strong. On Friday, the ISM Services index was reported to have reached a new all-time high at 69.1. And the ISM Manufacturing Index rose to 61.1 in the latest survey -- near its highest level in the last 10 years (only this past March's spike to 64.7 exceeds November). Supply chain bottlenecks partly reflect the strong demand for industrial products and the inflationary impulse that such bottlenecks support. But the strong business sentiment may also reflect how Corporate America is adjusting to the 'new normal' of the post-pandemic era -- and likes what it sees.

Stock market volatility is high. In the past week, the VIX has spiked back up to 32, highlighting the uncertainty that is permeating around stocks now.

As we wrote in Thursday's Midday, "price discovery," the spike in volatility appears to simply reflect the increased difficulty in determining the price of risk assets in a world of rising inflation, virus waves, and normalizing growth. And as we step into the 'new normal', perhaps such uncertainty is likely to persist such that volatility remains elevated for longer than we have seen in past cycles. One other note on the VIX: in the 3+ years prior to the pandemic from December 2016 through late-February 2020, the VIX had a median weekly level of 13. Since the VIX picked up on the pandemic risk in late-February 2020, the VIX has registered a median of 22.

One last item for the 'new normal' file: rates. While the stock market is going through another bout of elevated uncertainty and a spike in the VIX, yields on 10-year Treasuries have retreated back to 1.36%, well above the lows we saw at the heart of the pandemic in 2020, but at the very bottom of the range we experienced in the post-Great Financial Crisis era. Praveen Korapaty forecasts that yields will rise to 2.00% by year-end 2022 but it is interesting to see that as the economy 'normalizes', yields on 10-year Treasuries are not pushing higher -- even as inflation does. Inflation markets this week began to price in less inflation in the future -- contributing to the lower 10-year yield. But regardless of the technical factors that may be holding rates down, an ultra-low 10-year Treasury yield has provided a good backdrop for stock price appreciation in the past - especially the Tech-laden, 'long duration' US stock market.

Interesting fact: beyond the Tech-laden, 'long-duration' S&P 500, index returns this year have been quite a bit less impressive. The Russell 2000 Small Cap stock index, for example, is now up less than 10% for the year.

https://ift.tt/3diIbIx

from ZeroHedge News https://ift.tt/3diIbIx

via IFTTT

0 comments

Post a Comment