Is The Fed As Hawked Up As The Market?

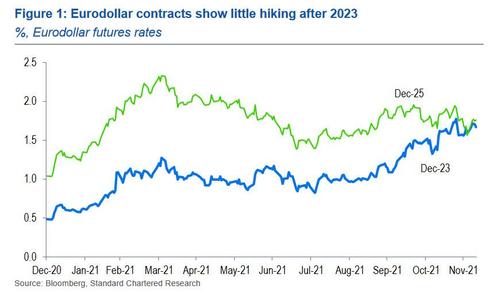

As Standard Chartered's chief FX strategist Steven Englander writes in his FOMC preview, the possible outcomes at the 15 December Fed meeting range from a modest acceleration of the taper to a sharp acceleration that reflects acute inflation worries, signalling a fast pace of rate hikes. "Our client discussions suggest that market participants see a significant risk of a sharp taper acceleration" Englander writes and sure enough, investors are pricing in almost three 25bps hikes by end-2022 and six by end-2023. But as we showed two weeks ago, Dec 2025 Eurodollar rates are no higher than for Dec 2023, suggesting a short-lived hiking cycle.

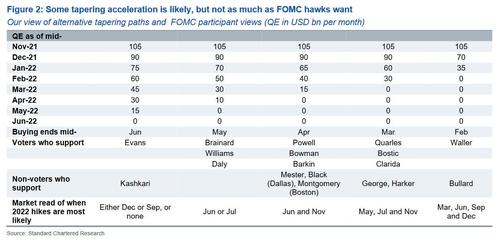

Echoing consensus, Englander expects the FOMC to accelerate to a 25BN per month taper pace starting in mid-January 2022, and to end balance-sheet expansion (QE) in mid-April. This, the FX strategist claims would tee up the mid-June meeting as the first ‘live’ meeting for rates, although the FOMC might not hike at the first opportunity. Futures markets price in a ~70% chance of a rates move by the early-May FOMC, and just over a full hike by the June meeting. An implied mid-April end to QE (as we expect) would likely be viewed as somewhat dovish, while a March end would raise the risk of a May hike and be seen as hawkish. Needless to say, the faster the taper, the faster investors are likely to expect subsequent hikes. It would be hard for the FOMC to signal convincingly that a February or March end to QE is consistent with a H2 rates lift-off.

A tapering acceleration to $25BN/month announced in December’s meeting may offer slight relief to USD rates given current Fed hike pricing, but the market could still speculate that the FOMC may opt to accelerate further at its next meeting in January.

Indeed, if the dovish spin that Englander expects materializes, the USD will face pressure, particularly if Powell argues convincingly that inflation could be close to a peak. G10 and EM commodity currencies have been the hardest-hit in the latest ratcheting up of Fed and inflation fears, so they would probably gain the most on an easing of these worries. Risk assets would also soar.

Investors will also be reading Powell’s lips, assessing whether his baseline stance has shifted fundamentally in a hawkish direction, and how emphatically he maintains that rate hikes will not necessarily immediately follow the end of QE. If Powell emphasizes data dependence, downplays inflation and policy rate forecasts, and de-links rate hikes from the end of QE, these would be indications that he still sees the possibility of an inflation pullback before a hiking cycle becomes well entrenched. Then watch stocks explode higher.

The market’s first focus will be the taper schedule

The decision on accelerating the taper schedule is made by FOMC voters. In Englander's view, the 2021 FOMC voters are still somewhat dovish on the whole (Figure 2). Powell’s repeated reference to ending balance-sheet expansion “a few months sooner” suggests to us that the end date will move two months earlier to April. “A few” is more than one, and it is unlikely he wants to end QE as early as mid-March no matter what terms Biden has given him.

In market terms, ending balance-sheet expansion in mid-March would mean that three 2022 hikes are firmly on the table. With almost three hikes already priced in, this would constitute a small hawkish surprise. If QE ends in mid-April, the market would probably see June as the most likely month for rate hikes to begin.

Std Chartered currently expects just one policy rate hike in Q3-2022, and April is the most likely timing for the end of QE. However, conditions may be different when policy rate hikes are considered. There may be new dovish FOMC members, the US economy may have slowed, employment growth among low-wage workers may stall, and inflation could begin to slide. Policy decisions that look straightforward now could look very different six months down the road.

If current inflation and economic conditions remain in place when rate hikes are under discussion (after QE has ended), more hikes are likely. But if conditions change, so will the policy rate outlook – and the Powell FOMC may not go full hawkish if it sees a way out based on changed conditions. A tapering schedule that now appears to point to two hikes may not play out that way if inflation pressures ease.

Hawks and doves believe in alternate forms of immaculate disinflation

Hawkishness has become so fashionable among analysts and policy makers, reflecting upside inflation moves in recent months, that few hawks bring up the sacrifice ratio – the output loss required to get inflation down. Historically, reducing inflation has required an increase in unemployment.

Englander's read of September FOMC projections does not indicate that participants saw reducing inflation as requiring an increase in the unemployment rate – the unemployment projections appeared to be headed uniformly downwards. However, the narrative that inflation can be brought down without pain has not worked out well in the past.

This is worth noting because it is easier for central bankers to sound hawkish when growth is strong and the unemployment cost of disinflation is remote. It may be less easy to move aggressively in the middle of a midterm election year if employment growth has slowed to around trend and segments of the workforce are still lagging badly in regaining lost jobs

And while Doves were proven wrong in their view that inflation is transitory, they remain consistent – and if inflation falls on its own and underlying inflation has not picked up too much, then the case for aggressive policy moves is not strong. The key parameter for both hawks and doves is how much inflation is left after transitory inflationary forces fade. Doves would argue that services ex-energy inflation has not shifted off its pre-COVID trend, and that prices of goods ex-food and energy are likely to fall at some point, then rise much more slowly than they have since COVID hit. But that assumes only a mild pick-up in services inflation and a sharp fall in goods inflation.

What about the dots and inflation forecasts?

The December FOMC projections are expected to show a two-hike median in the dot plot for 2022, with four or five FOMC participants at zero or one hike, and six (including Powell) at two. For 2023, Englander expects the median to shift to three additional hikes, taking the projected fed funds midpoint to 1.375%. Then, in 2024 median will be at 2.125%, reflecting a move to equilibrium rather than inflation- induced tightening. At least four participants will expect to see fed funds at 1.875% or higher by end-2023. The spin is likely to be that most participants expect both maximum employment and inflation targets to be hit in 2022, so these are market-friendly hikes aimed at gently approaching neutral. The high projections will represent the views of FOMC participants who see inflation risk as severe.

The FOMC’s projections reflect policies that FOMC participants see as appropriate for reaching targets. The 2.3% September core PCE median for 2022 is likely to be revised upwards to at least 2.4% or 2.5%, reflecting fears of persistent inflation. But the 2023 and 2034 forecasts will likely be considerably lower since the FOMC is assumed to follow the policy needed to get back towards target. Our 2022 forecast (Q4/Q4) is 2.6%, and we expect significant disinflation from Q2 onwards.

The September median core PCE forecast of 2.2% for 2023 will require either very good luck on inflation outcomes or tighter policy moves. But the FOMC does not have much leeway on 2023 inflation projections, because the assumption is that appropriate policy is followed – and inflation tolerance is unlikely to be seen as appropriate policy. The FOMC’s GDP and unemployment projections are unlikely to signal anything that looks like a slump. Markets could be puzzled by a projected deus ex machina decline in inflation on the back of consistently negative real policy rates, which enables the FOMC to resume a measured pace of returning to neutral but does not depend on inflation being “transitory”

Omicron supply shocks and policy rates

The market (and FOMC) consensus is that negative supply shocks are inflationary – this was not clear in Q2-2020 but is now broadly accepted. The FOMC is unlikely to react explicitly to Omicron at the 15 December meeting, or even declare how it would react. Powell is likely to describe Omicron as a downside risk that the FOMC will deal with as its economic and price impact becomes clear. If pushed, he may indicate the importance of matching supply and demand over the long term. This could mean less accommodation unless it becomes clear that the impact will be temporary. We do not expect Powell to directly indicate a policy response

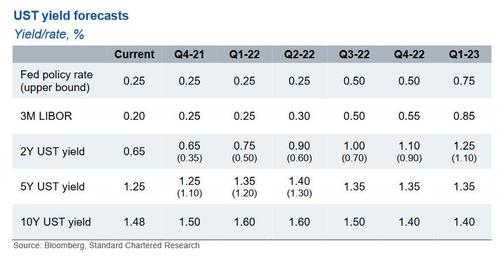

UST yield forecasts – Catching up with our core flattening view

Englander has held a core curve-flattening view since Q2, centered on the 5Y/30Y; the spread has narrowed by more than half since then. He expects the flattening bias to shift increasingly to the 2Y/10Y spread in 2022. Given Powell’s hawkish shift in late November, along with Omicron-related uncertainty, the gap between the 2Y/10Y and the 5Y/30Y spreads has subsequently narrowed by around 20bps. Expect further curve flattening for the year ahead.

In 2022, additional upside will be focused more on the 2Y sector than the 5Y given concerns about the proximity of Fed policy rate lift-off. Englander therefore raises his 5Y yield forecast for end-Q2-2022 slightly to 1.40% from 1.30%, and increase our 2Y yield forecast to 0.90% from 0.60%; he maintains his end-2022 5Y and 10Y yield forecasts for now, but raises 2Y forecasts to 1.10% from 0.90%. Still, the Fed will ultimately hike rates more slowly that market pricing implies. Hence, it is worth noting that 1Y forwards imply a 2Y UST yield around 1.35%.

https://ift.tt/31YpTKv

from ZeroHedge News https://ift.tt/31YpTKv

via IFTTT

0 comments

Post a Comment