November Payrolls Preview: Strong Enough To Justify The Accelerated Taper?

With Powell's Fed having telegraphed it will accelerate the taper at this month's meeting so it can start presumably start hiking as soon as June of 2022, the November payrolls report may be moot although traders will be looking for barbell signs: will it be strong enough to validate an accelerated taper, or could it come so far below expectations that the Fed will be forced to delay its taper-boosting plans.

Looking at the expectations, Newsquawk reminds us that analysts look for 550k nonfarm payrolls to be added to the US economy in November, similar to October's 531k; the jobless rate is seen falling by one-tenth of a percent to 4.5%. While as noted above the Fed appears almost certain to announce a quickening in the pace of QE tapering, analysts will be carefully watching measures of labor market slack to gauge the progress towards the Fed's 'three tests' for rate hikes: i) Participation was unchanged in October, ii) employment-population ticked up by 0.1ppts, while iii) the U6 measure of underemployment fell 0.2ppts.

With the inflation tests met, the labor market data will form a key part of the Fed's arguments for rate hikes, and any significant improvement in these metrics may see markets further price in tighter rates next year. Meanwhile, labor market gauges have generally been constructive in November: the rate of initial jobless claims going into the November survey period improved relative to the October window; ADP's gauge of payrolls was in line with expectations, though the pace eased vs October; business surveys saw employment sub-indices improve and are alluding to a very tight labor market, while today's Challenger job cuts fell to the lowest since 1993.

Here is a summary of expectations:

- Nonfarm payrolls are expected to print 550k in November vs 531k in October (private payrolls expected at 530k vs 604k prior,

- manufacturing payrolls expected at 45k vs prior 60k);

- the 3-month average nonfarm payrolls trend rate eased to 442k in October (vs 629k in September),

- the 6-month average rose to 666k (from 622k) and the 12-month average eased to 481k (from 494k).

- The unemployment rate is seen declining by 0.1ppts in November to 4.5%;

- Labor market participation was unchanged at 61.6% in October (vs 63.6% in February 2020),

- U6 underemployment declined by 0.2ppts to 8.3% (vs 7.0% in February 2020), and the employment-population ratio rose 0.1ppts to 58.8% (vs pre-pandemic 61.1%).

- Average hourly earnings are seen rising 0.4% M/M, with the annual measure expected to rise by 0.1ppts to 4.0% Y/Y,

- Average workweek hours are likely to be unchanged at 34.7hrs.

POLICY FOCUS: Fed Chair Powell this week delivered hawkish testimony to lawmakers, where he stated that the economy had continued to strengthen, the labor market had continued to improve, and he sees inflation moving down significantly over the next year. He added that it was appropriate to consider wrapping up the tapering of asset purchases a few months sooner, which participants will discuss at the December FOMC. Powell telegraphing the debate in advance may have taken some of the sting out of incoming economic data -- the rationale being that the Fed is set to accelerate the taper barring any significant deterioration in labor market and inflation data before the December 15th confab -- but Powell still suggested that there was a three-part test for raising rates (economy at maximum employment, inflation at 2%, inflation on track to moderately exceed 2% for some time);

Fed officials have attempted to break the link between tapering and eventual rate hikes, but forward-looking markets will be assessing incoming data within the context of the three tests, and will price expectations of the Fed rate hike trajectory accordingly. The inflation test has been met, but Powell said there was still ground to cover to reach maximum employment, though he has previously said that could be achieved by the middle of next year; this week's labor market data, therefore, remains a key part of the eventual rate hike debate.

SLACK: Taking an aggregate of the headline since March 2020, there are still some 4.44mln nonfarm payrolls to be recouped to get back to pre-pandemic levels. Goldman Sachs explains that it has been childcare constraints and elevated fiscal transfers which have likely weighed on participation, but these factors should have only a small effect going forward, but it may still take some time for some people to feel comfortable in returning to work, leaving some potential for longer-lasting drags. "We continue to expect that the labor force participation rate will increase in the nearterm, but we have nudged down our participation rate forecast to 1ppt below trend at end-2021 (61.9%) and 0.5ppts below trend at end-2022 (62.1%)," the bank says, "but because jobs are abundant and residual weakness in participation in mid-2022 will likely be due to changes in fiscal policy, wealth, and worker preferences, we expect that the FOMC will judge any participation shortfall that remains at that point to be structural or voluntary and will update their maximum employment goal accordingly."

JOBLESS CLAIMS: In the week that traditionally coincides with the BLS survey window for the jobs report, initial jobless claims were little changed at 270k from the prior week's 269k; but since the October jobs report survey window, claims have eased from 351k. Continuing claims, meanwhile, printed 2.049mln in the survey week, down from 2.11mln in the prior week, and lower than the 2.81mln in the October survey period. Pantheon Macroeconomics said that the trend in initial jobless claims remains firmly downward, but the read may not be clear in the holiday season: "Unfortunately the numbers will be volatile over the holidays, as usual, and the next clean read on the data will be in mid-January," and by then, "we think claims will be close to the lows seen in the pre-COVID cycle, about 210K."

ADP: The ADP's national employment gauge saw 534k job additions to the US economy in November, more or less in line with the 525k forecast; the prior was revised down trivially by 1k to 570k. ADP's economists noted that the labor market recovery continued to "power through" its challenges last month. "Job gains have eclipsed 15 million since the recovery began, though 5 million jobs short of pre-pandemic levels," ADP said, "service providers, which are more vulnerable to the pandemic, have dominated job gains this year." On the pandemic, ADP's economists said it was too early to tell if the Omicron variant could potentially slow the jobs recovery in coming months.

BUSINESS SURVEYS: Within the ISM manufacturing report, the employment index rose by 1.3 points to 53.3, remaining in expansion for a third month, with the report noting some indications that the ability to hire is improving, though this is being partially offset by the challenges of turnover and backfilling. "Survey panellists’ companies are still struggling to meet labour-management plans, but there were modest signs of progress," ISM said, "an increasing share of comments noted improvements regarding employment," where "an overwhelming majority of panellists indicate their companies are hiring or attempting to hire." 51% of those surveyed were expressing difficulties in filling positions, with the situation becoming more acute in the month. Meanwhile, the services ISM is released after this month's jobs data, but using the IHS Markit flash November PMIs as a proxy, similar themes have been seen. IHS Markit said that pressure on capacity persisted amid labour shortages, with backlogs of work rising at the second-fastest pace on record. "Firms sought to expand their workforce numbers, but employment growth was held back by challenges finding suitablecandidates."

JOB CUTS: Challenger's November report said that announced job cuts had dropped to 14,875 from the 22,822 in October, the lowest monthly total since May 1993. Year-to-date, employers have announced plans to cut 302,918 jobs from their payrolls, the lowest January-November total on record, and vs 2,227,725 vs the same period in 2020. Challenger said that "with the Omicron variant emerging and the unknowns that come with its spread, coupled with the ongoing difficulty hiring and retaining workers, it’s no surprise job cuts are at record lows," adding that "employers are spread thin, planning best- and worst-case scenarios in terms of COVID, while also contending with staff shortages and high demand."

Speaking of Goldman, the bank is more optimistic than consensus and estimates nonfarm payrolls rose 575k in November, above the 531k gain in October and higher than the bank's initial forecast of +550k (which is in line with consensus). The bank expects no change in government payrolls, and thus private payrolls will also rise +575k in November (vs. consensus +525k). According to the bank, the summer expiration of federal unemployment insurance benefits in some states boosted job-finding rates there, and the programs expired in the remaining states on September 5th. Over 4.6mn people have dropped off the unemployment benefit rolls since early September, and we assume 300-400k found new jobs during the November payroll month.

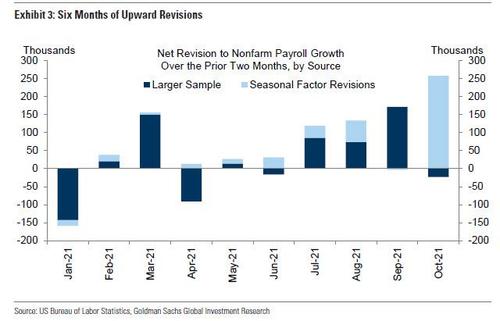

Goldman also believes upward revisions to prior-month nonfarm payrolls are fairly likely in tomorrow’s report. The chart below reveals a trend of increasingly large upward revisions over the course of the year, with prior-month job growth revised up on net in each of the last six reports (including +235k with last month’s release). There are two potential explanations, both of which could potentially lead to upward revisions in tomorrow’s report as well.

- First, some reopening establishments may respond to the BLS survey with a lag (e.g. 1-2 months after reopening). This would result in positive revisions to the not-seasonally-adjusted data that occurred in May, July, August, and September (dark blue bars below).

- Second, the seasonal factors may be overfitting to the advance releases, mistakenly attributing some of the strong job creation to an evolution of seasonality (light blue lines below).

ARGUING FOR A STRONGER REPORT:

- End of federal enhanced unemployment benefits. The expiration of federal benefits in some states boosted job-finding rates over the summer, and all remaining such programs expired on September 5. The 239k pickup in job growth in October relative to September is consistent with a boost from improved labor supply, and with 4.6 mn individuals no longer receiving benefits versus in early September, this tailwind is expected to continue in tomorrow’s report and beyond.

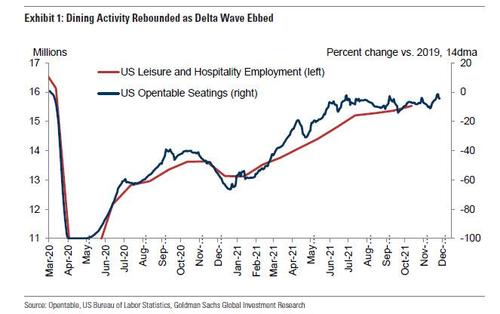

- Public health. The Delta wave coincided with a late-summer slowdown in job growth, with leisure and hospitality employment growth slowing sharply in September and October (see Exhibit 1). With covid infection rates falling since September, restaurant seatings on OpenTable have rebounded,and economists expect strong gains in leisure and hospitality and in other services.

- Job availability. The Conference Board labor differential—the difference between nthe percent of respondents saying jobs are plentiful and those saying jobs are hard to get—increased to a record-high of 46.9. JOLTS job openings decreased by 191kin September to 10.4mn but remained significantly higher than the pre-pandemic record.

- Jobless claims. Initial jobless claims fell during the November payroll month, averaging 257k per week vs. 320k in October. Continuing claims in regular state programs decreased 283k from survey week to survey week.

- Education seasonality. Education payrolls weighed on the previous two reports, declining 170k cumulatively in September and October (public and private). This reflects some janitors and support staff declining to return for the fall school year. While schools will eventually fill these open positions, the start-of-year catalyst for a large rise in education jobs has passed, and we are assuming only second derivative improvement in tomorrow’s report, such as a flat reading or a modest gain (mom sa).

- Employer surveys. The employment components of business surveys generally increased in November. Goldman's services survey employment tracker increased 0.5pt to 55.1 and its manufacturing survey employment tracker increased 0.7pt to 59.6. The Goldman Sachs Analyst Index (GSAI) increased 4.3pt to 77.2 in November, and the employment component rose 1.6pt to a record-high of 75.6.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas declined by 10% month-over-month in November after increasing by 18% in October (SA by GS),and remain near their three-decade low.

ARGUING FOR A WEAKER REPORT:

- Supply constraints in retail. Labor supply constraints may have weighed on pre-holiday hiring in the retail industry, for which the BLS seasonal factors anticipate net hiring of around 350k. If so, retail payroll could fall on a seasonally adjusted basis.

- Vaccine mandates. The vaccine mandates announced by the Biden administration nin September apply to roughly 25mn unvaccinated workers, and may have weighed on November job growth in healthcare and government. While the federal deadline for compliance is generally not until early January and faces an uncertain future in the court system, early adoption in some states may have reduced job growth at the margin in tomorrow’s report.

NEUTRAL FACTORS

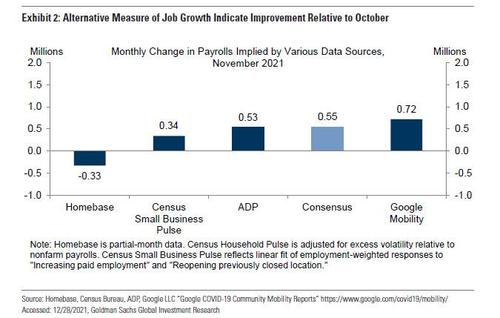

- Big Data. High-frequency data on the labor market were mixed. Three of the four measures available this month indicate another sizeable gain. However, the Homebase data that directionally flagged the September payroll missindicates an outright decline

- ADP. Private sector employment in the ADP report increased by 534k in November, in line with consensus expectations for a 525k gain and consistent with strong growth in the ADP panel.

https://ift.tt/3G4Cudu

from ZeroHedge News https://ift.tt/3G4Cudu

via IFTTT

0 comments

Post a Comment