This $1.6 Trillion Market Could Cease To Exist Soon

By Bloomberg Markets Live commentators Ye Xie and Amy Li

By now, it’s clear that Beijing is greatly discouraging, if not completely forbidding, listings of Chinese tech companies in the U.S. What’s unclear is what Beijing will do with existing Chinese ADRs, an overwhelming majority of which used variable-interest entities to circumvent Chinese laws to get listed.

Even if Beijing doesn’t demand the likes of Alibaba and Baidu dismantle their VIEs immediately, the authorities have signaled that Hong Kong, instead of New York, is now the preferred capital market for China Inc. Over time, the $1.6 trillion ADR market may become a footnote in history books.

Bloomberg reported that China plans to ban companies from listing overseas through VIEs. But companies using such structures would still be allowed to pursue IPOs in Hong Kong, subject to regulatory approval. The China Securities Regulatory Commission quickly denied the report, without giving details.

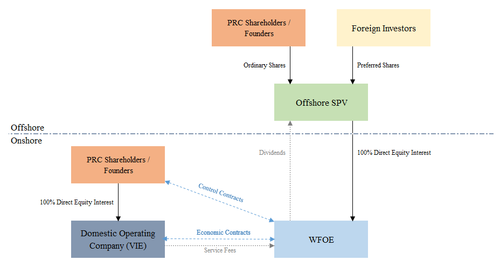

The controversial VIE structure, designed to bypass Chinese restrictions on foreign investment in sensitive sectors including the internet industry, has been used by most Chinese ADRs for decades. It allows a Chinese firm to transfer profits to an offshore entity, whose shares foreign investors can own. There’s always been an argument over why the best companies should be allowed to skirt Chinese laws and enrich foreigners, while depriving local investors opportunities to benefit from the crown jewels of the economy. As Paul Gillis, professor at Peking University, put it bluntly: “The VIE has always made a mockery of rule of law in China.”

Washington is also increasing security over VIEs, deeming they lack transparency and legal protection for investors. In other words, both sides would be happy to do away with VIEs.

But with billions of dollars at stake, outlawing the VIEs and demanding an immediate delisting would cause massive disruption and damage China’s reputation. Listing VIEs in Hong Kong may be still allowed, suggesting “we shouldn’t worry about the big hammer dropping on existing VIEs, as that would contradict Beijing’s stance re VIE listing in the HK,” noted Jason Hsu, chief investment officer of Rayliant Global Advisors.

What could happen is that the existing VIEs get “grandfathered,” but ADRs are encouraged to pursue dual-listings in Hong Kong. “Perhaps over time, as most of the liquidity shifts toward the HK venue, with the U.S. listing taking on a diminished role, the concern would become a non-concern,” said Hsu.

The fate of VIEs isn’t the only concern for Chinese ADRs. Under a law (HFCA) passed under the Trump administration in December, Chinese companies may face delisting if they refuse to hand over financial information to American regulators, a demand that Beijing has refused so far. “Unless something unexpected happens, the Chinese ADR market should be eliminated within three years because of HFCA,” said Jesse Fried, professor at Harvard Law School. “Even absent the HFCA, China might have prevented companies from listing in the U.S. to build up its own markets and have greater control over the companies. But the U.S. government seems to be doing China’s work for it.”

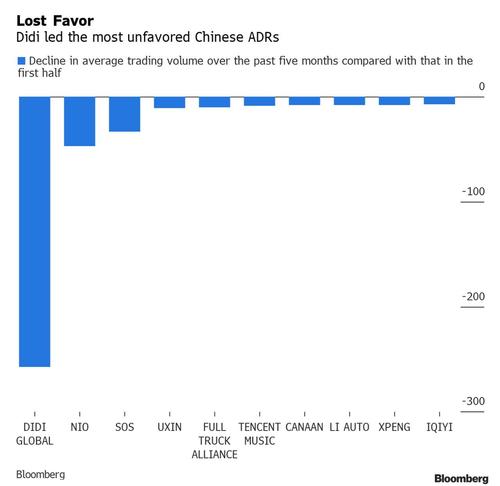

With all this going on, trading activity in most Chinese ADRs has greatly diminished since the tightening of regulations during the summer. The average daily trading volume for Didi, for example, has declined to 31 million shares since July, from 288 million in June when it was listed. In aggregate, the trading volume of Chinese ADRs has declined 44% since July, from the first half of the year.

This may be where we are going.

https://ift.tt/31p6hhW

from ZeroHedge News https://ift.tt/31p6hhW

via IFTTT

0 comments

Post a Comment