WTI Holds Losses After 3rd Straight Weekly Crude Draw, Cushing Stock Builds

Oil continued to its slide as as the IEA said the global oil market has returned to surplus, while some countries tightened restrictions in an effort to tame the omicron variant’s spread.

“Omicron has the market spooked and news of new restrictions in the U.K. has led to more selling,” said Spencer Vosko, director for crude oil at Black Diamond Commodities LLC.

“Brent contango is steeper in the dated market and has now appeared in futures markets, leading to a weaker sentiment.”

Expectations are for a 3rd straight weekly crude draw, but all eyes will be on Cushing stocks (which are building) and product inventories for a sign of renewed demand.

API

-

Crude -815k (-1.7mm exp)

-

Cushing +2.257mm

-

Gasoline +426k

-

Distillates -1.016mm

Although smaller than expected, API reported crude stocks fell for the third straight week (and Cushing stocks rose for the 5th straight week)...

Source: Bloomberg

WTI was hovering around $70.40 ahead of the API print and limped very modestly higher on the mixed data...

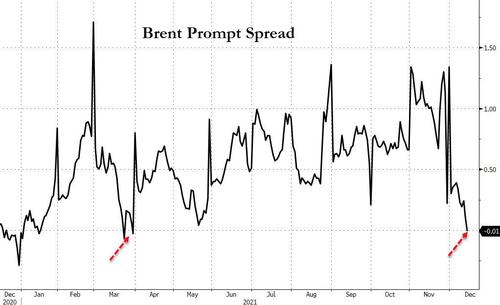

Finally, as we detailed earlier in the day, as the market digests the near-term effects of omicron on oil demand, Brent’s so-called prompt spread flipped into contango for the first time since March, excluding contract expiration days.

Source: Bloomberg

The bearish market structure, in which the contract for immediate delivery is trading at a discount to oil for future delivery, indicates plentiful supply over the short term.

https://ift.tt/3q3KchY

from ZeroHedge News https://ift.tt/3q3KchY

via IFTTT

0 comments

Post a Comment