The Evolution Of Credit & The Growing Fiat Money Crisis

Authored by Alasdair Macleod via GoldMoney.com,

After fifty-one years from the end of the Bretton Woods Agreement, the system of fiat currencies appears to be moving towards a crisis point for the US dollar as the international currency. The battle over global energy, commodity, and grain supplies is the continuation of an intensifying financial war between the dollar and the renminbi and rouble.

It is becoming clear that the scale of an emerging industrial revolution in Asia is in stark contrast with Western decline, a population ratio of 87 to 13. The dollar’s role as the sole reserve currency is not suited for this reality.

Commentators speculate that the current system’s failings require a global reset. They think in terms of it being organised by governments, when the governments’ global currency system is failing. Beholden to Keynesian macroeconomics, the common understanding of money and credit is lacking as well.

This article puts money, currency, and credit, and their relationships in context. It points out that the credit in an economy is far greater than officially recorded by money supply figures and it explains how relatively small amounts of gold coin can stabilise an entire credit system.

It is the only lasting solution to the growing fiat money crisis, and it is within the power of at least some central banks to implement gold coin standards by mobilising their reserves.

Evolution or revolution?

There are big changes afoot in the world’s financial and currency system. Fiat currencies have been completely detached from gold for fifty-one years from the ending of the Bretton Woods Agreement and since then they have been loosely tied to the King Rat of currencies, the dollar. Measured by money, which is and always has been only gold, King Rat has lost over 98% of its relative purchasing power in that time. From the Nixon Shock, when the Bretton Woods agreement was suspended temporarily, US Government debt has increased from $413 bn to about $30 trillion — that’s a multiple of 73 times. And given the US Government’s mandated and other commitments, it shows no signs of stabilising.

This extraordinary debasement has so far been relatively orderly because the rest of the world has accepted the dollar’s hegemonic status. Triffin’s dilemma has allowed the US to run economically destructive policies without undermining the currency catastrophically. Naturally, that has led to the US Government’s complacent belief that not only will the dollar endure, but it can continue to be used for America’s own strategic benefits. But the emergence of rival superpowers in Asia has begun to challenge this status, and the consequence has been a financial cold war, a geopolitical jostling for position, particularly between the dollar and China’s renminbi, which has increased its influence in global financial affairs since the Lehman crisis in 2008.

Wars are only understood by the public when they are physical in form. The financial and credit machinations between currency-issuing power blocs passes it by. But as with all wars, there ends up a winner and a loser. And since the global commodity powerhouse that is Russia got involved in recent weeks, America has continued its policy of using its currency status to penalise the Russians as if it was punishing a minor state for questioning its hegemonic status. The consequence is the financial cold war has become very hot and is now a commodity battle as well.

Bringing commodities into the conflict is ripe with unintended consequences. Depending how the Russians respond to US-led sanctions, which they have yet to do, matters could escalate. In the West we have comforted ourselves with the belief that the Russian economy is on its uppers and Putin will have to either quickly yield to sanctions pressures, or face ejection by his own people in a coup. But that is a one-sided view. Even if it has a grain of truth, it ignores the consequences of Putin’s military failures on the ground in Ukraine so far, and his likely desperation to hit back with the one non-nuclear weapon at his disposal: Russia’s commodity exports.

He may take the view that the West is damaging itself and little or no further action is required. And surely, the fact that China has stockpiled most of the world’s grain resources gives Russia added power as a marginal supplier. Putin can afford to not restrict food and fertiliser exports, blaming on American policy the starvation that will almost certainly be suffered by all non-combatant nations. He could cripple the West’s technology industries by banning or restricting exports of rare metals which are of little concern to headline writers in the popular press. He might exploit the one big loophole left in the sanctions regime by supplying China with whatever raw materials and energy it needs at discounted prices. And China could compound the problem for the West by restricting its exports of strategic commodities claiming they are needed for its own manufacturing requirements.

While everyone focuses on what is seen, it is what is not seen that is ignored. Commodities are the visible manifestation of a trade war, while payments for them are not. Yet it is the flow of credit on the payment side where the battle for hegemonic status is fought. The Americans and their epigones in Europe have tried to shut down payments for Russian trade through the supposedly independent SWIFT system. And even the Bank for International Settlements, which by dealing with both Nazi Germany and the Allies retained its neutrality in the Second World War, is siding with the West today.

But step back for a moment to look at how broadly based the West’s position is in a global context, because that will be a factor in whether the dollar’s hegemony will survive this conflict. We see America, the EU, Japan, the UK, Canada, Australia, and New Zealand on one side. In population terms that’s roughly 335, 447, 120, 65, 38, 26 and 5 million people respectively, totalling 1,036 million, only 13% of the world population. This point was made meaningfully by the Saudis who now want to talk with Putin rather than Biden. As long ago as 2014, this writer was informed by a director of a major Swiss refinery that Arab customers were sending LBMA 400-ounce bars for recasting into Chinese four-nine one kilo bars. The real money saw this coming at least eight years ago.

Even if the US’s external policies do not end up undermining the dollar’s global status, it is becoming clear that the King Rat of currencies is under an existential threat. And the Fed, which is responsible for domestic monetary policies, in conjunction with the Biden administration is undermining it from the inside as well by trying to manage a failing US economy by accelerating its debasement.

A betting man would therefore be unlikely to put money on a favourable dollar outcome. Whether the dollar suffers a crisis or merely an accelerated decline, just as Nixon changed the world’s monetary order in 1971 it will change again. That the current situation is unsatisfactory is widely recognised by multiple commentators, even in America, calling for a financial and currency reset. And it is assumpted that the US Government and its central bank should come up with a plan.

There are two major problems with the notion that somehow the deck chair attendant can save the ship from sinking by rearranging the sun loungers.

-

The first error is insisting that money is the preserve of only the state and is not to be decided by those who use it. It was the underlying fallacy of Georg Knapp’s State Theory of Money published in 1905. That ended with Germany printing money to arm itself in the hope that it would win: it didn’t and Germany ended up destroying its papiermark.

-

The second error is that almost no one understands money itself, as evidenced by the whole financial establishment, from the governments down to junior fund managers, thinking that their currencies are money. Commentators calling for a reset are themselves in the dark.

Events will deal with the fallacies behind the State Theory of Money and whether it will turn out to be an evolution or revolution. But at least we can have a stab at explaining what money is for a modern audience, so that the requirements and conditions of a new currency system to succeed can be better understood.

What is money for?

The pre-Keynesian classical economic explanation of money’s role was set out in Say’s Law, otherwise known as the law of markets. Jean-Baptiste Say was a French economist, who in his Treatise on Political Economy published in 1803 wrote that,

“A product is no sooner created than it, from that instant, affords a market for other products to the full extent of its own value.”

And

“Each of us can only purchase the productions of others with his own productions — and so the value we can buy is equal to the value we can produce. The more men can produce the more they will purchase.”

Money or credit is the post-barter link between production and consumption facilitating the exchange between the two. What to produce and what is needed in exchange is a matter for those involved in individual transactions. And the medium of exchange used is a decision for each of the parties. They will tend to use a medium which is convenient and widely accepted by others.

Say’s Law was incorrectly redefined and trashed by Keynes to “…that the aggregate demand price of output as a whole is equal to the aggregate supply price for all volumes of output is equivalent to the proposition that there is no obstacle to full employment.” This has subsequently been shortened to “supply creates its own demand”. Keynes’s elision of the truth was leading to (or was it to justify?) his erroneous invention of mathematical macroeconomics. It is simply untrue.

All Say was pointing out is we divide our labour as the most efficient means of production for driving improvements in the human condition. That cannot be argued with, even by blinkered Keynesians. Money, or more correctly credit has two roles in this division of labour. The first is as the medium for investment in production, because things must be made before they can be sold and there are expenses in the form of presale payments that must be made. And the second is to act as the commonly accepted intermediary between the sale of products to their buyers. Instead of opining that supply creates its own demand, if we say instead that people make things so they can buy the products and services they don’t make for themselves, it is so obviously true that Keynes and his self-serving theories don’t have a leg to stand on. And importantly, full employment has nothing to do with it.

The money involved is always credit. Even the act of lending gold coins to an entrepreneur to make something is credit because it is to be repaid. If gold coins are the payment medium between production and consumption, they are the temporary storage of production before it is spent. In this very narrow sense, they represent the credit of production which will be spent. The principal quality of gold, which when it is at rest is undeniably money, is that it has no counterparty risk and is to be parted with last.

The point is that money in circulation is a subsection of wider credit and is the very narrowest of definitions of circulating media. But even under a gold standard, it is hardly ever used in transactions and rarely circulates. This is partly due to a Gresham’s Law effect, where it is only exchanged for inferior forms of credit as a last resort, and partly because it is less convenient than transferring banknotes or making book entries across bank ledgers. By far the most common forms of circulating media are credit in the form of banknotes issued by a central bank, and transferable credit owed by banks to depositors.

But in our estimate of a practical replacement of the current fiat currency-based system, we must also acknowledge that credit is far broader than that recorded as circulating by means of the banking system. We are increasingly aware of the term, “shadow banks” most of which are pass-through channels of credit rather than credit creators. But doubtless, there is expanded credit in circulation originating from shadow banks, the equivalent of officially recorded bank credit, which is not captured in the money supply statistics. But there are also wider forms of credit in any economy.

Defining credit

To further our understanding of credit, we must define the fundamental concept of credit:

Credit is anything which is of no direct use, but which is taken in exchange for something else, in the belief or confidence that we have the right to exchange it away again.

It is the right to a future payment, not necessarily in money or currency. It is not the transfer of something, but it is a right to a future payment. Consequently, the most common form of credit is an agreement between two parties which has nothing to do with bank credit per se.

Bank credit is merely the most obvious and recorded subset of the entire quantity of credit in an economy. And the whole world of derivatives, futures, forwards, and options, are also credit for an action in time, additional to bank credit. Global M3 money supply is said to be $40 trillion equivalent, about 3% of investments, derivatives, and cryptocurrencies, all of which are forms of credit: rights and promises to future payments in credit or currency. And this is in addition to private credit agreements between individuals and other individuals, and between businesses and individuals, which are extremely common.

The commonly stated position among sound money advocates of the Austrian school is that bank credit should be replaced by custodial deposit-taking banks and separate arrangers of finance. But given the broad definition of credit in the real world, eliminating bank credit appears untenable when individuals are free to offer multiple amounts of credit and the vast bulk of credit creation is outside the banking system.

Consider the case of a bookie accepting wagers for a horse race. Ahead of the event, he takes on obligations many times the capital in his business, in return for which he is paid in banknotes or drawings on bank credit by his betting customers. When the race is over, he keeps the losers’ stakes and is liable for payments to holders of the winning bets. He has debts to the winners which are only extinguished when the winners collect. While there are differences in procedures and of the risks involved, in principal there is little difference between a bookie’s business and that of a commercial bank; they are both dealers in credit. Arguably, the bookie has the sounder business model.

The restriction imposed on an individual providing credit to others is his potential liability if it is called upon. The unfairness in the current system is not that bank credit is permitted, but that is permitted with limited liability. Surely, the solution is to ensure that all providers of credit are responsible for the risks involved. Licenced banks and their shareholders should face unlimited liability. It is even conceivable that listed capital in an overleveraged bank might trade at negative values if shareholders face a risk of unlimited calls on their wealth. That should promote responsibility in bank lending. It will not eliminate the cycle of bank credit expansion and contraction, but it will certainly lessen its disruptive impact.

Variations in the purchasing power of a medium of exchange

A proper consideration of credit, the all-embracing term for mediums of exchange to include future promises, shows that government statistics for money supply are a diminishingly small part of overall credit in an economy. We must take this fact into account when considering changes in the official quantity of money on the purchasing power of units of the medium of exchange (that is credit in the form of circulating banknotes and commercial bank credit — M1, M2, M3 etc.).

A downturn in economic activity must be considered in the broader sense. If, for example, I say to my neighbour that if he arranges it, I will cover half the cost of fencing the boundary between our properties, I have offered him credit upon which he can proceed to contract a fencing supplier and installer. However, if in the interim my circumstances have changed and I cannot deliver on my promise, the credit agreement with my neighbour is withdrawn and the fence might not be installed.

A father might promise his son an allowance while he attends university. That is a credit agreement with periodic drawdowns lasting the course. Later, the father might promise help in buying a property for his son to live in. These are promises, whose values are particular and precarious. And they will be valid only so long as they can be afforded. If there is a general change in economic conditions for the worse, it is almost certainly driven more by the withdrawal of unrecorded credit agreements between individuals and small businesses such as corner shops, and not directly due to bank credit contraction.

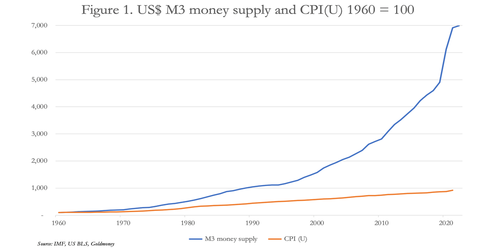

An appreciation of these facts and of changes in human behaviour which cannot be recorded statistically explains much about the lack of correlation between measures of credit (i.e., broad money supply) and prices. The equation of exchange (MV=PQ) does not even capture a decent fraction of the relationship between the quantity of credit in an economy and prices. Our understanding of the wider credit scene goes some way to resolving a mystery that has bedevilled monetary economists ever since David Ricardo first proposed the relationship over two centuries ago. In theory, an increase in the quantity of measurable credit (that is currency in the banking system) leads to a proportionate increase in prices. Even allowing for statistical legerdemain, that is patently not true, as Figure 1 illustrates.

Figure 1 shows that over the last sixty years, the broadest measure of US dollar money supply has increased by nearly seventy times, while prices have increased about nine. The equation of exchange explains it by persuading us that each unit of currency circulates less so that the increase in the money quantity somehow leads to less of an effect on prices. This interpretation is consistent with Keynes’s denial of Say’s Law. The Law tells us that we all make profits and/or earn salaries, which in the time-space of a year means we can only spend and save once. That is an unvarying velocity of unity. Instead, the mathematical economists have introduced a variable, V, which simply balances an equation which should not exist.

That is not to say that credit expansion does not affect the purchasing power of a currency. Logic corroborates it. But an understanding of the true extent of credit in an economy confirms that the sum of currency and recorded bank credit is just a small part of the story – only one eighth as indicated by the divergence between M3 and consumer prices — all else being equal.

It brings us to the other driving force in the credit/price relationship, which is the public acceptability of the currency. Ludwig von Mises, the Austrian economist, who lived through the Austrian inflation in the post-WW1 years and whose advice the Austrian government was reluctant to accept, observed that variations in public confidence in the currency can have a profound effect on its purchasing power. Famously, Mises described a crack-up boom as evidence that the public had finally abandoned all faith in the government’s currency and disposed of all of it in return for goods, needed or not.

It leads to the sensible conclusion that irrespective of changes in the circulating quantity, the purchasing power is fully dependent on the public’s faith in the currency. Destroy that, and the currency becomes valueless as a medium of exchange. If confidence is maintained, it follows that the price effects of a currency debasement may be minimised.

This brings us to gold coin. If the state backs its currency with sufficient gold which the public is free to obtain on demand from the issuer of the currency, then the currency takes on the characteristics of gold as money. We should not need to justify this established and ancient role for gold, or silver for that matter, to the current generations of Keynesians brainwashed into thinking it’s just old hat. Though they rarely admit it, central bankers fully committed to their fiat currencies still retain gold reserves in the knowledge that they are no one’s liability; that is to say, true money while their currencies are simply credit.

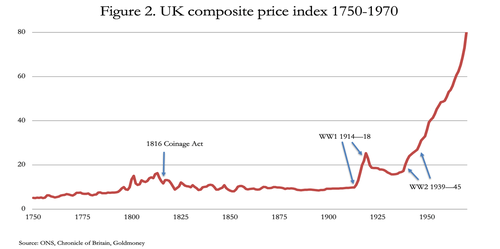

Given what we now know about the extent of credit beyond the banking system and the role of public confidence in the currency when it is a credible gold substitute, we can see why a moderate expansion of the currency need not undermine its purchasing power proportionately. While the cycle of bank credit expansion and contraction leads to the boom-and-bust conditions described by Von Mises and Hayek in their Austrian business cycle theory, the effects on prices under a gold standard do not appear to have been enough to destabilise a currency’s purchasing power. Figure 2 illustrates the point.

Admittedly there are several factors at work. While the increase in the quantity of currency in circulation was generally restricted by the gold coin standard, the bank credit cycle of expansion and contraction led to periodic bank failures. Then as now, the quantity of bank credit relative to bank notes was eight or ten times, and so long as the note-issuing bank remained at arm’s length from the tribulations of commercial bank credit the overall price effects were contained.

Britain abandoned the gold standard in 1914, and just as the abandonment of the silver standard in the 1790s led to an increase in the general price level, a dramatic increase occurred during the First World War. This was due to deficit spending by the state driving up material costs at a time when imported factors of supply were limited by the destruction of merchant shipping.

The end of the war restored the supply/demand balance and saw a reduction in military spending. Prices fell and then stabilised. A gold bullion standard at the pre-war rate of exchange was re-established in 1925, only to be abandoned in 1931. The Second World War and subsequent lack of any anchor to the currency led to an inexorable rise in prices before America abandoned the Bretton Woods Agreement in 1971. And since then, the sterling price of gold has risen even further from £14.58 when the Agreement ceased to £1,470 today. Measured in true money the currency has lost over 99% of its purchasing power over the last fifty-one years.

Both logic and the empirical evidence point to the same conclusion: price stability can only be achieved under a working gold coin standard, whereby ordinary people can, should they so wish, exchange banknotes for coin on demand. Despite making up most of the circulating medium, fluctuations in bank credit then have less of an effect on prices, for the reasons stated above.

Can cryptocurrencies replace gold?

The reason gold is relatively stable in purchasing power terms is that through history, above ground stocks have expanded at similar rates to population growth. A very gradual increase in gold’s purchasing power comes from manufacturing, technological, and competitive production factors. In other words, the price stability clearly demonstrated in Figure 2 above between 1820—1914 is evolutionary.

Whether cryptocurrencies or central bank digital currencies might have a stabilising role for prices in future is highly contentious. We can readily dismiss yet another version of state-issued currencies as being a worse form of credit than failing fiat currencies. The aim behind them is communistic, to enable the state to allocate credit resources wherever and to whomsoever its political class may desire. It is with the intention of reducing the vagaries of human action on the state’s intended outcome. Just as every replacement currency for failing fiat in the past has failed, if CBDCs are introduced they will fail as well. It is unnecessary to comment further.

Cryptocurrencies, particularly bitcoin, are seen by a small minority of enthusiasts as the money of the future, being outside the state’s printing presses. But as observed above, in reality, sound money is augmented by fluctuating quantities of credit in far larger quantities. So long as sound money provides price stability, circulating credit inherits those characteristics.

Bitcoin, the leading claimant to being future money, lacks both world-wide acceptance and the flexibility required for long-term stability and therefore economic calculation. Imagine an entrepreneur planning to invest in production, a project which from the drawing-board to final sales takes several years. His nineteenth century forebears had a reasonable idea of final prices, so could calculate costs, sales values, and therefore the interest cost of the capital deployed over the whole project to leave him with a profit. No such certainty exists with bitcoin because final prices cannot be assumed. Furthermore, central banks do not have bitcoin as part of their reserves, and by embarking on plans for their own CBDCs have signalled that they will not have anything to do with it. But in most cases central banks or their government treasury ministries possess gold bullion, which as a last resort they can deploy to stabilise a failing currency.

While there will undoubtedly be future benefits from their underlying technologies, it is impossible to see how cryptocurrencies can have a practical role in backing wider credit.

Conclusion

The evolution of fiat dollars which dates from the abandonment of the Bretton Woods Agreement is coming to an inevitable conclusion: fiat currencies come and go and only gold goes on forever. Whoever wins the financial battle now raging with increasing intensity over commodity prices, the US dollar as the King Rat of fiat currencies is losing its assumed superiority over the renminbi, and possibly the rouble if the Russians can stabilise it. The old-world population backing the dollar is heavily outnumbered by the newly industrialising Eurasia as well as its commodity and raw material suppliers in Africa and South America.

Not mentioned in this article is the Federal Reserve Board’s commitment to sacrifice the dollar to support financial values — that ground has been well covered in earlier Goldmoney articles. But it is a repetition of John Law’s policies in 1720 France, now underway to stop the global financial bubble from imploding. And just as the Mississippi Company continued after 1720 when the French livre collapsed entirely that year, we see the same dynamics in play for the entire fiat currency system today.

John Law’s policies of credit stimulation for the French economy were remarkably like those of modern Keynesians. This time, the expansion of money supply on a global basis has been on an unprecedented scale, encouraged by the subdued effect on prices measured by government-compiled consumer price indices. Undoubtedly, much of the lack of price inflation is down to statistical method, but from Figure 1 we have seen that over the last sixty years the quantity of currency and credit captured by US dollar M3 has grown about seven and a half times more rapidly than prices. We have concluded that this disparity is partly due to not all credit in the economy being captured in the monetary statistics.

Understanding the relationship between money which is only physical gold coin, currency which is bank notes and credit which includes bank credit, shadow bank credit, derivatives, and personal guarantees, is vital to understanding what is required to replace the fiat-currency system. It also explains why a relatively small base of exchangeable gold coin in relation to the overall credit in an economy is sufficient to guarantee price stability.

https://ift.tt/mEnW570

from ZeroHedge News https://ift.tt/mEnW570

via IFTTT

0 comments

Post a Comment