WTI Rebounds After Big Surprise Crude & Product Draws

Oil prices ended lower today, erasing yesterday's mid-morning bounce, on the back of renewed China (lockdown) demand anxiety and increasing doubts about Europe's Russian oil embargo ever coming to anything significant.

"Crude prices are declining as Beijing tightens up their COVID controls and as tanker-tracker data showed Russian crude flows increased," said Edward Moya, senior market analyst at Oanda, in a note.

" Energy traders are not convinced that the EU will be able to move forward with an embargo on Russian oil. "

An oil embargo "may seem simple, but the details are complicated and likely to cause problems figuring out how to wean off Russian oil without causing a massive oil price spike," said Stephen Innes, managing partner, SPI Asset Management, in emailed comments.

So for now, all eyes are once again on inventory levels for signs of demand destruction on the product side.

API

-

Crude -3.479mm (-200k exp)

-

Cushing +978k

-

Gasoline -4.5mm (-300k exp) - biggest draw since Oct 2021

-

Distillates -4.457mm (-1.5mm exp)

Major crude and product draws were a bullish surprise for energy traders...

Source: Bloomberg

WTI slipped down to around $102.50 ahead of the API print and rebounded above $103 after...

Notably, WTI's discount to Brent continues to broadly trend lower (smaller discount) as US exports rise...

Source: Bloomberg

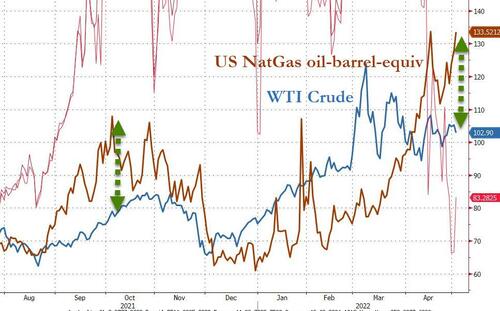

Finally, for some context, US NatGas prices topped $8 today - the highest since 2008 - which implies around a $133 oil barrel equivalent, dramatically rich to US WTI Crude...

Source: Bloomberg

Thanks for sparking the mass exports Joe, oh and... On Tuesday, diesel hit a record $5.37 per gallon, making it significantly more expensive than gasoline, which is now at a national average price per gallon of $4.204, according to AAA.

https://ift.tt/EaKf23H

from ZeroHedge News https://ift.tt/EaKf23H

via IFTTT

0 comments

Post a Comment