Big-Tech & Bitcoin Jump, Bonds & Bullion Dump As Housing Market Slumps

Ugly housing data and clear signals of demand destruction in the energy complex were not enough to stop stocks soaring further as the short-squeeze continues...

From last Thursday's lows, "Most Shorted" stocks are up a somewhat stunning 16%...

Source: Bloomberg

Once again the opening of the US Cash equity market was the most bullish thing in bull-land and panic-buyers piled in, sending Nasdaq up over 2% at its highs (but selling hit as Europe closed). That didn't last long as the short-squeeze resumed for another big day for Small Caps and Big-Tech...

Cyclicals have been ripped higher at the cash open for 4 straight days now while Defensives are flat-ish...

Source: Bloomberg

Treasuries were mixed today with the belly weakest (5Y+3bps) and long-end outperforming (30Y -1bps) as yields dumped and pumped on the day...

Source: Bloomberg

Which inverted the yield curve (5s30s) once again...

Source: Bloomberg

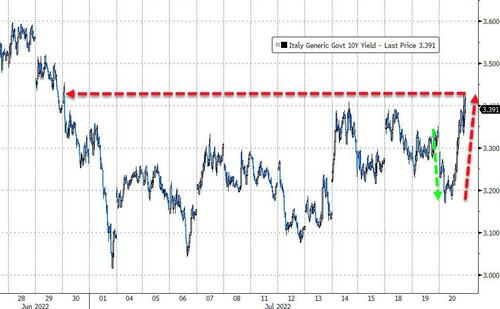

Italian bonds started the day off with a bid but the reality of Draghi's collapsing coalition ended up sending yields soaring to 3-week highs...

Source: Bloomberg

Bitcoin extended its recent breakout gains, topping $24k today

Source: Bloomberg

Ethereum topped $1600...

Source: Bloomberg

The dollar rebounded off last week's lows after 3 straight down days...

Source: Bloomberg

Gold futures tumbled back below $1700, driven a big sell program as Europe closed...

WTI closed back below $100 after rallying hard despite notable signals of demand destruction from Gasoline inventories...

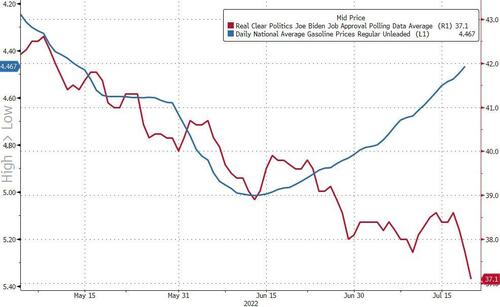

And finally, while US pump prices have tumbled now for 34 straight days, President Biden's approval rating has just collapsed to a new record low...

Source: Bloomberg

Maybe it's not just about the "Putin Price Hike" after all?

https://ift.tt/xMX7AIK

from ZeroHedge News https://ift.tt/xMX7AIK

via IFTTT

0 comments

Post a Comment