WTI Rises Modestly After Second Straight Weekly Crude Draw

Oil prices ended the day lower as worries about a recession dulled demand expectations and increased supply threats from the Biden admin's SPR.

The oil market market continues to show "significant downside risk and fear of recession," said Robbie Fraser, manager, global research & analytics at Schneider Electric.

The "supply side headline about an additional 20 million barrels of oil being made available from the [Strategic Petroleum Reserve] between September and October was also a bearish catalyst for oil," Tyler Richey, co-editor of Sevens Report Research, told MarketWatch, adding that the planned SPR releases have been "largely on schedule in recent months."

For now all eyes will be on tonight's API data and tomorrow's official data to see if these trends are continuing.

API

-

Crude -4.073mm (-1.121mm exp)

-

Cushing

-

Gasoline

-

Distillates

Acccording to API, Crude stocks fell significantly more than expected last week (the second straight weekly draw if it carries over into the official data tomorrow)...

Source: Bloomberg

WTI was hovering around $95.25 ahead of the API print and moved very modestly higher after the crude draw...

We note that WTI found support again for now at its 200DMA...

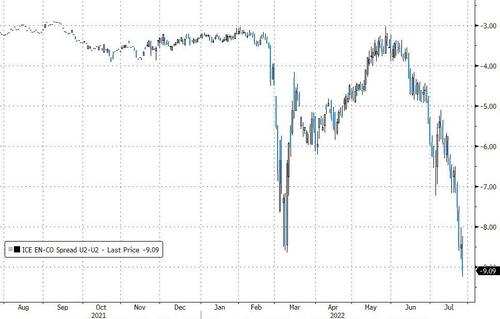

Finally, we note that the gap between global oil benchmarks has blown out in recent days...

“The slackening of gasoline demand is weighing on the WTI complex,” brokerage PVM Oil Associates Ltd wrote this week.

“At the same time, Brent prices have found support from a plethora of sources,” including underproduction by key oil producers.

WTI-Brent is now over $9 - the widest spread since April 2020 when WTI went negative...

Source: Bloomberg

As Bloomberg reports, demand in the US is slowing as historically high gasoline prices cuts into driving habits, while ongoing strategic oil sales have kept crude circulating in the market. Meanwhile, Europe has sought to reduce its dependency on Russia in the wake of the war and is paying enormous premiums for crude grades.

https://ift.tt/jGEQ5tm

from ZeroHedge News https://ift.tt/jGEQ5tm

via IFTTT

0 comments

Post a Comment