Disney Soars After Smashing Subscriber Expectations, Hikes Streaming Price By 38%

Update (5pm ET): it wasn't all good news, however, because while the price hike will surely lead to a significant drop in users, even the current status quo is leading to a slowdown in growth, with the company now forecasting 135-165 million core Disney+ subs, slashing its previous 2024 subscriber forecast:

- *DISNEY LOWERS 2024 SUBSCRIBER FORECAST

- *DISNEY SEES 135M TO 165M 'CORE' DISNEY+ SUBS BY 2024

* * *

Earlier:

A few weeks after Netflix finally surprised with an earnings beat after what seemed like an eternity of misses, moments ago Disney also came out of the Q2 earnings gate blazing, with numbers that smashed expectations (the company added 14.4 million new Disney+ subs, smashing estimates of 9.8 million) and announcing that it is raising the price of its flagship Disney+ streaming service by 38% to $11, part of a plan to generate more revenue for its money-losing online businesses and build on third-quarter results that beat estimates for sales, profit and subscriber growth. Prices for some packages that include Hulu and ESPN+ will also rise. The uber-woke mouse also took a page out of the NFLX playbook and said that on Dec. 8, Disney will introduce an ad-supported version of the flagship streaming service.

Here are the details:

- Adjusted EPS $1.09 vs. 80c y/y, estimate 96c

- Disney+ subscribers 152.1 million, +31% y/y, beating estimate 148.4 million

- ESPN+ subscribers 22.8 million, +53% y/y, estimate 23.2 million

- Hulu & Live TV subscribers 4.0 million, estimate 4.1 million

- Total Hulu subscribers 46.2 million, +7.9% y/y, estimate 46.4 million

- Revenue $21.50 billion, +26% y/y, estimate $21 billion

- Media and entertainment distribution revenue $14.11 billion, +11% y/y, estimate $14.33 billion

- Parks, experiences and products revenue $7.39 billion, +70% y/y, estimate $6.65 billion

- Total segment operating income $3.57 billion, +50% y/y, estimate $3.36 billion

- Media and entertainment distribution operating income $1.38 billion, -32% y/y, estimate $1.51 billion

- Parks, experiences and products operating income $2.19 billion vs. $356 million y/y, estimate $1.71 billion

- ESPN+ ARPU $4.55, missing estimate $4.98

- Hulu SVOD ARPU $12.92, estimate $13.29

Despite the solid top-line results, operating losses at the direct-to-consumer business, which includes the streaming services, more than tripled to $1.06 billion as the company continues to invest in new programming and expand to new territories. That was worse than the $697 million analysts expected.

Profit in Disney's traditional TV business, which includes the ABC and ESPN networks, rose 13% to $2.47 billion, thanks to higher ad revenue and fees from cable distributors. Programming costs were flat to down.

Profit at the company’s theme parks, a star in recent months as consumers went on vacations again after two years of the pandemic, rose sixfold to $2.19 billion. US resorts were the main driver, while international parks lost money and consumer products delivered only a modest increase.

The company reported a 26% jump in sales for its film studio to $2.11 billion, but suffered a loss of $27 million as the strong performance of “Doctor Strange in the Multiverse of Madness” in theaters was offset by lower home-entertainment revenue.

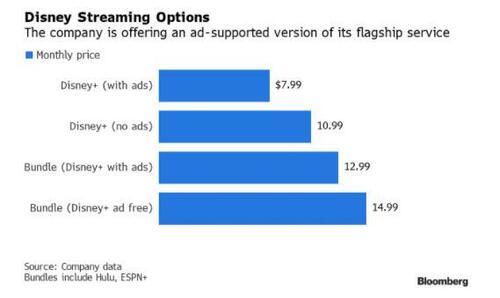

The breakdown of the company's new pricing tiers will be as follows, including the ad-free version:

The introduction of an ad-supported tier is meant to boost subscribers and generate more revenue by giving customers options for how much they want to pay for the service. Disney said last month it sold $9 billion of ads for the upcoming TV season, with 40% of that going to its online offerings. Current Disney+ subscribers will begin seeing the ad-supported version unless they agree to pay more for the commercial-free plan.

Some comments from embattled CEO Bob Chapek:

- "With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings”

- "In fiscal 2020 and 2021, we delayed, or in some cases, shortened or canceled, theatrical releases. In addition, we experienced significant disruptions in the production and availability ofcontent, including the delay of key live sports programming during fiscal 2020 and fiscal 2021"

- "Thus far, we have generally been able to release our films theatrically in fiscal 2022, although certain markets continue to impose restrictions on theater openings and capacity"

- "We have incurred, and will continue to incur, costs to address government regulations and the safety of our employees, guests and talent, of which certain costs are capitalized and will be amortized over future periods"

- In the current quarter, the Company recognized charges of $42 million primarily due to asset impairments related to our businesses "in Russia

According to Bloomberg, the price increases, subscriber gains and the strong Q3 performance from theme parks may help reverse investor sentiment that sent the shares down 27% this year through Wednesday’s close.

Disney - the world’s largest entertainment company - has been trying to stem losses in its direct-to-consumer business as it navigates a transition from traditional TV viewing to online options. Disney+, which launched in November 2019, and includes films and TV shows from the company’s vast library, as well as new series tied to company brands such as Marvel and “Star Wars" remains unprofitable. Disney has said it expects Disney+ to be profitable in fiscal 2024.

Shares of Disney rose as much as 6.1% to $119.33 in extended trading after the announcement.

https://ift.tt/59lJLa8

from ZeroHedge News https://ift.tt/59lJLa8

via IFTTT

0 comments

Post a Comment