"Sea Of Green": Bears Crushed As Stocks Storm Above 50% Fib Retracement

And just like that, the bears were run over.

We had a hint that today's session was going to be a faceripper when we reported last night that some of the most stubborn market bears - the hedge funds - had thrown in the towel and had capitulated on their shorts. Sure enough, amid this accelerating marketwide short squeeze (which so far still has evaded the most bearish "long only" funds which we will discuss in a latter post), today's meltup was especially memorable as it not only cemented the Nasdaq's new bull market, but sent the broader market up more than 3% for the week, its 4th consecutive week of gains (starting with the week when Powell announced "we're at neutral") the longest stretch of gains since November...

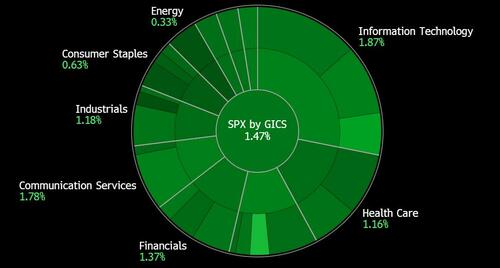

... thanks to a sea of green across every single sector...

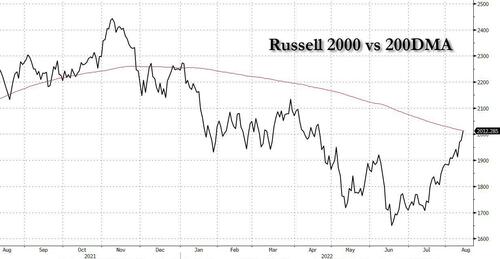

... but more importantly today's eruption higher has pushed stocks above key thresholds, such as the 200DMA on the Russell...

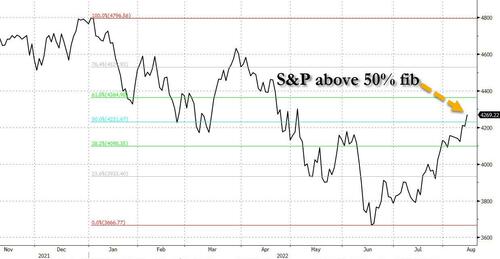

... and leaving the 100DMA on the S&P far in the rearview mirror with the 200DMA looming...

... but most importantly, the S&P is now back over the 50% retracement level from the Jan all time high to the Jun bear market lows.

This is key because as we noted yesterday, there has never been a "bear market rally" that bounce back above the 50% fib and then went on to make lower lows, although as Michael Burry earlier noted earlier this week, he clearly disagrees that this is anything more than a bear market rally.

— Cassandra B.C. (@MichaelJBurry__) August 11, 2022

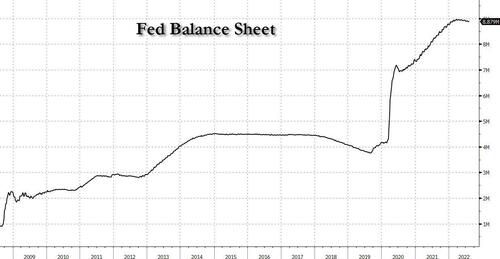

While time will tell who is right, for once Burry is on the side of the Fed, which is not only actively shrinking its balance sheet now thanks to QT...

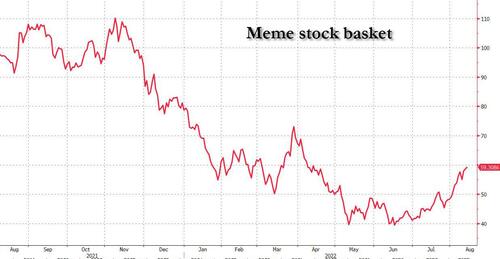

... for now retail remains firmly in control, and this was another week when meme stocks stormed higher as forced short squeezes sent the meme stock basket to the highest level in 5 months...

... propelling names like Gamestop, Bed Bath and Beyond and AMC to multi-month highs.

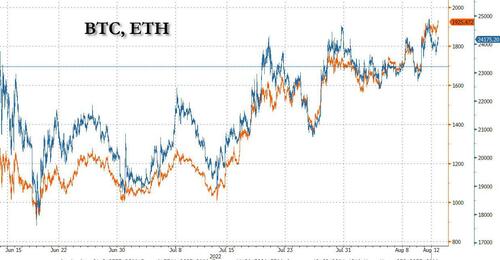

In fact, despite the Fed balance sheet shrinkage, our consolidate bubble basket chart shows a strong rebound across various "bubble" components such as momentum longs, unprofitable tech names, SPACs, cryptos and even the ARK fund, as some of the highest beta trash out there is already pricing in not only the end of QT but the start of QE...

... and nowhere was this more obvious than in cryptos where ETH today traded to a new 3 month high and is set to break above $2,000 this weekend, up more than 100% from its June lows.

“The music hasn’t stopped,” said Matt Bartolini, State Street Global Advisors’ head of SPDR Americas Research. “The labor market continues to be positive, earnings growth continues to be positive. So largely, if there is a recession, it’s going to be relatively shallow.”

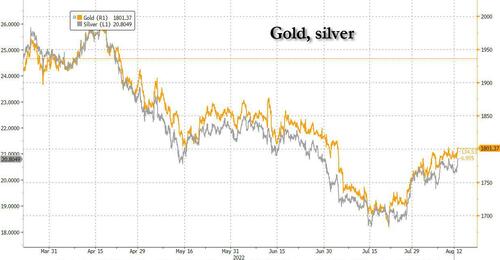

While yields went nowhere today, unlike yesterday's sharp spike which depressed risk assets, and oil sliding among speculation that the neverending negotiation over the Iran Nuclear Deal may finally be coming to a close, we even saw some upside to the precious metal complex with silver closing at the highest of the day, alongside gold which managed to sneak above 1,800 in the last few minutes of trading.

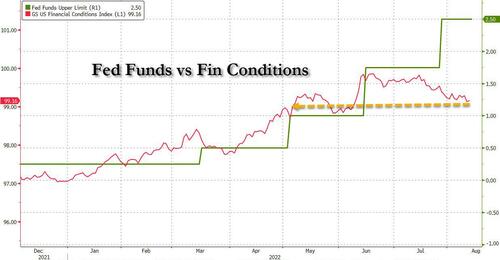

Yet for all the meltup euphoria, a casual look at what lies ahead brings up storm clouds because unless earnings rebound - and with margins collapsing that's unlikely - the markets will need to see multiple expansion, which however is unlikely unless real yields drop turn negative again...

... which however is especially unlikely since the Fed will have to aggressively step in and contain the market's froth which has undone the tightening from the latest 150bps of Fed rate hikes...

... leaving Powell with no other choice than to hammer markets at the first possible opportunity

https://ift.tt/GwqoyDn

from ZeroHedge News https://ift.tt/GwqoyDn

via IFTTT

0 comments

Post a Comment