Stocks Fumble As Bulls Fail To Hold Critical 50% Retracement

The first attempt by bulls and the S&P to cement the recent meltup as more than just a bear market rally and the start of a new secular rally higher, failed today when spoos failed to break above the critical 50% retracement level from the January all-time high to June "max panic" bear-market lows. While stocks did manage in early trading to break above the closely watched level of 4,220 which is the 50% Fib retracement - which matters as there has never been a bear market rally that closed above the 50% fib that subsequently went on to make new lows - the rally fizzled shortly after the open and spoos drifted lower all day, eventually closing below the critical support level.

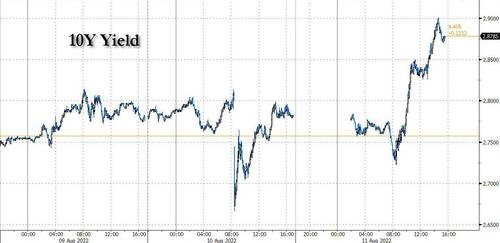

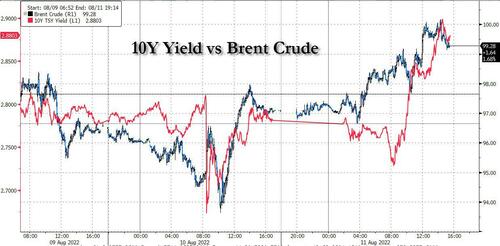

The drift lower in risk coincided with a sharp rebound in TSY yields, which initially dumped to session lows just north of 2.70% after the latest inflationary good news when PPI M/M declined outright (but was still up 9.8% Y/Y, just in case the White House is still confused) but then drifted ever higher...

... alongside the move higher in commodities and especially oil...

... with crude prices rising after the market realized that demand destruction fears are unfounded (and potentially rigged by the DOE and/or Biden admin to push oil prices lower). Indeed, nationwide gas prices are now below $4 a gallon and that should provide substantial relief for what has been a lackluster summer driving season, indeed leading to a sharp recovery in gasoline demand. Meanwhile, as Oanda's Edward Moya notes, "te economy is in too good shape for further crude demand destruction to occur and that should keep oil prices supported well above the $90 level."

Incidentally, after yesterday's big CPI miss, we got more of the same today when producer prices in July not only missed lofty estimates, but turned negative for the first time since early in the pandemic which of course isn't much of a surprise given how far energy prices have dropped over the past month (and have already bounced on expectations of an easier Fed). The producer price index for final demand fell 0.5% from a month earlier and increased 9.8% from a year ago, both coming in much lower than their respective consensus estimates. As Oanda notes, "Inflationary pressures are clearly easing, but a lot of that decline is dependent if oil prices continue to grind lower. The risk of higher oil prices going into year end are elevated, so this moderation in inflationary pressures might not last."

Sure enough, one place where inflation fears re-emerged was Treasuries, where the long-end of the curve underperformed on the day, leading losses after early block sales in bond and ultra-long contracts and then extending drop after 30-year bond auction tailed by over 1bp...

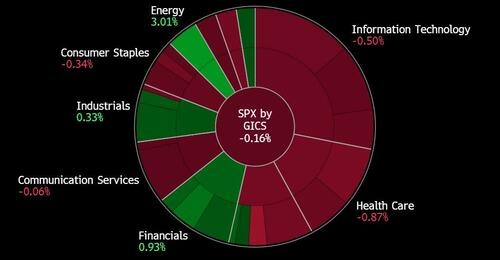

... and while most stocks turned red, strength in commodities helped push the energy sector solidly in the green.

As an aside, Goldman reminds us that real rates have struggled to move back into negative territory as the Fed continues to keep policy in restrictive territory....

.... and since multiple expansion has been highly correlated to moves in forward rates, Goldman notes that to justify a further rally we need to see either EPS revised up (unlikely) or real rates move back to negative territory.

The IEA is noting that global oil demand growth will continue as oil consumption will benefit from new demand as elevated natural gas supplies. The oil market still looks like it will be very tight over the next year even if it does dip into a surplus this quarter.

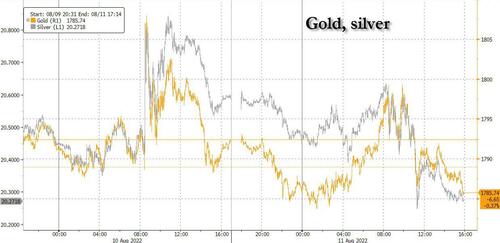

Elsewhere, gold prices slumped to session lows after briefly breaking out above $1800 yesterday, as investors realize they may have become too optimistic about a Fed pivot. That said, gold needs to see more data in the next couple of months to confirm that inflationary pressures are moderating. Looking ahead, Oanda warns that gold "looks a little vulnerable here and momentum selling could drag prices towards the $1780 level."

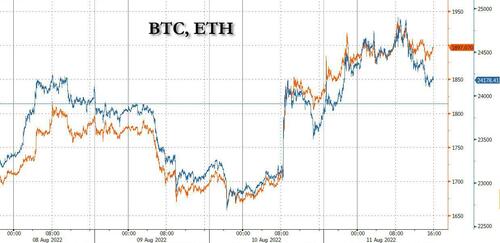

Finally, looking at cryptos, ethereum is leading the charge higher in the cryptoverse as investor optimism grows for a successful merge into ETH 2.0. The world’s second largest cryptocurrency is nearing a pivotal update, now tentatively scheduled for Sept 15, that will tackle two big problems; being much more energy efficient and faster. ETH was last trading around $1,900 more than doubling from its June crash lows.

Bitcoin is also above the $24,000 level, but is clearly seeing massive resistance from the $25,000 level. It seems, it might take a while longer for Bitcoin to rally above the $25,000 level, but when it does it momentum could take it towards the $28,400 level initially.

https://ift.tt/M2hOL4E

from ZeroHedge News https://ift.tt/M2hOL4E

via IFTTT

0 comments

Post a Comment